Is Greenstan safe?

Business

License

Is Greenstan Safe or Scam?

Introduction

Greenstan is a relatively new player in the forex market, having been established in 2021. Positioned as an online trading platform, it claims to offer various trading services, including forex, commodities, and cryptocurrencies. However, the influx of new brokers in the market has raised concerns among traders regarding the legitimacy and safety of these platforms. It is essential for traders to conduct thorough evaluations before committing their funds, as the forex market is fraught with potential scams and fraudulent activities. This article investigates whether Greenstan is a safe broker or a scam by examining its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulation of a forex broker is a critical factor in determining its legitimacy and safety. A properly regulated broker is subject to oversight by financial authorities, which helps protect traders from potential fraud. In the case of Greenstan, the broker claims to be based in Australia and is associated with the National Futures Association (NFA). However, there are concerns about its regulatory standing, as it lacks a robust licensing structure from a reputable authority.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0538567 | Australia | Suspicious Clone |

The NFA is known for its stringent regulatory requirements, but Greenstan‘s association with it raises red flags. Reports suggest that Greenstan may be operating as a suspicious clone, which means it could be impersonating a legitimate broker or operating without proper licensing. This lack of clarity regarding its regulatory status is a significant concern for potential traders. A broker’s regulatory quality and history of compliance are crucial; if a broker has a history of complaints or regulatory infractions, it should be approached with caution. In the case of Greenstan, the absence of a solid regulatory framework is a cause for alarm, indicating that it may not be a safe option for traders.

Company Background Investigation

Understanding the company behind a forex broker is essential for assessing its credibility. Greenstan was founded in 2021, making it a relatively new entity in the trading industry. The limited operational history raises questions about its stability and longevity. The ownership structure and management team of Greenstan are not well-documented, which contributes to the opacity surrounding the broker.

Moreover, the lack of transparency in the company‘s operations and its failure to disclose information about its management team further exacerbate concerns. A reputable broker typically provides detailed information about its founders, management, and operational strategies to build trust with potential clients. In contrast, Greenstan’s failure to do so may indicate a lack of accountability and transparency, leading to questions about its legitimacy.

Trading Conditions Analysis

The trading conditions offered by a broker are a critical aspect of its overall appeal. Greenstan claims to provide competitive spreads and various trading instruments. However, the overall fee structure appears to be somewhat opaque. Traders must be cautious of brokers that do not clearly outline their fees, as hidden charges can significantly impact profitability.

| Fee Type | Greenstan | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of specific data regarding spreads, commissions, and overnight interest rates makes it challenging to assess whether Greenstan offers competitive trading conditions. Moreover, reports indicate that some traders have faced unexpected fees or withdrawal issues, further questioning the broker's reliability. It is essential for traders to fully understand the cost structure before engaging with any broker, as this can significantly affect their trading experience.

Customer Fund Security

The security of customer funds is paramount when evaluating a forex broker. Greenstan claims to implement measures to protect client funds, such as segregated accounts. However, without robust regulatory oversight, the effectiveness of these measures is questionable.

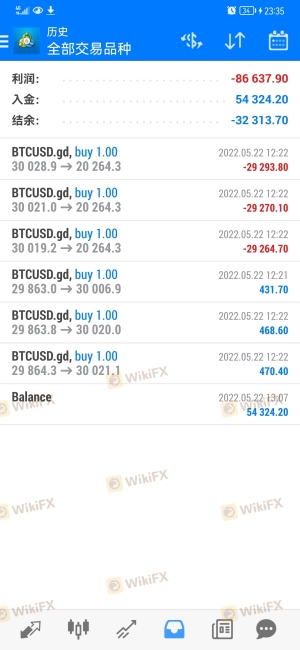

A reputable broker typically offers investor protection schemes, such as negative balance protection, which prevents traders from losing more than their initial deposit. Unfortunately, there is little information available regarding Greenstan's policies on fund protection and investor compensation. Additionally, any historical issues related to fund security or client withdrawals could indicate a lack of reliability.

Customer Experience and Complaints

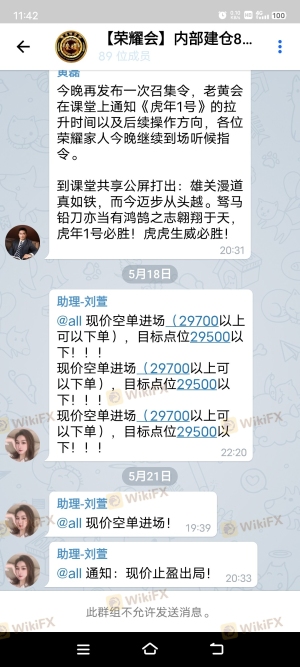

Customer feedback plays a vital role in determining the credibility of a broker. Reports indicate that Greenstan has garnered a significant number of complaints in a short period. Common grievances include withdrawal issues, lack of customer support, and allegations of manipulation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Customer Support | Medium | Delayed Responses |

| Manipulation Claims | High | Unaddressed |

For instance, several users have reported being unable to withdraw their funds after making deposits, leading to frustration and financial losses. The lack of timely responses from customer support further compounds these issues, suggesting that Greenstan may not prioritize customer service. Such patterns of complaints raise serious concerns about the broker's operational integrity and whether it can be trusted.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Greenstan utilizes the MetaTrader 4 platform, which is well-regarded for its functionality and user-friendliness. However, reports of execution issues, such as slippage and order rejections, have surfaced, indicating potential problems in trade execution quality.

Traders have expressed concerns about the reliability of the platform, with some suggesting that there may be signs of manipulation. A reputable broker should provide a seamless trading experience, with minimal technical issues and transparent execution practices. The concerns raised about Greenstan's platform performance warrant caution from potential traders.

Risk Assessment

Engaging with any broker carries inherent risks, and Greenstan is no exception. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns about safety. |

| Financial Risk | Medium | Potential for hidden fees and withdrawal issues. |

| Operational Risk | High | Numerous complaints regarding service and execution. |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial deposits, and remain cautious about any promises of high returns.

Conclusion and Recommendations

In summary, the evidence suggests that Greenstan is not a safe broker. The combination of dubious regulatory status, opaque company background, numerous customer complaints, and potential issues with fund security raises significant red flags. Traders are advised to exercise extreme caution when considering engagement with Greenstan. For those seeking reliable alternatives, it may be prudent to explore well-established brokers with solid regulatory frameworks and positive customer feedback. Ultimately, the safety of your funds and the integrity of your trading experience should be the top priority when selecting a forex broker.

Is Greenstan a scam, or is it legit?

The latest exposure and evaluation content of Greenstan brokers.

Greenstan Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Greenstan latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.