Is GiroFX safe?

Business

License

Is GiroFX Safe or Scam?

Introduction

GiroFX is an online forex broker that has gained attention in the trading community since its inception in 2020. Positioned as a platform for retail traders, it claims to offer a range of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, as the forex market continues to grow, so does the number of fraudulent brokers, making it essential for traders to carefully evaluate the legitimacy and safety of their chosen trading platforms. In this article, we will delve into an in-depth analysis of GiroFX, assessing its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The information presented is drawn from various reputable online sources, including user reviews, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor that determines its legitimacy and reliability. Regulated brokers are required to adhere to strict guidelines that protect traders' interests, while unregulated brokers operate without oversight, posing significant risks to investors. In the case of GiroFX, it has been identified as an unregulated broker, with no licensing from any recognized regulatory authority.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Regulated |

| ASIC | N/A | Australia | Not Regulated |

| CySEC | N/A | Cyprus | Not Regulated |

The lack of regulation raises serious concerns about the safety of funds deposited with GiroFX. Notably, the Financial Supervisory Authority (FI) in Sweden has issued warnings against GiroFX, indicating that it operates illegally within the European Union. This lack of regulatory oversight means that traders have no recourse in the event of disputes or fraudulent activities, making it imperative to question Is GiroFX safe? The absence of a regulatory framework, combined with multiple warnings from authorities, suggests that trading with GiroFX carries a high risk of financial loss.

Company Background Investigation

GiroFX presents itself as a UK-based broker, yet it lacks transparency regarding its ownership and operational structure. The company does not disclose the name of its parent organization or key personnel, which is a significant red flag for potential investors. A reputable broker typically provides detailed information about its management team, including their qualifications and experience in the financial sector.

The absence of such information raises concerns about the broker's credibility and operational integrity. Furthermore, the companys website lacks essential disclosures, such as financial statements or reports, which are critical for assessing its financial health. The anonymity surrounding GiroFX makes it difficult for traders to ascertain the legitimacy of the broker, leading many to question whether GiroFX is safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital. GiroFX offers a minimum deposit requirement of $200, which is relatively low compared to industry standards. However, the broker's fee structure is not clearly outlined, leading to potential hidden costs that traders may encounter.

| Fee Type | GiroFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of transparency in fees is concerning, as it may indicate that traders could face unexpected charges. Additionally, the absence of a demo account limits potential traders' ability to test the platform before committing funds. This lack of clarity surrounding trading costs raises further questions about Is GiroFX safe for prospective clients.

Customer Fund Security

The security of customer funds is paramount in assessing a broker's reliability. GiroFX does not provide adequate information regarding its fund protection measures. Regulated brokers are required to keep client funds in segregated accounts, ensuring that traders' money is protected in the event of insolvency. In contrast, GiroFX appears to operate without such safeguards.

Moreover, there is no indication that GiroFX offers negative balance protection, which can leave traders vulnerable to significant losses. The absence of these fundamental safety measures intensifies concerns about the security of funds held with the broker. Historical data suggests that many unregulated brokers like GiroFX have faced allegations of misappropriating client funds, further questioning Is GiroFX safe for investors.

Customer Experience and Complaints

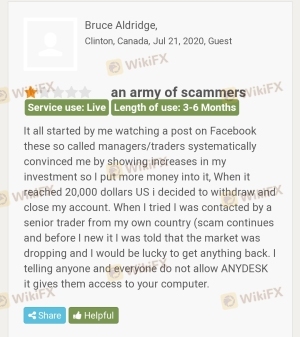

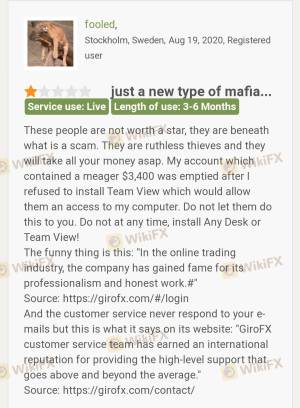

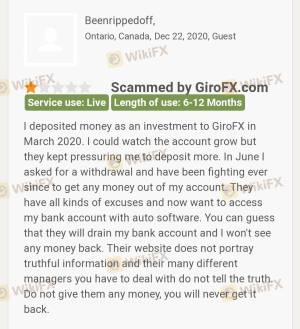

User feedback is an essential component in evaluating a broker's reputation. GiroFX has received a considerable amount of negative reviews across various platforms, with many users reporting difficulties in withdrawing funds and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Lack of Transparency | High | Poor |

Common complaints include users being unable to withdraw their funds after multiple requests, a typical tactic employed by fraudulent brokers to retain clients' money. These complaints highlight a systemic issue with GiroFX's operational practices, leading to the conclusion that potential traders should be wary of the broker's reliability. The repeated patterns of negative feedback raise serious doubts about Is GiroFX safe for trading.

Platform and Trade Execution

The trading platform is a critical aspect of a broker's offering. GiroFX utilizes a web-based platform that lacks compatibility with popular trading software such as MetaTrader 4. This may limit traders' ability to utilize advanced trading tools and features, which are often essential for effective trading strategies.

In terms of order execution, users have reported issues with slippage and rejected orders, which can severely impact trading performance. The lack of a robust trading environment raises questions about the overall reliability of the platform. Given these factors, it is crucial to consider whether GiroFX is safe for traders who rely on efficient trade execution.

Risk Assessment

Engaging with an unregulated broker like GiroFX presents various risks. The absence of regulatory oversight, coupled with negative user experiences, amplifies the likelihood of financial loss.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Poor customer service and response |

To mitigate these risks, potential traders should conduct thorough research before engaging with GiroFX. It is advisable to start with a minimal deposit and to be cautious about committing larger sums until the broker's legitimacy can be verified.

Conclusion and Recommendations

In conclusion, the evidence suggests that GiroFX operates as an unregulated broker with significant red flags. The absence of regulatory oversight, coupled with negative user feedback and a lack of transparency, raises serious concerns regarding the safety of trading with this broker.

For traders seeking reliable options, it is recommended to consider regulated brokers with established reputations in the industry. Alternatives such as eToro or Plus500, which are regulated by reputable authorities, provide safer trading environments and better protections for investors. Ultimately, potential clients must weigh the risks carefully and consider whether GiroFX is safe for their trading activities.

Is GiroFX a scam, or is it legit?

The latest exposure and evaluation content of GiroFX brokers.

GiroFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GiroFX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.