Is FXTRD safe?

Business

License

Is FXTRD Safe or Scam?

Introduction

FXTRD is an online forex broker that has positioned itself within the competitive landscape of the foreign exchange market. As traders explore various platforms to make informed decisions, it becomes crucial to evaluate the credibility and safety of these brokers. The forex market is rife with opportunities, but it also harbors risks, including potential scams. Therefore, traders must conduct thorough assessments of forex brokers like FXTRD to ensure their investments are secure.

This article aims to provide an objective analysis of FXTRD, examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on a review of multiple online sources, including regulatory databases, user reviews, and expert analyses, to present a comprehensive understanding of whether FXTRD is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and trustworthiness. Unfortunately, FXTRD operates without any valid regulatory oversight, which raises significant concerns regarding its safety. Brokers that lack regulation are not held accountable to any financial authority, leaving traders vulnerable to potential fraud and mismanagement of their funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a reputable regulatory body overseeing FXTRD is alarming. Regulations are vital as they ensure brokers adhere to specific standards that protect investors. For instance, brokers regulated by authorities like the FCA (UK) or ASIC (Australia) must maintain a minimum capital requirement, segregate client funds, and provide transparency in operations. FXTRD's lack of regulation implies that it can operate without such safeguards, which is a significant red flag for potential investors.

Furthermore, the company has been flagged for operating under suspicious licenses, with reports indicating that it may not be legally registered in its claimed jurisdiction. This raises questions about the broker's operational integrity and whether it is a legitimate entity or a scam waiting to happen. Therefore, it is crucial for traders to consider these factors when assessing whether FXTRD is safe.

Company Background Investigation

FXTRD LLC, the entity behind the trading platform, was established in 2021 and is purportedly based in Saint Vincent and the Grenadines. However, information regarding its ownership structure and management team is scarce, which is concerning. Reliable brokers typically provide transparent details about their management and operational history, allowing traders to understand who is handling their investments.

The lack of information about FXTRD's management team further complicates the assessment of its credibility. A robust management team with experience in finance and trading is essential for establishing trust. In the case of FXTRD, the absence of this information suggests a lack of transparency, which is often associated with unregulated or fraudulent brokers.

Moreover, the company's website does not offer sufficient details on its operational practices or the services it provides. This opacity can lead to distrust among potential clients, as they may feel uncertain about the safety of their funds and the legitimacy of the trading environment. Therefore, the lack of transparency surrounding FXTRD's operations and management raises significant concerns about its safety.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. FXTRD claims to offer various trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the broker's fee structure remains unclear, with many users reporting hidden fees and unfavorable conditions.

| Fee Type | FXTRD | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0-2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2.0% |

The absence of clear information regarding spreads, commissions, and overnight fees is concerning. Traders expect transparency in these areas to make informed decisions about their trading strategies. Moreover, reports from users indicate that FXTRD employs aggressive sales tactics, urging clients to deposit more funds or trade frequently, raising suspicions about the broker's intentions.

Additionally, the lack of a demo account option further complicates the assessment of trading conditions. A demo account allows potential clients to test the platform and understand the trading environment without risking real money. The absence of this feature may indicate that FXTRD is not genuinely interested in fostering a transparent and user-friendly trading experience. Consequently, these factors contribute to the overall perception that FXTRD may not be a safe trading platform.

Customer Funds Security

The security of customer funds is paramount when considering a forex broker. FXTRD's lack of regulation raises significant concerns about its ability to protect clients' investments. Regulated brokers are typically required to segregate client funds from their operational funds, ensuring that clients' money is protected in the event of insolvency. Unfortunately, FXTRD does not provide any information on its fund protection measures.

Moreover, there are no indications that FXTRD offers negative balance protection, a crucial feature that prevents traders from losing more than their initial investment. The absence of these safety nets leaves clients vulnerable to substantial financial losses.

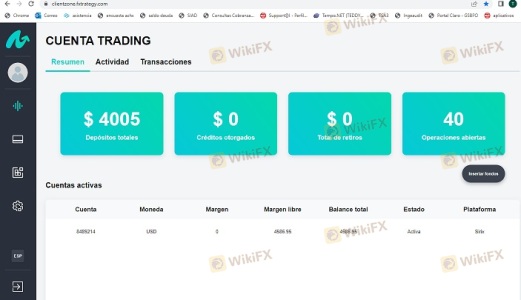

Historically, unregulated brokers have faced numerous complaints regarding fund mismanagement and withdrawal issues. Many users have reported difficulties in withdrawing their funds from FXTRD, with claims that the broker imposes unreasonable conditions or delays. Such practices are common among fraudulent brokers, reinforcing the notion that FXTRD may pose a significant risk to traders' financial security.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a forex broker. Unfortunately, reviews of FXTRD are predominantly negative, with many users expressing dissatisfaction with their trading experiences. Common complaints include withdrawal issues, lack of customer support, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | High | Poor |

| Aggressive Sales Tactics | Medium | Poor |

Many users have reported that once they deposited funds, communication with the broker became increasingly difficult. Complaints about being unable to withdraw money or facing excessive fees during the withdrawal process are prevalent. This pattern of behavior aligns with the tactics employed by scam brokers, where they prioritize acquiring deposits over providing quality service.

For instance, one user reported attempting to withdraw their funds only to be met with requests for additional deposits or fees, a classic red flag that indicates a potential scam. Such experiences highlight the risks associated with trading on unregulated platforms like FXTRD, raising further doubts about its safety.

Platform and Execution

The performance of a trading platform is crucial for a successful trading experience. FXTRD claims to offer a user-friendly platform, but user reviews suggest otherwise. Many traders have reported issues with platform stability, order execution speed, and slippage.

The quality of order execution is particularly important in the forex market, where price fluctuations can occur rapidly. Users have expressed concerns about frequent slippage and rejected orders, which can significantly impact trading outcomes. Moreover, there are allegations of potential platform manipulation, where the broker may alter prices to benefit its position at the expense of traders.

Overall, the trading experience on FXTRD appears to be fraught with challenges, further indicating that it may not be a safe choice for traders seeking a reliable platform.

Risk Assessment

Using FXTRD presents several risks that traders should be aware of. The lack of regulation, unclear trading conditions, and negative user feedback collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with platform stability |

Given these risks, it is advisable for traders to approach FXTRD with caution. Engaging with unregulated brokers can lead to significant financial losses, and it is crucial to consider alternative options that offer greater security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXTRD raises numerous red flags that warrant caution. The lack of regulation, transparency issues, and negative customer feedback indicate a high likelihood that FXTRD may not be a safe trading platform.

Traders should be particularly wary of the potential for fund mismanagement and withdrawal difficulties. For those seeking a reliable forex trading experience, it is advisable to consider regulated brokers with a proven track record of customer satisfaction and transparency.

If you are considering trading with FXTRD, it is essential to conduct thorough research and weigh the risks involved. Opting for well-regulated alternatives can significantly enhance the safety of your trading activities.

Is FXTRD a scam, or is it legit?

The latest exposure and evaluation content of FXTRD brokers.

FXTRD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTRD latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.