Is FXPRIMUSS safe?

Business

License

Is FXPrimus Safe or a Scam?

Introduction

FXPrimus, established in 2009, has positioned itself as a prominent player in the online forex trading market, offering a diverse range of financial instruments including forex, commodities, and cryptocurrencies. With a motto declaring itself as "the safest place to trade," FXPrimus aims to attract traders seeking a secure trading environment. However, as the forex market can be rife with scams and unreliable brokers, it is critical for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective assessment of FXPrimus, analyzing its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The insights presented here are drawn from a wide range of sources, including user reviews and regulatory information, to offer a comprehensive view of whether FXPrimus is indeed safe or potentially a scam.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most critical factors that determine its legitimacy and safety for traders. FXPrimus operates under multiple regulatory authorities, which is a positive sign for potential clients. The primary regulatory bodies overseeing FXPrimus include the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 261/14 | Cyprus | Verified |

| VFSC | 14595 | Vanuatu | Verified |

| FSCA | 46675 | South Africa | Verified |

The quality of regulation plays a significant role in ensuring that brokers adhere to strict operational standards, maintaining the safety of client funds. CySEC, being a tier-1 regulator, imposes rigorous requirements on its licensed firms, including the segregation of client funds and participation in an investor compensation fund. This fund provides additional security, covering up to 90% of deposits, up to a limit of €20,000, in the event of broker insolvency. Conversely, while the VFSC provides a regulatory framework, it is considered less stringent compared to CySEC, which may raise concerns about the level of oversight for clients trading under this license. Historically, FXPrimus has maintained a clean regulatory track record, indicating compliance with established guidelines.

Company Background Investigation

FXPrimus was founded by a team of experienced traders from both retail and hedge fund backgrounds, with the goal of creating a reliable and secure trading platform. The company operates under the brand name Primus Global Ltd, with offices in Cyprus, Vanuatu, and South Africa. This global presence allows FXPrimus to cater to a wide range of clients, although it does not accept traders from certain regions, including the USA and Japan.

The management team behind FXPrimus is composed of professionals with extensive experience in the financial markets, which contributes to the broker's credibility. Transparency is a crucial aspect of any financial institution, and FXPrimus provides a wealth of information on its website regarding its operations, regulatory compliance, and trading conditions. However, some users have expressed concerns regarding the availability of detailed educational resources, which could hinder new traders' understanding of the forex market.

Trading Conditions Analysis

When evaluating whether FXPrimus is safe, analyzing its trading conditions is essential. FXPrimus offers a range of account types, including the Primus Classic, Primus Pro, and Primus Zero accounts, each with varying minimum deposit requirements and trading fees. The overall fee structure is competitive, especially for high-frequency traders, as it features low spreads and commission options. Below is a comparison of core trading costs:

| Fee Type | FXPrimus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | From 0.1 pips |

| Commission Model | $5 per lot (Zero) | $8 per lot |

| Overnight Interest Range | Varies by asset | Varies widely |

FXPrimus does not impose deposit or withdrawal fees, which is a significant advantage for traders looking to manage their costs effectively. However, the minimum deposit requirement can be a barrier for some, particularly for the Primus Zero account, which requires a $1,000 initial deposit. Overall, the trading conditions at FXPrimus are designed to be favorable for active traders, but new traders may find the initial capital requirement somewhat daunting.

Customer Fund Security

One of the most crucial aspects of evaluating whether FXPrimus is safe involves examining its customer fund security measures. FXPrimus employs several strategies to protect client funds, including segregated accounts, which ensure that clients' deposits are kept separate from the broker's operational funds. This practice is essential in safeguarding traders' capital in the event of financial difficulties faced by the broker.

Moreover, FXPrimus offers an investor compensation fund, providing additional security for traders. The broker also implements negative balance protection, ensuring that clients cannot lose more than their deposited amounts during trading. While these measures are promising, it is vital to consider any historical issues related to fund security. Reports of delayed withdrawals or difficulties in accessing funds have surfaced, which may raise concerns for potential clients.

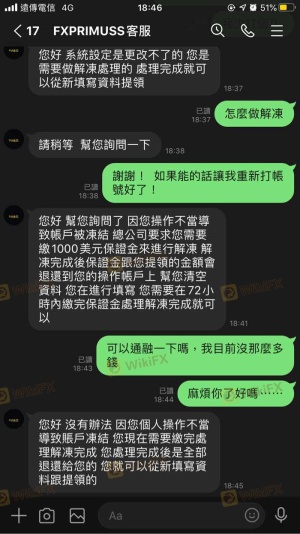

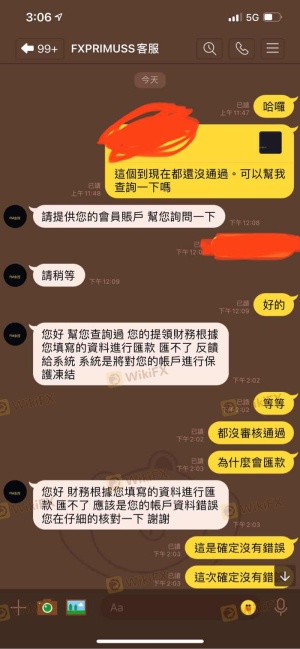

Customer Experience and Complaints

Customer feedback is a valuable tool for assessing the overall reliability of a broker. Reviews of FXPrimus reveal a mixed bag of experiences. Many users commend the broker for its responsive customer support and competitive trading conditions. However, there are also reports of withdrawal issues and instances where clients felt their concerns were not adequately addressed. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Verification | Medium | Adequate |

| Platform Stability | Medium | Ongoing issues |

For instance, one trader reported a significant delay in processing a withdrawal request, leading to frustration and uncertainty. Another user expressed dissatisfaction with the platform's performance during high volatility periods. These complaints highlight the importance of considering user experiences when determining the overall safety of FXPrimus.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. FXPrimus primarily utilizes the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their robust features and user-friendly interfaces. The broker's platform performance is generally reliable, but some users have reported instances of slippage and order rejections, particularly during volatile market conditions. This raises concerns about the quality of order execution, which is vital for traders aiming to capitalize on market movements.

Risk Assessment

Using FXPrimus comes with inherent risks, as is the case with any trading platform. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple regulators with varying oversight quality. |

| Fund Security Risk | Medium | Solid security measures in place, but some complaints regarding withdrawals. |

| Market Risk | High | Trading in volatile markets can lead to significant losses, especially with high leverage. |

To mitigate these risks, traders are advised to employ sound risk management strategies, such as setting stop-loss orders and only trading with capital they can afford to lose.

Conclusion and Recommendations

In conclusion, FXPrimus presents itself as a legitimate broker with a solid regulatory framework and a commitment to client fund security. However, potential traders should remain vigilant, considering the mixed reviews regarding customer experiences and withdrawal issues. While FXPrimus is not a scam, it is essential for traders to weigh the pros and cons carefully. For those new to trading or seeking a more comprehensive educational experience, exploring alternative brokers with stronger educational resources and customer support might be advisable. Overall, FXPrimus can be a suitable choice for experienced traders looking for high leverage and competitive trading conditions, but caution is warranted for those new to the forex market.

Is FXPRIMUSS a scam, or is it legit?

The latest exposure and evaluation content of FXPRIMUSS brokers.

FXPRIMUSS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXPRIMUSS latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.