Is FIN8ITY safe?

Business

License

Is Fin8ity A Scam?

Introduction

Fin8ity is an online forex broker that positions itself as a platform for traders interested in foreign currency exchange and other financial instruments. With the increasing interest in forex trading, potential investors are often drawn to platforms like Fin8ity, hoping to capitalize on the market's volatility. However, the rise of online trading platforms has also led to a surge in scams and unreliable brokers, making it imperative for traders to carefully assess the legitimacy and safety of their chosen trading platforms. This article aims to provide a comprehensive evaluation of Fin8ity, focusing on its regulatory status, company background, trading conditions, client security, customer experiences, platform performance, and overall risk assessment. The information is derived from multiple sources, including user reviews, regulatory databases, and industry analyses.

Regulation and Legitimacy

Understanding the regulatory landscape is crucial when assessing whether Fin8ity is safe. Regulation serves as a protective measure for traders, ensuring that brokers adhere to certain standards of conduct and transparency. Fin8ity, however, does not appear to be regulated by any major financial authority, which raises significant concerns about its legitimacy. Below is a summary of the regulatory information available for Fin8ity:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Fin8ity operates without the oversight that helps protect traders from fraud and malpractice. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US, impose strict rules on brokers to ensure fair practices. Without such oversight, the risk of financial loss increases significantly. Furthermore, the lack of transparent information regarding Fin8ity's operations and the nature of its services further complicates the picture. Traders should approach this broker with caution, as unregulated entities often lack the accountability that regulated brokers are required to maintain.

Company Background Investigation

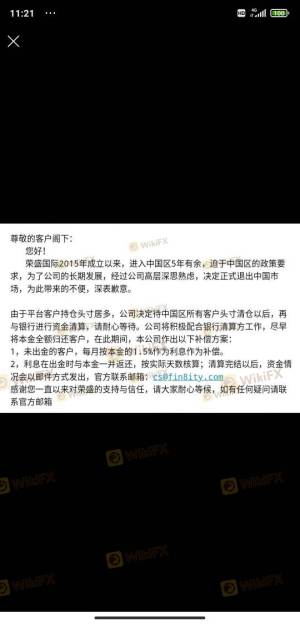

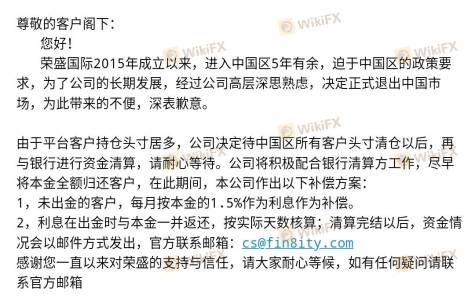

Fin8ity, operating under the name Gold Crystal Finity Limited, has a relatively obscure presence in the online trading landscape. The company was registered in the British Virgin Islands, a location often associated with offshore financial operations. This raises questions about its operational transparency and accountability. The ownership structure of Fin8ity is not clearly disclosed, which is a red flag for potential investors. A lack of transparency regarding ownership can often indicate a higher risk of fraud or mismanagement.

The management team behind Fin8ity also lacks visibility, with little to no information available about their professional backgrounds and expertise in the financial industry. This lack of information can be concerning, as a knowledgeable and experienced management team is often a good indicator of a broker's reliability. Moreover, the company's history shows no significant track record or reputation within the trading community, which further complicates the assessment of whether Fin8ity is safe.

Trading Conditions Analysis

When evaluating the trading conditions offered by Fin8ity, it is essential to consider the overall fee structure and any unusual or problematic policies. Fin8ity claims to provide competitive trading conditions; however, the absence of detailed information regarding spreads, commissions, and overnight fees raises concerns. Below is a comparison of Fin8ity's core trading costs against industry averages:

| Fee Type | Fin8ity | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not disclosed | 1.0 - 2.0 pips |

| Commission Structure | Not disclosed | $0 - $10 per trade |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The lack of transparency in Fin8ity's trading conditions can be a significant disadvantage for traders. Unusual fees or unclear policies can lead to unexpected costs, impacting overall profitability. Additionally, the absence of a clear commission structure may indicate hidden fees that could be detrimental to traders, particularly those engaging in high-frequency trading. Without clear information on trading conditions, it becomes challenging to determine whether Fin8ity is safe, as traders may unknowingly incur excessive costs.

Client Funds Security

The security of client funds is a paramount concern for any trader. It is crucial to understand the measures Fin8ity has in place to protect client deposits. Unfortunately, there is limited information available regarding Fin8ity's fund safety protocols. Effective fund security typically includes features such as segregated accounts, investor protection schemes, and negative balance protection.

An analysis of Fin8ity's policies reveals a lack of clarity on these critical safety measures. For instance, it is unclear whether client funds are held in segregated accounts, which is essential for ensuring that traders' money is protected in the event of the broker's insolvency. Additionally, without any mention of investor protection schemes, traders may be left vulnerable to losses. Historical issues regarding fund security or any controversies surrounding the broker have not been openly documented, which raises further concerns about whether Fin8ity is safe.

Customer Experience and Complaints

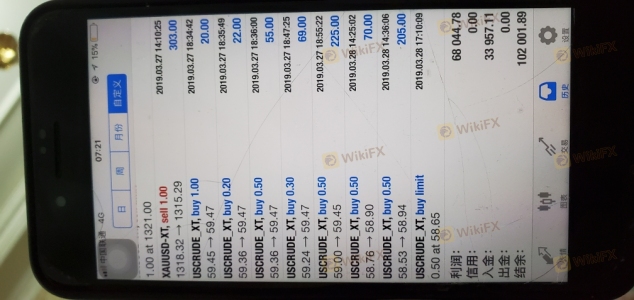

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Fin8ity indicate a mixed bag of experiences, with several users reporting issues related to withdrawals and customer service. Common complaints include difficulties in accessing funds, poor communication from customer support, and a general lack of responsiveness.

The following table summarizes the main types of complaints received about Fin8ity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Response | Medium | Poor |

| Transparency of Fees | High | Non-responsive |

Two notable cases highlight the challenges faced by clients. In one instance, a user reported being unable to withdraw their funds after multiple attempts, leading to frustration and a sense of mistrust towards the platform. In another case, a trader expressed dissatisfaction with the lack of clarity regarding fees, feeling misled by the broker's marketing claims. These patterns of complaints raise significant concerns about the overall customer experience and whether Fin8ity is safe for potential investors.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Fin8ity claims to offer a user-friendly interface and reliable execution; however, user feedback suggests otherwise. Many traders have reported issues with platform stability, slow execution times, and instances of slippage. These factors can severely impact trading outcomes, particularly in fast-moving markets.

The overall quality of order execution is another critical aspect to consider. Traders have expressed concerns about the frequency of rejected orders and the overall responsiveness of the platform. Signs of potential platform manipulation, such as frequent slippage or unusual price movements, could indicate deeper issues that warrant further investigation. Therefore, it is essential to consider whether Fin8ity is safe based on the reliability of its trading platform.

Risk Assessment

Using Fin8ity comes with inherent risks that traders must be aware of. The absence of regulation, unclear trading conditions, and a lack of transparency all contribute to the overall risk profile of this broker. Below is a summary of key risk areas associated with trading through Fin8ity:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Oversight | High | No regulatory body overseeing operations |

| Transparency of Fees | High | Unclear fee structure and hidden costs |

| Customer Support Issues | Medium | Reports of poor communication and responsiveness |

| Platform Reliability | High | Issues with execution and potential manipulation |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Fin8ity. It is advisable to seek alternative brokers with established regulatory oversight and a strong reputation in the industry.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the legitimacy and safety of Fin8ity. The lack of regulatory oversight, coupled with unclear trading conditions and a history of customer complaints, suggests that traders should exercise extreme caution when considering this broker. While Fin8ity may present itself as a viable trading option, the risks associated with using an unregulated platform cannot be overlooked.

For traders seeking reliable alternatives, it is recommended to explore well-established brokers that offer robust regulatory protections, transparent fee structures, and a proven track record of customer satisfaction. Ultimately, the question remains: Is Fin8ity safe? The consensus leans towards caution, urging potential traders to consider more reputable options in the forex market.

Is FIN8ITY a scam, or is it legit?

The latest exposure and evaluation content of FIN8ITY brokers.

FIN8ITY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FIN8ITY latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.