Is Fasonla Tech safe?

Business

License

Is Fasonla Tech Safe or Scam?

Introduction

Fasonla Tech Limited is a relatively new player in the forex market, claiming to offer a variety of trading instruments and services through its online platform. As a forex broker, Fasonla Tech aims to attract traders with promises of high returns and advanced trading tools. However, the financial landscape is fraught with risks, and traders must exercise caution when selecting a broker. The importance of thorough due diligence cannot be overstated, as the consequences of choosing a fraudulent or unreliable broker can be severe, including significant financial losses.

This article aims to provide an objective analysis of Fasonla Tech, evaluating its safety and legitimacy. The assessment is based on a comprehensive review of available information, including regulatory status, company background, trading conditions, client experiences, and risk factors. By utilizing this structured approach, we aim to answer the critical question: Is Fasonla Tech safe?

Regulation and Legitimacy

Understanding the regulatory environment in which a forex broker operates is crucial for assessing its legitimacy. Regulatory oversight serves as a safeguard for traders, ensuring that brokers adhere to established standards of conduct and financial practices. In the case of Fasonla Tech, the broker claims to be registered in Hong Kong but lacks proper regulatory oversight from recognized authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Hong Kong | Not Regulated |

The absence of regulation raises significant concerns about the safety of funds and the overall trustworthiness of the broker. Many reports indicate that Fasonla Tech has received numerous complaints regarding withdrawal issues, which is a common red flag for unregulated brokers. The lack of a regulatory framework means that clients have limited recourse in the event of disputes or financial losses.

Regulatory quality is paramount; brokers operating without oversight are often associated with higher risks of fraud and malpractice. Fasonla Tech's unregulated status makes it particularly vulnerable to such issues, leading to the conclusion that Fasonla Tech is not safe for traders seeking a reliable forex trading environment.

Company Background Investigation

Fasonla Tech Limited was established relatively recently, positioning itself in a highly competitive market. However, the lack of transparency regarding its ownership structure and management team raises concerns. A thorough investigation into the company's history reveals that it is not listed in any credible financial registries, and the address provided appears to be a generic office space rather than a legitimate financial institution.

The management team behind Fasonla Tech has not been publicly disclosed, which further complicates the assessment of the broker's credibility. A reputable broker typically provides detailed information about its leadership, including their qualifications and experience in the financial industry. The absence of this information can lead to skepticism regarding the broker's intentions and operational integrity.

Furthermore, the company's transparency regarding its business practices and financial disclosures is minimal. In an industry where trust is paramount, Fasonla Tech's lack of openness about its operations raises serious questions about its legitimacy and whether it can be considered a safe trading option. Therefore, potential clients should approach Fasonla Tech with caution, as the company does not inspire confidence in its reliability or integrity.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Fasonla Tech presents itself as a competitive player in the market, claiming to provide access to various trading instruments, including forex, commodities, and cryptocurrencies. However, the specifics of its fee structure and trading conditions remain vague.

| Fee Type | Fasonla Tech | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Low |

| Commission Model | Not Specified | Standard |

| Overnight Interest Rates | Unclear | Clear |

The lack of clarity regarding spreads, commissions, and overnight interest rates is concerning. Traders should be aware that high spreads can significantly impact profitability, especially for those engaging in frequent trading. Additionally, the absence of a clear commission structure may lead to hidden fees that could erode trading profits.

Reports from users indicate that Fasonla Tech employs aggressive marketing tactics, promising unrealistic returns that are often too good to be true. Such tactics are characteristic of brokers that may not have the best interests of their clients at heart. If a broker's trading conditions appear overly favorable without sufficient justification, it is prudent to question their legitimacy. Consequently, traders should be cautious and consider whether Fasonla Tech is safe based on its unclear and potentially unfavorable trading conditions.

Client Fund Security

The security of client funds is a critical consideration when assessing any forex broker. Fasonla Tech's policies regarding fund safety are ambiguous at best. A reputable broker typically segregates client funds from its operational capital, ensuring that clients' money is protected in the event of financial difficulties. However, there is no clear indication that Fasonla Tech follows such practices.

Furthermore, the absence of investor protection schemes raises alarm bells. Many regulated brokers are required to participate in compensation schemes that protect clients in case of broker insolvency. Fasonla Techs lack of such protections leaves clients vulnerable, as they may have no recourse to recover their funds in the event of a financial crisis.

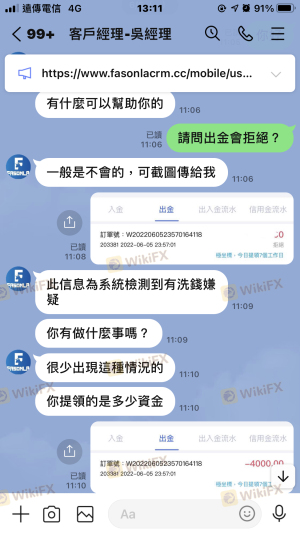

Historical complaints about withdrawal issues further exacerbate concerns about fund safety. Numerous users have reported being unable to access their funds, often citing excessive fees or bureaucratic hurdles as obstacles to withdrawal. These issues suggest a lack of commitment to client fund security, leading to the conclusion that Fasonla Tech is not safe for traders who prioritize the security of their investments.

Client Experience and Complaints

Analyzing client feedback is essential for understanding the overall experience with a broker. In the case of Fasonla Tech, user reviews are overwhelmingly negative, with many clients expressing frustration over withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Ineffective |

| Account Manipulation | High | Ignored |

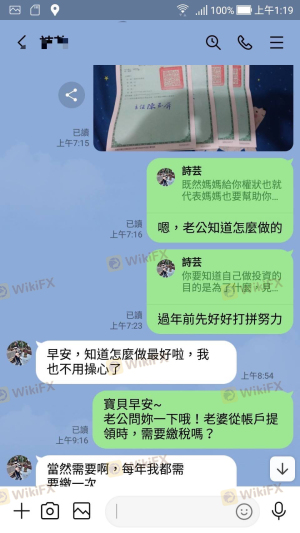

Common complaints include the inability to withdraw funds, with clients often reporting that their accounts were manipulated to prevent access to their money. Additionally, many users have noted that customer service is unresponsive, with inquiries going unanswered for extended periods. This lack of support can leave clients feeling abandoned and helpless in resolving their issues.

One notable case involved a trader who reported being unable to withdraw a significant sum, only to be told that they needed to pay additional fees to access their funds. Such tactics are often employed by unscrupulous brokers to extract more money from clients. The prevalence of these complaints strongly indicates that Fasonla Tech is not safe, as it fails to provide a satisfactory client experience and adequate support.

Platform and Trade Execution

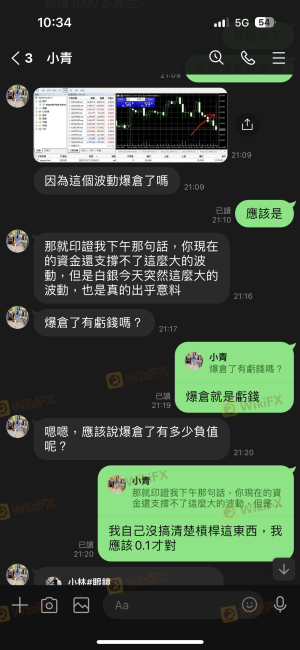

The performance of the trading platform is a crucial factor for any forex trader. Fasonla Tech claims to offer a robust trading platform, but user experiences tell a different story. Many clients have reported issues with platform stability, including frequent crashes and slow execution times.

The quality of order execution is also a significant concern. Reports of slippage and rejected orders are common among users, which can lead to substantial financial losses, especially for those employing automated trading strategies. Additionally, some clients have raised suspicions about potential platform manipulation, where trades are executed at unfavorable prices, further eroding trust in the broker.

Given these issues, it is essential for traders to scrutinize the trading environment offered by Fasonla Tech. A reliable broker should provide a seamless trading experience with minimal disruptions. The challenges reported by users suggest that Fasonla Tech is not safe, as it compromises the integrity of trade execution and overall platform performance.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Fasonla Tech is no exception. The lack of regulation, unclear trading conditions, and numerous client complaints contribute to a heightened risk profile for potential users.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Withdrawal issues and unclear fees. |

| Operational Risk | Medium | Platform instability and execution issues. |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Always verify the regulatory status of a broker before investing.

- Start with a Demo Account: If possible, test the platform with a demo account to assess its functionality.

- Limit Initial Investments: Begin with a small amount to gauge the broker's reliability before committing larger sums.

Overall, the risks associated with trading through Fasonla Tech are considerable, and potential traders should exercise extreme caution.

Conclusion and Recommendations

In conclusion, the evidence gathered strongly suggests that Fasonla Tech is not a safe broker. The lack of regulation, poor client experiences, withdrawal difficulties, and overall opacity of operations raise serious concerns about its legitimacy. Traders seeking a reliable and trustworthy forex broker should be wary of Fasonla Tech and consider alternatives that offer robust regulatory oversight and transparent practices.

For those looking for safer options, consider established brokers with strong regulatory credentials, positive client feedback, and a commitment to fund security. Some recommended alternatives include reputable names in the forex industry, which are known for their reliability and client-centric services. Always prioritize safety and due diligence when engaging in forex trading to protect your investments.

Is Fasonla Tech a scam, or is it legit?

The latest exposure and evaluation content of Fasonla Tech brokers.

Fasonla Tech Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fasonla Tech latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.