Is EASYBESTWIN safe?

Software Index

License

Is EasyBestWin Safe or a Scam?

Introduction

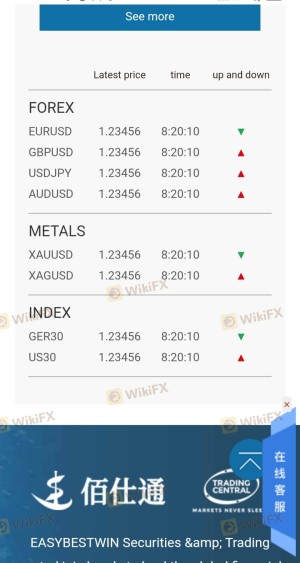

EasyBestWin is a forex and CFD broker that has recently attracted attention in the trading community. Positioned as a platform for trading various financial instruments, it claims to offer competitive trading conditions and a user-friendly interface. However, the rise of online trading has also brought about a surge in scams and unregulated brokers, making it imperative for traders to carefully evaluate their options. In this article, we will investigate whether EasyBestWin is a safe trading platform or a potential scam. Our investigation is based on a comprehensive review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety. Regulated brokers are subject to strict oversight, which helps protect traders from fraud and malpractice. Unfortunately, EasyBestWin has been flagged for operating without any valid regulatory licenses. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation is a significant red flag. Without oversight from a recognized regulatory authority, traders face heightened risks, including the potential for fraud and the inability to recover funds in case of disputes. The lack of regulatory compliance raises concerns about the broker's operational transparency and reliability. Traders are advised to be cautious and consider the risks of engaging with an unregulated broker like EasyBestWin.

Company Background Investigation

EasyBestWin is affiliated with Beston Internet Technology Limited, a company that operates out of Hong Kong. However, detailed information about the company's history, ownership structure, and management team is scarce. This lack of transparency is concerning, as it makes it difficult for potential clients to assess the credibility of the broker. A thorough background check reveals that the company has not established a strong reputation in the industry, with many users reporting negative experiences.

The management team behind EasyBestWin has not been publicly disclosed, which further complicates the assessment of the broker's reliability. A transparent company typically provides information about its leadership and their relevant experience in the financial sector. The absence of such details raises questions about the competence and integrity of the individuals running the brokerage.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. EasyBestWin claims to provide competitive spreads and various account types. However, the overall fee structure appears to be opaque and potentially unfavorable for traders. Below is a comparison of key trading costs:

| Fee Type | EasyBestWin | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by EasyBestWin are higher than the industry average, which could significantly impact a trader's profitability. Additionally, the lack of a clear commission structure raises concerns about hidden fees that may be applied during trading. Traders should be vigilant and ensure they fully understand the cost implications before committing to this broker.

Customer Funds Security

The security of customer funds is a critical aspect of any brokerage. EasyBestWin has not demonstrated robust measures to safeguard client funds. Without regulatory oversight, there are no guarantees regarding the segregation of client accounts or the implementation of negative balance protection policies. Traders should be aware that in the event of financial difficulties faced by the broker, their investments may be at risk.

Historically, unregulated brokers have been involved in various financial scandals, leading to significant losses for traders. The absence of a compensation scheme or investor protection mechanisms further exacerbates the risks associated with trading on the EasyBestWin platform. Traders are strongly encouraged to consider these factors when assessing whether EasyBestWin is safe for their investments.

Customer Experience and Complaints

User feedback is an invaluable resource when evaluating a broker's reliability. A review of customer experiences with EasyBestWin reveals a concerning pattern of complaints. Many users report issues related to withdrawal delays, unresponsive customer support, and difficulties in executing trades. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Trade Execution Problems | High | Poor |

One notable case involved a trader who reported making a profit but was unable to withdraw their earnings. The lack of timely responses from customer support exacerbated the situation, leading to frustration and distrust. Such complaints highlight a concerning trend that potential clients should consider when questioning if EasyBestWin is a safe broker.

Platform and Trade Execution

The trading platform offered by EasyBestWin is built on the widely used MetaTrader 4 (MT4) system. While MT4 is known for its reliability and user-friendly interface, the overall performance of EasyBestWin's platform has received mixed reviews. Users have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

The quality of order execution is paramount for traders, particularly in the fast-paced forex market. Any signs of manipulation or unfair practices can lead to substantial financial losses. Traders should be cautious and consider these factors when determining if EasyBestWin is a trustworthy trading platform.

Risk Assessment

Engaging with EasyBestWin carries inherent risks, primarily due to its unregulated status and the numerous complaints from users. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential loss of funds without recourse |

| Customer Support Risk | Medium | Poor response to complaints and inquiries |

To mitigate these risks, traders are advised to conduct thorough due diligence before investing. It may be prudent to start with a small amount or consider alternative brokers with established regulatory oversight and positive user feedback.

Conclusion and Recommendations

In conclusion, the investigation into EasyBestWin raises significant concerns regarding its safety and reliability as a forex broker. The absence of regulatory oversight, coupled with numerous complaints from users, suggests that this broker may not be a safe option for traders.

Traders should exercise caution and consider alternative options that offer better regulatory protection and a more transparent operational model. Brokers such as EasyMarkets or regulated platforms with strong reputations may provide safer trading environments. Ultimately, thorough research and careful consideration are essential when determining if EasyBestWin is a scam or a viable trading option.

Is EASYBESTWIN a scam, or is it legit?

The latest exposure and evaluation content of EASYBESTWIN brokers.

EASYBESTWIN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EASYBESTWIN latest industry rating score is 2.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.