Is Earn Markets safe?

Business

License

Is Earn Markets Safe or a Scam?

Introduction

Earn Markets is an online trading platform that positions itself within the foreign exchange (Forex) market, claiming to provide a range of trading services including forex, cryptocurrencies, and commodities. As with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The Forex market has seen a surge in the number of brokers, some of which may not adhere to regulatory standards, leading to potential risks for traders. This article aims to investigate whether Earn Markets is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with using this platform.

To ensure a comprehensive analysis, this investigation utilizes a combination of qualitative and quantitative methods. Information was gathered from various online reviews, regulatory databases, and user feedback to provide a balanced view of Earn Markets. The assessment framework focuses on several key areas including regulation and legality, company background, trading conditions, client fund safety, customer experiences, platform performance, and risk evaluation.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in assessing its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct and financial practices. Unfortunately, Earn Markets operates as an offshore broker and lacks authorization from any reputable regulatory authority. This raises significant concerns regarding its legitimacy and the safety of clients' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Earn Markets does not provide the protections typically afforded to clients of regulated brokers, such as access to compensation funds or negative balance protection. Furthermore, the company has been reported to misrepresent its operational location, claiming to operate from the UK without the necessary FCA authorization. This lack of transparency is alarming and suggests that the broker may not be acting in good faith. Additionally, many offshore brokers are known to exploit regulatory loopholes, making them more susceptible to fraudulent practices, which further complicates the evaluation of whether Earn Markets is safe.

Company Background Investigation

Understanding the background of Earn Markets is essential in determining its credibility. The company claims to provide trading services but offers little information regarding its history, ownership structure, or management team. This lack of transparency is a significant red flag, as reputable brokers typically provide detailed information about their operations, including the identities of key personnel and their professional backgrounds.

The absence of verifiable information about the management team raises questions about their expertise and the company's operational integrity. Furthermore, the use of stock photos and the absence of employee profiles on the website contribute to the suspicion surrounding the broker. Legitimate companies generally have a clear and accessible organizational structure, which is crucial for building trust with their clients. Consequently, the lack of disclosure regarding Earn Markets' management and ownership further complicates the analysis of whether Earn Markets is safe for traders.

Trading Conditions Analysis

A broker's trading conditions can significantly impact a trader's experience and profitability. Earn Markets presents itself as offering competitive trading conditions, but the reality may differ. The overall fee structure and any unusual policies should be scrutinized to determine if they align with industry standards.

| Fee Type | Earn Markets | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.1 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Earn Markets advertises low spreads, the lack of clarity regarding commissions and overnight interest rates raises concerns. Traders may find themselves facing hidden fees that could diminish their profits. Moreover, the absence of a minimum deposit requirement can be enticing; however, it may also attract inexperienced traders who are unaware of the risks involved. This ambiguity surrounding trading costs further complicates the assessment of whether Earn Markets is safe, as traders may be vulnerable to unexpected charges that could impact their trading experience.

Client Fund Safety

The safety of client funds is a paramount concern when evaluating any trading platform. Earn Markets does not provide adequate information on its fund safety measures, which is concerning. The absence of segregated accounts and investor protection mechanisms raises significant red flags regarding the security of clients' deposits.

Traders should expect that their funds are held in segregated accounts, separate from the broker's operational funds. This practice is essential for ensuring that client money is protected, especially in the event of insolvency. Furthermore, the lack of information regarding negative balance protection indicates that traders may be exposed to the risk of losing more than their initial investment. Given the broker's offshore status and the absence of regulatory oversight, the potential for fund misappropriation or loss is heightened. This leads to the conclusion that Earn Markets may not be safe for traders looking to protect their investments.

Customer Experience and Complaints

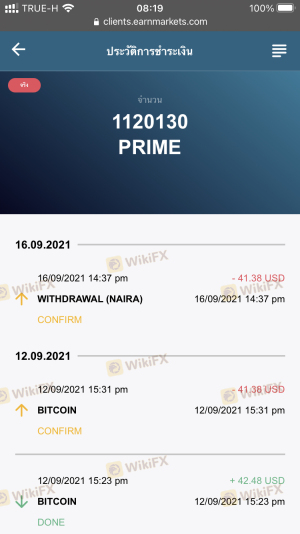

Analyzing customer feedback is crucial for understanding the overall experience of trading with a particular broker. Reviews of Earn Markets reveal a concerning pattern of complaints, particularly regarding withdrawal issues and lack of customer support. Many users report difficulties in accessing their funds, which is a significant warning sign when assessing whether Earn Markets is safe.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | High | Poor |

| Misleading Promotions | Medium | Poor |

Several traders have shared their experiences of being pressured to deposit additional funds or facing excessive withdrawal fees. These tactics are commonly associated with fraudulent brokers and indicate a lack of ethical business practices. The company's response to these complaints has been largely inadequate, further eroding trust among its clientele. Such feedback highlights the need for potential traders to exercise caution and consider these red flags before engaging with Earn Markets.

Platform and Execution

The performance of a trading platform is vital for a seamless trading experience. Earn Markets claims to provide access to popular trading platforms like MetaTrader 4, but user reviews suggest that the platform's stability and execution quality may not meet expectations. Issues such as slippage and order rejections have been reported, which can adversely affect trading outcomes.

The lack of transparency regarding execution quality raises concerns about potential platform manipulation. Traders should be wary of brokers that do not provide clear information about their order execution processes, as this can lead to unfavorable trading conditions. Given the reported issues with Earn Markets' platform performance, it is prudent for traders to consider whether this broker is safe for their trading activities.

Risk Assessment

Engaging with any trading platform carries inherent risks, and it is essential to evaluate these risks comprehensively. The following risk assessment summarizes the key risk areas associated with Earn Markets:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Fund Safety Risk | High | Lack of segregation and protection. |

| Withdrawal Risk | High | Reports of withdrawal difficulties. |

| Transparency Risk | Medium | Limited information about management. |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated brokers, and avoid investing more than they can afford to lose. Engaging in demo trading before committing real funds can also help assess the platform's performance and suitability.

Conclusion and Recommendations

In conclusion, the investigation into Earn Markets raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, transparency, and numerous complaints about withdrawal issues suggest that this broker may not be safe for traders. While the platform may initially appear appealing due to its low spreads and diverse offerings, the associated risks and red flags cannot be overlooked.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative options that are regulated by reputable authorities. Brokers like XM, OctaFX, and others that offer robust regulatory protections and transparent trading conditions may provide a safer trading experience. Ultimately, thorough due diligence is essential for any trader looking to navigate the complexities of the Forex market effectively.

Is Earn Markets a scam, or is it legit?

The latest exposure and evaluation content of Earn Markets brokers.

Earn Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Earn Markets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.