Regarding the legitimacy of DUHFX forex brokers, it provides VFSC and WikiBit, .

Is DUHFX safe?

Business

License

Is DUHFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Dragon Universal Holding Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Duhfx Safe or Scam?

Introduction

Duhfx is an online forex broker established in 2017 and based in Vanuatu. It positions itself as a platform for retail traders looking to engage in the foreign exchange market. However, the rapid growth of online trading has also led to an increase in fraudulent schemes, making it essential for traders to exercise caution when selecting a broker. Evaluating the credibility of a forex broker like Duhfx involves understanding its regulatory status, company background, trading conditions, and customer experiences. This article aims to provide a comprehensive assessment of Duhfx by analyzing these factors and synthesizing information from various sources, including user reviews and regulatory disclosures.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial indicator of its legitimacy and safety. Duhfx claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, recent reports indicate that this license has been revoked, which raises significant concerns about the broker's operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 14634 | Vanuatu | Revoked |

The importance of regulation cannot be overstated, as it provides a framework for protecting traders' interests. A broker operating without valid regulatory oversight is often considered high risk, as they may not adhere to the industry standards that protect investors. The revocation of Duhfx's license suggests a lack of compliance with necessary regulatory requirements, which is a red flag for potential investors. Furthermore, there have been no negative regulatory disclosures found during the evaluation period, but the absence of a valid license makes it difficult to trust the broker's claims of safety.

Company Background Investigation

Duhfx is owned by Dragon Universal Holding Limited, which has been operational since 2017. The company claims to offer a comprehensive trading experience through its platform, using the popular MetaTrader 4 (MT4) software. However, the lack of transparency regarding its ownership structure and the absence of detailed information about the management team raises concerns.

The management teams professional experience is crucial in determining a broker's reliability. Unfortunately, there is limited information available about the individuals behind Duhfx, which can hinder potential traders' ability to assess the broker's credibility. Transparency in company operations, including clear information about the management team and their qualifications, is essential for building trust with clients. Without this transparency, it is challenging to evaluate whether Duhfx is genuinely committed to providing safe trading conditions or if it operates with less scrupulous intentions.

Trading Conditions Analysis

When assessing whether Duhfx is safe, it is essential to analyze its trading conditions, including fees and spreads. Duhfx presents an overall fee structure that seems competitive at first glance, but potential traders should be wary of any hidden fees or unusual policies.

| Fee Type | Duhfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5-2.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs at Duhfx is around 2.0 pips, which is on par with the industry average. However, the absence of a clear commission structure can be concerning, as it may indicate hidden costs that could affect profitability. Additionally, traders should be cautious of any unusual overnight interest rates that could be imposed unexpectedly. A broker's fee structure should be transparent and easy to understand; any ambiguity in this area can be a sign of potential issues.

Client Fund Safety

The safety of client funds is a primary concern for any trader. Duhfx claims to implement various measures to ensure the security of client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable, especially given the revocation of its regulatory license.

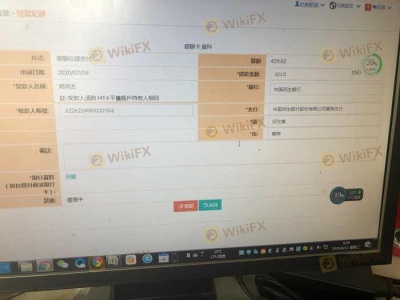

The lack of robust investor protection schemes, such as negative balance protection, further complicates the safety assessment. Traders should always seek brokers that offer comprehensive safety measures to protect their investments. The historical context of Duhfx also raises concerns, as there have been reports of delayed withdrawals and unresponsive customer service, which can indicate potential issues with fund security.

Customer Experience and Complaints

Customer feedback plays a significant role in evaluating a broker's reliability. Reviews of Duhfx reveal a pattern of complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Customer Service Issues | Medium | Poor |

Many users have reported difficulties in withdrawing their funds, with some claiming that their requests were ignored or delayed indefinitely. Such complaints are alarming and suggest that Duhfx may not prioritize customer satisfaction or fund accessibility. The lack of effective communication from the company further exacerbates these issues, making it difficult for traders to resolve problems when they arise.

Platform and Trade Execution

The trading platform offered by Duhfx is MetaTrader 4, a well-regarded platform in the trading community. However, the performance and stability of the platform are critical factors in determining whether Duhfx is safe for trading.

Users have reported mixed experiences with order execution, including instances of slippage and rejected orders. These issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. While the MT4 platform is generally reliable, any signs of manipulation or performance issues could undermine the credibility of Duhfx as a broker.

Risk Assessment

Using Duhfx involves several risks that potential traders should consider carefully.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license raises concerns. |

| Fund Security Risk | High | Reports of withdrawal issues. |

| Customer Service Risk | Medium | Poor response to complaints. |

Given the high regulatory risk, combined with concerns about fund security and customer service, it is prudent for traders to approach Duhfx with caution. To mitigate these risks, traders should conduct thorough research, start with a small investment, and ensure they have a clear understanding of the broker's policies.

Conclusion and Recommendation

In conclusion, the evidence suggests that Duhfx may not be a safe choice for forex trading. The revocation of its regulatory license, coupled with numerous complaints regarding fund accessibility and customer service, raises significant red flags. Traders should be particularly cautious, as there are indications of potential fraud or mismanagement.

For those seeking reliable alternatives, it is advisable to consider brokers with strong regulatory oversight, transparent fee structures, and a proven track record of customer satisfaction. Some reputable options include brokers regulated by the FCA, ASIC, or NFA, which are known for their stringent compliance standards and investor protection measures. Always prioritize safety and conduct thorough due diligence before committing funds to any trading platform.

Is DUHFX a scam, or is it legit?

The latest exposure and evaluation content of DUHFX brokers.

DUHFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DUHFX latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.