Is Dotway Capitals safe?

Business

License

Is Dotway Capitals Safe or Scam?

Introduction

Dotway Capitals is a forex broker that positions itself as a platform for traders seeking to engage in the foreign exchange market. In an industry rife with both reputable and dubious players, it is crucial for traders to exercise caution when selecting a broker. The potential for financial loss is significant, and the consequences of choosing an unreliable broker can be devastating. This article aims to provide an objective analysis of Dotway Capitals, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. Our investigation draws upon a range of sources, including user reviews, regulatory databases, and industry analysis, to evaluate whether Dotway Capitals is indeed safe or a scam.

Regulation and Legitimacy

The regulatory environment surrounding forex brokers is vital for ensuring the safety of traders' funds and the integrity of trading practices. Dotway Capitals operates without any significant regulatory oversight, raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Dotway Capitals is not subject to the same stringent requirements that govern licensed brokers. This lack of oversight can lead to potential risks for traders, including the possibility of fraud and the inability to recover funds in the event of a dispute. Moreover, the lack of a regulatory track record raises questions about the broker's compliance with industry standards and practices. Traders are advised to be wary of engaging with unregulated brokers, as they often lack the necessary safeguards to protect investors.

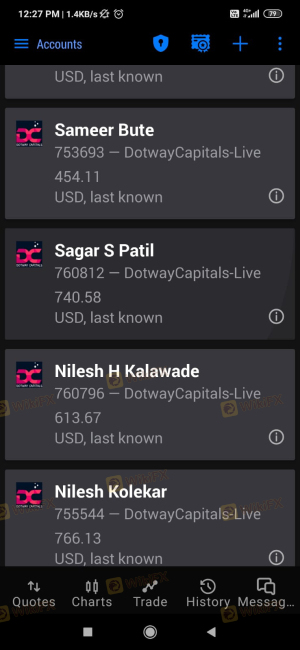

Company Background Investigation

Dotway Capitals company history and ownership structure remain largely opaque. There is limited publicly available information regarding its establishment, operational history, or who is behind the brokerage. This lack of transparency is a red flag for potential investors. A reputable broker typically provides clear information about its management team and corporate structure, enabling traders to assess the professionalism and expertise of those running the firm.

Further complicating matters is the absence of a detailed company profile, which is often indicative of a broker trying to evade scrutiny. Without a clear understanding of the broker‘s history and operational practices, it becomes increasingly difficult for traders to trust Dotway Capitals. The company’s failure to disclose its ownership and operational details raises legitimate concerns about its accountability and reliability.

Trading Conditions Analysis

When evaluating whether Dotway Capitals is safe, it is essential to analyze its trading conditions, including fees and spreads. The overall cost structure of a broker can significantly impact a traders profitability. However, information regarding Dotway Capitals' fees is not readily accessible, which can lead to confusion and unexpected costs for traders.

| Fee Type | Dotway Capitals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of clear information about spreads and commissions is concerning, as it suggests that traders may encounter hidden fees or unfavorable trading conditions. Moreover, the absence of a detailed fee structure can lead to unexpected charges, which could erode trading profits. Traders should be cautious when dealing with brokers that do not provide transparent information about their trading costs.

Client Fund Safety

The safety of client funds is paramount when assessing the legitimacy of any forex broker. Dotway Capitals' policies regarding fund security are not well-documented, which raises questions about the measures in place to protect investors' capital.

In general, reputable brokers implement various safety measures, including the segregation of client funds, investor protection schemes, and negative balance protection policies. However, the lack of information regarding Dotway Capitals' practices in these areas is alarming. Without adequate measures to safeguard client funds, traders may be at significant risk of losing their investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether Dotway Capitals is safe or a scam. Reviews from current and former clients often highlight their experiences, which can reveal potential issues with the broker. Common complaints include withdrawal difficulties, lack of customer support, and unresponsive management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Moderate |

| Transparency of Fees | High | Poor |

Many users report significant challenges when attempting to withdraw their funds, which is often a strong indicator of a scam. The inability to access funds can lead to frustration and financial loss for traders. Additionally, the lack of responsive customer support compounds these issues, leaving traders feeling abandoned and concerned about the safety of their investments.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors in evaluating a broker. Dotway Capitals' platform has received mixed reviews regarding its stability and execution quality. Traders have reported issues such as slippage and order rejections, which can significantly impact trading outcomes.

Furthermore, indications of potential platform manipulation have emerged, with some users expressing concerns about the broker's practices during high volatility periods. A trustworthy broker should provide a seamless trading experience, free from technical glitches or manipulative practices.

Risk Assessment

Engaging with Dotway Capitals presents various risks that traders should consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Potential loss of funds due to lack of safeguards. |

| Operational Risk | Medium | Issues with platform stability and execution. |

Given the high-risk factors associated with Dotway Capitals, traders should approach with caution. Implementing risk mitigation strategies, such as limiting exposure and conducting thorough research, is essential for anyone considering trading with this broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Dotway Capitals is not a safe broker and may exhibit characteristics of a scam. The lack of regulation, transparency issues, and numerous customer complaints raise significant red flags. Traders are advised to exercise extreme caution and consider alternative brokers that are well-regulated and have a proven track record of reliability.

If you are looking for safer trading options, consider brokers that are regulated by top-tier authorities and have positive reviews from users. Prioritizing safety and transparency is crucial in the volatile world of forex trading, and choosing the right broker can make all the difference in your trading success.

Is Dotway Capitals a scam, or is it legit?

The latest exposure and evaluation content of Dotway Capitals brokers.

Dotway Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Dotway Capitals latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.