Regarding the legitimacy of Global DTT forex brokers, it provides FCA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is Global DTT safe?

Business

License

Is Global DTT markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

DIRECT TRADING TECHNOLOGIES UK LIMITED

Effective Date: Change Record

2018-09-18Email Address of Licensed Institution:

info@dttfs.co.uk, complaint@dttfs.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.dttfs.co.uk/Expiration Time:

--Address of Licensed Institution:

Direct Trading Technology Ltd 76 Cannon Street London City Of London EC4N 6AE UNITED KINGDOMPhone Number of Licensed Institution:

+44 2035355815Licensed Institution Certified Documents:

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

DTT VAN LTD

Effective Date:

2023-01-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Direct TT A Scam?

Introduction

Direct TT, operating under the name Direct Trading Technologies Ltd, positions itself as a global player in the forex market, offering a range of trading services across various asset classes including forex, commodities, and cryptocurrencies. However, the rise of online trading has also brought about an increase in scams and fraudulent activities, making it crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen brokers. In this article, we will investigate whether Direct TT is a scam or a safe trading option. Our methodology involves analyzing regulatory status, company background, trading conditions, customer experiences, and overall risk factors associated with this broker.

Regulation and Legitimacy

The credibility of any forex broker heavily relies on its regulatory status. Direct TT claims to be regulated by several authorities, including the Vanuatu Financial Services Commission (VFSC) and the UKs Financial Conduct Authority (FCA). However, the legitimacy of these claims has come under scrutiny, particularly regarding the FCA, which has flagged Direct TT as a "suspicious clone."

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40169 | Vanuatu | Offshore Regulation |

| FCA | 795892 | United Kingdom | Suspicious Clone |

The VFSC is often criticized for its lenient regulatory framework, which does not offer the same level of investor protection as more stringent jurisdictions like the FCA or ASIC. While Direct TT holds a license from the VFSC, it is essential to note that this does not guarantee the same level of oversight and consumer protection as brokers regulated in more robust jurisdictions. Furthermore, the FCA's designation of Direct TT as a suspicious clone raises significant concerns about the broker's legitimacy and compliance history.

Company Background Investigation

Direct TT was established in 2019, and its ownership structure remains somewhat opaque, which is a red flag for potential investors. Limited information is available regarding the management team, their qualifications, or their experience in the financial sector. Transparency is crucial in building trust, and the lack of information raises questions about the company's operational integrity and commitment to regulatory compliance.

The company's headquarters are claimed to be in multiple jurisdictions, including the United Kingdom, the United Arab Emirates, and Vanuatu. However, the absence of a verifiable physical office in these locations further complicates the situation. Without clear ownership and management details, potential clients may find it challenging to assess the broker's reputation and reliability. The absence of robust transparency and information disclosure is a significant concern for traders considering whether "Is Direct TT safe."

Trading Conditions Analysis

When evaluating whether Direct TT is safe, one must consider its trading conditions, including fees, spreads, and overall cost structure. Direct TT requires a minimum deposit of $500, which is relatively high compared to industry standards. The broker offers several account types, each with varying spreads and commission structures.

| Fee Type | Direct TT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.0 pips | 1.0 - 1.5 pips |

| Commission Structure | Commission-free for most accounts | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

The average spread for major currency pairs at Direct TT is reported to be around 3.0 pips, which is significantly higher than the industry average. This could indicate that traders may incur higher costs when trading with this broker. Additionally, the lack of transparency regarding overnight interest rates could lead to unexpected charges, further complicating the cost assessment for potential clients.

Client Funds Security

Client fund safety is a paramount concern when evaluating any broker. Direct TT claims to implement various safety measures, including segregated accounts to protect client funds. However, the effectiveness of these measures largely depends on the regulatory environment in which the broker operates. The VFSC's oversight does not offer the same level of protection as more reputable regulators, raising concerns about the actual security of client funds.

Furthermore, Direct TT does not provide clear information regarding investor protection schemes or negative balance protection policies, which are critical to safeguarding clients against significant losses. The lack of historical data on any past security breaches or fund safety issues does not alleviate concerns; instead, it leaves potential clients wondering about the broker's reliability.

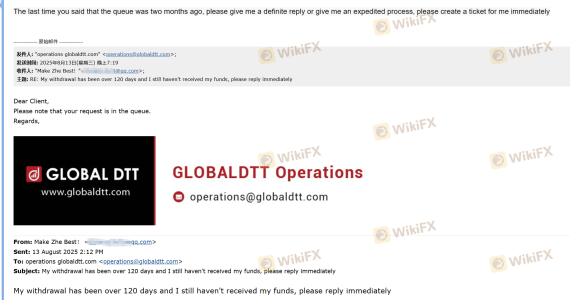

Customer Experience and Complaints

Analyzing customer feedback is essential in determining whether Direct TT is a scam. Online reviews indicate a mixed bag of experiences, with some users reporting difficulties in withdrawing funds. Common complaints include high spreads, poor customer service, and issues related to transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Spreads | Medium | Minimal explanation |

| Poor Customer Service | High | Unresolved queries |

One notable case involved a trader who struggled to withdraw funds after experiencing a significant loss due to high spreads. After multiple attempts to contact customer service, the trader reported receiving inadequate responses, further eroding trust in the broker. Such experiences contribute to the growing sentiment that Direct TT may not be a reliable choice for traders seeking a safe trading environment.

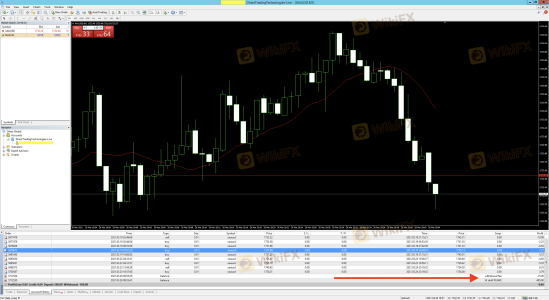

Platform and Trade Execution

The performance of a trading platform is critical in evaluating a broker's reliability. Direct TT offers popular platforms such as MetaTrader 4 and MetaTrader 5, which are known for their functionality and user-friendly interfaces. However, user reports suggest that order execution quality is inconsistent, with some traders experiencing slippage and rejected orders.

There are concerns about potential platform manipulation, particularly given the broker's status as a market maker. This could create conflicts of interest, as the broker stands to gain from client losses. The lack of transparency regarding execution policies further complicates the evaluation of whether Direct TT is a safe trading option.

Risk Assessment

When considering whether Direct TT is safe, it is essential to assess the various risks involved with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with a suspicious clone status. |

| Fund Security Risk | High | Lack of robust investor protection measures. |

| Transparency Risk | Medium | Limited information on management and ownership. |

| Execution Risk | Medium | Inconsistent order execution and potential conflicts of interest. |

Traders should exercise caution and consider alternative brokers that offer better regulatory oversight and transparency. It is advisable to conduct thorough research, understand the risks involved, and seek brokers with a solid reputation and proven track record.

Conclusion and Recommendations

In conclusion, the investigation into Direct TT reveals several concerning factors that suggest it may not be a safe trading option. The broker's regulatory status is questionable, and its high spreads, poor customer service, and lack of transparency further exacerbate concerns.

While Direct TT may offer an array of trading instruments and platforms, the risks associated with trading through this broker are significant. Traders are advised to approach Direct TT with caution and consider alternative brokers that provide stronger regulatory oversight and better protection for client funds. For those seeking reliable trading options, brokers regulated by reputable authorities such as the FCA or ASIC are recommended.

Is Global DTT a scam, or is it legit?

The latest exposure and evaluation content of Global DTT brokers.

Global DTT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global DTT latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.