Is cwg safe?

Business

License

Is CWG Markets A Scam?

Introduction

CWG Markets has emerged as a notable player in the foreign exchange (forex) market, offering a range of trading services and instruments to traders globally. Established in 2018, the broker claims to provide a secure and efficient trading environment, which includes access to popular trading platforms like MetaTrader 4 and 5. However, with the proliferation of online trading platforms, traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities in the forex market necessitates a thorough evaluation of each trading platform's legitimacy. This article aims to investigate the safety and reliability of CWG Markets by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. CWG Markets claims to be regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Vanuatu Financial Services Commission (VFSC). Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 785129 | United Kingdom | Verified |

| Vanuatu Financial Services Commission (VFSC) | 41694 | Vanuatu | Verified |

The FCA is known for its stringent regulations, which require brokers to adhere to strict operational standards, including client fund segregation and regular audits. This regulatory oversight provides a level of assurance to traders regarding the safety of their funds. However, the VFSC is often criticized for its less rigorous regulatory framework compared to top-tier regulators. Therefore, while CWG Markets is regulated, the varying quality of oversight between the FCA and VFSC raises questions about the overall safety of trading with this broker.

Additionally, CWG Markets has faced scrutiny due to regulatory disclosures indicating potential compliance issues. In 2023, there were reports of unauthorized activities linked to the broker, which could affect its credibility. Thus, while CWG Markets is regulated, traders should remain vigilant and conduct their due diligence to ascertain whether CWG is safe for trading.

Company Background Investigation

CWG Markets operates under the ownership of CWG Markets Limited, with headquarters located in both the United Kingdom and Vanuatu. The company was founded in 2018 and has since expanded its operations to serve clients in numerous countries. The management team comprises individuals with diverse backgrounds in finance and trading, which is generally a positive indicator of the broker's operational competence.

However, the transparency of the company has been a point of concern. Information regarding the management team and their professional experiences is not readily available, which can hinder traders' confidence in the broker's legitimacy. Furthermore, the lack of detailed information about the company's ownership structure may raise red flags for potential investors. Transparency is crucial in the financial services industry, and any lack thereof can lead to skepticism regarding the broker's intentions.

In summary, while CWG Markets has a relatively short history, the background investigation reveals a company that operates in a regulated environment. However, the lack of transparency regarding its management and ownership could be a cause for concern among traders evaluating whether CWG is safe.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact the trading experience. CWG Markets provides various account types, each with different minimum deposit requirements, spreads, and commission structures. The following table summarizes the key trading costs associated with CWG Markets:

| Cost Type | CWG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 pips |

| Commission Structure | $0 - $6 per trade | $5 per trade |

| Overnight Interest Range | Varies by instrument | Varies widely |

CWG Markets boasts competitive spreads, particularly for its advanced and institutional accounts, which can start as low as 0.0 pips. However, the commission structure varies, with some accounts charging commissions that can significantly affect profitability, particularly for high-frequency traders.

A potential concern for traders is the broker's minimum deposit requirement, which is relatively low compared to industry standards. While this may attract new traders, it also raises questions about the broker's commitment to maintaining a sustainable business model. Furthermore, there have been complaints regarding hidden fees and unclear commission structures, which can lead to unexpected costs for traders.

In conclusion, while CWG Markets offers competitive trading conditions, traders should carefully evaluate the fee structure and be aware of any potentially hidden costs. Understanding these costs is essential for assessing whether CWG is safe for trading.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. CWG Markets claims to implement several security measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of insolvency.

Additionally, the broker states that it adheres to the Financial Services Compensation Scheme (FSCS) in the UK, which provides coverage for clients up to £85,000 in case of broker failure. This regulatory protection adds an extra layer of security for traders but is only applicable to clients trading under the FCA-regulated entity.

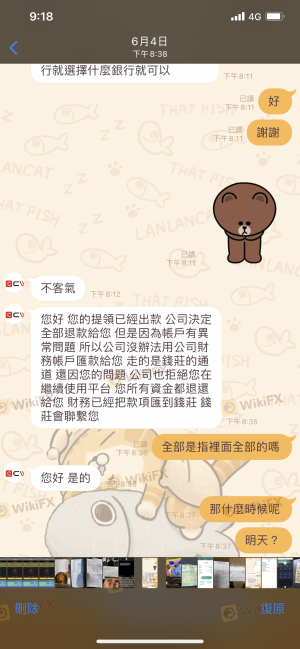

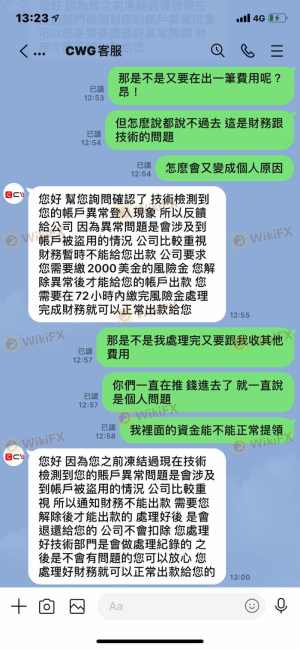

However, there have been historical concerns regarding fund withdrawals and delays reported by clients. Some users have expressed dissatisfaction with the withdrawal process, claiming that their funds were held for extended periods without clear communication from the broker. Such incidents can significantly impact a trader's perception of safety and trustworthiness.

In summary, while CWG Markets has established measures for fund security, the historical issues with withdrawals raise concerns about the overall safety of client funds. Traders should weigh these factors carefully when considering whether CWG is safe for their trading activities.

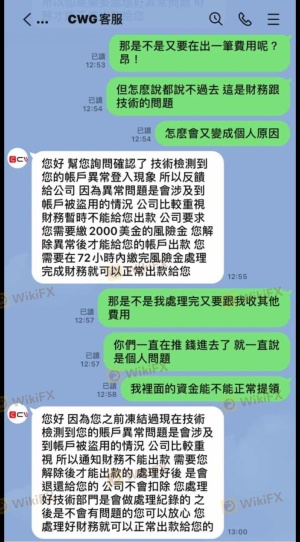

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. CWG Markets has received mixed reviews from clients, with some praising its trading conditions and customer support, while others have raised concerns about withdrawal issues and customer service responsiveness.

The following table outlines common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow and unclear |

| Customer Support Issues | Medium | Inconsistent response |

| Account Verification Problems | Medium | Lengthy process |

One notable complaint involves users experiencing significant delays in withdrawing their funds, with some claiming that their requests were ignored or met with vague responses from customer support. This type of feedback can be detrimental to a broker's reputation and raises questions about whether CWG is safe for traders who prioritize timely access to their funds.

A typical case involved a trader who reported waiting over a month for a withdrawal to be processed, only to be told that additional documentation was required. Such experiences highlight the importance of efficient customer support and clear communication in the trading environment.

In conclusion, while CWG Markets offers some positive trading conditions, the negative customer experiences related to withdrawals and support highlight potential areas of concern that traders should consider before engaging with the broker.

Platform and Execution

The trading platform's performance and execution quality are critical aspects of the trading experience. CWG Markets offers both MetaTrader 4 and MetaTrader 5, which are widely regarded as reliable trading platforms. These platforms provide traders with a range of analytical tools, automated trading options, and a user-friendly interface.

However, some users have reported issues with order execution, including slippage and re-quotes, which can significantly impact trading outcomes. The quality of execution is a vital consideration, especially for day traders and scalpers who rely on fast and precise order fills.

Additionally, there have been allegations of platform manipulation, with some traders claiming that the broker's spreads widened during high volatility periods, leading to unfavorable trading conditions. Such practices, if true, could severely undermine the broker's credibility and raise concerns about whether CWG is safe for trading.

In summary, while CWG Markets provides access to reputable trading platforms, the reported issues with execution quality and potential manipulation warrant caution from traders considering this broker.

Risk Assessment

Engaging with any forex broker carries inherent risks, and CWG Markets is no exception. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed regulatory oversight |

| Client Fund Security | High | Historical withdrawal issues |

| Customer Support | Medium | Inconsistent response times |

| Execution Quality | Medium | Reports of slippage and re-quotes |

Traders should be aware that the mixed regulatory environment and historical issues related to client fund withdrawals pose significant risks. To mitigate these risks, it is advisable to:

- Conduct Thorough Research: Understand the broker's regulatory status and any historical issues.

- Start with a Demo Account: Test the platform and customer service before committing real funds.

- Limit Initial Investments: Use a smaller amount to gauge the broker's reliability before increasing exposure.

In conclusion, while CWG Markets offers some attractive trading conditions, the associated risks necessitate careful consideration. Traders must evaluate their risk tolerance and take proactive steps to safeguard their investments.

Conclusion and Recommendations

In conclusion, the investigation into CWG Markets reveals a broker that operates under regulatory oversight but is not without its concerns. The mixed reviews regarding customer experiences, particularly related to withdrawals and support, raise questions about the broker's reliability. Furthermore, the potential for execution issues and the varying quality of regulatory oversight necessitate caution.

For traders considering whether CWG is safe, it is essential to weigh the benefits against the risks. While some may find the trading conditions appealing, those who prioritize security and reliability may want to explore alternative options.

If you are looking for more reliable brokers, consider those with a strong regulatory background, transparent fee structures, and positive customer feedback. Options such as brokers regulated by top-tier authorities like the FCA or ASIC may provide a safer trading environment.

Overall, while CWG Markets has the potential to serve traders, the concerns raised in this analysis suggest that a cautious approach is warranted.

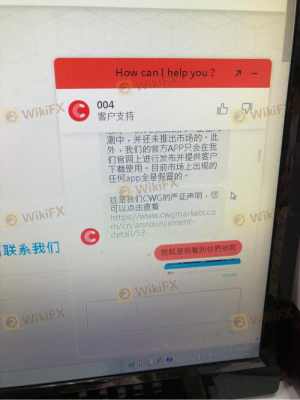

Is cwg a scam, or is it legit?

The latest exposure and evaluation content of cwg brokers.

cwg Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

cwg latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.