Is Capitalforex safe?

Business

License

Is CapitalForex Safe or a Scam?

Introduction

CapitalForex is a relatively new player in the forex trading market, positioning itself as a broker catering to both novice and experienced traders. In an industry where trust is paramount, it is crucial for traders to carefully evaluate the legitimacy and reliability of any broker before committing their hard-earned money. This article aims to provide a comprehensive analysis of CapitalForex, investigating its regulatory status, company background, trading conditions, customer experiences, and overall safety. By employing a structured evaluation framework, we will determine whether CapitalForex is a safe trading option or potentially a scam.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's credibility and trustworthiness. It ensures that the broker operates under strict guidelines that protect traders' funds and uphold fair trading practices. CapitalForex claims to be regulated; however, the specifics of its regulatory status are essential to understand fully.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not specified | N/A | N/A | Not verified |

The absence of clear regulatory information raises concerns about the broker's legitimacy. Reliable brokers are typically regulated by respected authorities such as the FCA in the UK, ASIC in Australia, or CySEC in Cyprus. The lack of such oversight may expose traders to higher risks, including potential fraud or mismanagement of funds. Furthermore, a broker's regulatory history is critical; if they have faced sanctions or complaints in the past, it could indicate ongoing issues with compliance and customer protection. This lack of regulatory clarity is a significant red flag when assessing is CapitalForex safe.

Company Background Investigation

Understanding the companys history and ownership structure is vital for evaluating its reliability. CapitalForex, established recently, lacks a well-documented history that many seasoned brokers possess. The absence of transparency regarding its ownership and management team can create uncertainty about its operational integrity.

The management team's qualifications and experience play a crucial role in a broker's success and credibility. If the leadership lacks industry experience or has a questionable background, it can impact the broker's trustworthiness. Unfortunately, information regarding the management team of CapitalForex is sparse, which further complicates the assessment of its reliability.

In terms of transparency, a reputable broker should provide comprehensive information about its operations, including its physical office locations, contact details, and corporate structure. The lack of such information can lead to skepticism regarding is CapitalForex safe for traders, as it may indicate an attempt to operate without accountability.

Trading Conditions Analysis

The trading conditions offered by a broker are a critical factor for traders when deciding where to invest. CapitalForex provides a range of trading options, but understanding the associated costs is essential for evaluating its competitiveness in the market.

| Fee Type | CapitalForex | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not specified | 0.1 - 0.5 pips |

| Commission Structure | N/A | Low to Medium |

| Overnight Interest Range | N/A | Varies widely |

The absence of detailed information regarding spreads and commissions is concerning. Traders should expect transparency regarding costs, as hidden fees can significantly affect profitability. Additionally, if the broker employs unusual or high fees, it could indicate a lack of competitiveness or fairness in its pricing model. This lack of clarity raises questions about is CapitalForex safe for traders looking for a fair trading environment.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker's reliability. CapitalForex must implement robust measures to ensure that traders' money is protected from mismanagement or fraud.

CapitalForex's approach to fund security should include segregated accounts, which separate client funds from the broker's operational funds. This practice ensures that even in the event of the broker's insolvency, clients can retrieve their funds. Additionally, negative balance protection is essential to prevent traders from losing more than their initial investment.

However, without clear information on these security measures, it is challenging to ascertain whether CapitalForex prioritizes customer fund safety. Historical issues related to fund security or complaints from traders about difficulties in withdrawing their funds further exacerbate concerns about is CapitalForex safe.

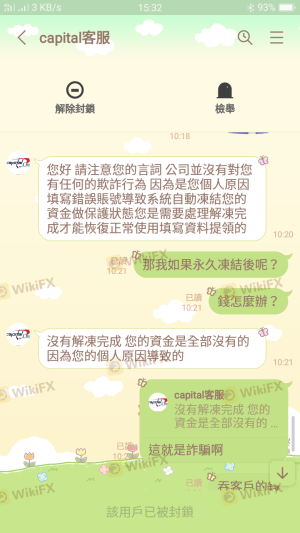

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's operational integrity. While some users may report positive experiences, negative reviews can highlight potential issues within the broker's service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Platform Stability Issues | Medium | Average |

| Customer Service Response | High | Slow |

Common complaints associated with CapitalForex include difficulties in withdrawing funds, delays in processing requests, and issues with platform stability. These complaints indicate a pattern of operational challenges that could undermine traders' confidence in the broker. If a broker struggles to respond effectively to customer issues, it raises significant concerns about its reliability and whether it can be trusted to manage traders' funds safely. Thus, understanding is CapitalForex safe involves considering the overall customer experience and the broker's responsiveness to complaints.

Platform and Execution

The trading platform's performance is crucial for a successful trading experience. CapitalForex must provide a stable and efficient platform that allows traders to execute orders promptly and effectively.

A platform that frequently experiences downtime or has high slippage rates can hinder traders' ability to capitalize on market opportunities. Moreover, any signs of platform manipulation, such as sudden price spikes or unjustified order rejections, can indicate deeper issues within the broker's operations.

If traders find that the platform does not meet their needs or that execution quality is subpar, it can significantly impact their overall trading experience. Therefore, evaluating the platform's performance is integral to determining is CapitalForex safe for traders.

Risk Assessment

Trading with any broker involves inherent risks. For CapitalForex, understanding the specific risks associated with its operations is essential for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of clear regulation raises concerns. |

| Fund Security | High | Insufficient information on fund protection measures. |

| Customer Support | Medium | Reports of slow response to complaints. |

Mitigating these risks involves thorough research before engaging with the broker. Traders should consider starting with small amounts to test the waters and assess the broker's reliability firsthand. Additionally, seeking alternative brokers with clearer regulatory oversight and better customer feedback can help traders make informed decisions about their investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that while CapitalForex may offer trading opportunities, significant concerns regarding its regulatory status, customer fund security, and overall transparency persist. The lack of clear regulatory oversight and transparency raises serious questions about is CapitalForex safe for traders.

For traders seeking a reliable and trustworthy broker, it may be advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com, which are regulated by respected authorities and have positive customer feedback, may provide safer trading environments.

Ultimately, traders must conduct their own due diligence and assess their risk tolerance before engaging with any brokerage, including CapitalForex.

Is Capitalforex a scam, or is it legit?

The latest exposure and evaluation content of Capitalforex brokers.

Capitalforex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capitalforex latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.