Is Bacera Bullion safe?

Business

License

Is Bacera Bullion Safe or a Scam?

Introduction

Bacera Bullion is a relatively new player in the forex market, primarily focusing on trading precious metals such as gold and silver. As the trading landscape continues to evolve, traders must exercise caution when selecting brokers, as the risk of encountering scams is ever-present. This article aims to provide a comprehensive evaluation of Bacera Bullion, examining its regulatory status, company background, trading conditions, and customer experiences. By employing a structured assessment framework, we hope to provide potential traders with the information they need to make informed decisions about whether Bacera Bullion is safe or a scam.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial in determining its legitimacy and reliability. Bacera Bullion claims to operate under the jurisdiction of Hong Kong; however, it lacks a valid regulatory license from any recognized financial authority. This absence of regulation raises significant red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Not Verified |

The lack of regulatory oversight means that Bacera Bullion is not subject to the stringent compliance requirements that protect traders in regulated markets. Furthermore, the absence of a regulatory body overseeing its operations makes it challenging to hold the broker accountable in the event of disputes or financial mismanagement. This situation underscores the importance of evaluating a broker's regulatory standing before committing funds.

Company Background Investigation

Bacera Bullion was established relatively recently, with reports suggesting it has been in operation for only 2 to 5 years. This limited history raises questions about the broker's stability and long-term viability. The ownership structure of Bacera Bullion is not transparently disclosed, which is another point of concern for potential clients.

The management team behind Bacera Bullion has not been extensively reviewed, and there is little available information regarding their professional backgrounds or expertise in the financial sector. This lack of transparency can lead to skepticism about the broker's commitment to ethical practices and customer service.

Overall, the limited history, opaque ownership structure, and lack of experienced management contribute to the perception that Bacera Bullion may not be a safe option for traders looking to engage in forex and precious metals trading.

Trading Conditions Analysis

When assessing whether Bacera Bullion is safe, it is essential to examine its trading conditions, particularly its fee structure. The broker's overall fees appear to be higher than industry averages, which can significantly impact profitability for traders.

| Fee Type | Bacera Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.2 pips |

| Commission Model | $20 per trade | $10 per trade |

| Overnight Interest Range | Varies | Varies |

Bacera Bullion charges a spread of 1.7 pips on major currency pairs, which is notably higher than the industry average of 1.2 pips. Additionally, the broker imposes a commission of $20 per trade, which is double the average commission charged by other brokers. These elevated fees can erode potential profits, making trading with Bacera Bullion less attractive.

Furthermore, the absence of competitive pricing structures, such as commission-free trading or tighter spreads, raises concerns about the broker's commitment to providing value to its clients. This pricing model may deter potential traders, leading them to seek alternatives that offer more favorable trading conditions.

Customer Funds Safety

The safety of customer funds is a critical aspect when evaluating whether Bacera Bullion is safe. The broker claims to hold client funds in segregated accounts, which is a standard practice among reputable brokers. However, without regulatory oversight, the effectiveness of these measures is questionable.

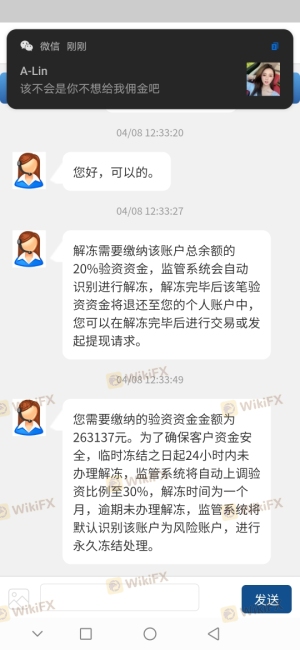

Investors should also consider whether Bacera Bullion offers negative balance protection, a feature that prevents traders from losing more than their initial deposit. Unfortunately, there is no clear information available regarding the implementation of such protections at Bacera Bullion. This lack of clarity can be alarming for potential clients, as it raises concerns about the safety of their investments.

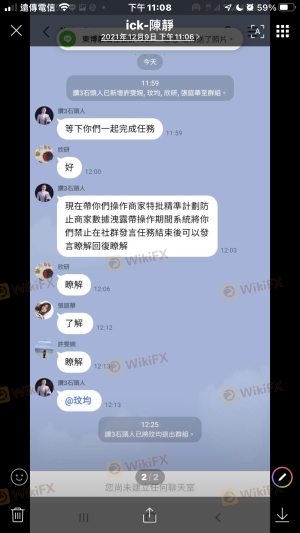

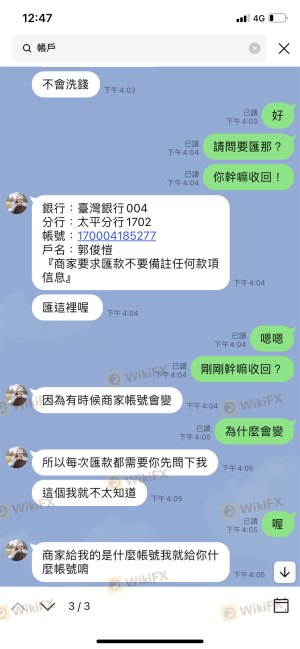

Historically, there have been complaints from traders regarding difficulties in withdrawing funds, which further complicates the assessment of the broker's reliability. Such issues can indicate deeper problems within the brokerage, suggesting that Bacera Bullion may not be a safe place for traders to invest their money.

Customer Experience and Complaints

Evaluating customer experiences is vital in determining whether Bacera Bullion is a scam. Reviews from current and former clients reveal a mixed bag of feedback, with several complaints highlighting significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Average |

| Customer Support Delays | High | Poor |

Many users have reported challenges when attempting to withdraw their funds, with some claiming that their accounts were frozen after they attempted to make a withdrawal. These complaints are serious and suggest a pattern of behavior that could indicate that Bacera Bullion is not a safe broker.

Additionally, the quality of customer support has been criticized, with users noting long response times and inadequate assistance. This lack of effective communication can exacerbate issues faced by traders, leading to frustration and dissatisfaction.

Platform and Trade Execution

The trading platform offered by Bacera Bullion is primarily the widely used MetaTrader 4 (MT4). While MT4 is known for its robust features and user-friendly interface, the performance and stability of Bacera Bullion's implementation are crucial factors to consider.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejected orders. Such issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies or relying on precise execution for their trades.

Additionally, there have been concerns raised about potential platform manipulation, which can further undermine trust in the broker. If traders suspect that their trades are being manipulated or that the platform is not functioning as intended, it raises serious questions about whether Bacera Bullion is safe for trading.

Risk Assessment

Using Bacera Bullion presents several inherent risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation. |

| Financial Risk | Medium | High fees and potential withdrawal issues. |

| Operational Risk | High | Complaints about platform stability. |

The absence of regulatory oversight poses a significant risk, as traders have limited recourse in the event of disputes or financial misconduct. Additionally, the high fee structure can lead to financial losses, particularly for traders who are not aware of the broker's hidden costs.

To mitigate these risks, potential traders should conduct thorough due diligence, consider starting with a demo account, and only invest funds they can afford to lose. Seeking alternative brokers with a solid regulatory framework may also be a prudent approach.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bacera Bullion may not be a safe broker for trading. The lack of valid regulation, high fees, and numerous complaints regarding withdrawal issues raise significant concerns about the broker's legitimacy. While some traders may find success, the risks associated with trading through Bacera Bullion cannot be overlooked.

For those considering forex trading, it may be wise to explore alternative brokers that offer stronger regulatory oversight, lower fees, and a more transparent operational history. Brokers such as Pepperstone, IG, or OANDA could provide safer trading environments, better customer service, and more competitive trading conditions.

In summary, potential traders should approach Bacera Bullion with caution and conduct thorough research before committing any funds.

Is Bacera Bullion a scam, or is it legit?

The latest exposure and evaluation content of Bacera Bullion brokers.

Bacera Bullion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bacera Bullion latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.