Is ADCCKC Limited safe?

Business

License

Is ADCCKC Limited Safe or a Scam?

Introduction

ADCCKC Limited is a relatively new player in the forex trading market, having been established approximately 1-2 years ago. Positioned as an online trading platform, it offers various trading instruments, but its credibility has come under scrutiny. Traders must exercise caution when selecting a forex broker, as the industry is rife with scams and unregulated entities. In this article, we will comprehensively evaluate whether ADCCKC Limited is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. Our investigation is based on multiple reputable sources and user feedback to provide a balanced view of this broker.

Regulatory Status and Legitimacy

A significant aspect of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect client funds. Unfortunately, ADCCKC Limited is not regulated, which raises serious concerns regarding its legitimacy. The absence of regulatory oversight means that the broker operates without accountability, allowing it to potentially engage in unscrupulous practices without fear of repercussions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation is alarming, especially given the reports of clients facing difficulties in withdrawing their funds. Without a regulatory body to oversee its operations, ADCCKC Limited poses a high risk to traders, making it imperative for potential clients to conduct thorough research before engaging with this broker. In the absence of regulatory oversight, the chances of encountering fraudulent behavior increase significantly, leading to a heightened risk of loss for traders.

Company Background Investigation

ADCCKC Limited's company history is limited, with minimal information available regarding its ownership structure and management team. The broker is registered in China, but its operational transparency is questionable. The company's website has reportedly experienced functionality issues, further complicating the ability to gather information about its operations.

The management team's background and professional experience are crucial in assessing the credibility of a broker. However, due to the lack of available information, it is difficult to gauge the expertise of those running ADCCKC Limited. Transparency is vital in the financial services industry, and the absence of clear information about the company's leadership raises red flags. Investors should be wary of engaging with a broker that lacks a solid foundation and clear operational history, as this could indicate potential risks and unethical practices.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. ADCCKC Limited's fee structure appears opaque, with no clear information on spreads, commissions, or other trading costs readily available. This lack of transparency can be a significant warning sign for potential traders.

| Fee Type | ADCCKC Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies widely |

| Overnight Interest Range | Not Disclosed | 0.5% - 2.0% |

The absence of disclosed trading costs can lead to unexpected expenses for traders, potentially eroding profits. Furthermore, reports of withdrawal issues and lack of customer support exacerbate concerns about the broker's reliability. Traders must be cautious and consider these factors when evaluating whether ADCCKC Limited is safe or a scam.

Customer Fund Security

The security of customer funds is a paramount concern for any trader. ADCCKC Limited's lack of regulation raises serious questions about its fund security measures. Regulated brokers are typically required to maintain client funds in segregated accounts, ensuring that trader money is protected in the event of company insolvency. However, without regulatory oversight, there is no assurance that ADCCKC Limited follows such practices.

Additionally, the absence of negative balance protection is concerning. This protection is crucial for traders, as it prevents them from losing more than their initial investment during extreme market conditions. Historical issues related to fund security, such as reports of clients being unable to withdraw their funds, further emphasize the risks associated with this broker.

Customer Experience and Complaints

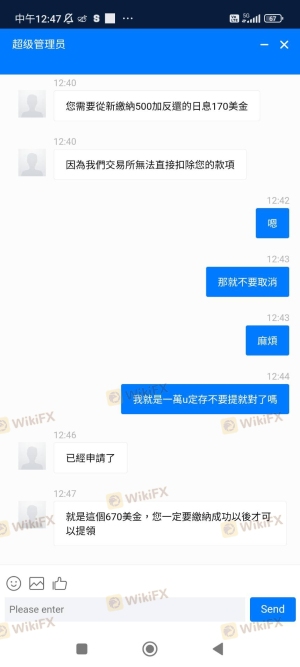

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, reviews of ADCCKC Limited are largely negative. Many users have reported issues with fund withdrawals, with some claiming they were unable to access their money altogether. This pattern of complaints raises significant concerns about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Transparency Issues | High | Poor |

Typical cases include traders who deposited funds only to find themselves unable to withdraw, leading to frustration and financial loss. The company's inadequate response to these complaints further exacerbates the situation, indicating a lack of commitment to customer service. This pattern of negative feedback strongly suggests that ADCCKC Limited may not be a safe option for traders.

Platform and Execution

Evaluating the trading platform's performance is crucial for any trader. ADCCKC Limited claims to offer a user-friendly trading experience, but the lack of detailed reviews makes it challenging to assess the platform's reliability. Key factors such as order execution quality, slippage rates, and the possibility of order rejections are critical in determining whether the platform operates fairly.

Unfortunately, there are no comprehensive reports available that detail the platform's performance, which adds to the uncertainty surrounding ADCCKC Limited. Traders should remain vigilant, as any signs of manipulation or poor execution can significantly impact trading outcomes.

Risk Assessment

Using ADCCKC Limited comes with several risks that potential traders should carefully consider. The absence of regulation, negative user feedback, and unclear trading conditions all contribute to a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Withdrawal issues reported |

| Transparency Risk | High | Lack of information available |

To mitigate these risks, traders should consider using a demo account or starting with a minimal deposit to gauge the broker's reliability. Thorough research and caution are paramount when dealing with unregulated brokers like ADCCKC Limited.

Conclusion and Recommendations

In conclusion, ADCCKC Limited is not a safe trading option. The combination of its unregulated status, negative user experiences, and lack of transparency raises significant red flags. Traders should approach this broker with extreme caution and consider alternative, regulated options that prioritize client safety and fund security.

For those seeking reliable forex brokers, it is advisable to select firms that are well-regulated and have a proven track record of positive customer experiences. By doing so, traders can significantly reduce their risk exposure and enhance their chances of success in the forex market.

Is ADCCKC Limited a scam, or is it legit?

The latest exposure and evaluation content of ADCCKC Limited brokers.

ADCCKC Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ADCCKC Limited latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.