Is 51Markets safe?

Business

License

Is 51Markets Safe or Scam?

Introduction

51Markets is a forex broker that positions itself as a significant player in the online trading landscape, claiming to offer a wide array of trading instruments and account types tailored for various trader profiles. However, as the forex market continues to grow, so does the number of brokers, making it imperative for traders to exercise caution and thoroughly evaluate the legitimacy and safety of their chosen trading platforms. This article aims to provide a comprehensive assessment of 51Markets, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a thorough analysis of various online sources, user reviews, and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its safety and credibility. In the case of 51Markets, it has been flagged as an unregulated forex broker. Despite claims of being regulated by various U.S. authorities, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), these assertions have been found to be misleading. Both the SEC and FINRA do not issue licenses for forex trading, which raises red flags regarding the legitimacy of 51Markets claims. Furthermore, a search conducted with the National Futures Association (NFA) revealed that 51Markets is not a member, confirming its lack of regulation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Not Regulated |

| SEC | N/A | United States | Not Applicable |

| FINRA | N/A | United States | Not Applicable |

The absence of regulatory oversight means that traders funds are not protected by any governing body, making it challenging to seek recourse in case of disputes or fraud. This lack of regulation significantly heightens the risk of engaging with 51Markets, as it operates in a regulatory gray area with minimal accountability.

Company Background Investigation

51Markets was established in 2019 and claims to be based in China. While the company markets itself as a leading forex broker, its operational history remains limited. The ownership structure is not transparent, with little information available regarding its founders or management team. This lack of transparency raises concerns about the brokers accountability and trustworthiness.

The management team of 51Markets has not been adequately disclosed, which is a critical aspect for potential investors. A competent management team with a proven track record is essential for the reliable operation of any financial service provider. The absence of detailed information regarding the teams qualifications and experience further complicates the assessment of the broker's legitimacy.

Moreover, the level of information disclosure from 51Markets is subpar, with vague references to its services and policies. Such opacity can be a warning sign for traders, indicating a lack of commitment to transparency and customer service, both of which are vital for fostering trust in the financial industry.

Trading Conditions Analysis

Examining the trading conditions offered by 51Markets reveals a mixed picture. The broker provides a variety of trading instruments, including forex, commodities, indices, precious metals, and cryptocurrencies. However, the overall cost structure associated with trading at 51Markets is concerning.

Core Trading Costs Comparison

| Cost Type | 51Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | Spread-only | Varies |

| Overnight Interest Range | N/A | Varies |

The spread structure at 51Markets starts at 1.5 pips for major currency pairs, which is on the higher end compared to the industry average. Additionally, the lack of transparency regarding commissions and overnight interest rates raises questions about hidden fees that could impact profitability.

Traders are often drawn to brokers with competitive pricing, and the higher spreads at 51Markets could deter potential clients. Furthermore, the absence of clear information on commission models and overnight interest policies suggests that traders may encounter unexpected costs, further complicating their trading strategies.

Client Funds Safety

The safety of client funds is a paramount concern for any forex trader. In the case of 51Markets, the lack of regulation poses significant risks to the security of client funds. The broker does not provide sufficient information regarding its fund protection measures, which is a critical aspect for any trader considering opening an account.

One of the essential safety measures is segregation of client funds, where traders' money is kept separate from the brokers operational funds. Additionally, investor protection schemes and negative balance protection are vital features that help safeguard traders from losing more than their deposited amounts. Unfortunately, 51Markets has not provided any information regarding these protective measures, leaving traders vulnerable to potential loss.

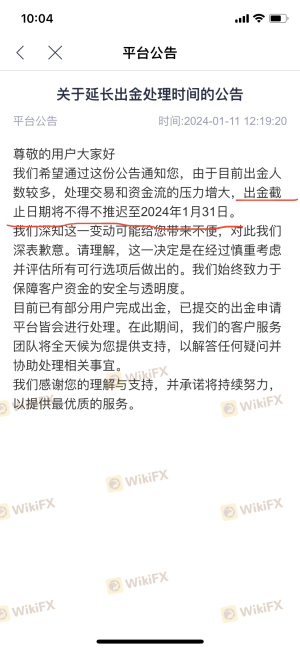

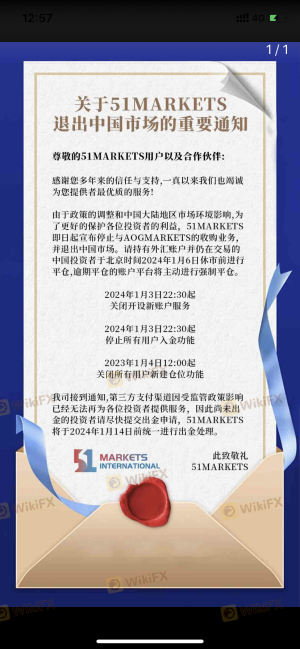

Historically, there have been allegations and complaints regarding the broker's handling of client funds, including issues with withdrawals and fund accessibility. Such incidents raise significant concerns about the broker's reliability and the safety of traders' investments.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the overall experience with a broker. In the case of 51Markets, numerous complaints have been reported, particularly regarding withdrawal issues and customer support responsiveness. Many users have expressed frustration over their inability to withdraw funds, which is a significant indicator of potential fraud or mismanagement.

Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Support | Medium | Inconsistent Support |

| Platform Issues | High | Unresponsive |

Several users have reported that their withdrawal requests were either delayed or denied altogether, which raises serious questions about the brokers trustworthiness. Additionally, the quality of customer support has been reported as inconsistent, with many users experiencing slow response times or unhelpful assistance. This lack of effective communication can exacerbate frustrations and lead to a negative trading experience.

Two notable cases include traders who reported being unable to access their funds after multiple withdrawal requests, leading to allegations of the broker engaging in fraudulent practices. These experiences highlight the potential risks associated with trading through 51Markets and serve as a warning to prospective clients.

Platform and Trade Execution

The trading platform is a critical component of any forex broker's offering. 51Markets utilizes the popular MetaTrader 4/5 platforms, known for their user-friendly interface and advanced trading features. However, user experiences with the platform have been mixed, with reports of instability and execution issues.

Traders have raised concerns about the quality of order execution, including instances of slippage and order rejections. Such issues can significantly impact trading performance, especially for those relying on precise execution for their strategies. Furthermore, any signs of potential platform manipulation, where the broker may influence pricing or execution to their advantage, can severely undermine trader confidence.

Risk Assessment

Using 51Markets comes with several inherent risks that potential traders should consider carefully. The lack of regulation, combined with historical complaints and issues surrounding fund safety, creates a precarious trading environment.

Key Risk Areas Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Safety | High | Lack of protective measures for client funds. |

| Customer Support | Medium | Inconsistent support can lead to unresolved issues. |

| Platform Stability | Medium | Reports of execution problems and instability. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with 51Markets. It is advisable to consider alternative, regulated brokers that offer better protection and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that 51Markets raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, combined with numerous complaints about fund withdrawals and customer support, indicates a potentially risky environment for traders. While the broker offers a variety of trading instruments and account types, the associated risks may outweigh the benefits.

For cautious traders, it is advisable to avoid engaging with 51Markets and instead consider regulated alternatives that provide a higher level of security and transparency. Brokers such as IG Markets, OANDA, and Forex.com are examples of reliable options that adhere to strict regulatory standards and offer robust customer support.

In summary, while 51Markets may present itself as a viable trading option, the risks associated with its unregulated status and negative user feedback warrant a careful approach. Always prioritize safety and regulatory compliance when choosing a forex broker.

Is 51Markets a scam, or is it legit?

The latest exposure and evaluation content of 51Markets brokers.

51Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

51Markets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.