Windsor Review 1

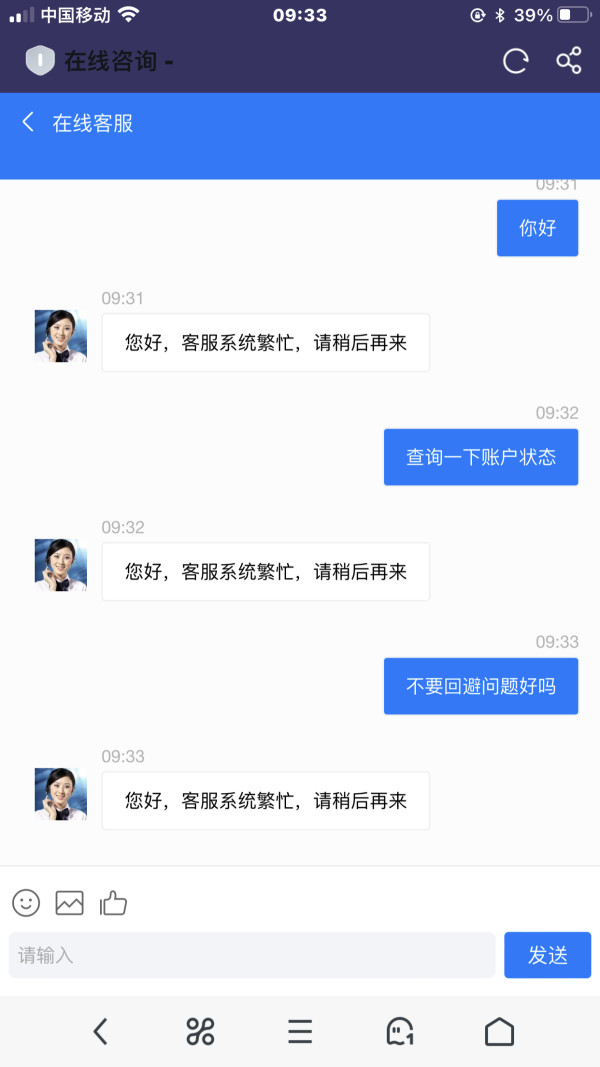

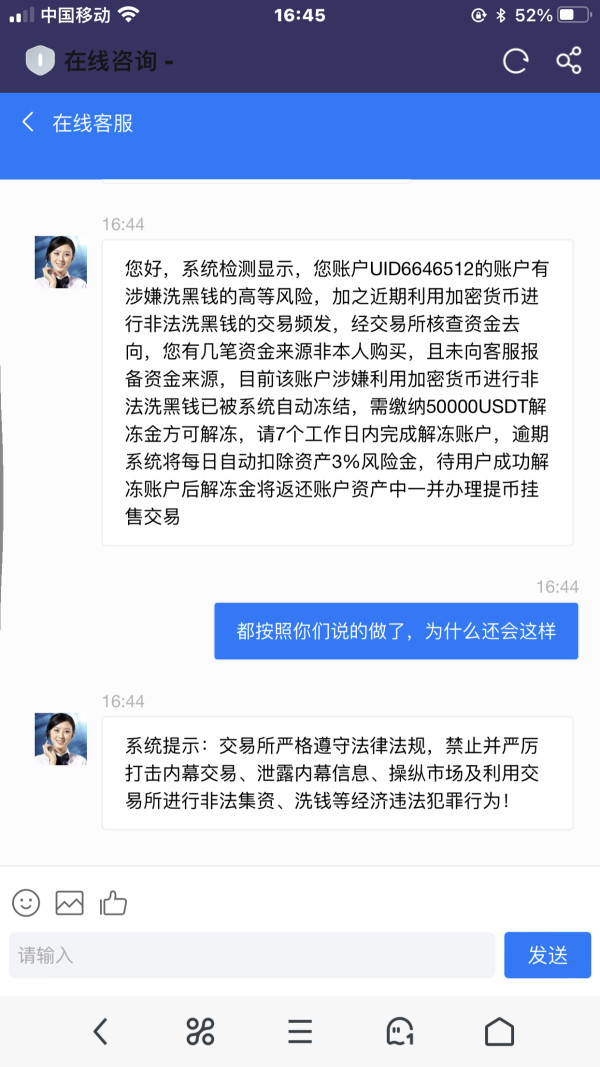

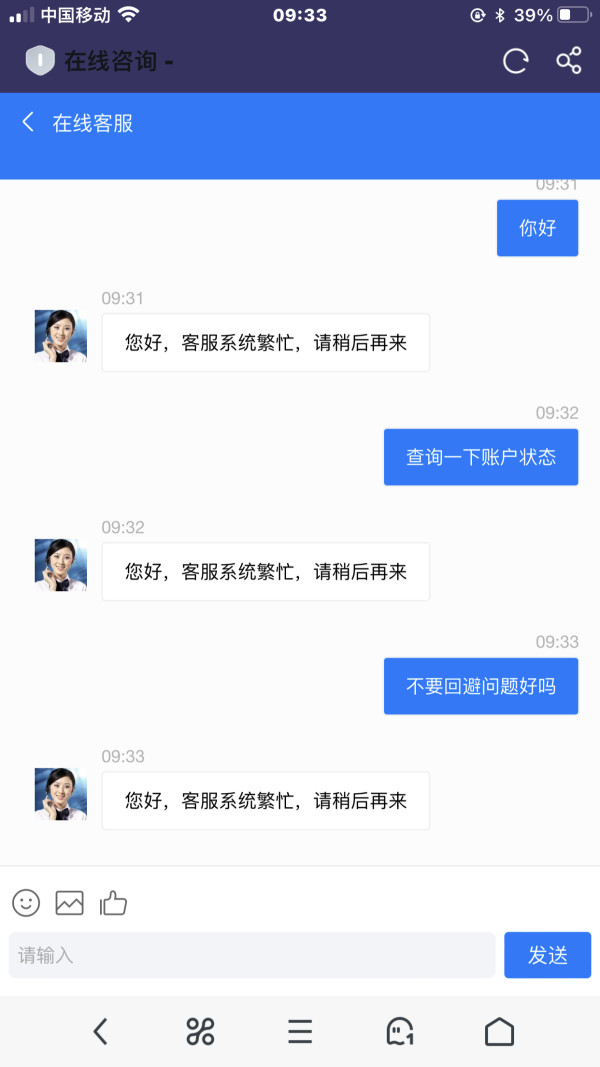

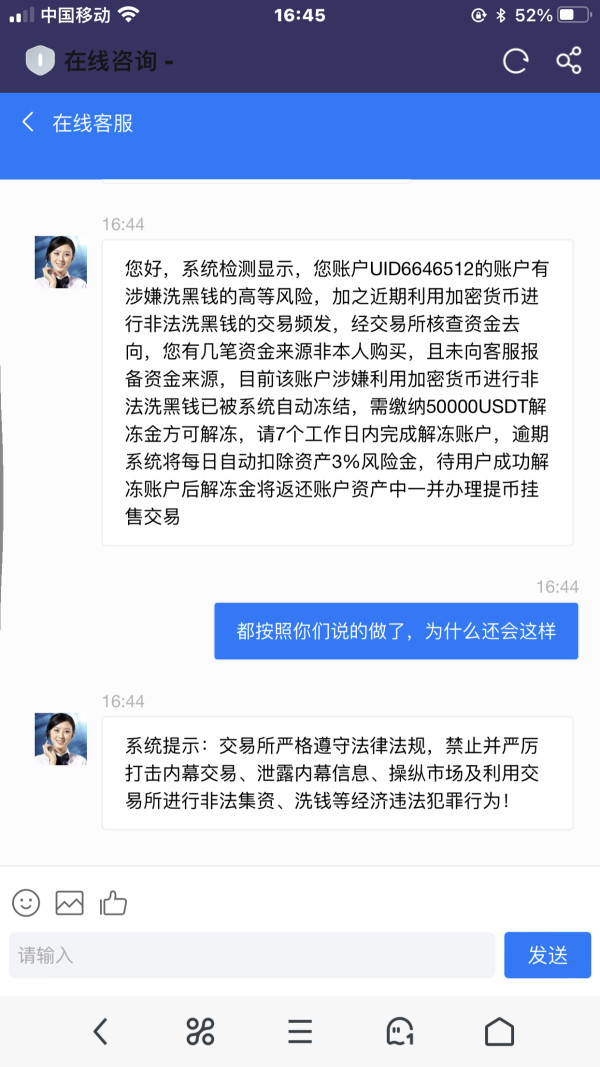

The scammer used online chat app to make money, and paid on the platform non-stop, with a total of 550,000 yuan before and after. Now they say that the funds are frozen, and I need to pay 360,000 yuan to unfreeze.

Windsor Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The scammer used online chat app to make money, and paid on the platform non-stop, with a total of 550,000 yuan before and after. Now they say that the funds are frozen, and I need to pay 360,000 yuan to unfreeze.

Windsor Brokers is an average forex broker. It competes with many other online trading platforms in a crowded market. This Windsor review shows that the broker wants to help both new and experienced traders who want to trade forex and commodities. The platform gives traders multiple tools and platforms, which makes it easy for people with different skill levels and goals to use.

The broker's main strength is its simple approach to forex and commodity trading. It provides basic services without making things too complicated for users. Windsor Brokers focuses on individual investors who want basic trading features instead of fancy advanced tools. The platform handles basic trading needs well, but it works in a tough market where special features help brokers succeed over time.

Windsor Brokers follows rules in multiple countries, which makes its business legitimate. The broker covers major forex pairs and commodity tools, which helps traders who like these traditional markets. However, we don't have much detailed information about specific trading conditions and advanced features in public sources.

Traders need to know that Windsor Brokers works through different regulatory groups in various countries. These include the Seychelles Financial Services Authority and the British Virgin Islands Financial Services Commission. These different rule systems may create different service levels and protection measures depending on where you live and which specific company you trade with.

This review uses official information and user feedback from multiple sources. Potential clients should check current terms and conditions directly with Windsor Brokers because rules and services may change over time.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Limited information available on specific account terms |

| Tools and Resources | 8/10 | Multiple trading platforms and tools for various trader levels |

| Customer Service | 6/10 | Basic support structure, specific details not widely documented |

| Trading Experience | 7/10 | Standard trading environment with essential features |

| Trustworthiness | 7/10 | Regulated entity with established industry presence |

| User Experience | 6/10 | Functional platform design, room for enhancement |

Windsor Brokers works as a forex and commodity trading provider for regular investors. The company built its reputation by focusing on main trading services and making things easy for traders who want simple market access without too much complexity. The broker's business plan centers on providing basic trading structure while following rules across multiple countries.

The platform's approach follows traditional forex broker principles. It offers standard trading tools and basic analysis features. Windsor Brokers has positioned itself to serve traders who value reliability and rule oversight over new technology or creative features. This approach appeals especially to careful traders and those new to forex markets who prefer established, regulated platforms.

Windsor Brokers operates under rule supervision from the Seychelles Financial Services Authority and the British Virgin Islands Financial Services Commission. This multi-country regulatory approach gives operational flexibility while maintaining compliance standards. The broker offers forex and commodity trading services through various trading platforms, though we don't have extensive documentation about specific platform details in available sources. The company's asset coverage includes major currency pairs and commodity tools, focusing on liquid markets that appeal to both retail and semi-professional traders.

Regulatory Jurisdictions: Windsor Brokers maintains regulatory compliance through the Seychelles Financial Services Authority and the British Virgin Islands Financial Services Commission. This provides multi-country oversight for its operations.

Deposit and Withdrawal Methods: We don't have specific information about available deposit and withdrawal methods in current documentation. This requires direct inquiry with the broker for current options.

Minimum Deposit Requirements: Current minimum deposit requirements are not specified in accessible sources. This means potential clients should contact Windsor Brokers directly for this information.

Bonus and Promotions: Available promotional offers and bonus structures are not detailed in current documentation. This suggests the broker may focus on standard trading conditions rather than promotional incentives.

Tradeable Assets: The platform supports forex and commodity trading. It covers major currency pairs and commodity instruments, though we don't have comprehensive documentation of specific asset lists.

Cost Structure: We don't have extensive public information about detailed spreads, commissions, and fee structures. This requires direct verification with the broker.

Leverage Ratios: Specific leverage offerings are not detailed in available information. These likely vary based on regulatory area and account type.

Platform Options: Windsor Brokers provides multiple trading platforms. However, we don't have comprehensive documentation of specific platform names and features in accessible sources.

Geographic Restrictions: Current geographic limitations and restricted territories are not specified in available documentation.

Customer Support Languages: We don't have detailed information about supported languages for customer service in accessible sources.

This Windsor review shows that while Windsor Brokers maintains regulatory compliance and offers main trading services, detailed operational information requires direct communication with the broker.

Windsor Brokers' account structure follows a traditional approach to forex broker services. However, we don't have comprehensive documentation about specific details of account types and their distinctive features in available sources. The broker appears to offer standard retail trading accounts suitable for individual investors, but detailed information about account levels, minimum balance requirements, and specific account benefits requires direct inquiry.

The account opening process likely follows standard industry practices. This involves identity verification and compliance procedures required by regulatory authorities in the Seychelles and British Virgin Islands. However, we don't have detailed information about specific documentation requirements, processing times, and verification procedures in accessible sources.

We don't have clear details about specialized account offerings such as Islamic accounts or professional trading accounts in available information. This lack of detailed account information suggests that Windsor Brokers may focus on simplified account structures rather than complex tiered systems.

The absence of detailed account condition information in public sources means potential clients should directly contact Windsor Brokers. This will help them understand specific terms, conditions, and account features that may be available.

Windsor Brokers shows strength in providing multiple trading platforms and tools designed to help traders across different experience levels. According to available information, the broker offers various trading platforms, which suggests a commitment to providing technology structure that meets diverse trading needs.

The platform selection shows that Windsor Brokers recognizes the importance of offering traders choice in their trading environment. Multiple platform options typically allow traders to select interfaces and functionality that match their trading styles and technical requirements. This approach benefits both beginners who may prefer simplified interfaces and experienced traders who require advanced analytical capabilities.

However, we don't have comprehensive documentation about specific details of research and analysis resources, educational materials, and automated trading support in available sources. The quality and depth of analytical tools, market research, and educational content remain unclear based on accessible information.

The broker's approach to tools and resources appears to emphasize practical trading functionality rather than extensive educational or research offerings. This focus may appeal to self-directed traders who primarily seek reliable execution and basic analytical tools rather than comprehensive educational support.

Customer service information for Windsor Brokers is limited in available documentation. This makes it difficult to provide a comprehensive assessment of support quality and availability. Standard industry practice suggests the broker likely offers multiple communication channels, but we don't have clear documentation about specific details of available support methods.

We don't have available information about response times, service quality metrics, and customer satisfaction data in accessible sources. This lack of detailed customer service information makes it challenging to evaluate the broker's commitment to client support and problem resolution.

Available information doesn't specify multilingual support capabilities. However, brokers operating in multiple countries typically provide support in several languages. The extent of language support and the availability of native-speaking representatives remains unclear.

We don't have detailed information about customer service hours and availability across different time zones in accessible sources. Given the global nature of forex markets, 24-hour support during trading hours would be expected, but available information cannot confirm this.

The limited availability of customer service details suggests potential clients should directly inquire about support options. They should ask about availability and service standards before opening accounts.

The trading experience offered by Windsor Brokers appears to focus on providing essential functionality rather than advanced features or creative technology. The broker's multiple platform offerings suggest an effort to accommodate different trading preferences and technical requirements.

Platform stability and execution speed are critical factors for forex trading success. However, we don't have available specific performance metrics and reliability data in accessible sources. The quality of order execution, including slippage rates and fill quality, cannot be assessed based on current information.

Mobile trading capabilities are increasingly important for modern traders. However, we don't have documented detailed information about mobile platform features and functionality in available sources. The extent of mobile trading support and feature parity with desktop platforms remains unclear.

We don't have comprehensive coverage of trading environment details in accessible documentation. This includes available order types, risk management tools, and advanced trading features. This Windsor review indicates that traders seeking specific advanced features should directly verify availability with the broker.

The overall trading experience appears to emphasize reliability and regulatory compliance rather than cutting-edge technology or creative features.

Windsor Brokers maintains regulatory oversight through the Seychelles Financial Services Authority and the British Virgin Islands Financial Services Commission. This provides a foundation for operational legitimacy. These regulatory relationships indicate the broker operates within established legal frameworks and maintains compliance with applicable financial services regulations.

The multi-country regulatory approach offers operational flexibility while maintaining oversight standards. However, it's important to note that regulatory protection levels may vary between countries, and clients should understand which regulatory entity oversees their specific trading relationship.

We don't have detailed information about fund safety measures and client money protection protocols in available sources. This makes it difficult to assess the specific protections available to client funds. Standard regulatory requirements typically include segregated client accounts, but we don't have documented specific implementation details.

Company transparency regarding ownership structure, financial statements, and operational details is limited in accessible information. We don't have comprehensively available information about the broker's corporate structure and background in public sources.

We don't have extensively documented industry reputation and track record information. This makes it challenging to assess the broker's standing within the forex industry. The absence of detailed negative event reporting suggests no major regulatory issues, but comprehensive reputation assessment requires additional research.

We don't have extensively available overall user satisfaction data for Windsor Brokers in accessible sources. This makes it difficult to provide a comprehensive assessment of client satisfaction levels. The broker's focus on serving both new and experienced traders suggests an effort to accommodate diverse user needs.

We don't have comprehensively documented platform interface design and usability details. However, the availability of multiple trading platforms indicates recognition of different user preferences. The quality of user interface design and navigation cannot be assessed based on available information.

Registration and account verification processes likely follow standard industry practices required by regulatory authorities. However, we don't have documented specific details about process efficiency and user experience in accessible sources.

Fund management experience, including deposit and withdrawal processes, is not detailed in available information. Processing times, available methods, and user satisfaction with financial transactions cannot be assessed based on current documentation.

We don't have documented common user complaints or satisfaction trends in accessible sources. This limits the ability to identify potential areas of concern or strength in the user experience.

The target user profile of individual investors seeking forex and commodity trading suggests Windsor Brokers aims to serve practical trading needs. It doesn't focus on providing comprehensive investment platforms.

Windsor Brokers presents itself as a straightforward forex and commodity broker suitable for traders seeking regulated market access without too much complexity. This Windsor review concludes that the platform serves its intended purpose as a basic trading provider, though detailed information about specific services and conditions requires direct verification.

The broker appears most suitable for individual investors who prioritize regulatory compliance and basic trading functionality over advanced features or comprehensive educational resources. Traders seeking cutting-edge technology or extensive research tools may find other platforms more suitable for their needs.

The main strengths include regulatory oversight and multiple platform options. The primary limitation lies in the lack of detailed public information about specific trading conditions and service features. Potential clients should conduct thorough research and direct communication with Windsor Brokers before making trading decisions.

FX Broker Capital Trading Markets Review