VIPGlobal Capital Review 1

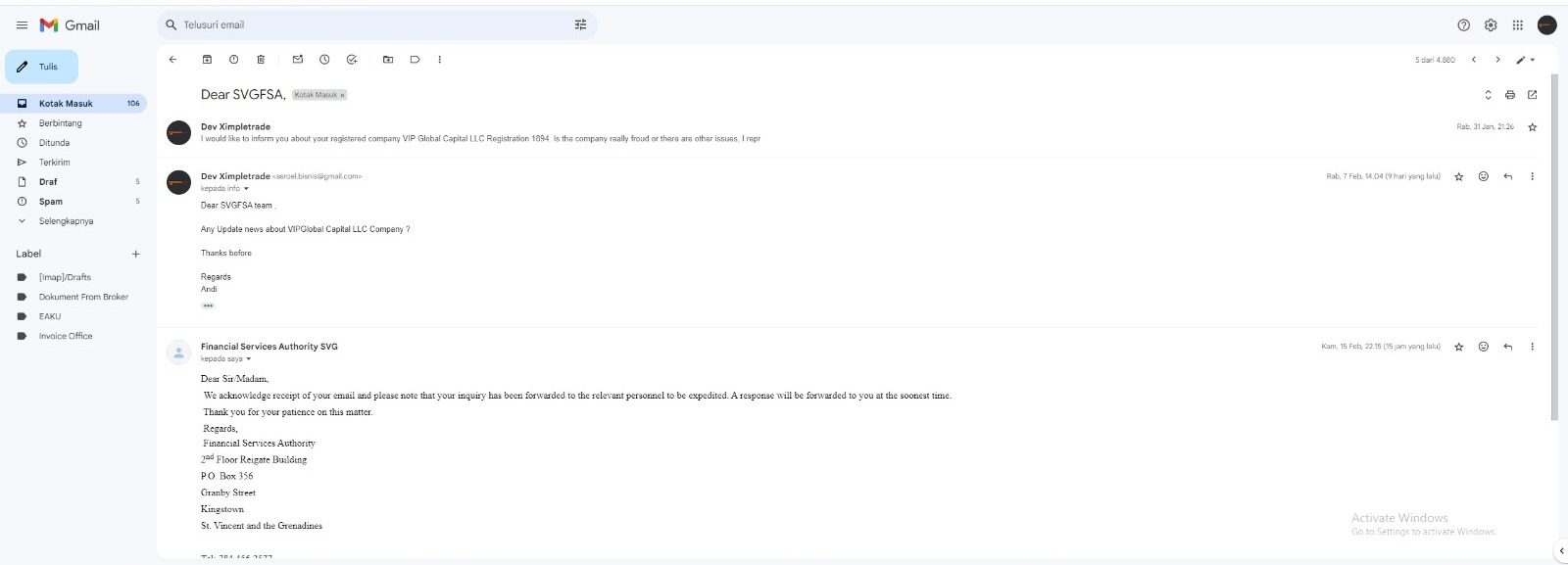

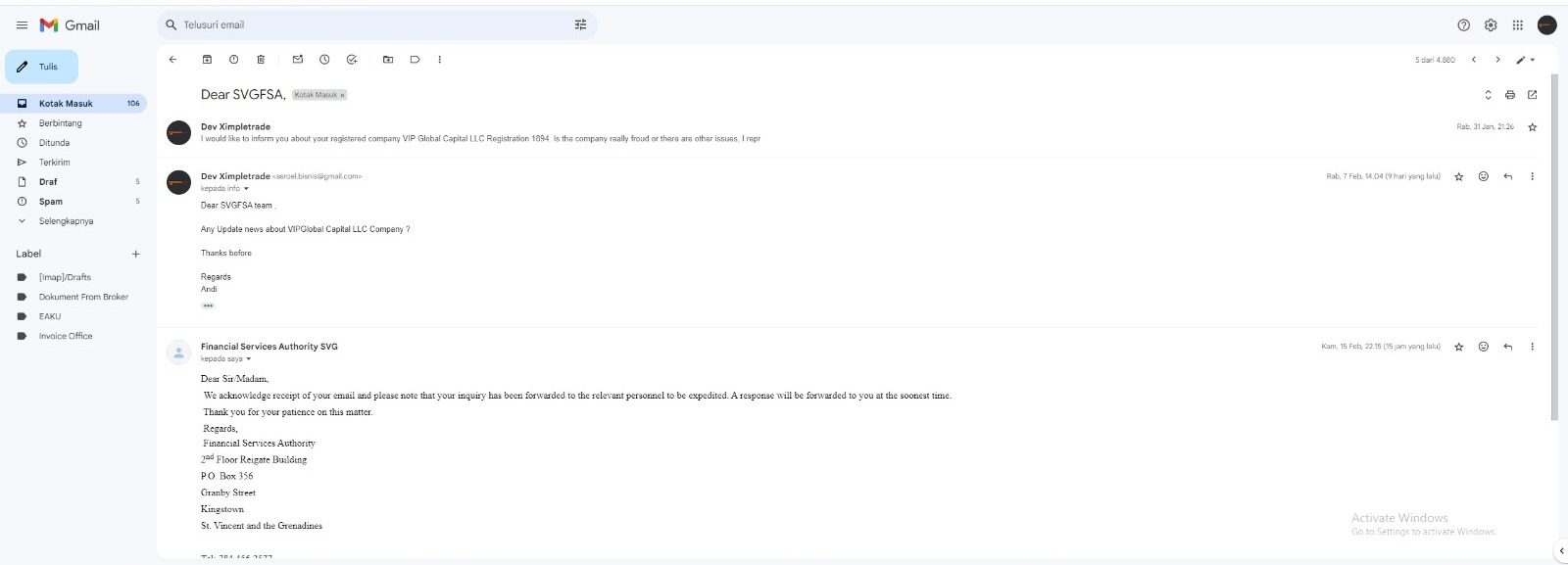

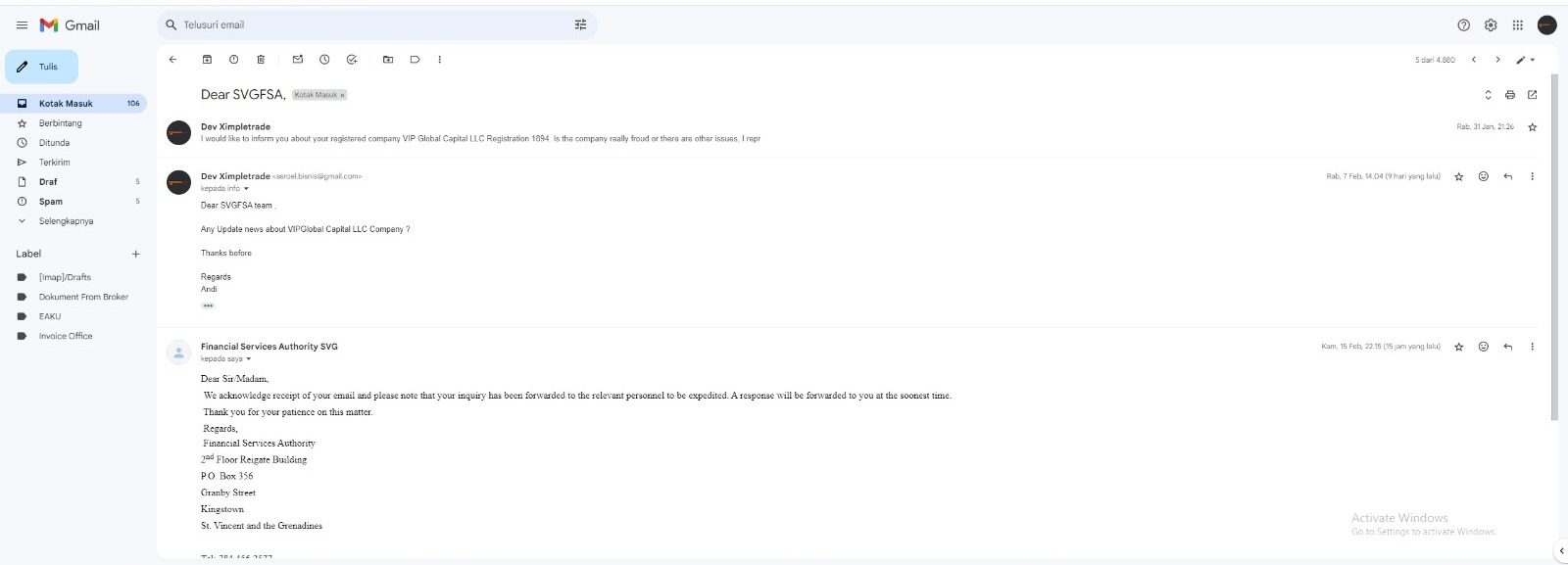

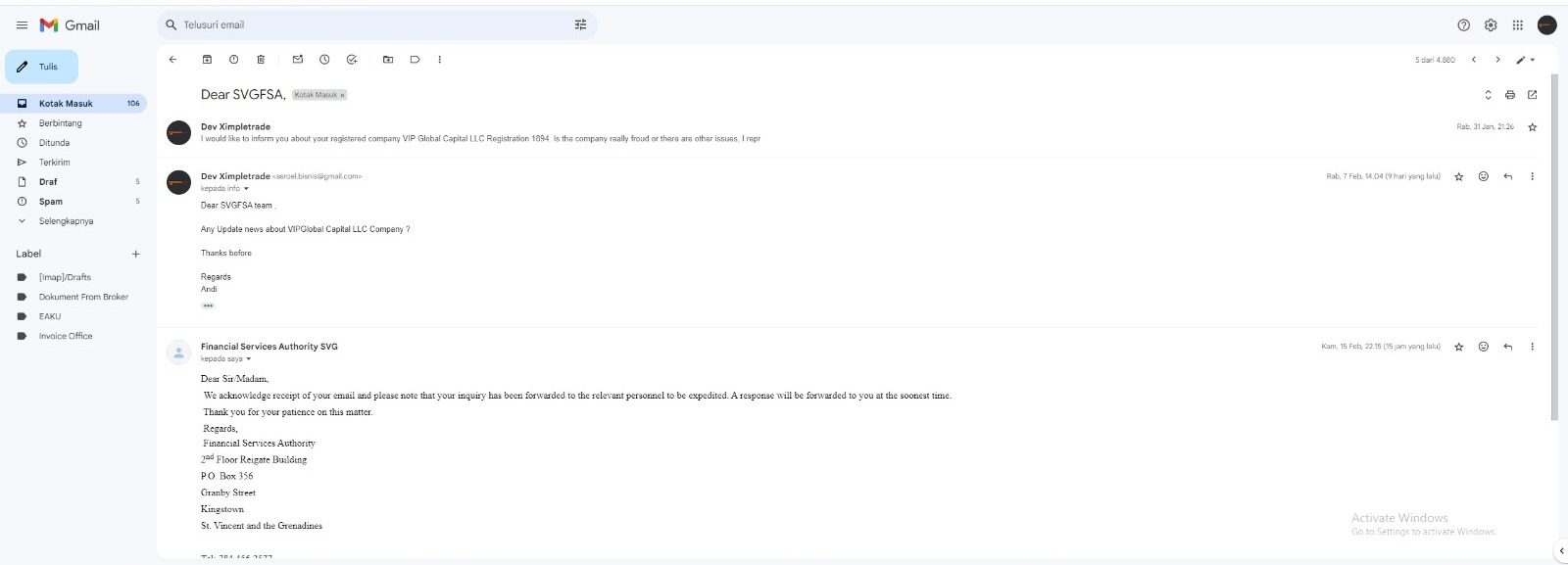

Please help identify this company because it has claimed many victims in Indonesia. It has been reported to the authorities but until now there has been no response. Please help.

VIPGlobal Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Please help identify this company because it has claimed many victims in Indonesia. It has been reported to the authorities but until now there has been no response. Please help.

VIPGlobal Capital presents itself as a forex broker operating from the Philippines. This vipglobal capital review reveals significant concerns about the platform's legitimacy and safety. The broker is currently classified as "Suspected Fraud" with a critically low WikiFX score of 1.48 out of 10. This indicates severe trust issues within the trading community.

VIPGlobal Capital offers seemingly attractive features such as a low minimum deposit of 10 USD and high leverage up to 1:1000. These benefits are overshadowed by the lack of proper regulatory oversight. The platform operates without valid forex licenses. This makes it an unregulated entity that poses substantial risks to investors.

The broker primarily targets low-capital traders with its minimal entry requirements. The absence of transparent information about spreads, commissions, and trading conditions raises red flags. User feedback consistently points to concerns about the platform's legitimacy. Multiple reports suggest fraudulent activities. Given the current status showing that VIPGlobal Capital appears to have ceased operations with its website unavailable, potential investors should exercise extreme caution. They should consider regulated alternatives for their trading activities.

Due to VIPGlobal Capital's unregulated status, investors across different regions may face varying levels of legal protection and risk exposure. The lack of regulatory oversight means that traders have limited recourse in case of disputes or financial losses. This review is based on available public information and user feedback. The assessment may be limited due to insufficient transparency from the broker. Given that the platform appears to have ceased operations, the information presented should be considered historical and may not reflect current circumstances.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | 4/10 | Low minimum deposit of 10 USD, but lacks diverse account types and comprehensive condition information |

| Tools and Resources | 3/10 | Limited to MetaTrader 4 platform with no mention of additional tools or educational resources |

| Customer Service | 2/10 | Multiple user complaints and lack of accessible customer service information |

| Trading Experience | 3/10 | Incomplete platform information with negative user feedback affecting overall experience |

| Trust and Safety | 1/10 | Unregulated status with fraud allegations and extremely low WikiFX rating |

| User Experience | 2/10 | General user dissatisfaction and widespread complaints about platform reliability |

VIPGlobal Capital Ltd operates as a forex trading platform headquartered in the Philippines. Specific founding details remain undisclosed in available documentation. The company positions itself as a provider of forex trading services. It targets primarily retail traders with low capital requirements. However, the broker's business model has come under scrutiny due to its unregulated status and questionable operational practices.

The platform's approach to attracting clients centers around offering high leverage ratios and low entry barriers. These features typically appeal to novice traders seeking maximum market exposure with minimal initial investment. However, these seemingly attractive features mask underlying concerns about the broker's legitimacy and long-term viability in the competitive forex market.

VIPGlobal Capital utilizes the MetaTrader 4 trading platform. This is a standard choice among many brokers in the industry. The platform operates without proper regulatory authorization. It does not hold any valid forex licenses from recognized financial authorities. This unregulated status places the broker outside the protective framework that legitimate financial institutions must adhere to. It creates significant risks for potential clients. According to WikiFX reports, the broker has been flagged for suspected fraudulent activities. This further undermines its credibility in the forex trading community.

Regulatory Status: VIPGlobal Capital Ltd operates as an unregulated entity without valid forex licenses from any recognized financial authority. This lack of regulatory oversight significantly increases investment risks. Clients have no institutional protection or recourse mechanisms typically available with licensed brokers.

Minimum Deposit Requirements: The platform requires a minimum deposit of 10 USD. This positions it among the lower-tier entry requirements in the forex market. While this low threshold may attract beginner traders, it often correlates with less sophisticated service offerings and operational standards.

Leverage Ratios: VIPGlobal Capital offers maximum leverage of 1:1000. This represents extremely high risk-reward ratios. Such leverage levels, while potentially profitable, can lead to rapid account depletion and substantial losses. This is particularly true for inexperienced traders.

Trading Platform: The broker exclusively utilizes MetaTrader 4 as its trading platform. It provides standard charting tools and basic trading functionalities. However, no information is available regarding additional proprietary tools or enhanced platform features.

Available Assets: Specific information about tradeable asset classes, including currency pairs, commodities, or other financial instruments, is not detailed in available documentation. This indicates limited transparency about the broker's offerings.

Cost Structure: Critical information about spreads, commissions, and other trading costs remains undisclosed. This makes it impossible for potential clients to accurately assess the true cost of trading with this vipglobal capital review platform.

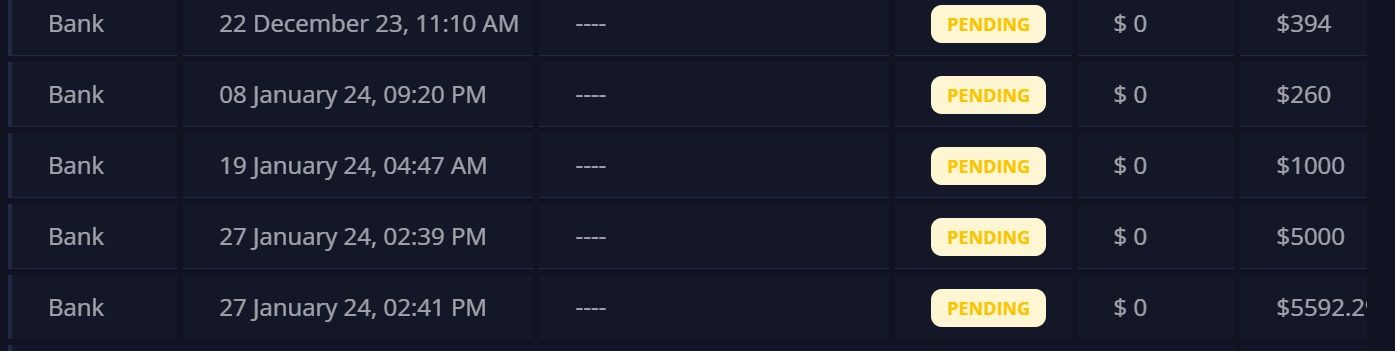

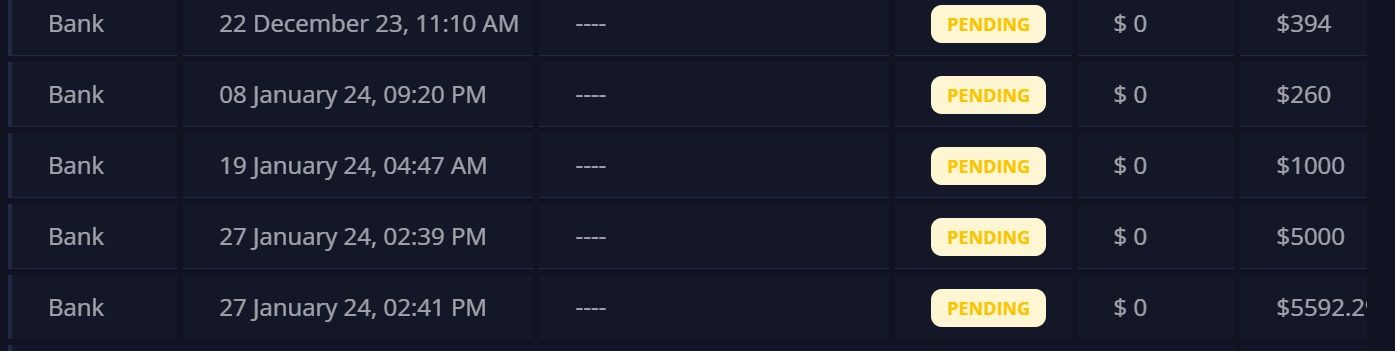

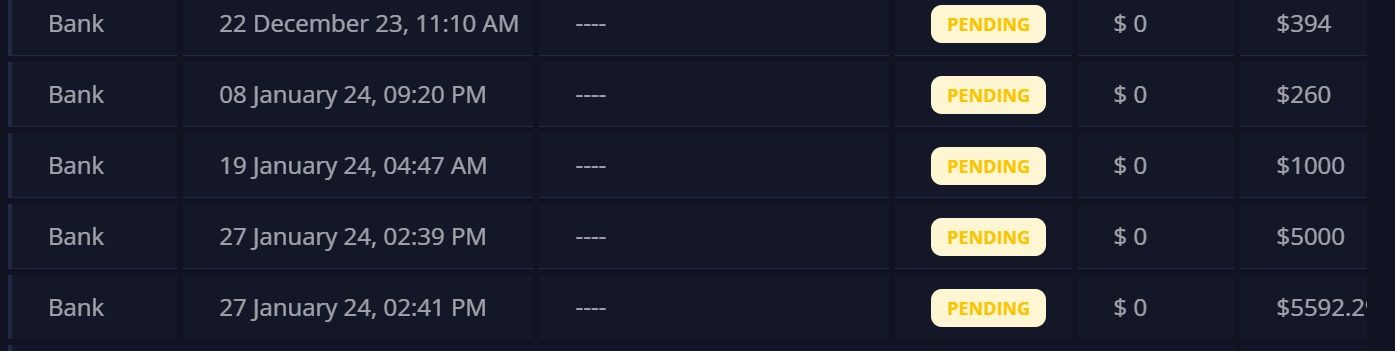

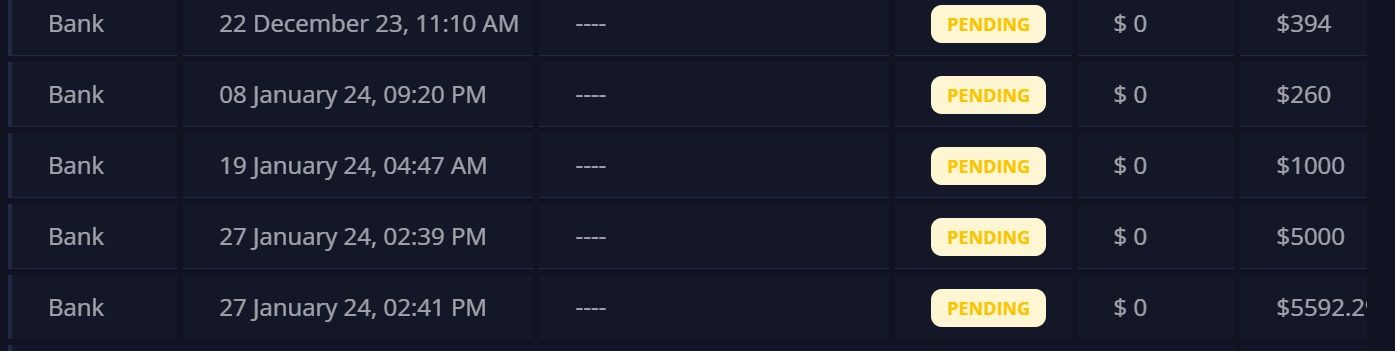

Payment Methods: Details regarding deposit and withdrawal methods, processing times, and associated fees are not specified in available materials. This further highlights the broker's lack of transparency.

Geographic Restrictions: Information about regional limitations or restricted countries is not provided in accessible documentation.

VIPGlobal Capital's account structure reveals significant limitations that potential traders should carefully consider. The broker's approach to account management lacks the sophistication and variety typically expected from established forex platforms. While the minimum deposit requirement of 10 USD appears attractive for budget-conscious traders, this low barrier often indicates a high-volume, low-service business model.

The absence of detailed information about different account tiers, special features, or premium services suggests a one-size-fits-all approach. This may not meet diverse trading needs. Unlike reputable brokers that offer multiple account types tailored to different experience levels and trading volumes, VIPGlobal Capital's simplified structure may reflect operational limitations rather than streamlined efficiency.

User feedback consistently raises concerns about the platform's legitimacy. Multiple reports suggest fraudulent activities. These allegations significantly impact the perceived value of any account conditions. The fundamental trust required for financial transactions appears compromised. The lack of Islamic account options, demo account details, or professional trading features further limits the broker's appeal to serious traders.

When compared to regulated competitors, VIPGlobal Capital's account conditions appear notably deficient. Established brokers typically provide comprehensive account documentation, clear terms of service, and transparent fee structures. These elements appear lacking in this vipglobal capital review assessment. The overall account offering fails to meet industry standards for transparency and customer protection.

The trading tools and resources offered by VIPGlobal Capital demonstrate significant limitations that impact the overall trading experience. The platform's reliance solely on MetaTrader 4, while providing access to a widely-used trading interface, suggests a lack of innovation or additional value-added services. Modern traders expect these services from their brokers.

Research and analytical resources, which are crucial for informed trading decisions, appear to be absent from the broker's offerings. Reputable forex platforms typically provide market analysis, economic calendars, trading signals, and educational materials to support their clients' trading activities. The lack of such resources indicates either operational limitations or a business model focused solely on transaction volume rather than client success.

Educational support, including webinars, tutorials, and trading guides, is not mentioned in available information about VIPGlobal Capital. This absence is particularly concerning given the broker's apparent targeting of novice traders through low minimum deposits. New traders require substantial educational support to develop trading skills and risk management understanding.

The platform's support for automated trading, expert advisors, or algorithmic trading tools remains unclear from available documentation. Modern forex trading increasingly relies on these sophisticated tools. Their absence or limited availability could significantly handicap serious traders. User feedback expressing doubts about the platform's legitimacy further undermines confidence in any tools or resources that may be available.

Customer service quality represents one of the most critical deficiencies in VIPGlobal Capital's operations. Available information provides no clear details about customer support channels, availability hours, or service quality standards. This lack of transparency regarding customer support infrastructure raises immediate concerns about the broker's commitment to client satisfaction and problem resolution.

The absence of specified communication methods, whether through live chat, email, phone support, or help desk systems, suggests either inadequate customer service infrastructure or deliberate opacity about support accessibility. Reputable brokers typically prominently display multiple contact methods and support availability to build client confidence.

Response time expectations and service level agreements are not documented in available materials. This leaves potential clients without clear understanding of support quality they might expect. This uncertainty becomes particularly problematic when considering the platform's unregulated status. Clients have limited external recourse for dispute resolution.

User feedback consistently points to negative experiences. Multiple reports suggest fraudulent activities and poor service quality. These complaints indicate systemic issues with customer treatment and platform reliability. The lack of visible customer service commitment, combined with negative user experiences, creates a concerning picture of the support environment.

Multilingual support capabilities and regional service availability remain unspecified. This potentially limits accessibility for international clients. The overall customer service picture suggests inadequate infrastructure and commitment to client support standards expected in the modern forex industry.

The trading experience offered by VIPGlobal Capital presents numerous concerns that significantly impact user satisfaction and platform viability. While the platform utilizes MetaTrader 4, which provides standard trading functionality, the overall experience appears compromised by operational and transparency issues. These issues affect trader confidence.

Platform stability and execution quality are fundamental to successful trading. Yet specific performance metrics, uptime statistics, or execution speed data are not available for VIPGlobal Capital. This lack of performance transparency makes it impossible for traders to assess whether the platform can handle their trading requirements effectively. This is particularly true during high-volatility market conditions.

Order execution quality, including slippage rates, rejection frequencies, and fill rates, remains undocumented. These metrics are crucial for traders to understand the true cost and reliability of their trading environment. The absence of such information, combined with user complaints about platform legitimacy, suggests potential issues with trade execution reliability.

The mobile trading experience, which has become essential for modern forex trading, is not detailed in available documentation. Most serious traders require robust mobile platforms for market monitoring and trade management. The lack of information about mobile capabilities represents a significant limitation.

Trading environment factors such as spreads, liquidity provision, and market depth are not transparently disclosed. This makes it difficult for traders to assess the true cost and quality of the trading environment. This vipglobal capital review reveals that the overall trading experience lacks the transparency and reliability standards expected from professional forex platforms.

Trust and safety concerns represent the most critical issues surrounding VIPGlobal Capital's operations. The broker's unregulated status immediately raises red flags about client protection and operational oversight. Without valid forex licenses from recognized financial authorities, the platform operates outside established regulatory frameworks designed to protect investor interests.

The WikiFX rating of 1.48 out of 10 indicates severe trust issues within the trading community. Such extremely low ratings typically reflect multiple negative factors including regulatory violations, user complaints, and operational irregularities. This rating places VIPGlobal Capital among the least trustworthy platforms in the forex industry.

Fraud allegations and suspected fraudulent activities represent the most serious concerns about the platform's legitimacy. Multiple reports suggest that users have experienced issues that indicate potential scam operations. The classification as "Suspected Fraud" by monitoring services provides clear warning signals about the platform's reliability.

Client fund protection measures, including segregated accounts, deposit insurance, or compensation schemes, are not documented in available information. Regulated brokers typically provide clear information about fund protection mechanisms to build client confidence. The absence of such information, combined with the unregulated status, suggests minimal protection for client deposits.

The apparent cessation of operations, with the website becoming unavailable, further confirms concerns about the platform's viability and legitimacy. This development validates earlier warnings about the broker's questionable status and operational sustainability.

User experience with VIPGlobal Capital reflects widespread dissatisfaction and concern about platform reliability and legitimacy. The overall user sentiment, as indicated by the extremely low WikiFX rating and fraud allegations, suggests that most interactions with the platform result in negative outcomes for traders.

The platform's user interface and ease of use, while potentially benefiting from MetaTrader 4's familiar environment, are overshadowed by fundamental concerns about platform legitimacy. Even if the technical interface functions adequately, users cannot have confidence in a platform flagged for fraudulent activities.

Registration and account verification processes are not detailed in available documentation. User feedback suggests potential issues with account management and verification procedures. The lack of transparent information about these basic processes indicates poor user experience design and limited commitment to customer onboarding.

Fund management experiences, including deposit and withdrawal processes, appear to be problematic based on user complaints and fraud allegations. Reliable fund management is essential for user confidence. The negative feedback in this area represents a critical failure in user experience delivery.

The target user profile appears to be novice traders attracted by low minimum deposits and high leverage. These users are particularly vulnerable to the risks associated with unregulated platforms. The mismatch between attractive marketing features and underlying platform risks creates a particularly concerning user experience scenario that prioritizes acquisition over client welfare.

This comprehensive vipglobal capital review reveals a trading platform that poses significant risks to potential investors despite some superficially attractive features. While the low minimum deposit of 10 USD and high leverage of 1:1000 might initially appeal to budget-conscious traders, these benefits are completely overshadowed by fundamental concerns about the broker's legitimacy and operational integrity.

The unregulated status of VIPGlobal Capital, combined with its classification as "Suspected Fraud" and extremely low WikiFX rating of 1.48, creates an environment of unacceptable risk for any serious trader. The apparent cessation of operations further validates concerns about the platform's viability and confirms the wisdom of avoiding this broker entirely.

For traders seeking legitimate forex trading opportunities, VIPGlobal Capital represents exactly the type of platform to avoid. The combination of regulatory absence, fraud allegations, poor user feedback, and operational opacity creates a perfect storm of risk factors that no potential trading benefits could justify. Serious traders should focus exclusively on properly regulated brokers with established track records and transparent operations.

FX Broker Capital Trading Markets Review