Titan Macro 2025 Review: Everything You Need to Know

Summary: Titan Macro has garnered mixed reviews, primarily due to its lack of regulatory oversight and concerns regarding user safety. While it offers a wide array of trading assets and competitive spreads, the absence of proper regulation raises significant red flags for potential investors.

Note: It is crucial to acknowledge that Titan Macro may operate under different entities across regions, which can affect user experience and legal protection. This review is based on a comprehensive analysis of various sources to ensure fairness and accuracy.

Rating Overview

How We Rate Brokers: Our ratings are based on a thorough analysis of user experiences, expert opinions, and factual data regarding trading conditions and platform reliability.

Broker Overview

Founded in 2023, Titan Macro operates as a trading platform based in the United States. It provides access to a diverse range of trading assets, including currencies, cryptocurrencies, commodities, and indices. The platform features its proprietary trading interface designed to facilitate user-friendly navigation and advanced charting tools. However, it is essential to note that Titan Macro operates without regulatory authorization, which raises concerns about its legitimacy and user safety.

Detailed Analysis

Regulated Geographic Areas/Regions: Titan Macro is unregulated and does not have authorization from recognized bodies such as the National Futures Association (NFA). This lack of oversight can lead to heightened risks for traders, particularly regarding security and transparency.

Deposit/Withdrawal Currencies/Cryptocurrencies: The platform supports deposits via cryptocurrency and wire transfers, providing flexibility for users. Notably, there is no minimum deposit requirement, allowing traders to start with any amount they choose. However, a 2% fee applies to withdrawals, which can impact overall profitability.

Minimum Deposit: Titan Macro does not impose a minimum deposit, making it accessible to a broad range of traders. This feature can attract novice traders looking to enter the market without significant financial commitment.

Bonuses/Promotions: There is limited information available regarding specific bonuses or promotions on Titan Macro. The absence of promotional offers may deter some traders seeking incentives.

Tradable Asset Classes: The platform offers a comprehensive selection of assets, including popular cryptocurrencies like Bitcoin and Ethereum, major and minor forex pairs, commodities such as gold, and various indices. This wide range of tradable assets allows for diversification and flexibility in trading strategies.

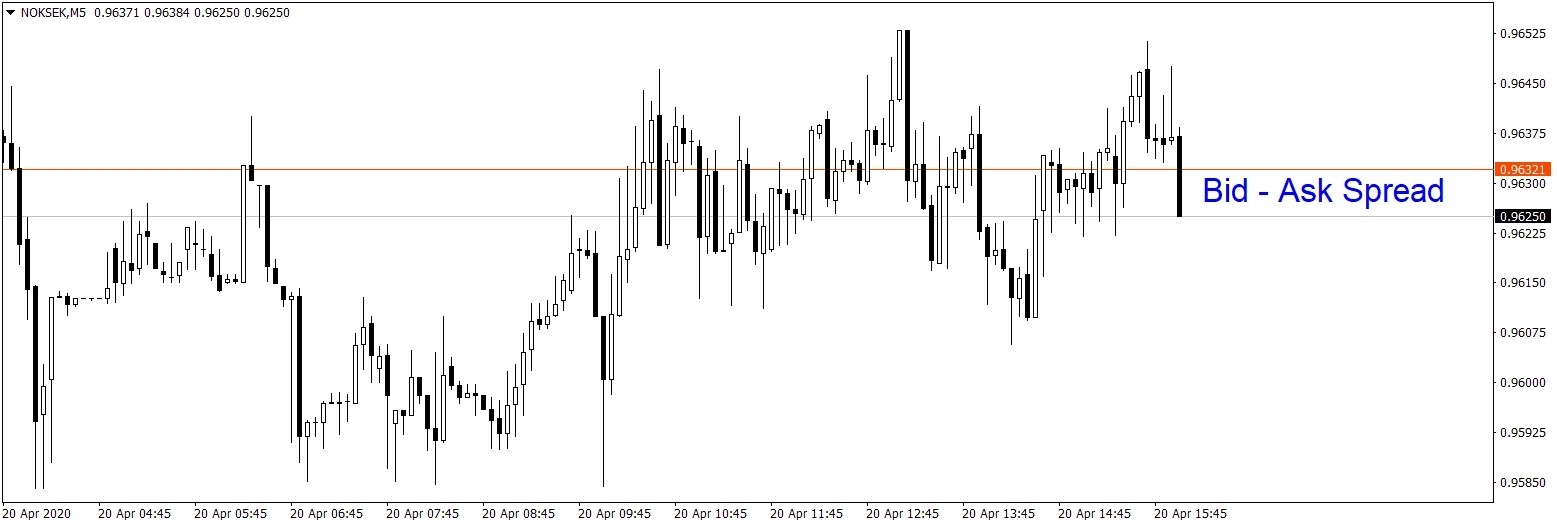

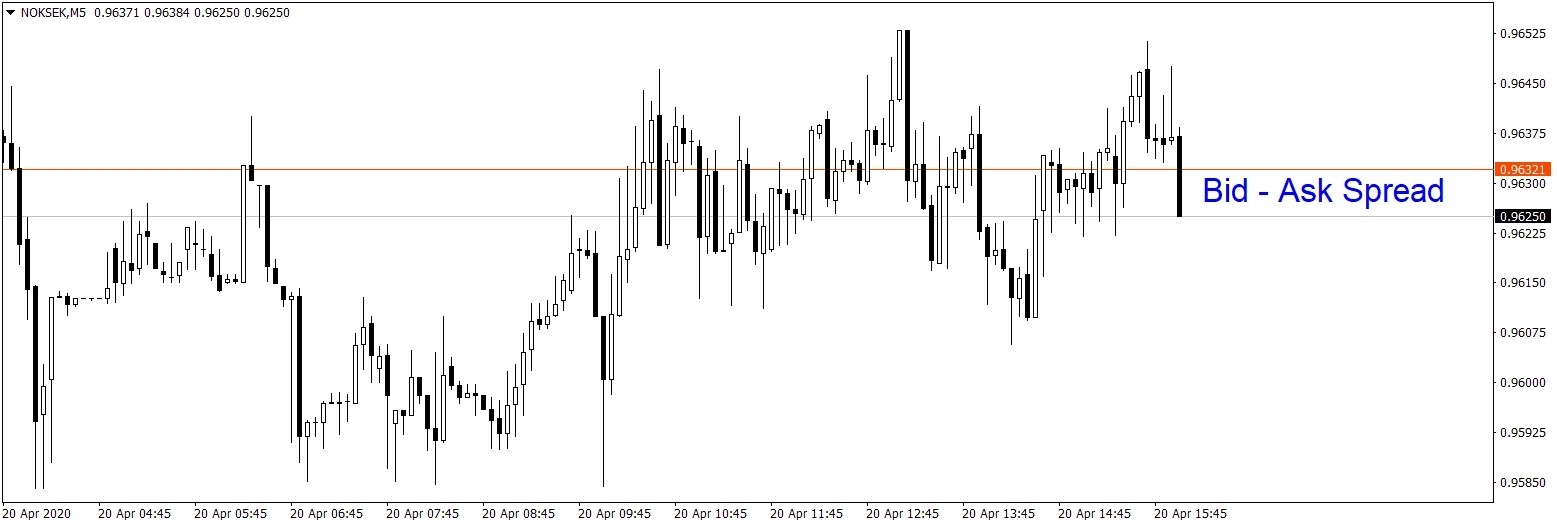

Costs (Spreads, Fees, Commissions): Titan Macro boasts competitive spreads, with rates as low as 0 pips on specific accounts. However, commission fees of $3.5 per lot traded apply to certain account types, which traders should consider when calculating their overall trading costs.

Leverage: The platform offers a maximum leverage of up to 500:1, allowing traders to control larger positions with a smaller capital investment. While this can amplify potential profits, it also increases the risk of significant losses.

Allowed Trading Platforms: Titan Macro utilizes its proprietary trading platform, which is designed to be user-friendly and feature-rich. The platform is accessible across various devices, including Windows, macOS, and mobile platforms.

Restricted Regions: Specific restrictions on account creation and trading may apply based on geographical location, particularly in regions with stringent financial regulations.

Available Customer Service Languages: Customer support is available through email and a live chat feature, with a focus on providing prompt assistance to users. However, the absence of phone support may limit the effectiveness of customer service for some users.

Rating Overview (Repeated)

Detailed Breakdown

Account Conditions: The lack of regulatory oversight is a significant drawback for Titan Macro, as it raises questions about the platform's legitimacy and user safety. The absence of a minimum deposit is a positive feature, but it does not outweigh the concerns related to regulation.

Tools and Resources: While the platform offers advanced charting tools, the overall educational resources available to users are limited. This could hinder the growth of less experienced traders who may require more comprehensive support.

Customer Service and Support: Titan Macro provides responsive customer support through email and live chat. However, the lack of phone support may frustrate users seeking immediate assistance.

Trading Setup/Experience: The proprietary trading platform is designed for ease of use, but the overall trading experience may be impacted by the platform's unregulated status. Traders should proceed with caution when utilizing Titan Macro for their investment activities.

Trustworthiness: The absence of regulatory oversight significantly affects Titan Macro's trustworthiness. Many experts recommend avoiding unregulated platforms due to the potential risks involved.

User Experience: Overall, user experiences appear mixed, with some praising the platform's features while others express concern over its legitimacy and safety. The lack of regulation and transparency can lead to a negative user experience for many traders.

In conclusion, while Titan Macro offers competitive trading conditions and a diverse range of assets, the platform's unregulated status raises significant red flags. Potential traders should carefully consider these factors before engaging with Titan Macro.