SwissPro Markets 2025 Review: Everything You Need to Know

Executive Summary

SwissPro Markets is an unregulated forex broker that offers competitive trading conditions with low spreads and zero commission structures. This SwissPro Markets review shows that the company provides spreads as low as 0.01 pips and leverage up to 1:1000, which makes it an attractive option for traders who want to keep costs low. The broker operates from the UAE. It offers trading across forex pairs, indices, precious metals, and stocks through the MT5 platform.

The platform serves mainly high-risk traders and beginners who like the zero minimum deposit requirement. However, the lack of regulatory oversight creates big concerns for trader protection and fund security. According to WikiBit reports, the company does not appear to be regulated by any government authority. This requires careful thought from potential clients. Despite offering over 200 trading instruments and 24/5 multilingual customer support, the regulatory gap remains a critical factor when evaluating this broker's overall suitability for serious trading activities.

Important Notice

Due to the absence of regulation from any government authority, users should exercise extreme caution when evaluating SwissPro Markets. Regional entity differences cannot be verified because of limited regulatory transparency. This review is based on available information from multiple sources including WikiBit and industry reports. It does not constitute personal investment advice. Traders should conduct their own due diligence and consider the risks associated with trading through unregulated brokers before making any financial commitments.

Rating Framework

Broker Overview

SwissPro Markets operates as a UAE-registered forex broker. Specific establishment dates are not detailed in available documentation. The company has positioned itself in the competitive forex market by offering aggressive pricing structures and high leverage ratios. According to industry reports, SwissPro Markets focuses on providing access to global financial markets through technology-driven solutions. It targets both novice and experienced traders seeking cost-effective trading opportunities.

The broker's business model centers around providing direct market access to foreign exchange, indices, precious metals, and stock trading. Their service offering emphasizes low-cost trading with zero commission structures and competitive spreads. The company operates primarily through digital channels. It offers MT5 and MT5 mobile platforms to facilitate trading across multiple asset classes. This SwissPro Markets review indicates that while the broker offers attractive trading conditions, the absence of regulatory oversight raises questions about operational standards and client protection measures.

Regulatory Status: SwissPro Markets currently operates without regulation from any recognized government authority. This creates potential risks for trader protection and fund security.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available documentation. This requires direct inquiry with the broker.

Minimum Deposit Requirements: The broker offers a zero minimum deposit requirement. This makes it accessible to traders with limited initial capital.

Bonuses and Promotions: Current promotional offerings and bonus structures are not specified in available materials.

Tradeable Assets: SwissPro Markets provides access to over 200 trading instruments across forex pairs, indices, precious metals, and stocks. This offers diverse portfolio opportunities.

Cost Structure: The broker implements a zero commission policy with spreads starting from 0.01 pips. This creates competitive trading costs for active traders.

Leverage Ratios: Maximum leverage reaches 1:1000. This provides significant capital amplification opportunities while increasing risk exposure.

Platform Options: Trading is facilitated through MT5 and MT5 mobile applications. These offer comprehensive charting and analysis tools.

Geographic Restrictions: Specific regional limitations or service restrictions are not detailed in current documentation.

Customer Support Languages: The broker provides multilingual customer support services to accommodate international clients. This comprehensive SwissPro Markets review highlights both opportunities and limitations within the broker's service framework.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

SwissPro Markets demonstrates strong appeal in account accessibility through its zero minimum deposit requirement. This eliminates financial barriers for new traders. The broker's account structure appears streamlined. However, specific account types and their individual features are not detailed in available documentation.

The zero commission policy across trading activities represents a significant advantage compared to traditional brokers who charge per-transaction fees. This cost structure can substantially reduce trading expenses for active traders. It particularly benefits those employing high-frequency strategies. However, the absence of detailed information regarding account verification processes, Islamic account options, and premium account features limits comprehensive evaluation.

According to industry standards, the combination of zero minimum deposits and commission-free trading creates competitive positioning. Yet, the lack of regulatory oversight raises questions about account protection measures and fund segregation practices. This SwissPro Markets review suggests that while account conditions appear favorable, traders should carefully consider the trade-off between cost savings and regulatory protection when evaluating account opening decisions.

The broker provides access to the MT5 platform. This offers comprehensive technical analysis tools, multiple timeframes, and advanced charting capabilities. MT5's algorithmic trading support enables automated strategy implementation. This appeals to sophisticated traders seeking systematic approaches. The platform includes various technical indicators, drawing tools, and market analysis features standard across professional trading environments.

However, available documentation does not detail additional research resources, educational materials, or proprietary analysis tools that could enhance trader decision-making. The absence of comprehensive educational content, market commentary, or fundamental analysis resources represents a limitation for traders seeking broader market insights. Many established brokers provide daily market analysis, economic calendars, and educational webinars. These are not clearly available through SwissPro Markets.

The MT5 mobile application extends trading capabilities to smartphones and tablets. This ensures market access across devices. While this provides basic functionality requirements, the overall tools and resources offering appears limited compared to full-service brokers who provide extensive research departments and educational programs for client development.

Customer Service and Support Analysis (Score: 7/10)

SwissPro Markets offers customer support through multiple channels including telephone, email, and online chat services. The 24/5 availability aligns with global forex market hours. This ensures support accessibility during active trading periods. Multilingual support capabilities accommodate international clients. This is essential for a broker targeting global markets.

The variety of contact methods provides flexibility for different communication preferences and urgency levels. Phone support enables immediate assistance for critical issues. Email communication allows detailed inquiry documentation. Online chat functionality offers real-time problem resolution without requiring phone calls. This appeals to digitally-oriented traders.

However, specific information regarding response times, support quality assessments, and problem resolution effectiveness is not available in current documentation. User feedback regarding customer service experiences is not detailed. This limits evaluation of actual service delivery quality. The absence of weekend support may create gaps for traders requiring assistance outside business hours. This is particularly concerning given the global nature of forex markets.

Trading Experience Analysis (Score: 8/10)

SwissPro Markets delivers competitive trading conditions through low spreads starting from 0.01 pips and high leverage up to 1:1000. These parameters create favorable environments for both scalping strategies and position trading. They accommodate diverse trading styles. The zero commission structure eliminates additional transaction costs. This potentially improves overall profitability for active traders.

The MT5 platform provides professional-grade trading functionality with advanced order types, one-click trading, and comprehensive market analysis tools. Technical analysis capabilities include multiple timeframes, various chart types, and extensive indicator libraries essential for informed trading decisions. The platform's stability and execution speed are crucial factors. However, specific performance metrics are not detailed in available documentation.

Mobile trading through MT5 applications ensures market access regardless of location. This enables traders to monitor positions and execute trades on-demand. The platform supports multiple asset classes beyond forex, including indices, precious metals, and stocks. This provides portfolio diversification opportunities. This SwissPro Markets review indicates that trading conditions appear competitive. However, the absence of regulatory oversight creates uncertainty regarding execution quality guarantees and dispute resolution mechanisms.

Trust and Safety Analysis (Score: 3/10)

The most significant concern regarding SwissPro Markets is the absence of regulation from any recognized government authority. Regulatory oversight provides essential protections including fund segregation requirements, operational standards, and dispute resolution mechanisms that are currently unavailable through this broker. This regulatory gap creates substantial risks for client fund security and operational transparency.

Without regulatory supervision, there are no guarantees regarding fund segregation practices. This means client deposits may not be protected from company operational funds. The absence of compensation schemes, which are typically provided through regulated brokers, leaves traders without recourse in case of broker insolvency or operational failures. Additionally, regulatory bodies typically impose capital adequacy requirements and operational standards that ensure broker stability.

According to available information, users have expressed concerns regarding the broker's legitimacy. This reflects broader market skepticism about unregulated entities. The lack of regulatory transparency makes it impossible to verify operational standards, financial stability, or compliance with industry best practices. This creates an environment where traders must rely entirely on the broker's voluntary commitment to fair practices without external oversight or protection mechanisms.

User Experience Analysis (Score: 6/10)

The MT5 platform interface provides user-friendly navigation with intuitive design elements that accommodate both novice and experienced traders. The platform's layout facilitates efficient market analysis and trade execution through well-organized menus and customizable workspace arrangements. Mobile applications extend this functionality to portable devices. They maintain consistency across platforms.

The zero minimum deposit requirement creates an accessible entry point for new traders. This eliminates financial barriers that might otherwise prevent market participation. This approach particularly appeals to beginners who wish to explore forex trading without substantial initial commitments. However, the absence of detailed information regarding account verification processes and funding procedures creates uncertainty about the actual user onboarding experience.

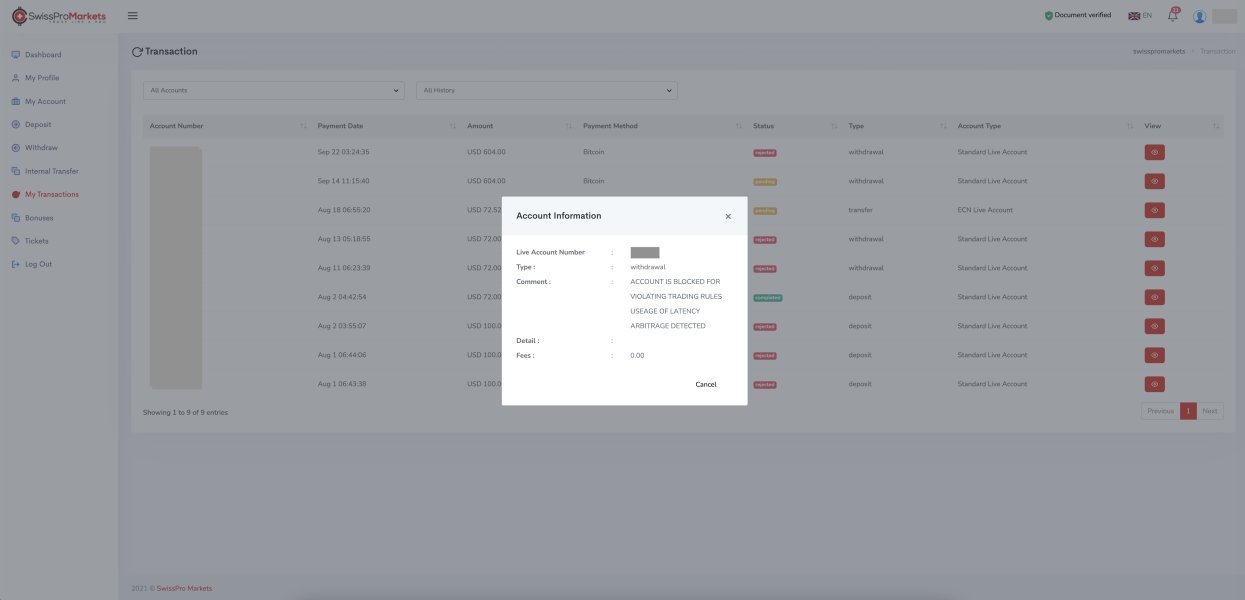

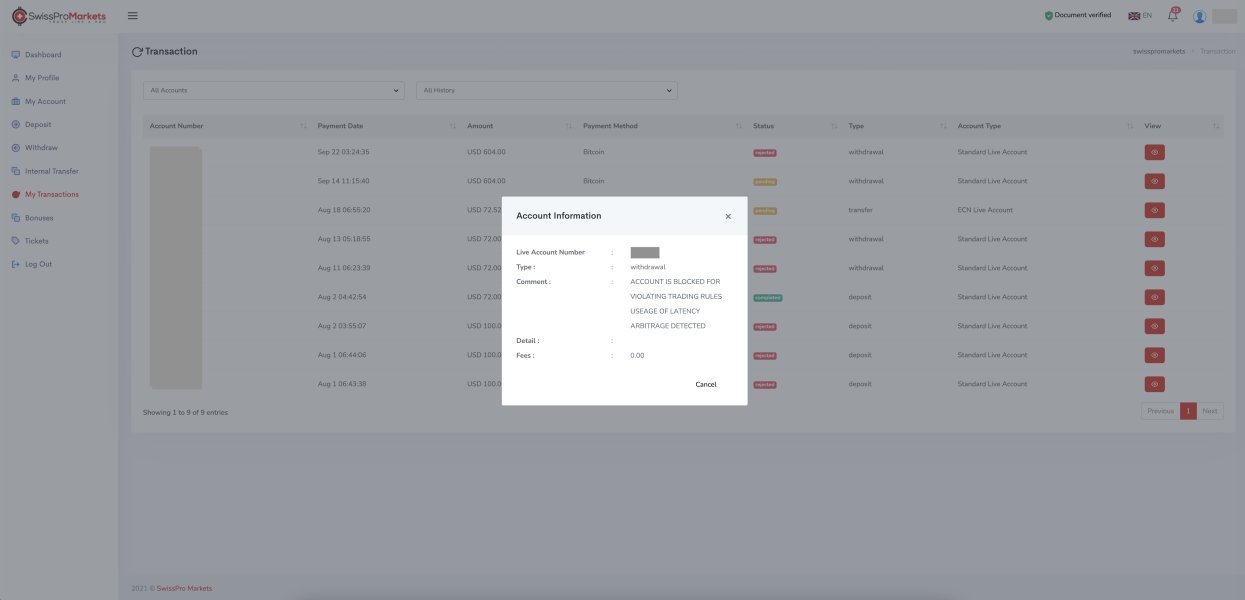

Available documentation indicates ongoing discussions regarding the broker's legitimacy. This suggests mixed user perceptions and experiences. The lack of comprehensive user reviews and satisfaction ratings limits evaluation of actual client experiences. Improvements in regulatory compliance and transparency would significantly enhance user confidence and overall experience quality. The combination of attractive trading conditions and regulatory concerns creates a complex user environment requiring careful risk assessment.

Conclusion

SwissPro Markets presents a mixed proposition for forex traders. It offers competitive trading conditions while lacking essential regulatory protections. The broker's zero commission structure, low spreads starting from 0.01 pips, and high leverage up to 1:1000 create attractive cost parameters for active traders. However, the absence of government regulation represents a critical limitation that affects overall safety and trustworthiness.

This broker appears most suitable for high-risk tolerance traders who prioritize cost efficiency over regulatory protection. The zero minimum deposit requirement makes it accessible for beginners. However, the regulatory concerns may outweigh the benefits for risk-averse traders. The combination of competitive trading conditions and regulatory gaps requires careful individual risk assessment before engagement.