Prime Codex 2025 Review: Everything You Need to Know

Summary: Prime Codex, an offshore forex broker established in 2021, presents a mixed bag of features and concerns for potential traders. While it offers low minimum deposits and high leverage, its lack of robust regulation raises significant red flags. Traders should proceed with caution, particularly regarding fund safety.

Note: It is crucial to consider the varying regulatory environments across different jurisdictions, as Prime Codex operates under less stringent oversight, which may impact user experiences and safety.

Rating Overview

We assess brokers based on features, user feedback, and regulatory status to provide a balanced view.

Broker Overview

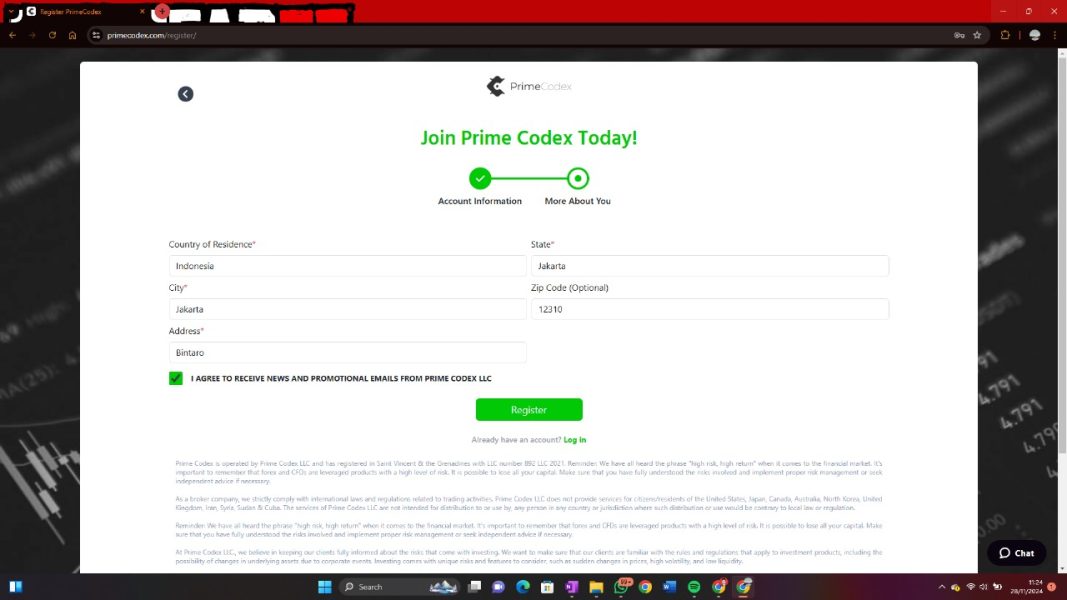

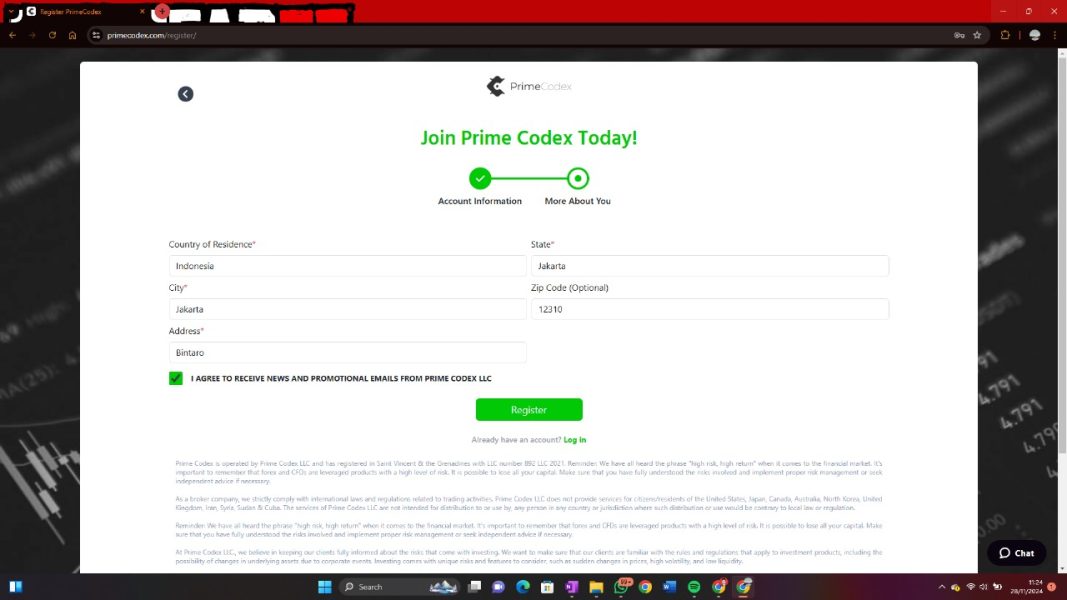

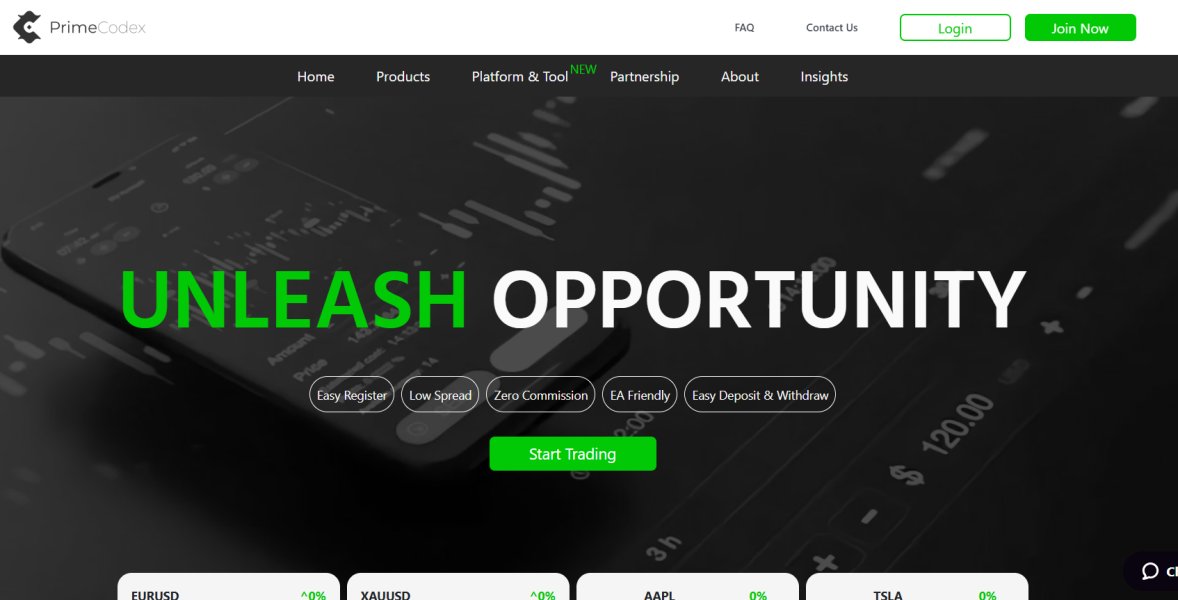

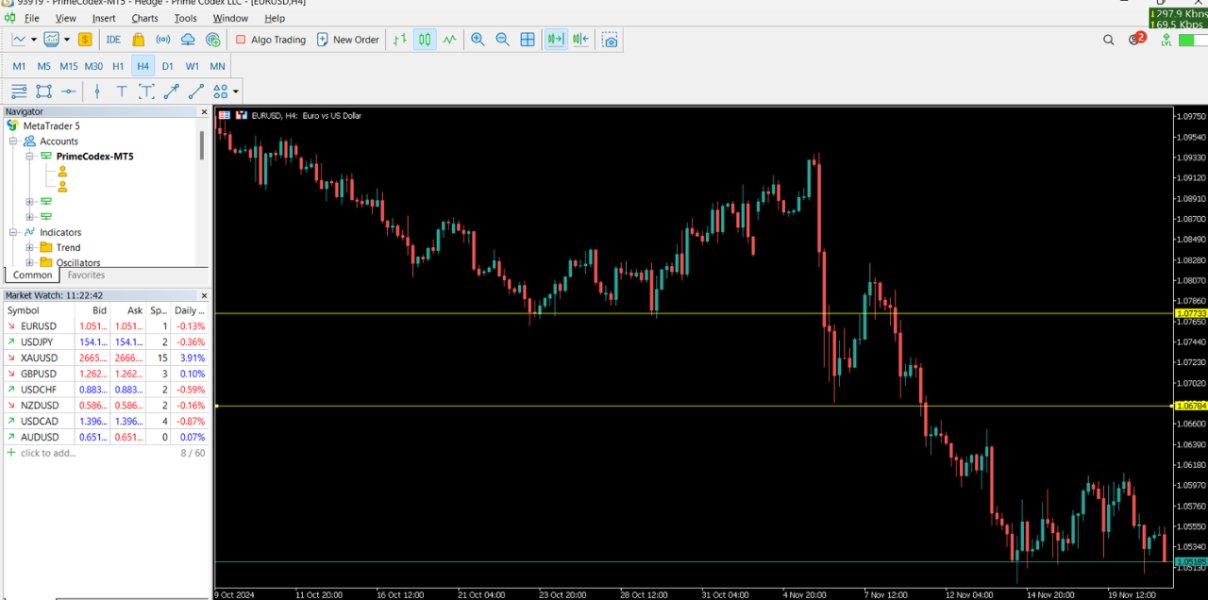

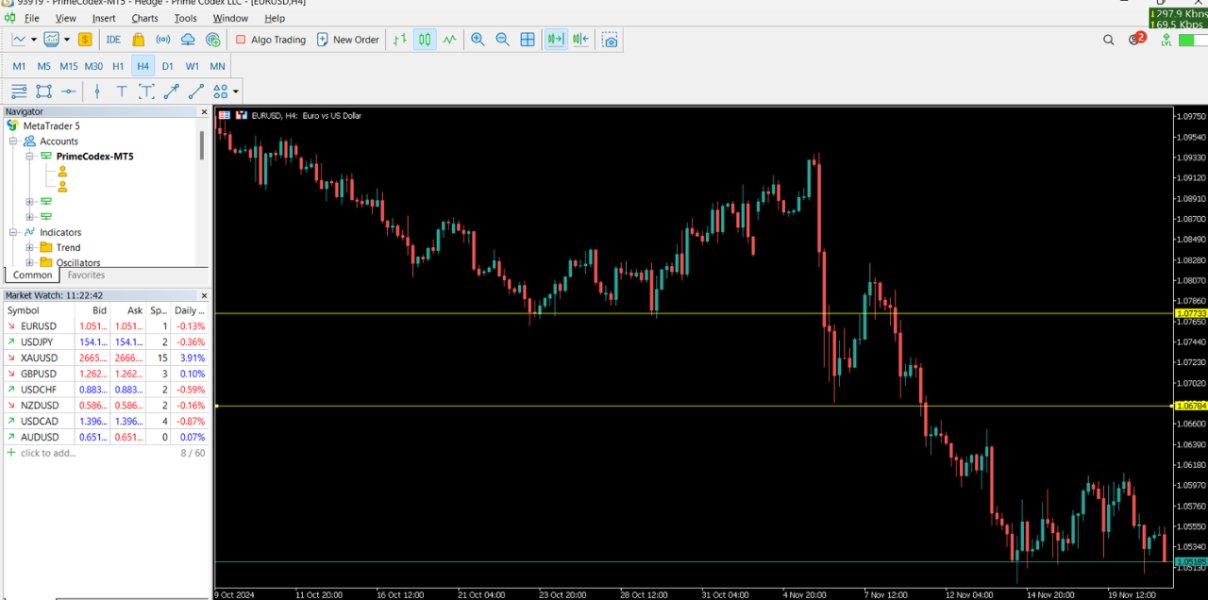

Founded in 2021, Prime Codex operates as Prime Codex LLC, registered in Saint Vincent and the Grenadines. This broker primarily offers trading through the popular MetaTrader 5 (MT5) platform, which is known for its advanced trading features. The platform supports a diverse range of asset classes, including forex, commodities, stocks, and cryptocurrencies. However, the broker lacks a reputable regulatory authority, which is a significant concern for potential investors.

Detailed Breakdown

-

Regulatory Regions: Prime Codex is based in Saint Vincent and the Grenadines, which is known for its lenient regulatory framework. The broker claims to be registered with local authorities, but it operates without the stringent oversight found in more reputable jurisdictions like the UK or US.

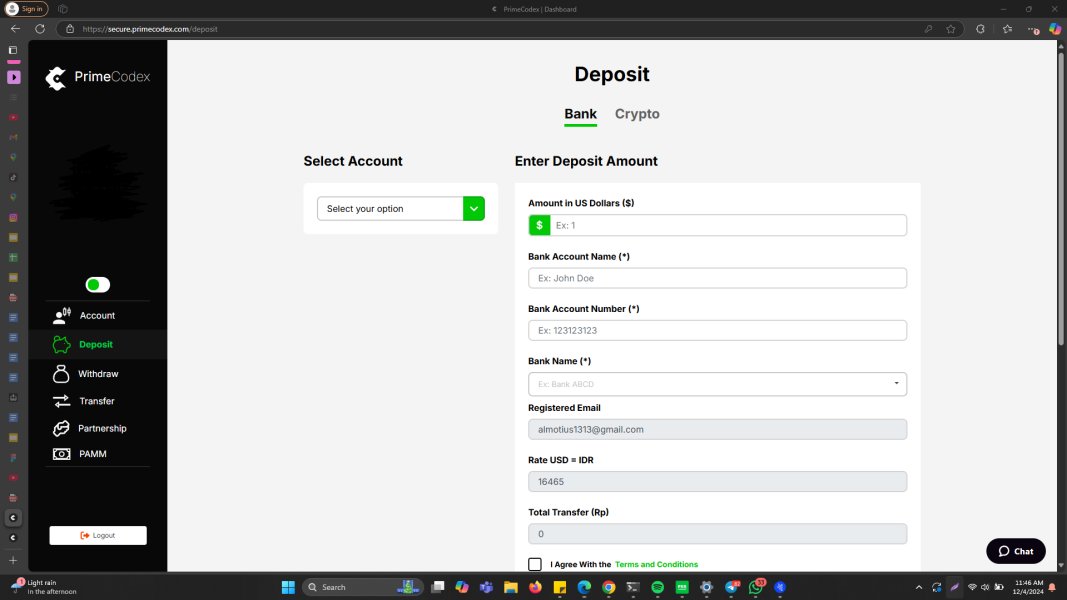

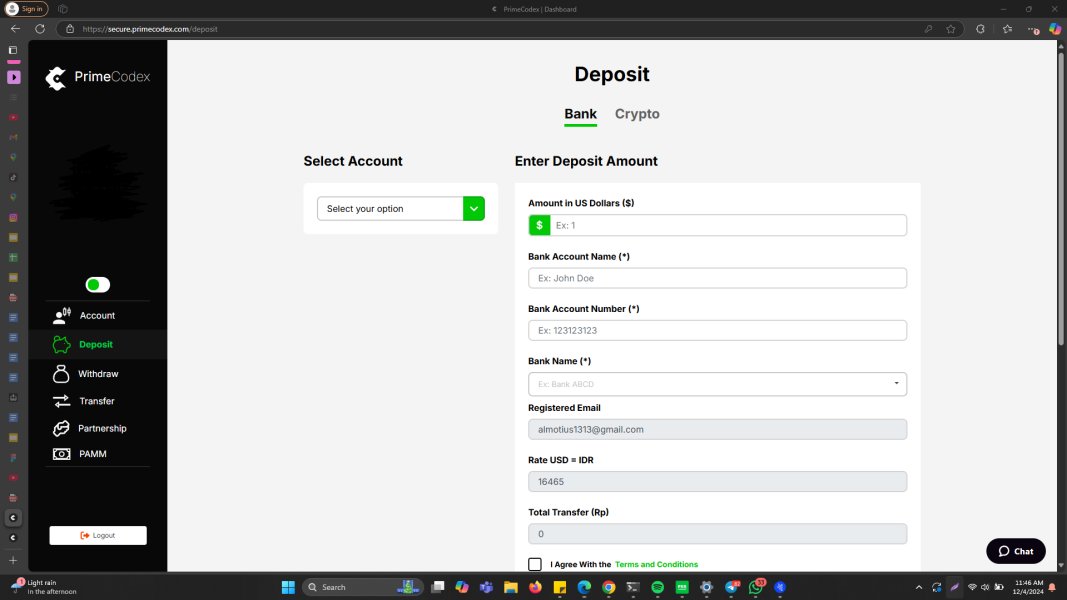

Deposit and Withdrawal Methods: The broker accepts deposits primarily in cryptocurrencies, which can raise concerns due to the anonymity and irreversibility of such transactions. Traditional deposit methods are not clearly outlined, which is a red flag for potential clients.

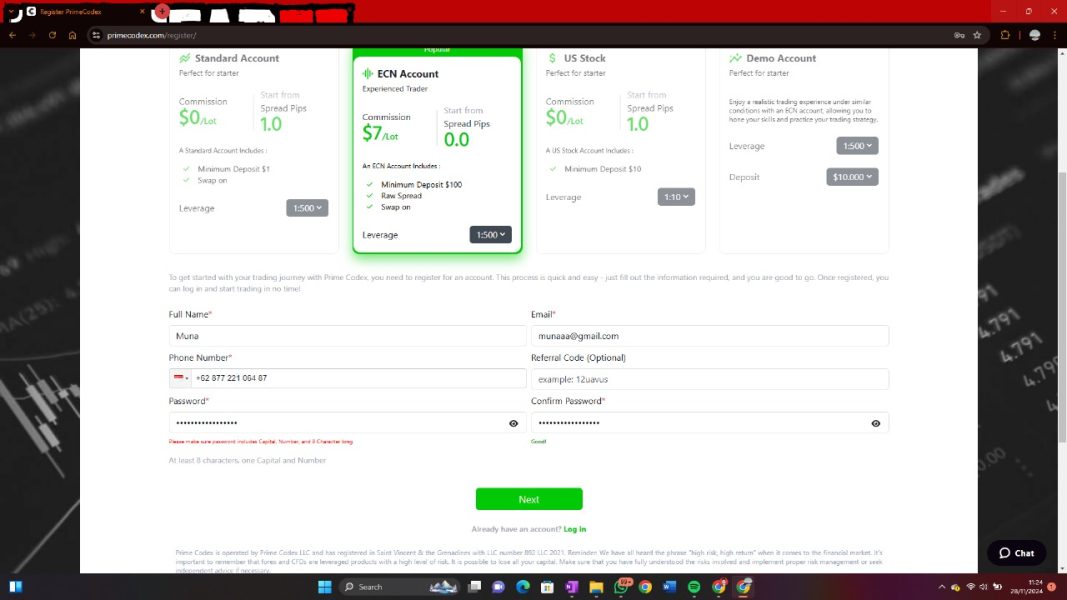

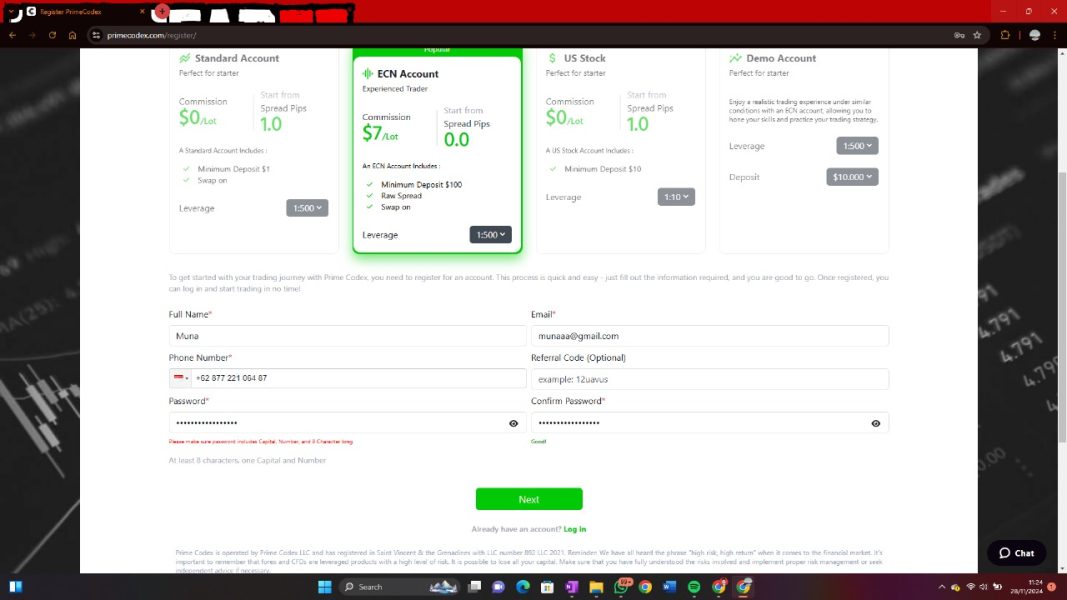

Minimum Deposit: Prime Codex has a remarkably low minimum deposit requirement, starting at just $1 for a standard account. This low barrier to entry can be appealing to new traders, but it also raises questions about the broker's business model.

Bonuses and Promotions: There are no significant bonuses or promotions mentioned, which is often a tactic used by brokers to attract clients. The absence of such offers may indicate a more straightforward approach to trading.

Tradeable Asset Classes: Prime Codex allows trading in various asset classes, including forex pairs, commodities like gold and silver, and stocks from major US companies. The diversity of options may attract traders looking for variety.

Costs (Spreads, Fees, Commissions): The broker offers competitive spreads starting from 0 pips; however, the commission for the ECN account is set at $7, which is above average compared to regulated brokers. This could significantly impact profitability, especially for high-frequency traders.

Leverage: Prime Codex offers leverage up to 1:500, which is significantly higher than the limits imposed by EU and US regulations (typically capped at 1:30). While high leverage can amplify profits, it also increases the risk of substantial losses.

Allowed Trading Platforms: The broker exclusively uses the MT5 platform, which is a positive aspect due to its advanced features, including algorithmic trading capabilities and comprehensive charting tools.

Restricted Regions: Prime Codex does not accept clients from several heavily regulated countries, including the US, UK, and Canada, which may limit its client base and raises concerns about its legitimacy in more regulated markets.

Available Customer Support Languages: The broker provides customer support primarily in English, but details regarding the responsiveness and quality of support are inconsistent across reviews.

Repeated Rating Overview

Detailed Evaluation

-

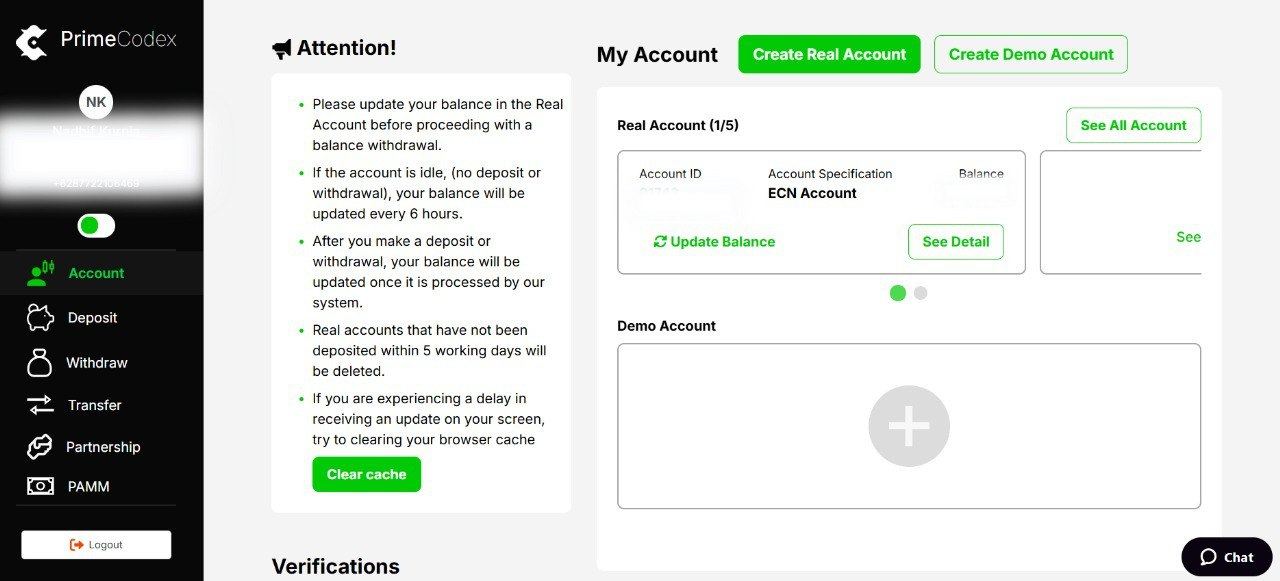

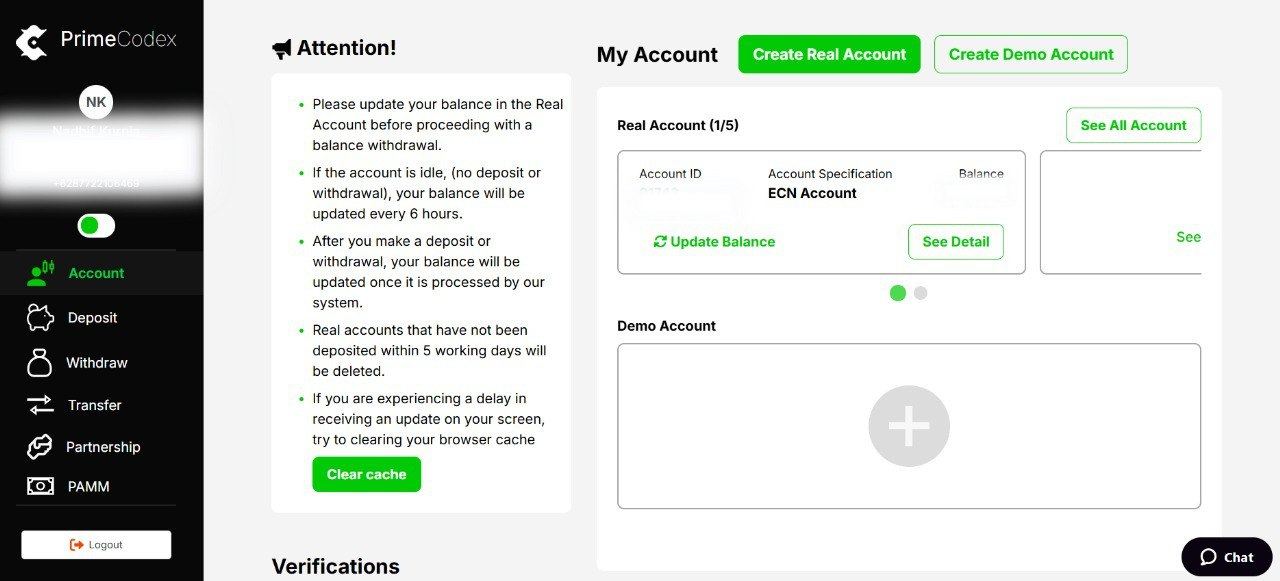

Account Conditions: While the minimum deposit is appealing, the lack of a credible regulatory framework makes it difficult to trust the broker fully. Users have reported mixed experiences regarding account management and withdrawal processes.

Tools and Resources: The MT5 platform is a strong point for Prime Codex, providing traders with advanced tools for analysis and strategy execution. However, the absence of educational resources or trading tools beyond the platform itself is a downside.

Customer Service and Support: Reviews indicate that customer service may be lacking, with some users reporting slow response times and difficulty in resolving issues. This is concerning for traders who may need timely assistance.

Trading Setup (Experience): The overall trading experience is rated as average, with users appreciating the platform's functionality but expressing concerns about the broker's reliability and transparency.

Trustworthiness: The lack of a reputable regulatory body overseeing Prime Codex is a major concern. Many reviews highlight the risks associated with trading with unregulated brokers, emphasizing the potential for fund mismanagement.

User Experience: While the interface is user-friendly, the overall trust in the broker is low due to its offshore status and the absence of essential protections for clients.

In conclusion, while Prime Codex offers several attractive features such as low minimum deposits and a well-regarded trading platform, the significant risks associated with its offshore status and lack of robust regulation warrant caution. Potential traders should thoroughly assess their risk tolerance and consider alternative, more regulated brokers for a safer trading experience.