Oubo Global Pty. Ltd 2025 Review: Everything You Need to Know

Executive Summary

This oubo global pty. ltd review looks at a new forex broker that started in 2022. The company is still very new but has set itself up as a provider of forex and CFD trading services under Australian Securities and Investments Commission regulation. However, the broker's background is not very clear, and there is little information about key trading conditions and fees.

The company wants to attract new and intermediate traders who want access to different financial markets. User feedback shows mixed experiences with this broker. While the broker offers regulated trading services, there are concerns about the company's ongoing deregistration process, which hurts its reputation badly. The lack of detailed information about account conditions, trading platforms, and customer support raises serious questions about how transparent the company is, and potential clients should think carefully before putting money with them.

Important Disclaimer

Oubo Global Pty. Ltd operates as an Australian-registered company under ASIC oversight. The company's headquarters are reportedly in Canada though. This structure across different countries may affect the trading experience for users in different regions, especially when it comes to regulatory protections and solving disputes.

Traders should know that regulatory coverage may be different depending on where they live and which specific company they work with. This review uses publicly available information and user feedback from various sources. Given the short operational history and ongoing corporate changes, prospective clients should strongly verify all trading conditions and regulatory status on their own before opening accounts.

Rating Framework

Broker Overview

Oubo Global Pty. Ltd appeared in the forex brokerage world in 2022. The company set itself up as a financial services provider that focuses on currency and derivative trading. The company operates from a Canadian headquarters while keeping Australian regulatory registration, which creates a unique legal framework that makes it different from purely domestic brokers.

This dual-location structure shows how forex brokerage operations are becoming more global, though it also makes things more complex when it comes to regulatory oversight and client protection. The broker's business model focuses on giving access to foreign exchange markets and contracts for difference across various asset classes. Despite entering the market recently, the company has tried to build credibility through ASIC regulation, which provides certain investor protections under Australian financial services law.

However, the broker's operational transparency stays limited, with key trading parameters and fee structures not easily found in available public information. The regulatory framework under which Oubo Global operates provides some level of oversight through ASIC, Australia's main financial markets regulator. This regulatory relationship suggests compliance with certain capital requirements and operational standards, though specific details about the broker's regulatory standing and any ongoing compliance issues are not clearly documented in available sources.

The company's focus on forex and CFD trading matches broader market trends toward derivative products. However, the specific range of available instruments and trading conditions remain poorly disclosed.

Regulatory Jurisdiction: Oubo Global Pty. Ltd operates under Australian Securities and Investments Commission oversight. This provides a framework of regulatory protection for clients. However, specific license details and compliance history are not easily found in public documentation.

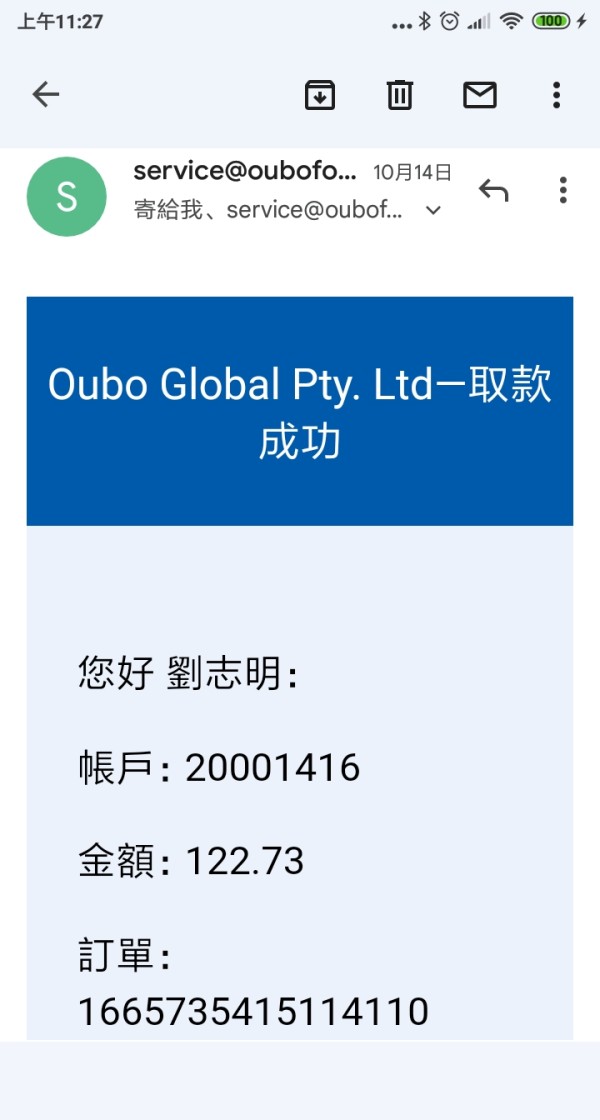

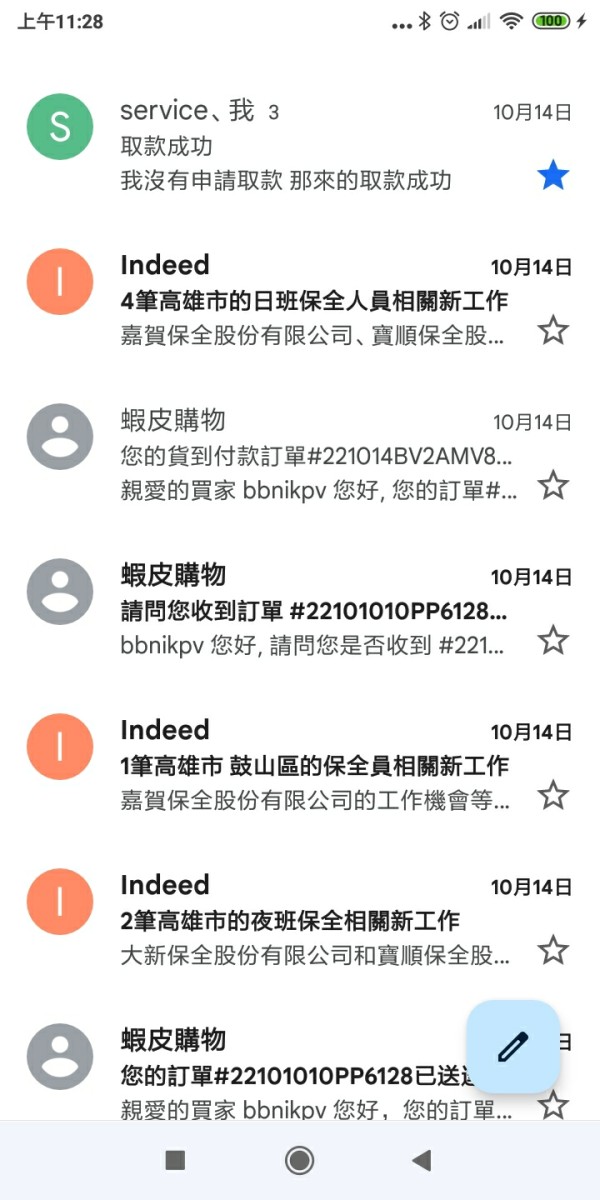

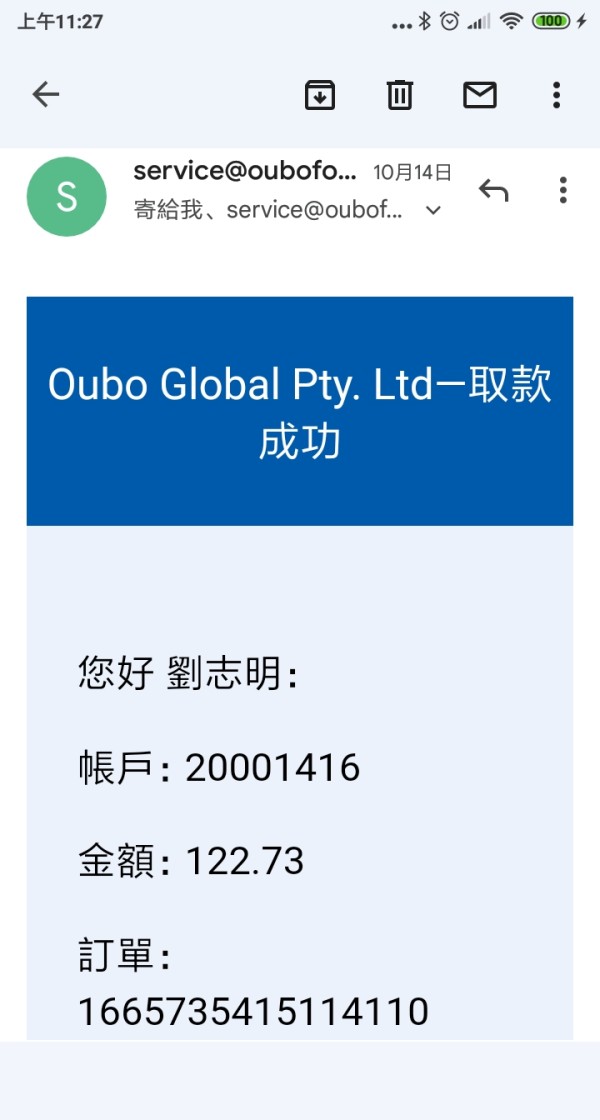

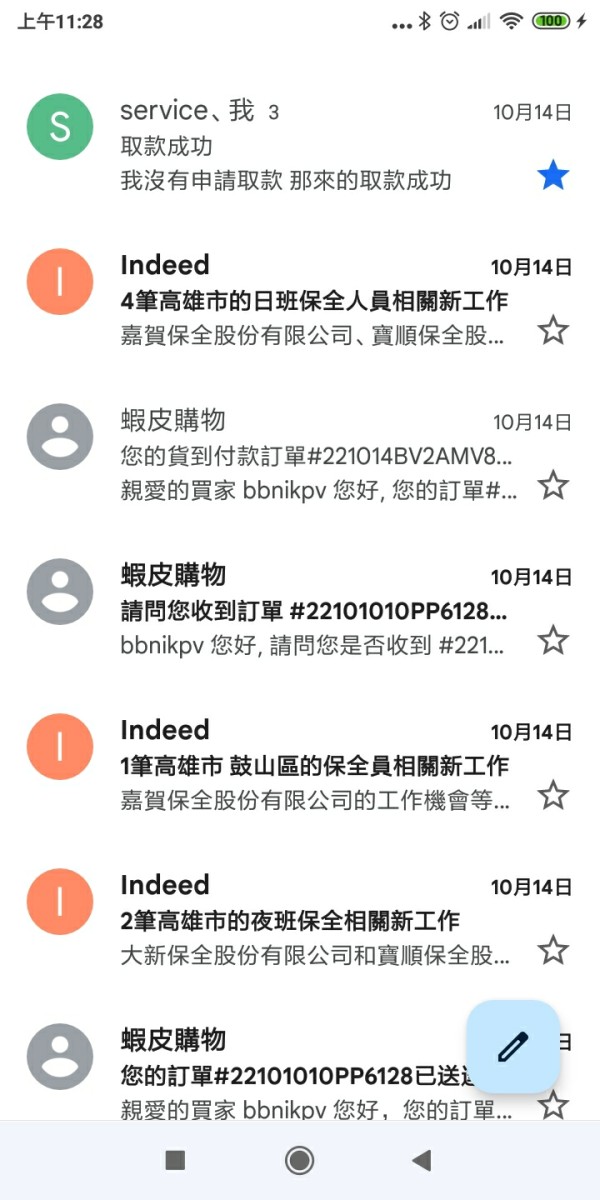

Deposit and Withdrawal Methods: Information about available funding methods, processing times, and fees is not detailed in available sources. This creates uncertainty for potential clients about transaction procedures.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not disclosed in accessible documentation. This limits transparency for prospective traders who want to evaluate entry barriers.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional programs are not documented in available materials. This suggests either no such offerings exist or there is limited marketing disclosure.

Tradeable Assets: The broker provides access to foreign exchange markets and contracts for difference. However, the specific range of currency pairs, indices, commodities, or other instruments available for trading is not fully detailed.

Cost Structure: Important information about spreads, commission rates, overnight financing charges, and other trading costs is not transparently disclosed. This makes it difficult for traders to accurately assess the total cost of trading with this broker.

Leverage Ratios: Maximum leverage levels available to different client categories and jurisdictions are not specified in available documentation. This creates uncertainty about trading conditions.

Platform Options: Specific trading platform software, whether proprietary or third-party solutions like MetaTrader, is not clearly identified in accessible sources. This comprehensive oubo global pty. ltd review reveals significant information gaps that prospective clients should address through direct broker contact before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Oubo Global's account conditions shows major transparency problems that significantly hurt the broker's rating in this category. Available documentation does not provide clear information about different account tiers, their features, or the specific requirements for opening an account. This lack of transparency makes it hard for potential clients to understand what they can expect from their trading relationship with the broker.

Minimum deposit requirements, which are crucial for account accessibility, are not disclosed in publicly available information. This prevents traders from making informed decisions about whether the broker's entry requirements match their financial capabilities. Also, the absence of detailed information about account verification procedures, required documentation, and processing timeframes creates uncertainty about the onboarding experience.

The limited availability of information about special account features hurts the transparency score even more. Features like Islamic accounts for Sharia-compliant trading, VIP services for high-volume traders, or demo account availability are not clearly documented. Without clear account condition details, traders cannot properly assess whether the broker's offerings meet their specific trading needs and preferences.

User feedback about account opening experiences is notably sparse, with insufficient data to determine typical processing times or common issues during registration. This lack of user testimony, combined with the overall information scarcity, contributes to the moderate rating assigned to account conditions in this oubo global pty. ltd review.

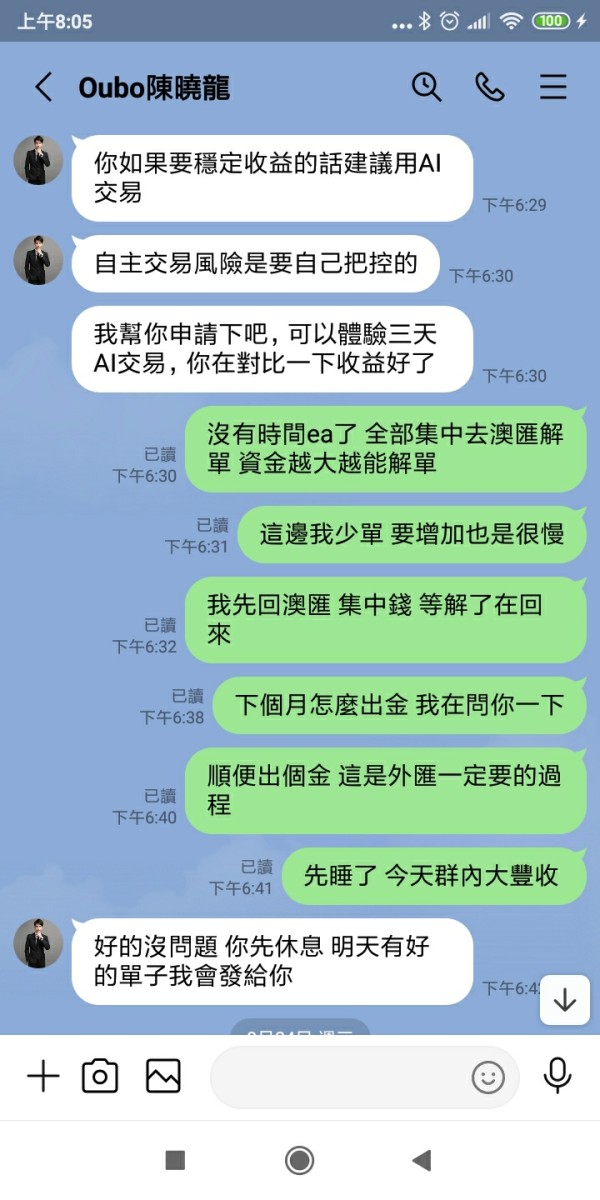

The assessment of trading tools and resources available through Oubo Global shows a mixed picture with significant information gaps. While the broker advertises forex and CFD trading capabilities, detailed information about the specific analytical tools, charting packages, and research resources provided to clients is not easily available in public documentation.

Market analysis resources are not clearly documented among the broker's offerings. This includes economic calendars, daily market commentary, technical analysis reports, and fundamental research. This absence of detailed resource information makes it difficult to evaluate the broker's commitment to supporting informed trading decisions through comprehensive market intelligence.

Educational resources, which are increasingly important for broker differentiation and client success, are not specifically mentioned in available materials. The lack of information about webinars, trading guides, video tutorials, or other educational content suggests either limited investment in client education or poor marketing of such resources.

Automated trading support is not detailed in accessible sources. This includes expert advisor compatibility, copy trading services, or algorithmic trading tools. Given the growing importance of automated trading solutions in modern forex markets, this information gap represents a significant evaluation challenge.

The moderate rating reflects the basic trading capability offerings while acknowledging the substantial information problems that prevent a more comprehensive assessment of the broker's tools and resources portfolio.

Customer Service and Support Analysis

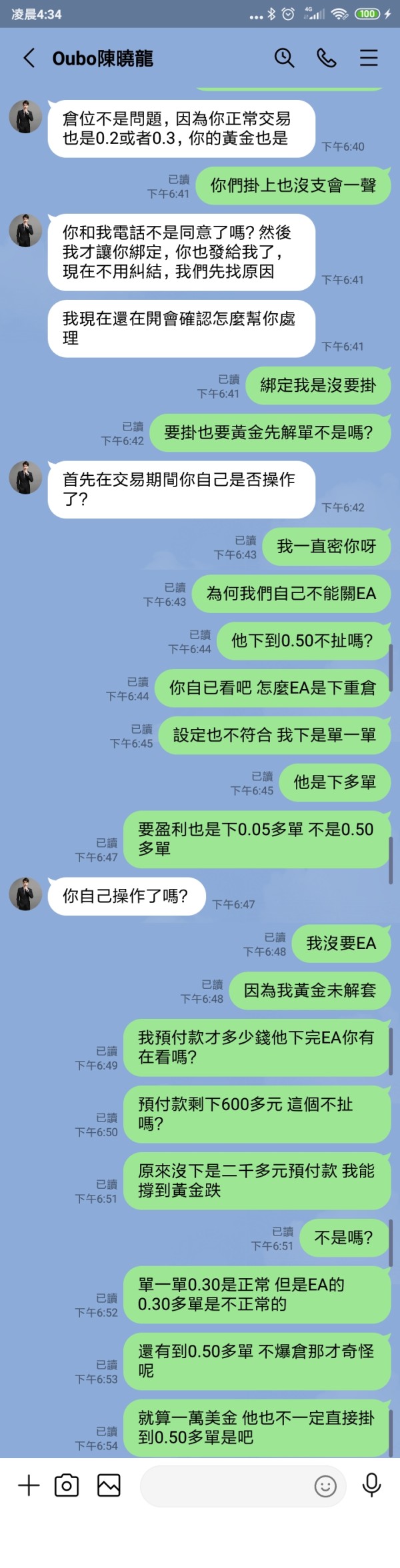

Customer service evaluation for Oubo Global shows concerning patterns that significantly hurt the broker's rating in this critical area. Available user feedback suggests limited positive experiences with customer support, while several sources indicate potential service quality issues that prospective clients should carefully consider.

The availability of multiple customer service channels, response time commitments, and service quality standards are not clearly documented in accessible information. This lack of transparency about support infrastructure raises questions about the broker's commitment to client service excellence and problem resolution efficiency.

Multilingual support capabilities are not specified in available documentation. These capabilities are essential for international brokers serving diverse client bases. This creates uncertainty for non-English speaking traders about their ability to receive adequate support in their preferred language.

Operating hours for customer support services are not clearly communicated in public materials. This includes weekend availability and holiday coverage. This information gap makes it difficult for traders to understand when they can expect assistance with urgent trading or account issues.

The limited positive user feedback available, combined with reports of negative experiences, contributes to the below-average rating assigned to customer service. The absence of documented case studies demonstrating effective problem resolution further hurts confidence in the broker's support capabilities.

Trading Experience Analysis

The evaluation of trading experience with Oubo Global is hurt by insufficient user feedback and limited technical performance data. Available information does not provide clear insights into platform stability, execution speed, or overall trading environment quality, making it challenging to assess the practical trading experience clients can expect.

Platform stability and uptime statistics are not documented in accessible sources, creating uncertainty about system reliability during critical trading periods. The absence of information about server locations, redundancy measures, and technical infrastructure investment raises questions about the broker's commitment to providing consistent trading access.

Order execution quality is not detailed in available documentation. This includes typical execution speeds, slippage rates, and requote frequency. These factors are crucial for evaluating the practical cost of trading and the likelihood of achieving intended trade outcomes, yet remain undocumented in public materials.

Mobile trading capabilities are not specifically described in accessible information. Mobile trading capabilities are increasingly important for active traders. The availability of dedicated mobile applications, mobile-optimized web platforms, or responsive design features remains unclear from available sources.

The moderate rating reflects the basic trading service provision while acknowledging significant information gaps that prevent a comprehensive assessment of the actual trading experience. This oubo global pty. ltd review emphasizes the need for potential clients to thoroughly test trading conditions through demo accounts or small initial deposits before committing substantial funds.

Trustworthiness Analysis

The trustworthiness evaluation of Oubo Global shows significant concerns that substantially hurt the broker's credibility rating. The most notable issue is the reported ongoing deregistration process, which creates uncertainty about the broker's future operational status and client fund security. This development raises serious questions about the stability and reliability of the brokerage operation.

ASIC regulation provides some level of oversight and client protection, though specific license details, compliance history, and any regulatory actions or warnings are not clearly documented in available sources. The regulatory relationship's current status requires careful verification by prospective clients, given the reported deregistration proceedings.

Client fund segregation practices, deposit insurance coverage, and other investor protection mechanisms are not detailed in accessible documentation. These safety measures are fundamental to broker trustworthiness, yet their absence from public information creates significant uncertainty about fund security.

Company financial transparency is not readily available for public review. This includes published financial statements, capital adequacy ratios, and operational metrics. This lack of financial disclosure limits the ability to assess the broker's financial stability and operational sustainability.

The combination of ongoing deregistration proceedings, limited regulatory transparency, and insufficient financial disclosure contributes to the low trustworthiness rating. Potential clients should exercise extreme caution and conduct thorough research before engaging with this broker.

User Experience Analysis

User experience evaluation for Oubo Global shows concerning patterns that significantly hurt overall client satisfaction ratings. Available feedback suggests an imbalance between positive and negative user experiences, with notably more critical reviews than favorable testimonials, indicating potential systematic issues with service delivery.

Interface design and platform usability information is not comprehensively documented in available sources, making it difficult to assess the quality of user interaction with the broker's trading systems. The absence of detailed platform screenshots, feature descriptions, or usability testing results limits the ability to evaluate the practical user experience.

Registration and account verification processes are not clearly outlined in accessible documentation, creating uncertainty about the typical client onboarding experience. Information about required documentation, verification timeframes, and common approval issues would be valuable for prospective clients but remains undocumented.

Funding and withdrawal experiences are not detailed in available user feedback. This includes typical processing times, fee structures, and common transaction issues. These operational aspects significantly impact overall user satisfaction but remain inadequately documented in accessible sources.

The below-average rating reflects the documented negative feedback patterns while acknowledging the limited positive testimony available. Prospective clients should carefully consider the mixed user experience reports and potentially start with minimal exposure to evaluate service quality personally before making substantial commitments.

Conclusion

This comprehensive oubo global pty. ltd review shows a broker facing significant credibility challenges despite its ASIC regulatory status. The ongoing deregistration proceedings represent a major red flag that substantially hurts the broker's trustworthiness and operational stability. While the company offers basic forex and CFD trading services targeting novice and intermediate traders, the lack of transparency about key trading conditions, fees, and operational procedures creates substantial uncertainty for prospective clients.

The broker's main advantages include regulatory oversight through ASIC and access to diversified trading instruments across forex and CFD markets. However, these benefits are significantly overshadowed by concerning factors including limited operational transparency, insufficient positive user feedback, and most critically, the reported deregistration process that raises serious questions about business continuity.

Potential clients should exercise extreme caution when considering Oubo Global, particularly given the combination of limited operational history, ongoing corporate changes, and insufficient transparency about fundamental trading conditions. The significant information gaps identified throughout this review suggest that traders would be better served by established brokers with proven track records and comprehensive disclosure of trading terms and conditions.