orangefx 2025 Review: Everything You Need to Know

1. Abstract

In this orangefx review, we look at a broker that has gotten a lot of attention for bad reasons. OrangeFX works under the VFSC in Vanuatu and offers high leverage up to 1:500 with many different trading options like forex, CFDs, and cryptocurrencies. The broker provides an impressive range of assets and uses the advanced MetaTrader 5 platform for trading. However, users consistently give negative feedback about their experiences. Traders complain about poor transparency, slow response times, and an unreliable trading setup overall. The broker's offshore location and weak oversight create red flags for traders who want safety. But it might work for high-risk traders who want aggressive leverage and many trading choices. User reviews and industry reports show that poor account conditions, bad customer service, and safety concerns hurt its reputation badly. While OrangeFX offers many trading options, the serious concerns about regulation and platform performance require careful thought before signing up.

2. Important Considerations

The broker's registration in Vanuatu creates a big regulatory gap that may put traders at risk. Our review uses user feedback, regulatory data, and current market conditions to form conclusions. Readers should know that our evaluation looked at user stories, compared industry standards, and checked regulatory credentials. All of these point to several problems with how the broker operates. Some features like the wide range of assets and high leverage might attract certain traders. The overall environment lacks transparency and has inconsistent customer support. Future clients must understand that different regional rules could affect fund safety and trustworthiness. This review highlights these important points to give a clear, unbiased view of what traders should expect.

3. Rating Framework

4. Broker Overview

OrangeFX is a broker that helps traders access many different financial instruments. The company doesn't share when it was established, but it has built its business on offering many trading opportunities for currencies, CFDs, cryptocurrencies, and securities. The broker operates from an offshore location and mainly targets high-risk traders who don't worry much about regulatory problems with offshore companies. This approach makes OrangeFX different in a competitive market, but it also makes users and experts question the broker's accountability and reliability. This risk-reward balance needs careful consideration from potential clients thinking about using its services.

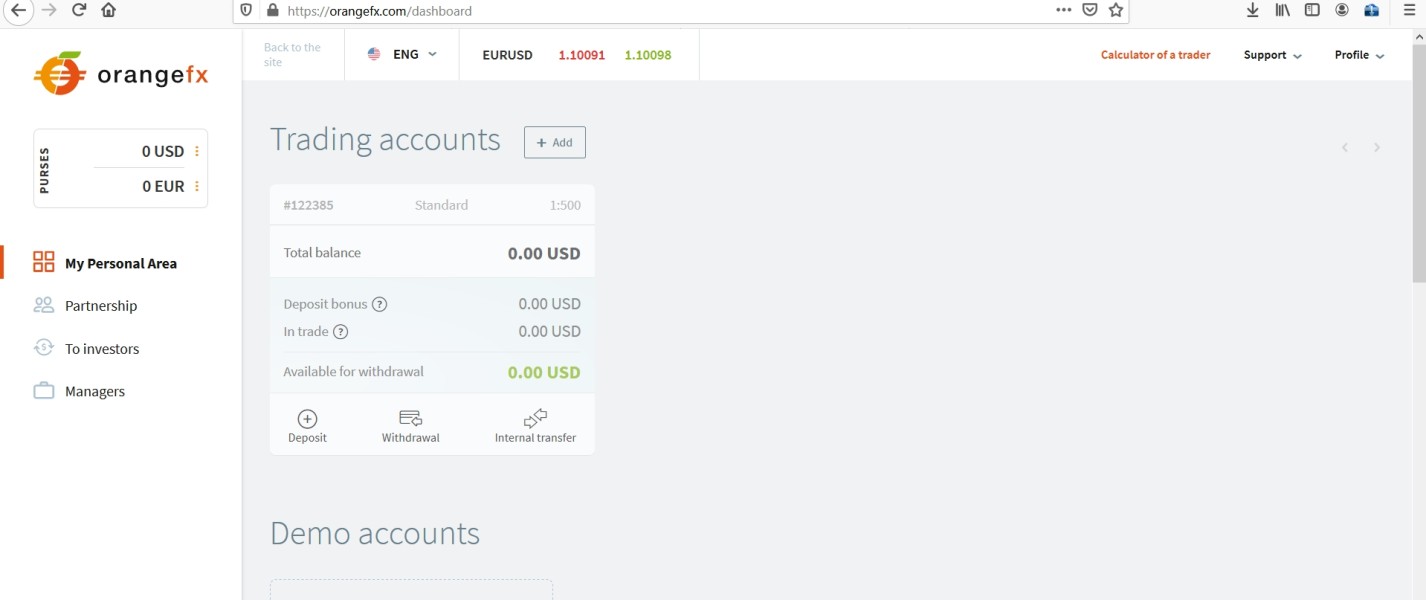

The broker uses the well-known MetaTrader 5 platform for its operations. MT5 offers advanced charts, technical analysis tools, and an easy-to-use interface for experienced traders. The broker provides many asset classes including forex pairs, CFDs on indices, stocks, bonds, commodities, precious metals, and cryptocurrencies. OrangeFX gets regulatory oversight from the Vanuatu Financial Services Commission , which is known for having relaxed rules. As this orangefx review shows, while multiple asset classes and high leverage might seem appealing, the unclear account conditions and poor customer service remain big problems for many traders.

Regulatory Region:

OrangeFX is registered in Vanuatu and works under VFSC oversight. VFSC is a recognized authority, but its rules are much more relaxed than those in other major financial areas.

Deposit and Withdrawal Methods:

The available documentation doesn't provide specific information about deposit and withdrawal methods.

Minimum Deposit Requirement:

There is no detailed information about the minimum deposit. This leaves potential traders unsure about how much money they need to start.

Bonus Promotions:

Details about bonus promotions are missing completely. It's unclear whether any incentives or promotional offers exist to attract new clients.

Tradable Assets:

OrangeFX offers many different tradable assets including forex, CFDs, cryptocurrencies, stocks, bonds, commodities, precious metals, and indices. This wide range is meant to work with different trading strategies and market views.

Cost Structure:

The cost structure shows point spreads starting from 0.1 pips, but there's no clear information about commission fees or other transaction costs. This unclear pricing creates problems for careful traders who want exact fee information.

Leverage Ratio:

Traders on OrangeFX can use high leverage up to 1:500. This may appeal to aggressive traders willing to take higher risks for potentially higher returns.

Platform Selection:

The broker uses the MetaTrader 5 platform, which is known for its complete analytical tools and strong functionality. Even with these advantages, some users have noted platform-related problems.

Regional Restrictions:

No specific information is available about regional restrictions. This leaves a gap in understanding which markets traders can access.

Customer Service Languages:

Details about the languages supported by customer service are not specified. This creates another layer of uncertainty about how easy communication will be.

This section of the orangefx review covers all critical aspects from regulatory details to cost structures. The missing key information in several areas – like deposit methods, minimum deposit requirements, and bonus promotions – shows notable gaps that may affect user experience and decision-making.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The account conditions provided by OrangeFX remain unclear and hard to understand. Important details such as account types, minimum deposit requirements, and commission structures are missing completely. Multiple user reports show that setting up accounts has been frustrating, mainly because of poor communication about account details and confusing account opening processes. The missing information on special account features, such as Islamic compliant accounts, adds to the growing list of problems. Compared to other brokers with clearer guidelines and transparent regulatory compliance, OrangeFX falls far short. Users have expressed disappointment about the lack of detailed information, making it hard for traders to understand entry costs and potential fees. This lack of transparency is a major problem, especially for those who value clear information when choosing a broker. With such big gaps in information, the broker's account conditions get a low rating, reflecting the overall negative feelings from the community. Detailed information was either not provided or poorly explained, forcing traders to look at better-established options. As this orangefx review shows, the uncertainties around account conditions could lead to hidden costs or unexpected trading barriers that risk hurting overall trading performance. This requires a careful approach from potential clients.

OrangeFX offers many different trading instruments, including forex, CFDs, and cryptocurrencies. This ensures that traders can access a broad selection of markets from one platform. The main trading tool is MetaTrader 5 , which is widely known for its advanced analytical capabilities, customizable interface, and extensive technical indicators. However, despite the rich variety of trading tools, there is a significant lack of research, analysis, and educational resources. Several users have noted that while they liked the variety of instruments available, the lack of comprehensive educational content and market analysis tools makes it challenging for new traders to build effective strategies. Also, automated trading support, while technically available through the MT5 environment, doesn't appear to be fully optimized or supported by separate resources. When compared with competitors that offer extensive educational material and curated research portfolios, OrangeFX's resource offering seems insufficient. User experiences have consistently pointed to an expectation gap regarding the balance of trading tools and support materials. While the existence of a robust trading platform is a positive factor, the shortcomings in supplementary resources significantly weaken the overall value proposition. This gap suggests that while experienced traders may navigate this landscape with relative ease, less seasoned investors could encounter difficulties without added educational support.

6.3 Customer Service and Support Analysis

Customer support represents a major weak point for OrangeFX. Reports from various users show that the available support channels don't work well, with response times being very long and service quality falling short of industry standards. Specific details such as the types of support channels offered or the availability of multilingual support are not disclosed. This creates even more uncertainty. Users have reported multiple instances where questions were either left unanswered or resolved in an unsatisfactory manner, leaving them with ongoing operational issues. This poor performance in customer service is especially problematic given the already complex nature of an offshore broker setup, where clear and prompt assistance is essential for resolving critical trading and account issues. Also, the lack of detailed information about service hours and escalation procedures has contributed to negative feelings around the overall support experience. The negative impact on customer satisfaction is clear, and when compared against the industry's best practices, OrangeFX's support services show significant room for improvement. Any broker, especially one operating under unclear regulatory conditions, must invest in a robust customer service infrastructure to maintain trust and operational efficiency.

6.4 Trading Experience Analysis

The trading experience on OrangeFX uses the robust MetaTrader 5 platform but has several usability concerns and performance issues. Traders have reported that while the platform is feature-rich and capable of delivering advanced charting solutions, real-world execution is frequently undermined by slippage and frequent re-quotes during volatile market conditions. These issues not only disrupt intended trading strategies but also create an environment of uncertainty and potential financial loss. The overall platform stability has been questioned, with multiple reports citing unexpected downtimes and lagging response times. Also, while the MT5 platform is generally considered a gold standard in the industry, the integration with OrangeFX's backend appears to be poor, resulting in an inconsistent trading experience. The platform supports a range of automated trading functions, but the actual real-time performance leaves much to be desired. Combined with these technical challenges is the inadequate level of customer support which further worsens the overall trading environment. These issues show the importance of reliable execution in establishing trader confidence, and as indicated by this orangefx review, the trading experience suffers from too many operational problems that take away from the potential advantages of the platform.

6.5 Trustworthiness Analysis

Trust is extremely important when dealing with financial brokers, and OrangeFX faces significant problems in this area. The broker is regulated by the VFSC in Vanuatu, but the regulatory framework in this jurisdiction is known to be more permissive, raising concerns about overall investor protection and fund safety. The limited transparency about key operational details has only fueled negative speculation among market participants. Multiple user reports emphasize the unclear company background and insufficient disclosure of critical financial safeguards. Also, the offshore nature of the broker, combined with a track record of unresolved complaints and recurring issues, contributes to a damaged reputation. These factors create a scenario where trust is severely undermined. While some traders may appreciate high leverage and a wide asset selection, the inherent risks associated with questionable regulatory oversight cannot be overlooked. Industry comparisons reveal that brokers operating under stricter regulatory regimes offer significantly enhanced investor protection measures. Despite meeting some functional expectations, the overall trustworthiness of OrangeFX remains highly suspect, casting a long shadow over its market credibility.

6.6 User Experience Analysis

The overall user experience with OrangeFX is marked by widespread dissatisfaction and several operational shortcomings. Users have frequently reported challenges ranging from difficulties navigating the platform to unresolved issues during account setup and trade execution. The interface design doesn't appear to have been optimized for ease-of-use, and there is little evidence to suggest that the registration and verification processes have been streamlined for user convenience. Also, the inability to effectively manage funds – for instance, a lack of clear information on deposit and withdrawal processes – further worsens the poor experience. User complaints consistently highlight an environment filled with delays and miscommunications, making routine interactions with the broker unnecessarily difficult. Despite the platform's potential, these recurring quality issues create significant friction for traders. This is especially problematic for those who prioritize an efficient, reliable user interface in their trading activities. Given these persistent problems, substantial improvements are needed to deliver an experience that aligns with modern trading expectations. Enhancing interface design, streamlining registration procedures, and improving overall transparency would be critical first steps towards boosting user satisfaction.

7. Conclusion

This orangefx review clearly shows that despite providing some attractive features – such as high leverage and a broad asset portfolio – the broker suffers from many underlying issues. The offshore registration and lax regulatory oversight, along with unclear account conditions and poor customer support, significantly hurt its credibility. This broker appears to be best suited for high-risk traders who can tolerate the inherent uncertainties. OrangeFX's numerous problems indicate that prospective clients should proceed with extreme caution and consider alternative brokers offering greater transparency and robust support.