Midtou 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex trading, Midtou has emerged as a contender, but not without controversy. The overall sentiment surrounding this broker is predominantly negative, with multiple sources labeling it as unregulated and potentially fraudulent. Key concerns include high minimum deposit requirements, inflated spreads, and a limited range of tradable assets.

Note: It is essential to recognize that Midtou operates under various entities across different regions, which complicates its regulatory status. This review aims to provide a fair and accurate overview of the broker, drawing from multiple sources to highlight both its strengths and weaknesses.

Rating Overview

How We Score Brokers: The ratings are derived from a comprehensive analysis of user experiences, expert opinions, and factual data regarding Midtou's services.

Broker Overview

Founded in 2018, Midtou operates under the umbrella of PT Midtou Aryacom Futures, an entity that claims to be regulated by Indonesia's Commodity Futures Trading Regulatory Agency (BAPPEBTI). However, many reviews suggest that this regulation is not robust enough to ensure trader safety. The broker primarily utilizes the popular MetaTrader 4 (MT4) platform, which is favored for its user-friendly interface and extensive analytical tools. Traders can access a limited range of assets, including around 20 currency pairs and precious metals, but notably lack options for CFDs on stocks or cryptocurrencies.

Detailed Breakdown

Regulated Geographies:

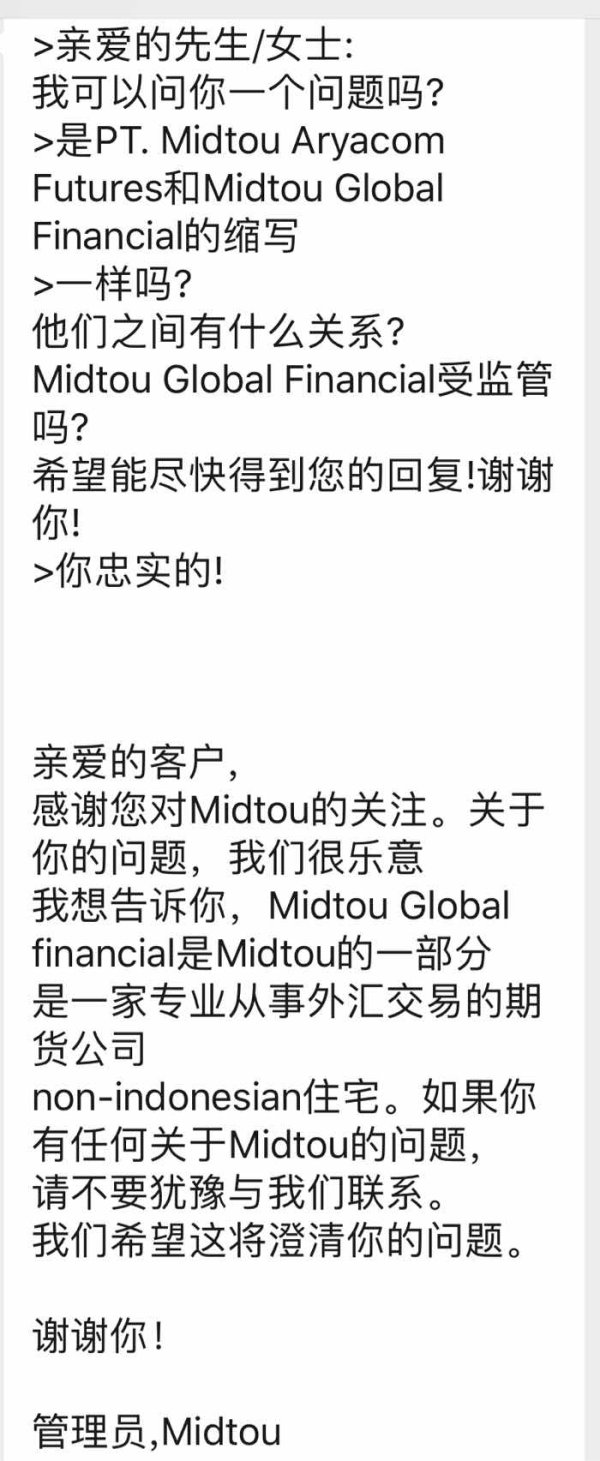

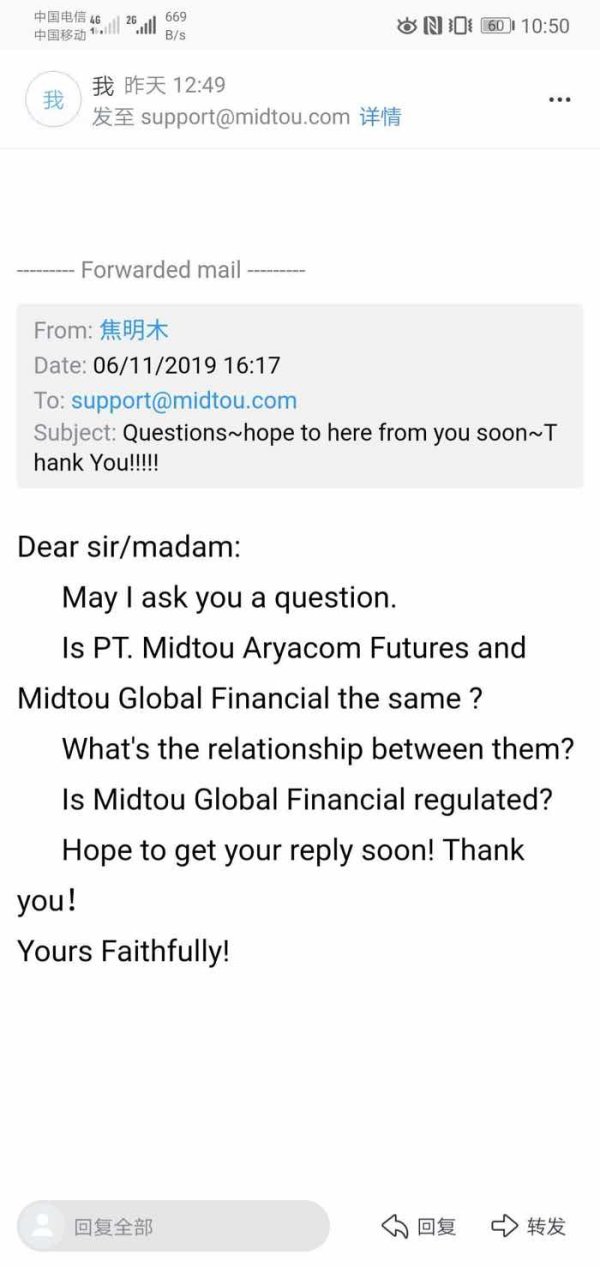

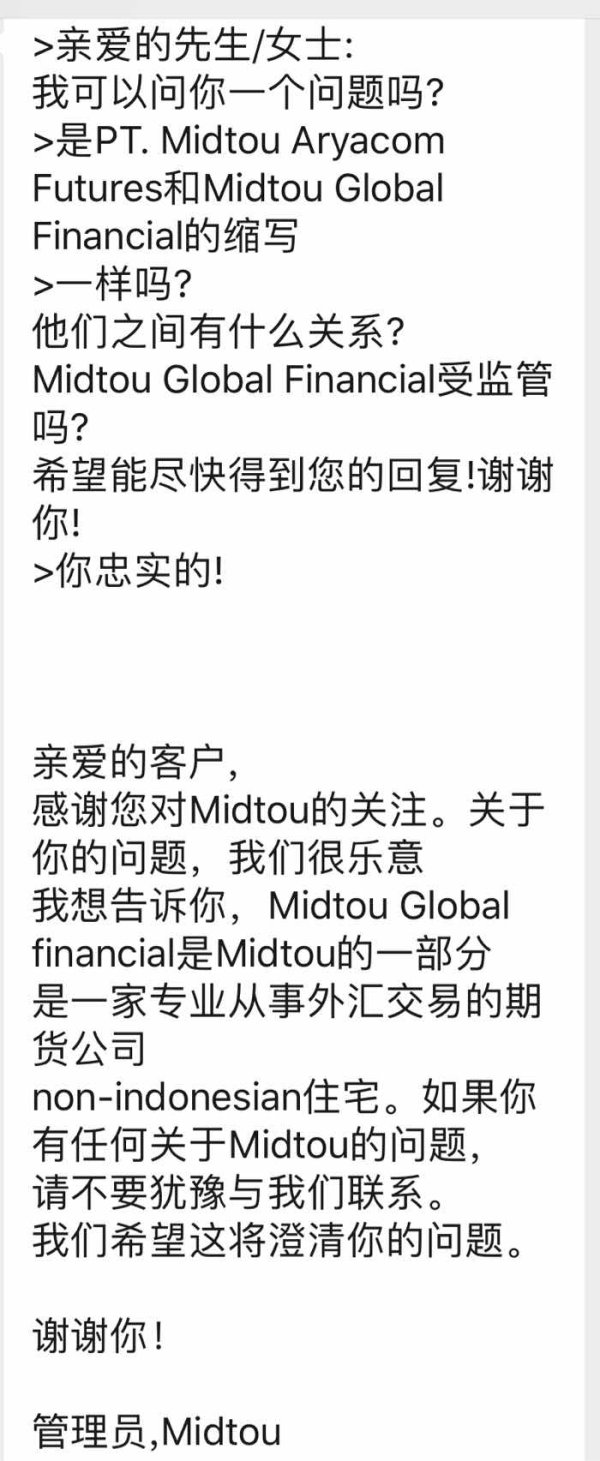

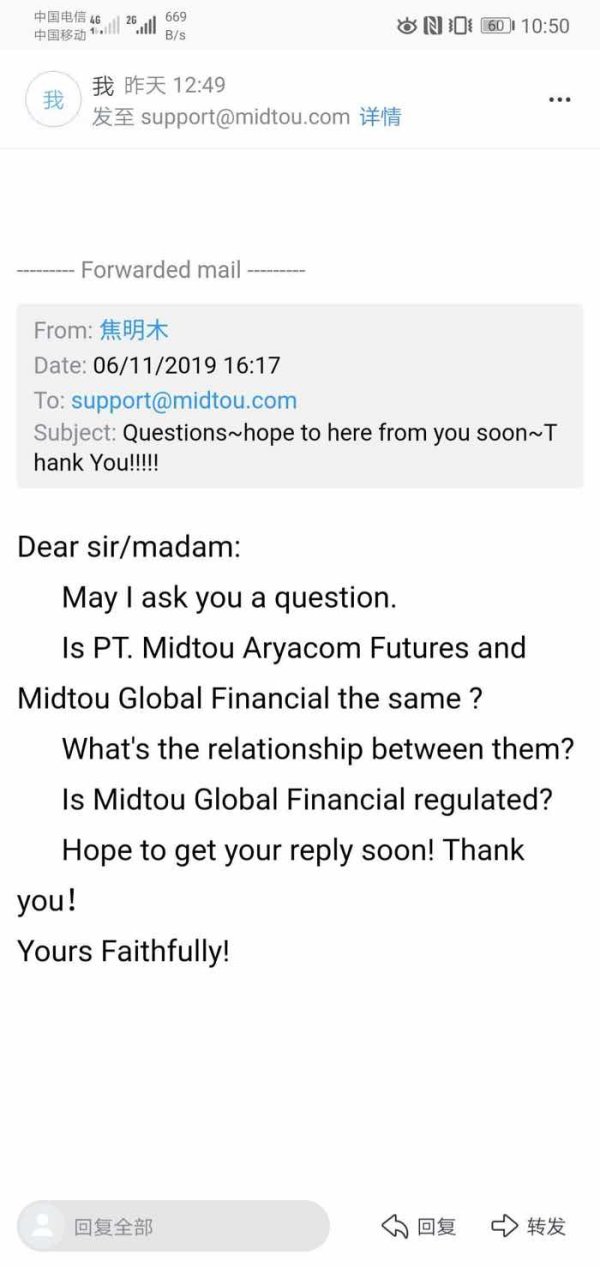

Midtou claims to be regulated in Indonesia; however, the effectiveness and enforcement of this regulation are frequently questioned. The Securities Commission of Malaysia has included Midtou in its investor alert list, raising red flags about its operational legitimacy.

Deposit/Withdrawal Currencies:

The broker operates primarily in US dollars, and there is no mention of accepting cryptocurrencies for deposits or withdrawals.

Minimum Deposit:

To open an account with Midtou, traders must deposit a minimum of $500, which is higher than many competitors, making it less accessible for new traders.

Bonuses/Promotions:

There is limited information regarding any bonuses or promotions offered by Midtou, which may deter potential clients looking for incentives.

Tradable Asset Classes:

Midtou offers a narrow selection of tradable assets, primarily focusing on forex pairs and a few precious metals. The absence of CFDs on stocks and cryptocurrencies limits its appeal to a broader trading audience.

Costs (Spreads, Fees, Commissions):

The broker advertises fixed spreads starting at 2 pips for EUR/USD, but user experiences indicate that actual spreads may be higher, often reaching 3 pips. This lack of transparency regarding costs is a significant drawback for traders.

Leverage:

Midtou provides high leverage options, reaching up to 1:500. While this can amplify potential profits, it also poses substantial risks, particularly for inexperienced traders.

Allowed Trading Platforms:

Traders can only use the MT4 platform, which, while reputable, limits flexibility for those who may prefer other platforms.

Restricted Regions:

There is no clear indication of restricted regions, but the broker's offshore registration in Belize raises concerns about its legitimacy and operational practices.

Available Customer Service Languages:

Customer support appears to be limited, with English as the primary language. Reviews indicate that reaching support can be challenging, contributing to a negative user experience.

Repeated Rating Overview

Detailed Rating Analysis

-

Account Conditions (4/10): The high minimum deposit and limited account types hinder accessibility for new traders. Users have expressed concerns about the lack of flexibility in account options.

Tools and Resources (5/10): While the MT4 platform offers various tools, the absence of additional platforms and resources limits traders' analytical capabilities.

Customer Service & Support (3/10): Users have reported difficulties in reaching customer support, which is a significant concern for those needing assistance.

Trading Experience (4/10): The trading experience is marred by high spreads and limited asset offerings, which can deter traders looking for competitive conditions.

Trustworthiness (2/10): The negative regulatory history and warnings from various financial authorities significantly impact trust levels among potential clients.

User Experience (3/10): Overall user feedback indicates dissatisfaction with the broker's services, particularly regarding transparency and support.

Product Range (4/10): The limited selection of tradable assets restricts opportunities for diversification, which is crucial for effective risk management.

In conclusion, while Midtou may offer some appealing features, the overall consensus from multiple sources points to significant concerns regarding its regulatory status, trading conditions, and customer support. Potential traders are advised to exercise caution and consider alternative brokers with better reputations and more favorable trading conditions.