MBFX 2025 Review: Everything You Need to Know

Executive Summary

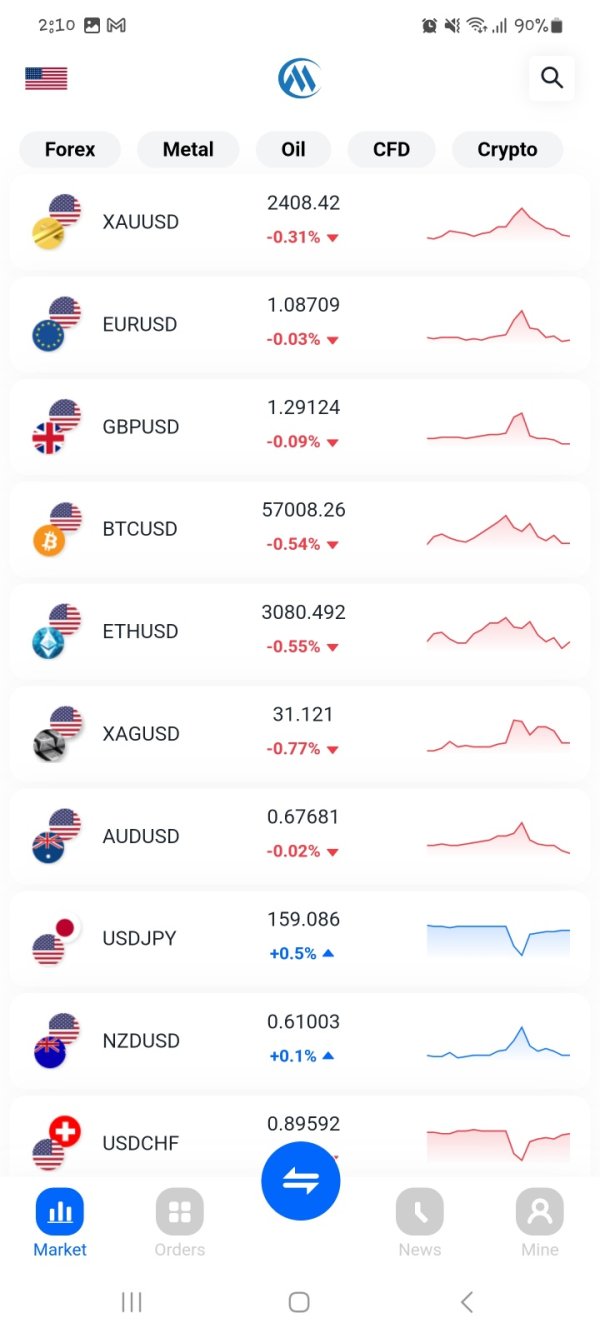

This mbfx review looks at a high-risk forex trading platform that has mixed user feedback across the industry. MBFX says it offers many features and multiple account types for different experience levels, from beginner-friendly options to copy trading accounts. The platform supports both forex and cryptocurrency trading. It positions itself as a flexible trading solution for modern investors.

However, our analysis shows big concerns that potential traders must think about carefully. User feedback points out troubling issues including withdrawal problems and poor customer service. This contributes to an overall low rating across review platforms. Some traders like the educational activities and account variety that MBFX offers. However, the negative reviews are much more common than positive experiences. The platform seems best for experienced traders who can handle potential risks. Even seasoned investors should be very careful when considering this broker.

Important Disclaimers

Regional Entity Differences: MBFX operates globally with multiple IB offices worldwide. Specific regulatory oversight varies by jurisdiction. Traders should check the regulatory status for their region before using the platform.

Review Methodology: This evaluation uses comprehensive analysis of user feedback, industry reports, and public information. Our assessment follows established industry standards for broker evaluation. It includes both quantitative metrics and qualitative user experiences to provide a balanced perspective.

Rating Framework

Broker Overview

MBFX says it is a global forex and cryptocurrency trading platform. It operates through multiple international business offices in major financial hubs worldwide. According to available information, the company has been serving international clients and partners. However, specific founding details and company history are limited in public documentation.

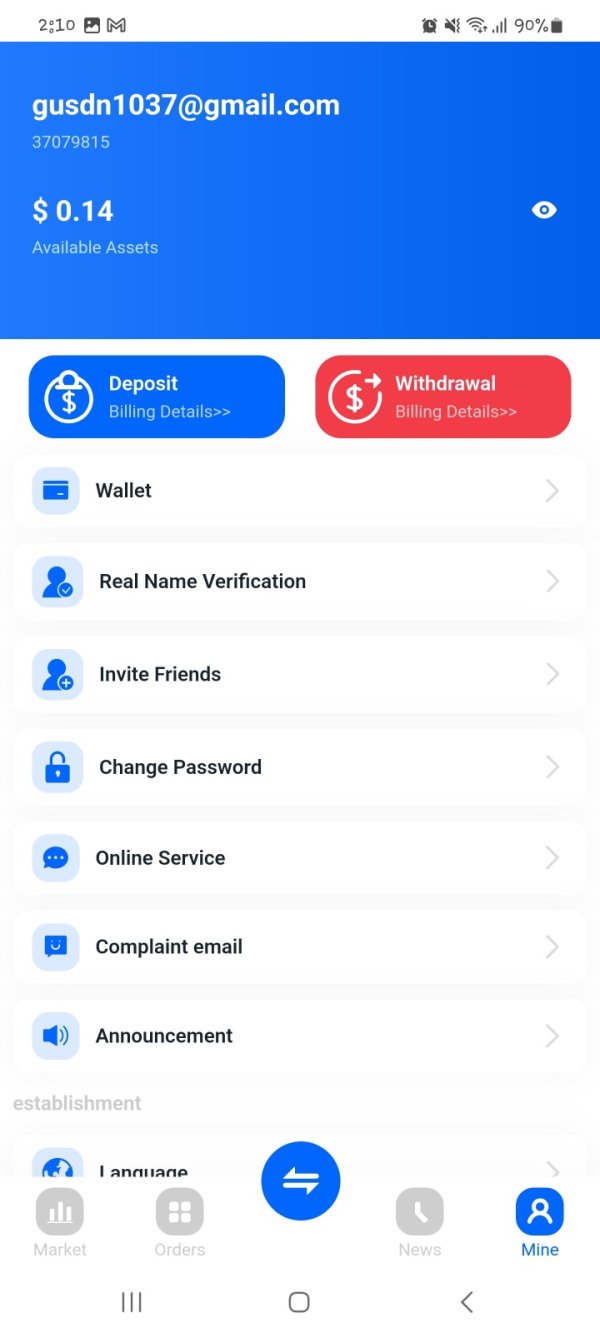

The broker's main business model focuses on providing diverse account types for traders with different experience levels and capital requirements. MBFX offers stock accounts, ultra-low spread accounts, standard trading accounts, and micro accounts. This suggests a comprehensive approach to market segmentation. The platform's focus on educational activities and beginner-friendly features shows it wants to attract new traders to the forex market.

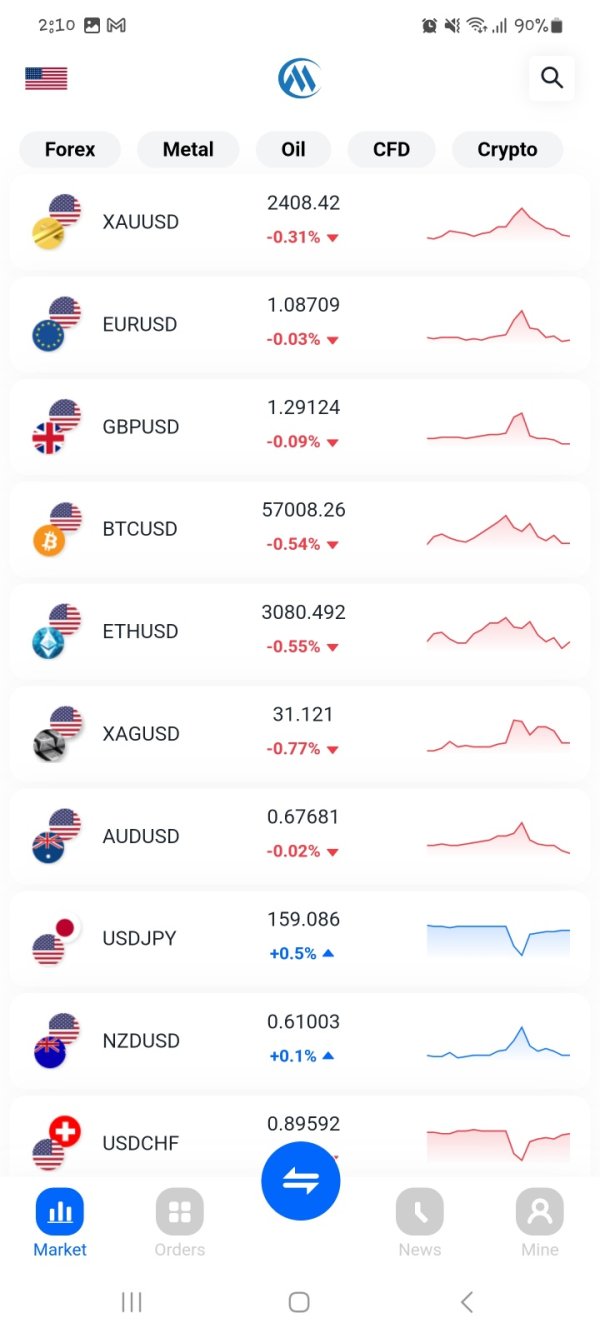

MBFX shows its ability to facilitate trading in cryptocurrencies alongside traditional forex pairs and other financial instruments. This multi-asset approach reflects current market trends where traders want diversified investment opportunities within a single platform. However, specific details about the company's regulatory framework, exact founding date, and detailed operational history are not well documented in available sources. This raises questions about transparency and regulatory compliance.

Regulatory Status: Available information does not specify concrete regulatory oversight or licensing details for MBFX operations. This represents a significant concern for potential traders seeking regulated trading environments.

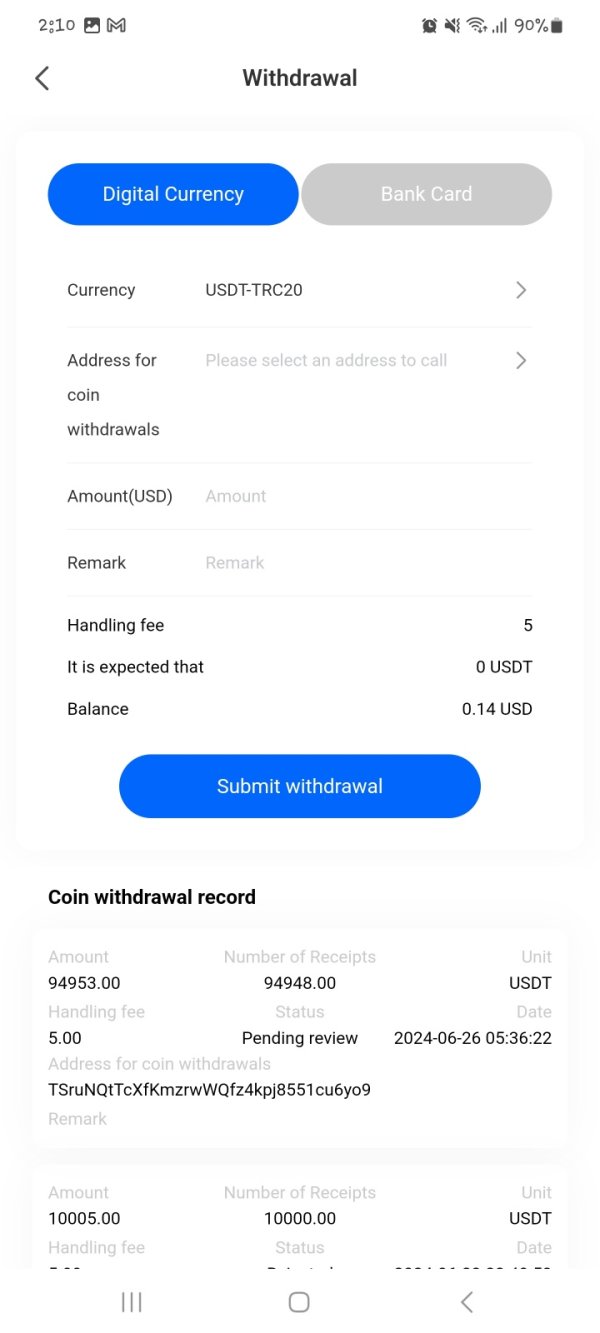

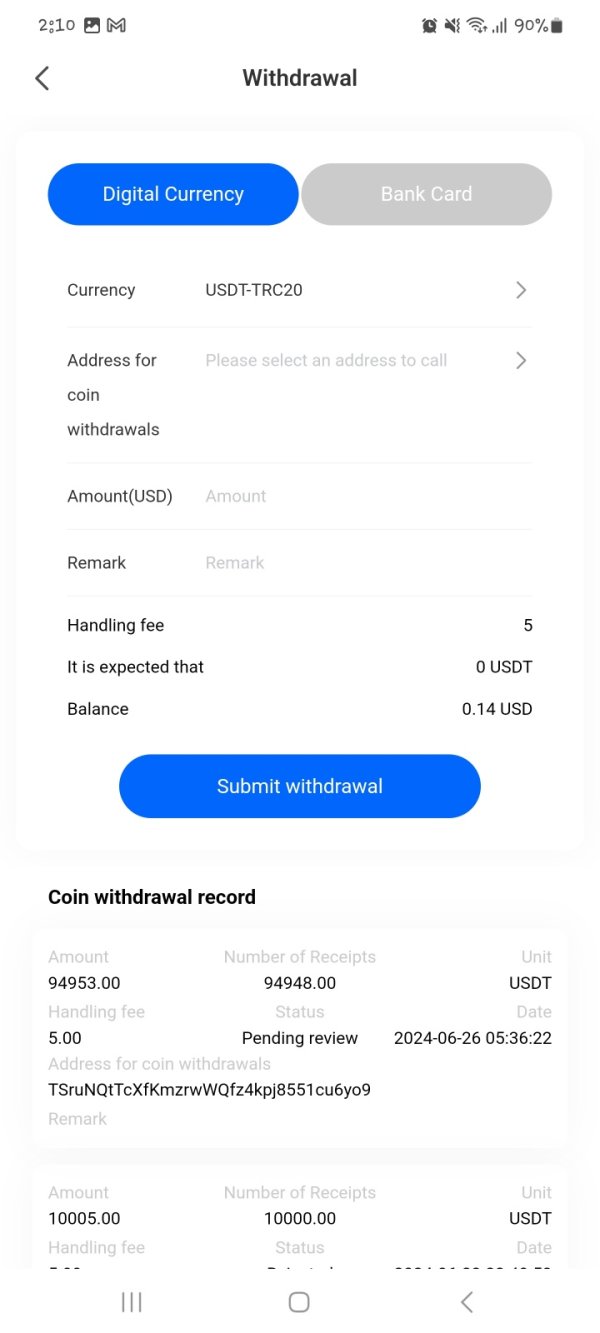

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available documentation. However, user feedback suggests withdrawal difficulties.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available sources. The presence of micro accounts suggests lower entry barriers for some account categories.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in available documentation.

Tradeable Assets: The platform supports forex currency pairs and cryptocurrency trading. However, the complete range of available instruments requires further verification.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not fully available in current sources. This limits cost comparison capabilities.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation.

Platform Options: The exact trading platforms supported by MBFX are not specified in available sources. However, the mention of various account types suggests multiple platform options may be available.

Geographic Restrictions: Specific regional limitations or service availability restrictions are not detailed in current documentation.

Customer Support Languages: Available language support for customer service is not specified in accessible information.

This mbfx review reveals significant information gaps that potential traders should consider when evaluating the platform's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

MBFX shows reasonable account diversity by offering multiple account types including stock accounts, ultra-low spread accounts, standard accounts, and micro accounts. This variety suggests an attempt to serve different trader profiles, from beginners with limited capital to more experienced traders seeking specific trading conditions. The inclusion of copy trading accounts shows recognition of social trading trends. This can benefit novice traders learning from experienced professionals.

However, the lack of detailed information about minimum deposit requirements, specific account features, and trading conditions significantly impacts the evaluation. User feedback shows satisfaction with account type variety, but withdrawal difficulties greatly reduce the overall account experience. The absence of clear information about account opening procedures, verification requirements, and special account features like Islamic accounts limits the platform's appeal to specific trader segments.

Compared to established brokers, MBFX's account offerings appear comprehensive on the surface. However, the lack of transparency about specific terms and conditions raises concerns about the actual value proposition. The mbfx review data suggests that while account variety exists, the practical implementation and user experience fall short of industry standards.

According to user feedback, MBFX provides educational activities that receive positive recognition from traders. This is particularly true for those who have been with the platform for extended periods. One user specifically mentioned satisfaction with educational offerings after two years of trading experience. This indicates consistent educational support. This focus on trader education represents a positive aspect of the platform's resource offerings.

However, detailed information about specific trading tools, research capabilities, analytical resources, and automated trading support is notably absent from available documentation. The lack of comprehensive tool descriptions makes it difficult to assess the platform's technical capabilities compared to industry standards. While educational activities receive praise, the absence of information about charting tools, market analysis, economic calendars, and other essential trading resources limits the overall rating.

The platform's educational focus suggests recognition of the importance of trader development. However, without detailed information about the breadth and quality of analytical tools, research resources, and platform functionality, the tools and resources offering cannot receive a higher rating despite positive educational feedback.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents one of MBFX's most significant weaknesses based on available user feedback. Multiple sources indicate that customer service responsiveness is inadequate. Users report delayed responses and insufficient support quality. These service issues directly impact trader satisfaction and platform reliability, particularly when combined with reported withdrawal difficulties.

The lack of detailed information about customer service channels, availability hours, multilingual support, and response time standards further compounds service concerns. Professional forex brokers typically provide multiple contact methods including live chat, email, phone support, and comprehensive FAQ sections. The absence of such detailed service information in MBFX documentation suggests potential limitations in customer support infrastructure.

User feedback consistently highlights customer service problems as a primary concern. Negative experiences significantly outweigh positive service interactions. The combination of poor responsiveness and withdrawal processing issues creates a particularly problematic service environment that undermines trader confidence and platform usability.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation reveals mixed feedback from users. Some report satisfactory experiences while others encounter significant issues. Available information suggests problems with order execution quality, including reports of slippage and requoting. This directly impacts trading effectiveness and profitability.

Platform stability and execution speed details are not comprehensively documented. This makes it difficult to assess the technical quality of the trading environment. The absence of specific information about platform functionality, mobile trading capabilities, and advanced trading features limits the evaluation of the overall trading experience.

User feedback indicates variability in spread stability and execution quality. This suggests inconsistent trading conditions that may affect different traders differently. The mbfx review data points to trading experience issues that, while not universally negative, raise concerns about platform reliability and execution standards compared to established industry benchmarks.

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent the most concerning aspects of MBFX operations. The absence of clear regulatory information in available documentation raises fundamental questions about oversight and compliance standards. Established forex brokers typically provide detailed regulatory credentials, licensing information, and compliance frameworks. These are notably absent from MBFX materials.

User feedback consistently includes warnings about exercising caution when dealing with the platform. Multiple sources describe MBFX as a high-risk trading environment. The combination of withdrawal difficulties, poor customer service, and lack of regulatory transparency creates a particularly concerning trust profile.

Industry reputation appears significantly damaged by negative user experiences and the absence of positive third-party endorsements or regulatory recognition. The lack of information about fund security measures, segregated account policies, and investor protection schemes further undermines confidence in the platform's safety standards.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with MBFX appears mixed. Experiences vary significantly between different users. While some traders report positive experiences with educational activities and account variety, negative feedback regarding withdrawal processes and customer service substantially impacts overall satisfaction scores.

The platform appears to attract traders seeking educational support and diverse account options. However, practical implementation issues create significant user experience challenges. Common complaints center on withdrawal difficulties and customer service problems. These represent fundamental operational issues that affect daily platform interaction.

User demographic analysis suggests the platform may be more suitable for experienced traders who can navigate potential challenges. Newcomers face higher risks due to service and operational issues. The user experience reflects a platform with some positive features undermined by significant operational shortcomings that impact daily trading activities.

Conclusion

This comprehensive mbfx review reveals a high-risk trading platform that requires extreme caution from potential users. While MBFX offers some positive features including account variety and educational activities, significant concerns about customer service, withdrawal processes, and regulatory transparency substantially outweigh these benefits. The platform may be suitable only for highly experienced traders who can navigate potential risks. However, even seasoned professionals should carefully consider the documented issues before engaging with MBFX services.