Hmarl 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Hmarl Broker has positioned itself as a forex trading platform that offers a diverse range of financial instruments, including forex, investment funds, and loans. However, this article uncovers significant concerns regarding its regulatory legitimacy and user experiences. Numerous allegations suggest Hmarl may operate in a high-risk environment, potentially classifying it as a scam. While it aggressively markets low-cost trading options appealing to beginner traders, the risks associated with fund withdrawals and inadequate support services present substantial trade-offs. Prospective investors must weigh the allure of competitive trading conditions against these serious cautionary indicators.

⚠️ Important Risk Advisory & Verification Steps

Warning: Trading with Hmarl Broker carries significant risks. Consider the following:

- Regulatory Concerns: Hmarl's claims of regulation are dubious, with implications of operating as a clone of a legitimate entity.

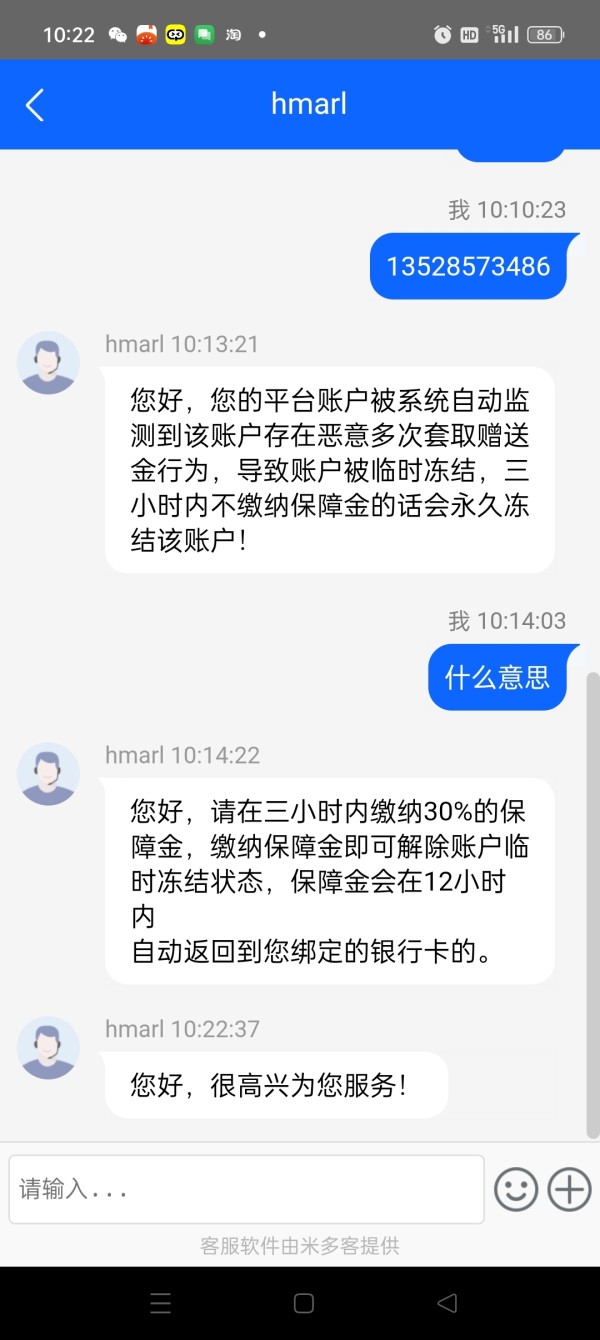

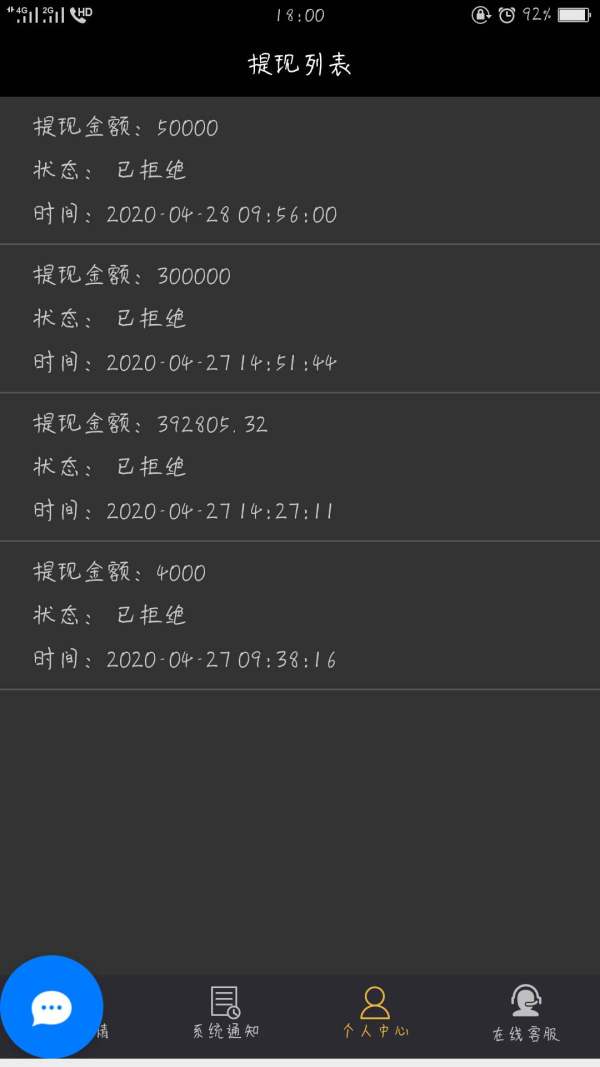

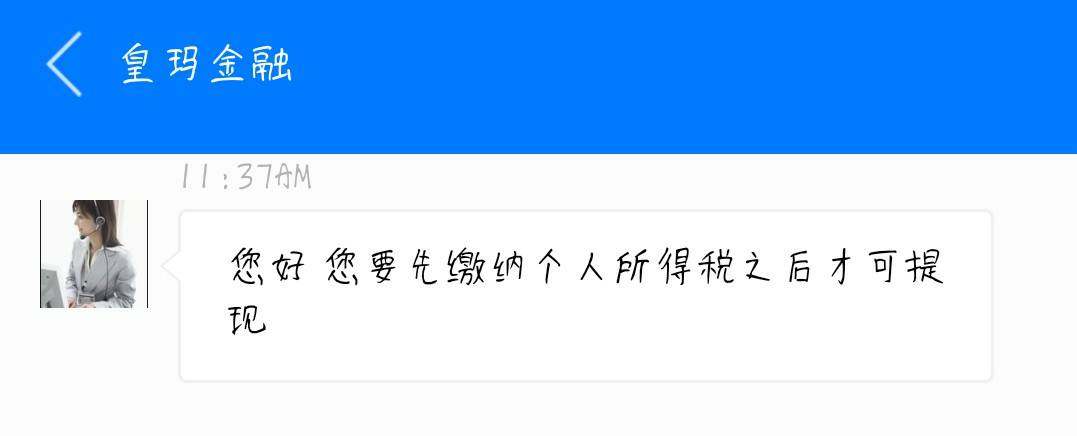

- Withdrawal Issues: Many users have reported difficulties accessing funds.

- Poor Customer Support: Complaints detail inadequate assistance and responsiveness from the broker.

Self-Verification Steps:

- Check if Hmarl is listed on authoritative regulatory websites.

- Investigate user reviews and complaints on platforms like WikiFX.

- Confirm the broker's operational status on the original website.

- Look for registration and licensing information from FCA and ASIC.

Rating Framework

Broker Overview

Company Background and Positioning

Established in November 2017, Hmarl (UK) Global Holdings Limited operates out of the United Kingdom. Despite its relatively new entry into the market, there are alarming signs including the companys dissolution in July 2023. This raises critical questions about its operational reliability. Coupled with the absence of comprehensive information about its management team, transparency regarding ownership and operations remains a significant concern, feeding into the narrative of potential scams associated with the broker.

Core Business Overview

Hmarl claims to offer a diverse array of trading options, primarily tailored toward forex transactions. However, the legitimacy of its claimed regulatory oversight by the Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC) is questionable. Reports circulate suggesting that Hmarl operates as a "clone" of a regulated entity, risking a precarious landscape for traders who invest their funds without proper verification of these claims.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Hmarl's assertions of being FCA and ASIC regulated brokers lack substantiation, raising high risk levels for traders. The FCA warning list indicates suspicions of Hmarl being a clone of a legitimate broker, which nullifies any trustworthiness assigned to its regulatory claims.

User Self-Verification Guide

- Visit official regulatory websites: FCA and ASIC.

- Cross-check licensing information: Look for valid brokers rather than clones.

- Review complaints: Look for insights from existing users on forums.

- Invest in small amounts first: Test the broker's responsiveness and legitimacy.

Industry Reputation and Summary

The prevailing opinions in the trading community echo concerns over fund safety and prompt service. Instances of exploitation are prominent, meaning self-verification becomes imperative.

Trading Costs Analysis

Advantages in Commissions

Hmarl markets a competitive, low-commission structure, attracting many new investors. However, specific data regarding trading costs are unclear, which may hint at ulterior motives or hidden fees.

The "Traps" of Non-Trading Fees

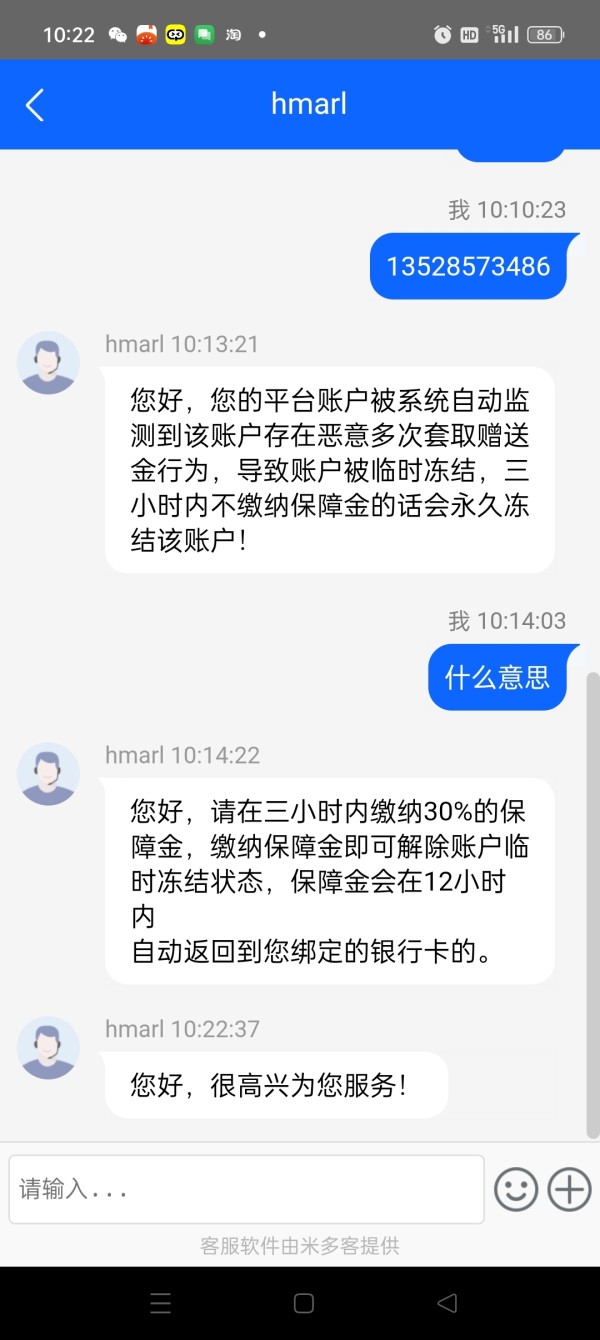

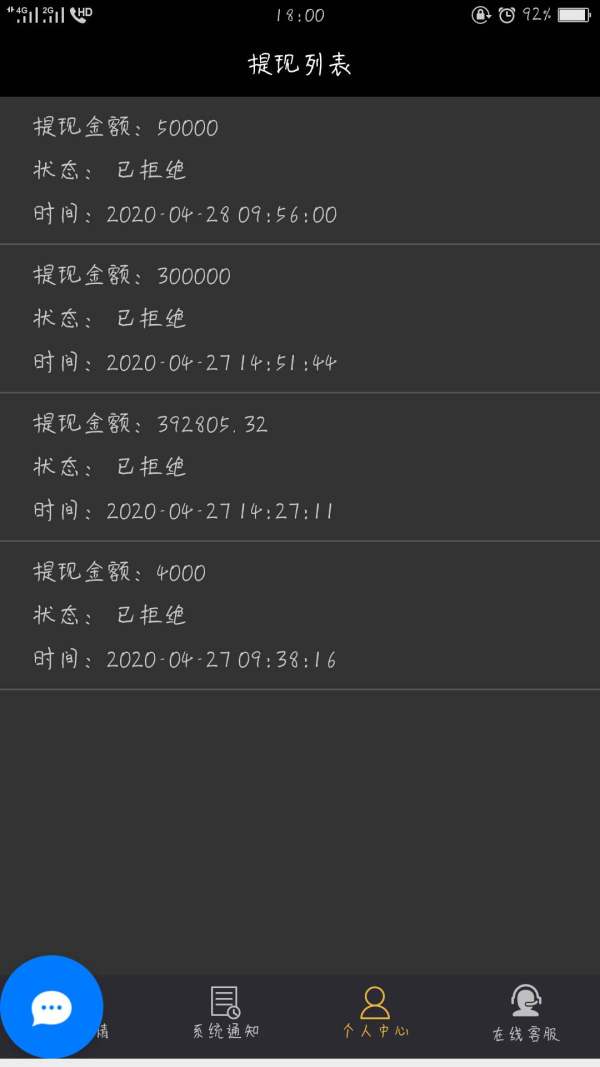

Many users have reported exorbitant withdrawal fees. One user noted, “The cash withdrawal did not arrive after transaction; account is locked, and it can only be unlocked by calling for a 30% security deposit.” Such hidden charges suggest a lack of transparency, which is a common practice among questionable brokers.

Cost Structure Summary

While Hmarl seemingly offers low commissions, the resultant hidden costs and high withdrawal fees could render it unbeneficial for many trader segments, especially those with minimal experience.

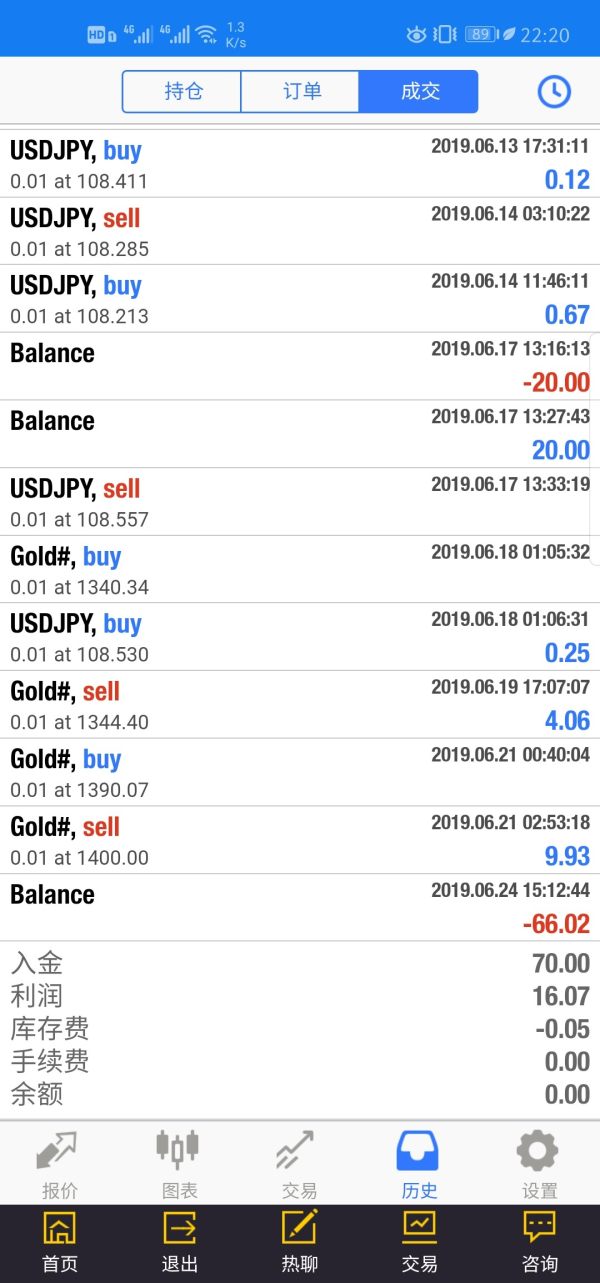

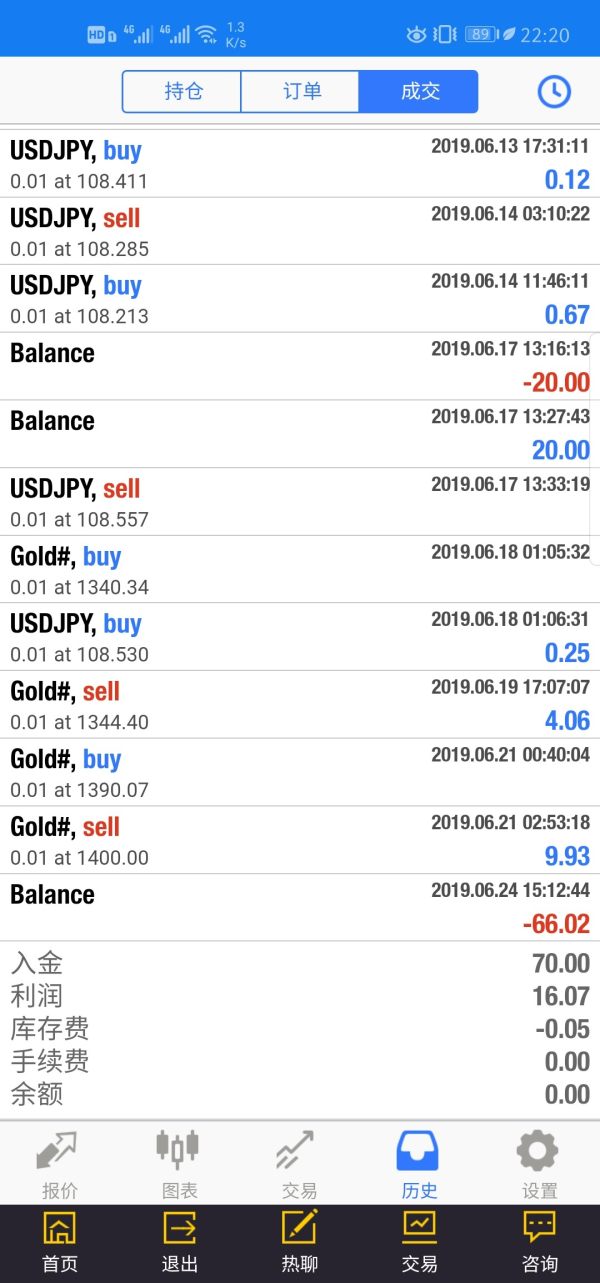

The broker advertises diverse trading platforms but has been criticized for ineffective user experience and poor tool availability. Reports of significant slippage during trading are common, raising doubt about execution efficiency.

Charting tools and educational materials offered observed appear insufficient for nurturing new trader skillsets, contradicting claims of a beginner-friendly environment.

User feedback largely points to poor usability and many issues raised about executing trades without delays or disconnections, which can severely disrupt trading strategies.

User Experience Analysis

Access and Navigation

New users report encountering difficulties when navigating the platform due to its insufficient layout and confusing processes.

Complaints Patterns

The primary complaint categories include high withdrawal issues and alleged scams regarding “bonus traps,” where users are incentivized to deposit larger amounts without reasonable assurances.

Customer Support Analysis

Support Accessibility

Compounding users' frustrations, support channels of Hmarl have also earned criticism due to counterproductive engagement and a lack of satisfying resolutions.

Complaint Response Times

Most reports classify support response times as exceedingly slow or nonexistent. Users have expressed sentiments reflecting inadequacy in handling inquiries impacting their ability to retrieve funds.

Account Conditions Analysis

Transparency of Terms

The conditions under which accounts are opened are not clearly defined, leading to inconsistency and disillusionment among new users who seek straightforward, trustable service.

Clear Definitions

Terms surrounding account management, deposits, and withdrawals need explicit clarification to avoid misinterpretations that could negatively affect user experience.

Conclusion

The overall analysis highlights significant concerns regarding Hmarl, suggesting that it may not be a reliable trading platform. Regulatory ambiguities, user complaints about fund withdrawals, and the operational dissolution raise red flags. Beginner traders seeking low-cost options should tread carefully, and it may be prudent to consider well-regulated alternatives, such as eToro or Forex.com, which provide a safer trading environment. Ultimately, a deeper understanding of Hmarl's shortcomings reinforces cautious skepticism towards potential investments with this broker. Thus, the answer to the question, "Is Hmarl safe?" leans decidedly towards caution and skepticism.