Grandefex 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive grandefex review reveals a concerning picture of an offshore broker that has attracted significant negative attention from the trading community. Grandefex was established in 2020 by Soleil Rouge Inc and has its headquarters in the Commonwealth of Dominica. The company presents itself as a trading platform offering access to forex pairs, indices, stocks, and commodities through their web trader platform.

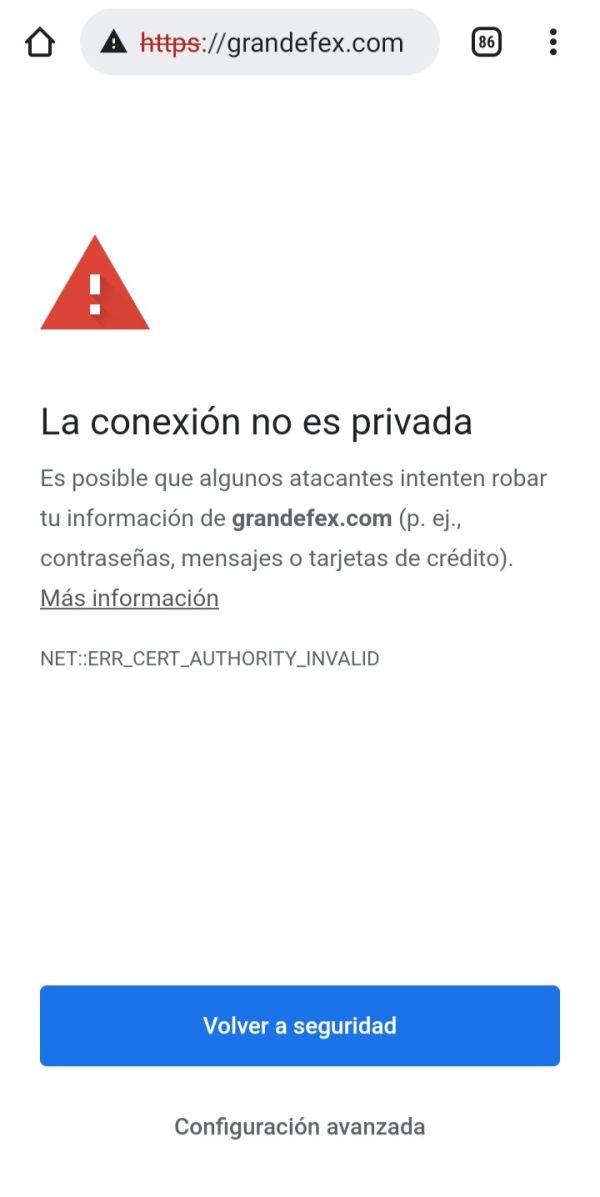

However, our analysis reveals substantial red flags that potential investors must consider carefully. According to multiple sources, including Business Module Hub and various review platforms, Grandefex receives poor ratings from clients and faces accusations of numerous scam activities. The broker operates without proper regulatory oversight, which raises serious concerns about client fund safety and trading conditions.

While the platform claims to provide investment opportunities across multiple asset classes, the lack of transparency regarding account conditions, fee structures, and regulatory compliance makes it unsuitable for most retail traders seeking a reliable trading environment. This grandefex review aims to provide traders with the information they need to make informed decisions.

Important Notice

As an offshore broker operating from the Commonwealth of Dominica, Grandefex lacks the regulatory transparency and oversight that characterizes reputable trading platforms. The regulatory information available is insufficient to verify the broker's compliance with international trading standards.

This review is based on available information from various sources and user feedback, but we have not conducted direct platform verification due to the concerning reports surrounding the broker's operations. Potential investors should exercise extreme caution and consider regulated alternatives before engaging with this platform. The risks associated with unregulated brokers can result in complete loss of invested funds.

Rating Framework

Broker Overview

Grandefex entered the online trading market in 2020, establishing its operations under Soleil Rouge Inc in the Commonwealth of Dominica. The broker positions itself as an international trading platform targeting investors seeking exposure to global financial markets. Despite its relatively recent establishment, the company claims to offer comprehensive trading services across multiple asset classes, with particular focus on the Spanish-speaking market according to available reports.

The broker's business model follows the typical offshore structure, operating from a jurisdiction known for its lenient regulatory environment. This setup allows the company to offer services with minimal regulatory oversight, which while potentially offering more flexible trading conditions, also significantly increases risk for client funds and trading operations.

According to Business Module Hub, the platform has struggled with client satisfaction since its inception, with multiple reports questioning its legitimacy and business practices. Grandefex operates exclusively through a web-based trading platform, providing access to forex pairs, stock indices, individual stocks, and commodity markets.

The broker's target demographic appears to be retail traders seeking high-leverage trading opportunities, though the lack of detailed information about account types and trading conditions makes it difficult to assess the platform's suitability for different trader profiles. Notably, the absence of specific regulatory licensing information in available documentation raises significant concerns about the broker's compliance with international trading standards. This lack of transparency is a major red flag highlighted throughout this grandefex review.

Regulatory Status: Available information indicates no specific regulatory oversight, with the broker operating from the Commonwealth of Dominica without mentioning compliance with major financial regulatory bodies.

Deposit and Withdrawal Methods: Specific information about supported payment methods is not detailed in available documentation, which represents a significant transparency issue for potential clients. This lack of clarity makes it difficult for traders to understand how they can fund their accounts or withdraw profits.

Minimum Deposit Requirements: The minimum deposit threshold is not specified in available sources, making it impossible to assess accessibility for retail traders.

Bonus and Promotional Offers: No information about promotional offerings or bonus structures is available in the reviewed documentation. Reputable brokers typically provide clear details about any promotional offers and their terms and conditions.

Available Trading Assets: The platform reportedly offers forex currency pairs, stock indices, individual stocks, and commodity trading opportunities, providing diversification across major asset classes.

Fee Structure: Detailed information about spreads, commissions, and other trading costs is not available in the reviewed sources, representing a major transparency concern for this grandefex review. Without clear fee information, traders cannot accurately calculate their trading costs or compare the broker to competitors.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available documentation.

Platform Options: Trading is conducted through a web-based platform, with no mention of mobile applications or third-party platform integration like MetaTrader. This limitation restricts trader flexibility and access to advanced trading tools.

Geographic Restrictions: Specific country restrictions are not outlined in available information.

Customer Support Languages: Supported languages for customer service are not specified in reviewed documentation. This lack of information makes it difficult for international clients to determine if they will receive adequate support in their preferred language.

Account Conditions Analysis

The account conditions offered by Grandefex remain largely opaque, with critical information missing from available documentation. This lack of transparency immediately raises concerns about the broker's commitment to client service and regulatory compliance.

Unlike established brokers that provide comprehensive account specifications, Grandefex fails to detail basic account structures, making it impossible for potential traders to make informed decisions about platform suitability. The absence of minimum deposit information is particularly concerning, as reputable brokers typically provide clear entry requirements to help traders assess accessibility.

Without this fundamental information, traders cannot determine whether the platform aligns with their capital allocation strategies. Additionally, the lack of account type differentiation suggests either a one-size-fits-all approach that may not serve diverse trading needs or a deliberate obfuscation of account structures.

The account opening process details are similarly absent from available documentation, making it impossible to assess user experience during onboarding. Legitimate brokers typically provide streamlined, transparent registration processes with clear documentation requirements. The information void surrounding Grandefex's account procedures adds to the growing list of transparency concerns highlighted in this grandefex review.

Special account features such as Islamic accounts, professional trader classifications, or institutional services are not mentioned in available sources. This suggests either limited service offerings or inadequate communication of available features, both of which reflect poorly on the broker's market positioning and client service capabilities.

Grandefex's trading tools and resources appear significantly limited based on available information. The platform operates solely through a web trader interface, which while functional, lacks the sophistication and feature richness that modern traders expect from professional trading platforms.

The absence of popular third-party platforms like MetaTrader 4 or 5 immediately limits the broker's appeal to experienced traders who rely on advanced charting tools and automated trading capabilities. Research and analytical resources are not detailed in available documentation, suggesting either minimal offerings or poor communication of available services.

Reputable brokers typically provide comprehensive market analysis, economic calendars, trading signals, and educational content to support trader decision-making. The apparent absence of these resources indicates a basic service offering that may not meet the needs of serious traders. Educational resources, including webinars, tutorials, and trading guides, are not mentioned in reviewed sources.

This represents a significant gap for novice traders who require comprehensive educational support to develop trading skills safely. The lack of educational infrastructure suggests the broker may not prioritize long-term client development and success.

Automated trading support and algorithmic trading capabilities are not addressed in available information. Modern trading environments increasingly rely on automated strategies, and the absence of such features limits the platform's competitiveness in the current market landscape. This grandefex review finds the tools and resources to be inadequate for serious trading activities.

Customer Service and Support Analysis

Customer service quality emerges as a major concern in this grandefex review, with multiple sources indicating poor client satisfaction and numerous complaints about service delivery. According to Business Module Hub, the broker is "poorly rated by clients," which suggests systemic issues with customer support operations rather than isolated incidents.

The specific customer service channels available are not detailed in reviewed documentation, making it impossible to assess accessibility and convenience for clients requiring assistance. Reputable brokers typically offer multiple contact methods including live chat, email support, phone assistance, and comprehensive FAQ sections.

The absence of this information raises questions about the broker's commitment to client service. Response times and service quality metrics are not available, though user feedback suggests significant dissatisfaction with support interactions. The reports of "many scam activities" associated with the platform indicate that customer service may be deliberately unhelpful or even adversarial when clients attempt to resolve issues or withdraw funds.

Multilingual support capabilities are not specified, which could limit accessibility for the broker's claimed international client base. Professional brokers typically provide support in multiple languages to serve diverse global markets effectively. The lack of clear customer service information represents another red flag in this comprehensive analysis.

Trading Experience Analysis

The trading experience offered by Grandefex appears problematic based on available information and user feedback patterns. Operating exclusively through a web trader platform, the broker lacks the technological sophistication that characterizes modern trading environments.

The absence of mobile trading applications limits flexibility for traders who require market access across multiple devices. Platform stability and execution quality are not detailed in available documentation, though the negative user feedback patterns suggest potential issues with trading infrastructure.

Reliable order execution and platform uptime are fundamental requirements for professional trading, and the lack of performance metrics or user testimonials supporting platform reliability raises significant concerns. The trading environment's competitiveness cannot be assessed due to missing information about spreads, execution speeds, and liquidity provision. Without transparent pricing information, traders cannot evaluate whether the platform offers competitive trading conditions compared to regulated alternatives.

Advanced trading features such as one-click trading, advanced order types, and risk management tools are not mentioned in available sources. Modern traders expect sophisticated order management capabilities, and the apparent absence of such features suggests a basic trading infrastructure that may not meet professional requirements. This grandefex review finds the overall trading experience to be substandard compared to regulated alternatives.

Trust and Safety Analysis

Trust and safety represent the most concerning aspects of Grandefex's operations, with this grandefex review uncovering multiple red flags that should deter potential investors. The broker operates without regulatory oversight from recognized financial authorities, immediately placing client funds at risk.

Unlike regulated brokers that must comply with strict capital adequacy requirements and client fund segregation rules, Grandefex's offshore structure provides minimal protection for trader deposits. The reports of "many scam activities" associated with the platform, as documented by Business Module Hub, indicate serious operational issues that extend beyond typical business disputes.

These allegations suggest potential fraudulent behavior that could result in complete loss of client funds. The pattern of negative user experiences suggests systemic problems rather than isolated incidents. Company transparency is severely lacking, with minimal information available about corporate structure, financial reporting, or operational procedures.

Legitimate brokers typically provide comprehensive corporate information, regulatory filings, and financial statements to demonstrate stability and transparency. Grandefex's opacity in these areas represents a major warning sign for potential investors.

The absence of client fund protection schemes, deposit insurance, or regulatory compensation programs means that traders have no recourse if the broker fails or engages in fraudulent activity. This contrasts sharply with regulated brokers that must participate in investor protection programs designed to safeguard client interests. The trust and safety concerns make Grandefex unsuitable for any serious trading activities.

User Experience Analysis

The overall user experience with Grandefex appears predominantly negative based on available feedback and documentation gaps. User satisfaction metrics, while not quantified in available sources, are described as poor, with multiple reports of problematic interactions and unresolved issues.

This pattern suggests fundamental problems with the broker's approach to client relationships and service delivery. Interface design and platform usability cannot be properly assessed due to limited documentation about the web trader platform's features and functionality.

However, the lack of mobile applications and advanced platform options suggests a basic user interface that may not meet modern trading expectations. The registration and account verification process details are not available, making it impossible to assess onboarding convenience. Legitimate brokers typically provide streamlined, transparent account opening procedures with clear documentation requirements and reasonable processing times.

Funding operations experience appears problematic based on the pattern of user complaints and scam allegations. Difficulty with withdrawals is a common complaint pattern associated with problematic brokers, and the negative feedback surrounding Grandefex suggests potential issues with fund access and withdrawal processing.

Common user complaints center around the scam allegations and poor service quality, indicating systemic issues that affect the majority of client interactions rather than isolated problems. This pattern strongly suggests that the platform is unsuitable for serious trading activities. The user experience analysis in this grandefex review reveals consistent problems across all aspects of client interaction.

Conclusion

This comprehensive grandefex review reveals a broker that presents significant risks to potential investors. With extremely low trust ratings, poor customer feedback, multiple scam allegations, and complete absence of regulatory oversight, Grandefex fails to meet the basic standards expected from a legitimate trading platform.

The lack of transparency regarding account conditions, fee structures, and operational procedures further compounds these concerns. While the platform claims to offer access to multiple asset classes including forex, indices, stocks, and commodities, the risks associated with the broker's operations far outweigh any potential benefits.

The absence of regulatory protection means that client funds are essentially unprotected, and the pattern of negative user experiences suggests that traders are likely to encounter significant problems. We strongly recommend that traders avoid Grandefex and instead consider regulated alternatives that provide proper investor protection, transparent operations, and demonstrated track records of client satisfaction.

The forex market offers numerous reputable brokers that combine competitive trading conditions with robust regulatory oversight and client protection measures. This grandefex review concludes that the platform poses unacceptable risks to trader capital and should be avoided entirely. Traders seeking reliable trading environments should focus on regulated brokers with proven track records and transparent operations.