Grand Bloom Forex 2025 Review: Everything You Need to Know

Executive Summary

This grand bloom forex review reveals major concerns about this broker's legitimacy and safety for traders. Grand Bloom Forex presents itself as a regulated entity under the Australian Securities and Investments Commission, but investigations show this claim is fraudulent. The broker has no actual connection to regulation and operates with a scam designation from multiple industry watchdogs.

Despite offering seemingly attractive trading conditions including a minimum deposit of $100 USD and leverage up to 1:400, the fundamental lack of proper regulation raises serious red flags. The broker is headquartered in Saint Vincent and the Grenadines and claims registration with SVG FSA, though this jurisdiction does not regulate forex trading activities. Our assessment indicates this platform targets high-risk tolerance traders who may be attracted to competitive leverage offerings, but the substantial fraud risks make it unsuitable for most retail investors.

User feedback presents mixed signals - while some praise the platform's intuitive interface, significant complaints exist regarding the broker's legitimacy and customer service quality.

Important Disclaimers

This evaluation is based on publicly available information and user feedback collected from various industry sources. Grand Bloom Forex claims regulatory oversight from ASIC, but verification shows no legitimate connection to this regulatory body. The broker operates under scam warnings from multiple financial intelligence platforms.

Our assessment methodology relies on documented evidence from regulatory databases, user testimonials, and industry reports. Traders should exercise extreme caution and conduct independent verification before engaging with this broker, as the regulatory claims appear to be deliberately misleading.

Rating Framework

Broker Overview

Grand Bloom Forex positions itself as a financial services provider in the competitive forex market. Specific founding details remain unclear in available documentation. The company operates from Saint Vincent and the Grenadines, a jurisdiction known for hosting numerous offshore financial entities with varying levels of oversight.

As a relatively newer entrant to the market, the broker has attempted to establish credibility through claimed regulatory associations that have proven to be fabricated. The business model specifics are not detailed in available information, though the broker appears to focus on retail forex trading with emphasis on high leverage products. This approach typically indicates a market maker model, though without proper regulatory disclosure, the exact operational structure remains opaque to potential clients.

The broker promotes itself through various digital channels and claims to offer comprehensive trading services across multiple asset classes. However, the lack of transparent corporate information and verified regulatory status creates significant uncertainty about the company's actual operational capacity and financial stability. The Saint Vincent and the Grenadines jurisdiction provides minimal investor protection compared to major regulatory frameworks.

Regulatory Status: Grand Bloom Forex falsely claims regulation by the Australian Securities and Investments Commission with license number AFSL: 226230. Verification with ASIC confirms no connection between this license and Grand Bloom Forex, marking this as fraudulent misrepresentation.

Minimum Deposit Requirements: The broker offers a relatively accessible entry point with a minimum deposit of $100 USD. This positions itself competitively for new traders seeking low-barrier market access.

Leverage Offerings: Maximum leverage reaches 1:400, which exceeds regulatory limits in many major jurisdictions and indicates targeting of less regulated market segments.

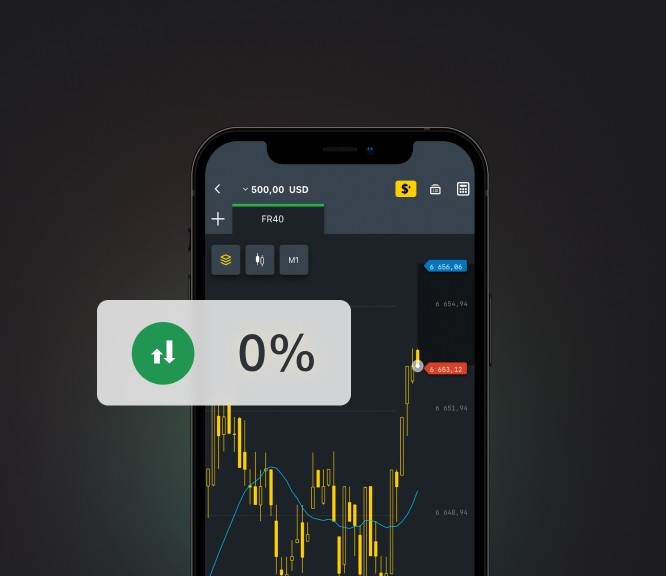

Trading Platforms: Available information mentions MT4 platform availability, though comprehensive platform details and additional options remain unspecified in source materials.

Asset Coverage: The broker claims to offer multiple asset classes, though specific instruments, market depth, and trading conditions for different asset types are not detailed in available documentation.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not provided in source materials. This creates transparency concerns for potential clients.

Geographic Restrictions: Specific country limitations and service availability details are not mentioned in available information, though the regulatory issues suggest limited legitimate market access.

This grand bloom forex review emphasizes the critical importance of regulatory verification. The fraudulent ASIC claims represent a fundamental breach of trust that undermines all other service offerings.

Account Conditions Analysis

The account structure at Grand Bloom Forex appears straightforward but lacks the detailed segmentation typically seen with established brokers. The $100 minimum deposit requirement positions the broker in the accessible range for retail traders, particularly those new to forex markets or operating with limited capital. However, this low barrier to entry, combined with fraudulent regulatory claims, suggests a strategy focused on attracting inexperienced traders who may not thoroughly verify regulatory credentials.

The absence of detailed account type information in available materials raises concerns about service differentiation and client segmentation. Legitimate brokers typically offer multiple account tiers with varying features, spreads, and service levels. The lack of such transparency suggests either limited service sophistication or deliberate opacity in operational details.

Account opening procedures and verification requirements are not specified in source materials. This is particularly concerning given the regulatory misrepresentation issues. Proper KYC and AML procedures are regulatory requirements that legitimate brokers prominently display.

User feedback indicates some satisfaction with the deposit process and leverage access, with reports of $100 deposits enabling high leverage trading. However, these positive experiences must be weighed against the fundamental regulatory deception and associated risks to client funds and trading integrity. The competitive minimum deposit may attract traders, but the underlying regulatory issues make this grand bloom forex review assessment cautionary rather than favorable for account conditions.

Information about Grand Bloom Forex's trading tools and resources remains limited in available documentation. This itself represents a significant concern for traders seeking comprehensive market analysis capabilities. The absence of detailed tool descriptions suggests either limited platform development or poor marketing transparency - both problematic for serious trading operations.

User feedback mentions platform intuitiveness, indicating some level of user interface development, but lacks specific details about charting capabilities, technical indicators, or advanced trading features that professional traders require. The claimed MT4 platform access, if legitimate, would provide standard industry tools, though customization and additional resources remain unspecified.

Educational resources, market analysis, and research capabilities are not mentioned in available materials. This represents a significant gap compared to established brokers who typically invest heavily in client education and market intelligence. This absence is particularly concerning for a broker targeting retail traders who often require substantial educational support.

Automated trading support, API access, and third-party tool integration details are not provided. This limits assessment of the platform's suitability for advanced trading strategies. The lack of information about mobile trading capabilities also creates uncertainty about platform accessibility and modern trading requirements.

Without comprehensive tool and resource information, combined with the regulatory legitimacy issues, traders cannot adequately assess whether the platform meets their technical requirements for effective market participation.

Customer Service and Support Analysis

Customer service quality emerges as a significant concern in available user feedback. Multiple complaints exist about response times and service professionalism. The absence of detailed customer support channel information in promotional materials suggests limited investment in client service infrastructure, which is particularly problematic for a financial services provider.

Response time issues mentioned in user feedback indicate potential understaffing or inadequate support system design. For forex trading, where market conditions can change rapidly and technical issues require immediate resolution, slow customer service can result in significant financial losses for traders.

Service quality complaints extend beyond response times to include concerns about staff knowledge and problem-solving capabilities. Users report frustration with the level of expertise demonstrated by customer service representatives, suggesting inadequate training or high turnover in support roles.

Multi-language support capabilities and service hours are not specified in available information. This creates uncertainty about global service coverage. Given the international nature of forex markets, 24/5 support coverage is typically expected from serious brokers serving global clientele.

The combination of user complaints about service quality and the broader regulatory legitimacy issues suggests systemic operational problems. These extend beyond simple customer service challenges to fundamental business practice concerns.

Trading Experience Analysis

User feedback regarding the trading experience presents mixed signals that require careful interpretation within the context of regulatory concerns. Reports of platform intuitiveness suggest some level of user interface development, though the absence of detailed trading condition information limits comprehensive assessment of the actual trading environment.

Platform stability and execution quality details are notably absent from available information. This is concerning given these factors' critical importance for trading success. Without specific data about slippage rates, order execution speeds, and system uptime, traders cannot adequately assess platform reliability for their trading strategies.

The claimed MT4 platform access, if legitimate, would provide industry-standard trading functionality, though customization options and additional features remain unspecified. Mobile trading capabilities and cross-device synchronization details are not provided, limiting assessment of platform accessibility for modern trading requirements.

Spread stability and trading cost transparency are not addressed in available materials. This creates uncertainty about the true cost of trading and potential for unexpected fees. This lack of transparency is particularly concerning when combined with the regulatory legitimacy issues.

User feedback about trading environment specifics remains limited, focusing more on general platform impressions rather than detailed trading condition experiences. This grand bloom forex review notes that without comprehensive trading environment transparency, combined with regulatory concerns, the platform presents significant risks for serious trading activities.

Trust and Safety Analysis

The trust and safety assessment for Grand Bloom Forex reveals fundamental concerns that should alarm potential clients. The broker's fraudulent claim of ASIC regulation represents a deliberate misrepresentation that undermines all other operational aspects. This is not a minor administrative error but a calculated deception designed to create false confidence in regulatory oversight.

The actual regulatory status shows registration only with SVG FSA, which does not regulate forex trading activities. This leaves clients without meaningful regulatory protection. This regulatory gap means no investor compensation schemes, no regulatory oversight of business practices, and no recourse through established financial authorities in case of disputes or fund recovery needs.

Industry watchdogs have issued scam warnings about Grand Bloom Forex. This indicates recognition within the financial intelligence community of significant risks associated with this broker. These warnings typically result from pattern analysis of operational practices, regulatory misrepresentation, and client complaint trends.

Fund security measures are not detailed in available information. This creates uncertainty about client money segregation, insurance coverage, and protection protocols that legitimate brokers prominently feature. The absence of transparency about fund protection, combined with fraudulent regulatory claims, creates substantial risk for client deposits.

Company transparency regarding management, financial reporting, and operational oversight is notably lacking. This prevents independent verification of business stability and operational integrity essential for financial service providers.

User Experience Analysis

User experience feedback for Grand Bloom Forex presents a complex picture requiring careful interpretation given the underlying regulatory concerns. Overall user satisfaction appears mixed, with some positive comments about platform usability balanced against serious concerns about legitimacy and operational integrity.

Interface design receives generally positive feedback. Users describe the platform as intuitive and accessible for trading activities. This suggests investment in user interface development, though the extent of platform sophistication beyond basic functionality remains unclear from available feedback.

Registration and verification processes are not detailed in available information. This prevents assessment of onboarding efficiency and compliance procedures. Given the regulatory misrepresentation issues, the adequacy of KYC and verification procedures becomes particularly important for assessing operational legitimacy.

Fund operation experiences, including deposit and withdrawal processes, lack detailed user feedback in available materials. This absence is concerning given that payment processing efficiency and reliability are critical factors in broker selection and ongoing satisfaction.

Common user complaints center on legitimacy concerns and customer service quality. This indicates awareness among some users of the regulatory issues and operational problems. The presence of both positive usability feedback and serious legitimacy concerns suggests a user base with varying levels of due diligence and regulatory awareness.

The target user profile appears to include high-risk tolerance traders attracted to competitive leverage offerings. However, the regulatory risks make this platform unsuitable for most retail investors seeking legitimate, regulated trading environments.

Conclusion

This comprehensive grand bloom forex review reveals a broker with fundamental integrity issues that overshadow any potentially attractive trading conditions. While Grand Bloom Forex offers competitive features like a $100 minimum deposit and 1:400 leverage, the fraudulent regulatory claims and associated scam warnings create unacceptable risks for traders.

The broker's deliberate misrepresentation of ASIC regulation represents a serious breach of trust that calls into question all other operational claims and service offerings. Combined with limited transparency about trading conditions, customer service complaints, and lack of meaningful regulatory oversight, Grand Bloom Forex presents risks that far outweigh any potential benefits.

This platform may appeal to high-risk tolerance traders attracted to aggressive leverage offerings and low entry barriers. However, the fundamental legitimacy concerns make it unsuitable for any trader prioritizing fund security and regulatory protection. The regulatory deception alone should disqualify this broker from consideration by responsible traders seeking legitimate market access.