Executive Summary

This goodtrade capital llc review shows a broker that raises major concerns in the forex trading industry. We found significant red flags after looking at user feedback and market data, which led to our negative assessment of GoodTrade Capital LLC. The broker operates without proper regulatory oversight since it's only registered in Saint Vincent and the Grenadines, offering minimal protection for investors.

User reviews show troubling patterns. These include poor customer service, platform problems, and lack of transparency in their operations. WikiFX monitoring data reveals 25 exposure reviews against only 2 positive reviews, creating a very concerning track record for potential traders.

GoodTrade Capital LLC poses serious risks for novice traders and anyone with low risk tolerance. The broker lacks regulation, receives negative user feedback, and operates without transparent practices, which threatens both trader funds and the overall trading experience. While they do offer MetaTrader 5 platform access and multiple asset classes, these few positives cannot overcome the fundamental trust and operational problems we discovered.

Important Disclaimer

This review uses publicly available information and user feedback from various sources as of 2025. GoodTrade Capital LLC does not serve residents of the United States or other areas where such services would break local regulations.

We used user testimonials, regulatory checks, and market analysis to evaluate this broker. Potential traders should do their own research and consider getting advice from qualified financial professionals before making investment decisions.

Overall Rating Framework

Broker Overview

GoodTrade Capital LLC started in the forex trading world in 2022. The company has its headquarters in New South Wales, Australia, but operates under registration in Saint Vincent and the Grenadines. They work as a Contract for Difference broker, focusing mainly on forex markets through derivative instruments rather than direct currency trading.

The broker's business model centers on CFD trading across multiple asset categories. These include foreign exchange pairs, market indices, and commodities, allowing clients to speculate on price movements without owning the actual assets. This approach creates both opportunities and risks depending on market conditions and trader skills.

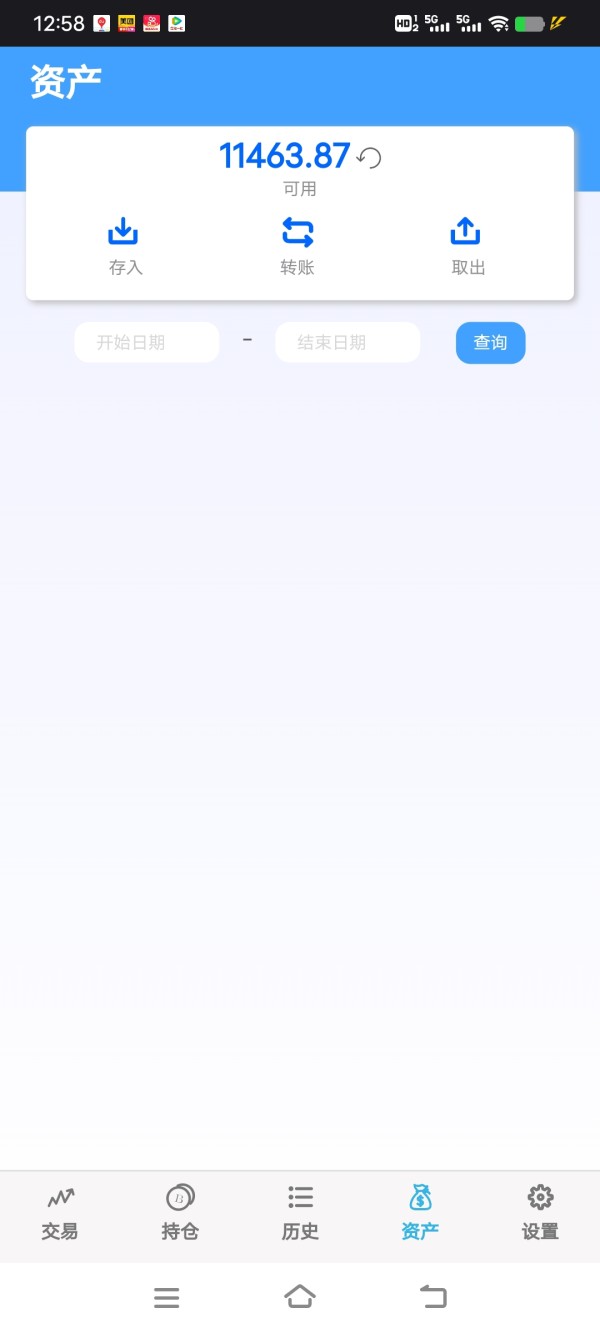

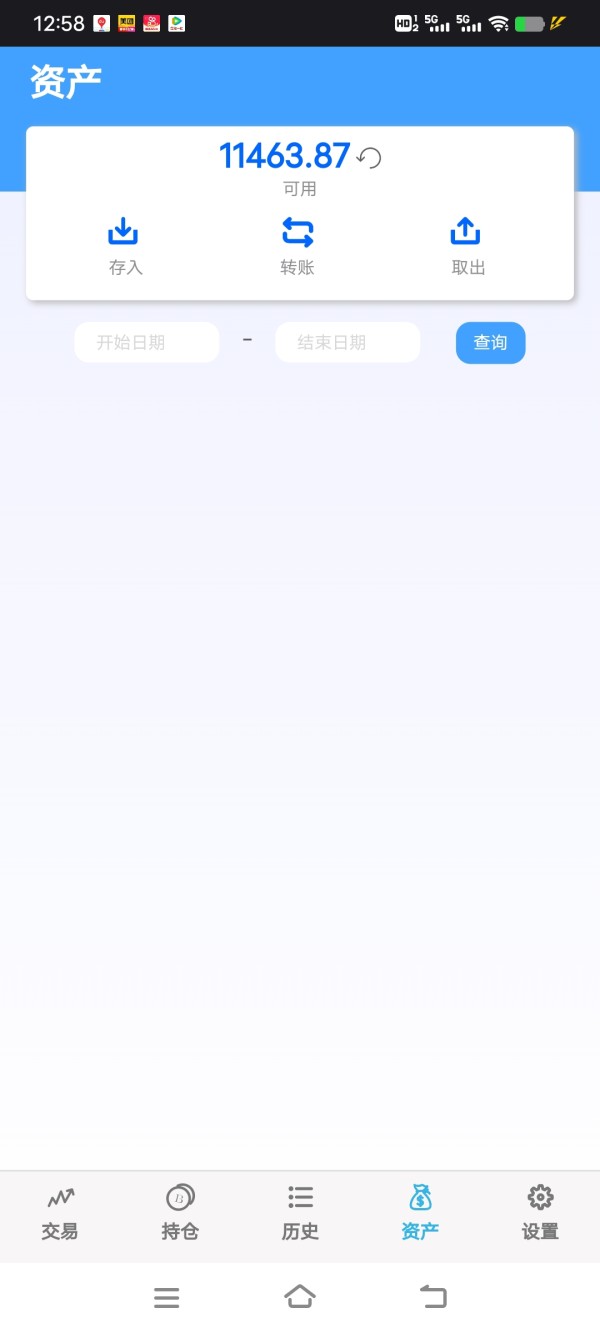

This goodtrade capital llc review shows that the company uses MetaTrader 5 as its main trading platform. The broker offers access to various currency pairs within the forex market, but their operational structure excludes services to United States residents and other restricted areas. They focus instead on international markets where regulatory requirements may be less strict, and the combination of recent establishment, offshore registration, and limited oversight creates a profile that needs careful consideration from potential clients.

Regulatory Status: GoodTrade Capital LLC operates under registration in Saint Vincent and the Grenadines, providing minimal oversight compared to major financial jurisdictions. The broker lacks authorization from established regulatory bodies such as FCA, ASIC, or CySEC, which creates significant risks for traders.

Funding Methods: Specific information about deposit and withdrawal methods was not available in our research. This represents a major transparency concern for potential clients who need clear funding procedures before opening accounts.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This raises questions about account accessibility and transparency in fee structures that traders should know before investing.

Promotional Offers: Details about welcome bonuses, promotional campaigns, or trading incentives were not mentioned in source materials. This suggests limited marketing initiatives or poor disclosure practices that could indicate operational problems.

Available Trading Assets: The broker provides access to forex currency pairs, market indices, commodities, and various CFD instruments. This offers reasonable asset diversity for different trading strategies, though execution quality remains questionable based on user feedback.

Cost Structure: Specific information about spreads, commissions, and additional fees remains unclear from available sources. User feedback suggests potential concerns about hidden costs and fee transparency that could significantly impact trading profitability over time.

Leverage Options: Leverage ratios and margin requirements are not explicitly detailed in available materials. This represents another area of limited transparency that traders need to understand before committing funds.

Platform Technology: The broker supports MetaTrader 5, a widely recognized trading platform that provides standard charting tools and automated trading capabilities. However, user reports suggest implementation issues that may affect performance and reliability.

Geographic Restrictions: Services are explicitly unavailable to US residents and other restricted jurisdictions. This limits the broker's global accessibility and may indicate regulatory compliance issues in major markets.

Customer Support Languages: Support services are provided in English through phone and email channels. Response quality appears problematic based on user reports, with many traders experiencing delays and inadequate assistance.

This goodtrade capital llc review highlights significant information gaps that potential traders should consider when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by GoodTrade Capital LLC present several concerning aspects that contribute to its low rating. Available information lacks specific details about account types, minimum deposit requirements, and account opening procedures, representing a fundamental transparency issue for potential clients.

User feedback indicates that the account opening process lacks clarity and simplicity. Traders report confusion about requirements and procedures, making it difficult to understand what they're signing up for before committing funds. The absence of detailed information about different account tiers makes it impossible for traders to understand what services and conditions they can expect based on their investment level.

Established, regulated brokers typically provide comprehensive account information including clear deposit requirements, account features, and benefits structures. GoodTrade Capital LLC falls significantly short of these standards, creating additional risks for traders. The lack of transparency around special account features such as Islamic accounts, professional trader accounts, or educational account options further diminishes the broker's appeal for serious traders.

The goodtrade capital llc review data suggests that the broker's approach to account management and client onboarding does not meet industry standards. This creates additional risks for traders who may not fully understand the terms and conditions of their trading relationship before committing funds to the platform.

GoodTrade Capital LLC receives a moderate rating for tools and resources primarily due to its adoption of MetaTrader 5. This professional-grade trading platform provides essential trading functionality including standard charting tools, technical indicators, and market analysis capabilities that can support various trading strategies.

The broker provides access to multiple asset classes including forex pairs, indices, and commodities. This allows for portfolio diversification and different trading approaches, though user feedback suggests that the quality and reliability of these tools may not meet trader expectations. Some traders report inconsistent platform performance that can disrupt trading activities during critical market moments.

Available information does not detail specific research and analysis resources such as market reports, economic calendars, or expert analysis. Many traders rely on these tools for informed decision-making, and their absence limits the broker's value proposition significantly. The lack of comprehensive educational resources also creates problems, particularly for newer traders who require guidance and learning materials to develop their skills.

Automated trading support through MetaTrader 5 provides some value for traders interested in algorithmic strategies. However, specific information about Expert Advisor compatibility and signal services remains unclear, making it difficult for traders to plan their automated trading approaches. The moderate rating reflects the basic platform functionality while acknowledging significant gaps in additional resources and support materials that enhance the trading experience.

Customer Service and Support Analysis

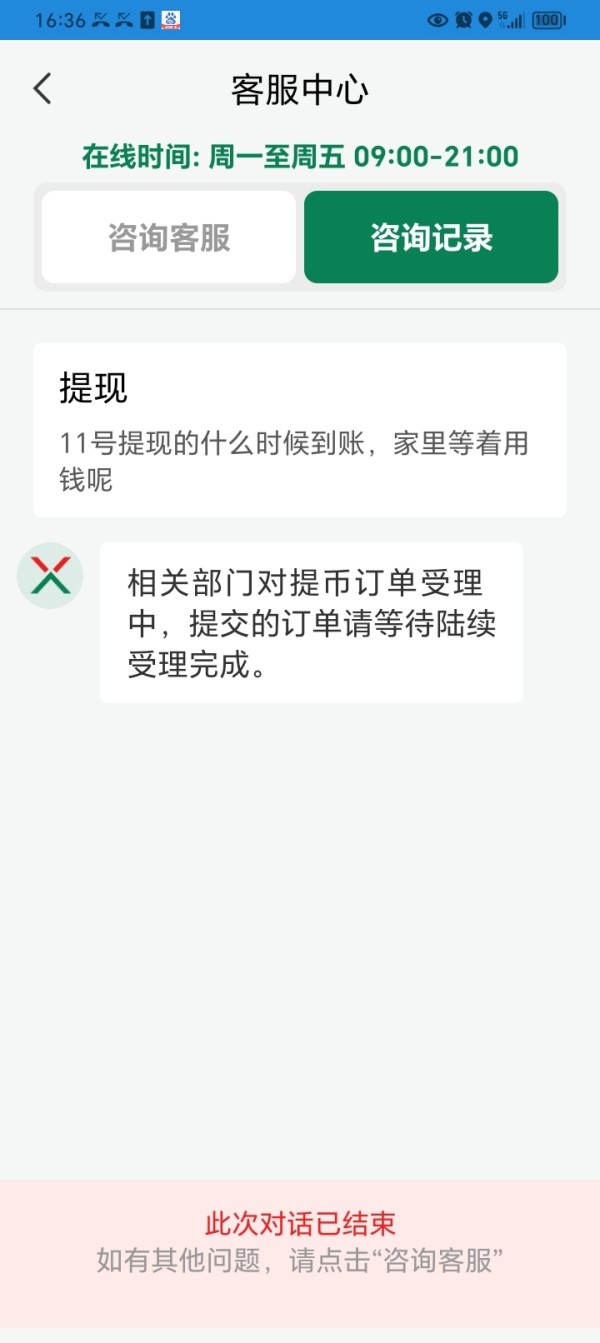

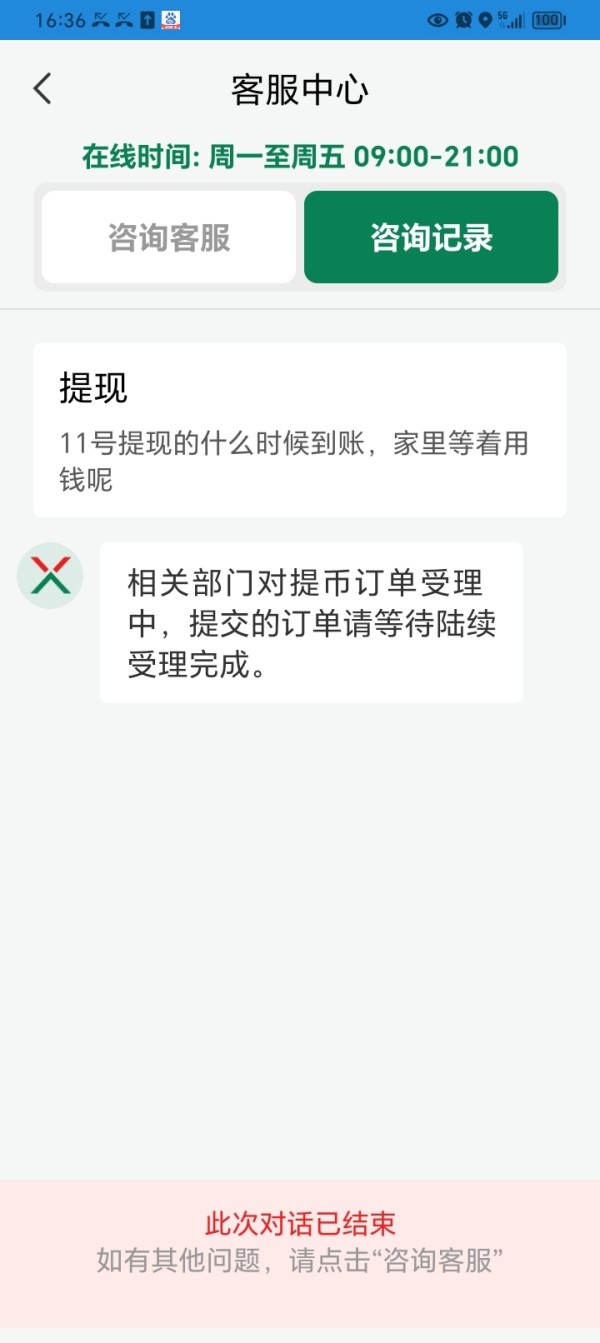

Customer service represents a significant weakness for GoodTrade Capital LLC based on available user feedback and limited support options. The broker provides customer support through phone and email channels, which covers basic communication needs but lacks modern support options such as live chat or comprehensive help centers that traders expect from professional brokers.

User feedback consistently highlights poor response times and inadequate service quality from the support team. Traders report difficulties in receiving timely assistance for account issues, technical problems, and general inquiries, which can be particularly problematic during active trading periods. When immediate support is crucial for resolving trading issues, delays can result in significant financial losses for traders.

The professional competency of support staff appears questionable based on user experiences. Reports suggest that representatives may lack sufficient knowledge to address complex trading-related questions or technical issues effectively, creating frustration for traders who require expert assistance. This becomes especially problematic when dealing with platform functionality or account management issues that require specialized knowledge.

Language support is limited to English, which restricts accessibility for international traders. Many traders prefer support in their native languages, and this limitation can create communication barriers that prevent effective problem resolution. Additionally, specific support hours and availability information is not clearly communicated, creating uncertainty about when assistance can be obtained during critical trading situations.

Trading Experience Analysis

The trading experience with GoodTrade Capital LLC receives a mediocre rating due to mixed user feedback regarding platform performance and execution quality. While the broker utilizes MetaTrader 5, which is generally considered a reliable platform, user reports suggest that implementation and server stability may be problematic for consistent trading activities.

Platform stability concerns include reports of connection issues, slow execution speeds, and occasional system downtime. These technical problems are particularly concerning for active traders who require consistent platform availability and fast order processing to capitalize on market opportunities. When platforms experience downtime during volatile market periods, traders can miss profitable opportunities or face unexpected losses.

Order execution quality appears inconsistent based on user feedback. Some traders report slippage issues and delays in order processing that can significantly impact trading profitability, especially for strategies that rely on precise entry and exit timing. During volatile market conditions, execution delays can turn profitable trades into losses or prevent traders from implementing proper risk management strategies.

User feedback regarding charting tools and technical indicators suggests that while basic functionality is available through MetaTrader 5, the overall trading environment may lack polish and reliability. Mobile trading support information is not clearly available, which may limit trading flexibility for users who require on-the-go access to manage their positions. The goodtrade capital llc review indicates that while basic trading functionality exists, the overall experience is hampered by technical issues and execution concerns that prevent it from meeting professional trading standards.

Trust and Reliability Analysis

Trust and reliability represent the most significant concerns with GoodTrade Capital LLC, earning the lowest rating among all evaluation categories. The broker's unregulated status, with registration only in Saint Vincent and the Grenadines, provides minimal investor protection and regulatory oversight compared to established financial jurisdictions that offer comprehensive trader protections.

The absence of authorization from major regulatory bodies such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission means that traders have limited recourse in case of disputes. This regulatory gap creates substantial risks for client funds and overall business practices, as there are no external authorities monitoring the broker's operations or ensuring compliance with industry standards.

Company transparency is severely lacking, with no available information about financial reporting, third-party audits, or fund segregation practices. These are standard practices among reputable brokers that help protect client funds and ensure operational integrity, and their absence raises serious questions about the broker's legitimacy. The lack of clear information about company ownership, management structure, and operational procedures raises additional red flags about business practices.

User feedback reveals characteristics commonly associated with problematic brokers. These include poor communication, unclear terms and conditions, and potential issues with fund withdrawals that can trap trader funds on the platform. The significant disproportion between negative exposure reviews and positive feedback suggests systematic issues rather than isolated incidents that could be resolved through improved customer service.

Industry reputation appears poor based on available monitoring data. WikiFX reporting shows 25 exposure reviews against only 2 positive reviews, indicating widespread user dissatisfaction and potential fraudulent characteristics that serious traders should carefully consider before risking their capital.

User Experience Analysis

Overall user satisfaction with GoodTrade Capital LLC is notably poor, reflecting widespread dissatisfaction across multiple aspects of the trading experience. The high proportion of negative feedback compared to positive reviews suggests systematic issues that affect the majority of users rather than isolated problems that could be easily fixed through operational improvements.

User interface design and platform usability receive criticism from traders who report that the overall experience lacks professional polish. The intuitive design expected from modern trading platforms is missing, and navigation difficulties along with unclear information presentation contribute to user frustration. These issues may impact trading efficiency and prevent traders from executing their strategies effectively.

The registration and account verification process appears unnecessarily complex based on user reports. Traders experience confusion and delays during account setup, creating immediate negative impressions that may discourage potential clients from completing the onboarding process. When the initial experience is problematic, it often indicates deeper operational issues throughout the platform.

Common user complaints center around customer service quality, platform reliability, and transparency issues that affect daily trading activities. The frequency and consistency of these complaints suggest that problems are inherent to the broker's operational model rather than temporary issues that can be easily resolved through system updates or staff training.

The user demographic analysis indicates that the broker is particularly unsuitable for novice traders. New traders require clear guidance, reliable support, and transparent operations to develop their skills safely, and GoodTrade Capital LLC fails to provide these essential elements. Even experienced traders may find the combination of operational issues and trust concerns make this broker an unsuitable choice for serious trading activities that require reliable execution and professional support.

Conclusion

This comprehensive goodtrade capital llc review reveals a broker that presents significant risks and concerns that outweigh any potential benefits. The combination of unregulated status, poor user feedback, and lack of transparency creates an environment unsuitable for serious forex trading activities that require reliable execution and professional support.

GoodTrade Capital LLC is not recommended for novice traders or those with low risk tolerance. The substantial red flags and characteristics associated with problematic brokers make this platform particularly dangerous for inexperienced traders who may not recognize warning signs until after losing money. Even experienced traders should exercise extreme caution given the regulatory gaps and negative user experiences that suggest systematic operational problems.

While the broker offers MetaTrader 5 platform access as a positive feature, this single advantage is insufficient to offset fundamental concerns. The issues with trust, reliability, and operational quality create risks that professional traders typically avoid when selecting brokers for their trading activities. Traders seeking professional forex trading services would be better served by choosing regulated brokers with established reputations and transparent operational practices that protect client interests.