FTMO PipsPRO 2025 Review: Everything You Need to Know

FTMO PipsPRO has garnered significant attention in the forex trading community, but the overall sentiment surrounding this broker is largely negative. Users and experts alike have raised serious concerns regarding its regulatory status, lack of transparency, and potential association with scams. Notably, FTMO PipsPRO claims to operate from the UK but lacks proper licensing from the Financial Conduct Authority (FCA), which raises red flags about its legitimacy and investor safety.

Note: It is crucial to be aware that FTMO PipsPRO operates in a complex regulatory environment, and varying jurisdictional rules can impact user experiences and protections. This review aims to present a balanced view based on available data.

Ratings Overview

We assess brokers based on user feedback, expert opinions, and factual data to provide an accurate representation of their offerings.

Broker Overview

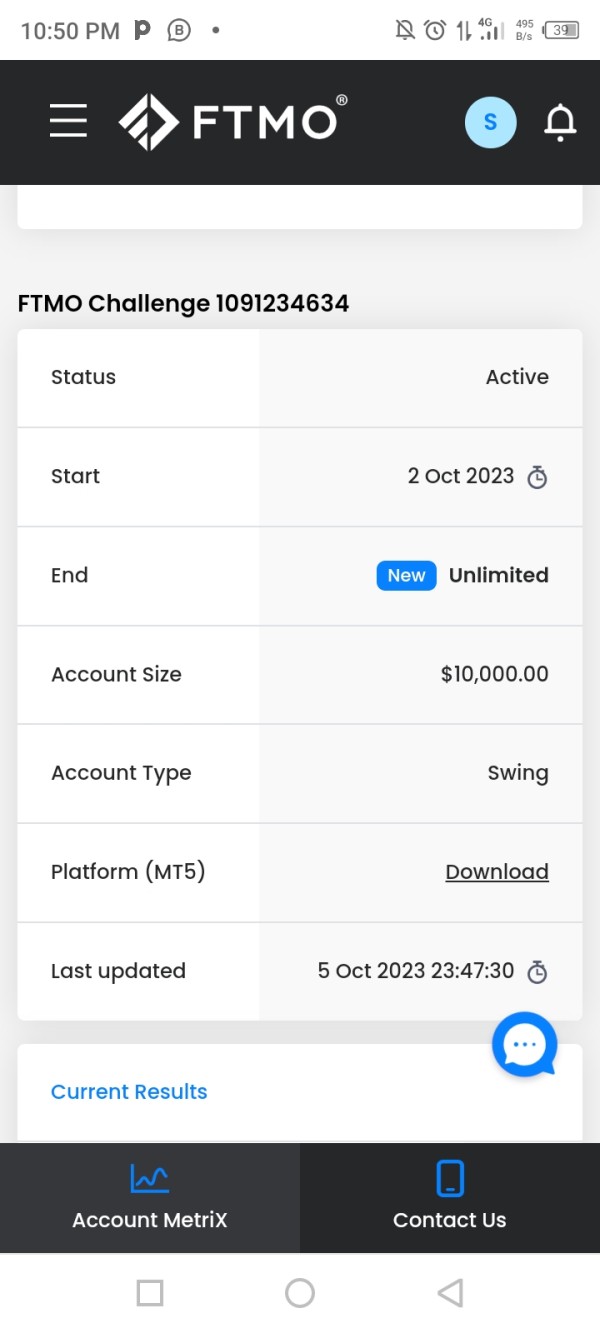

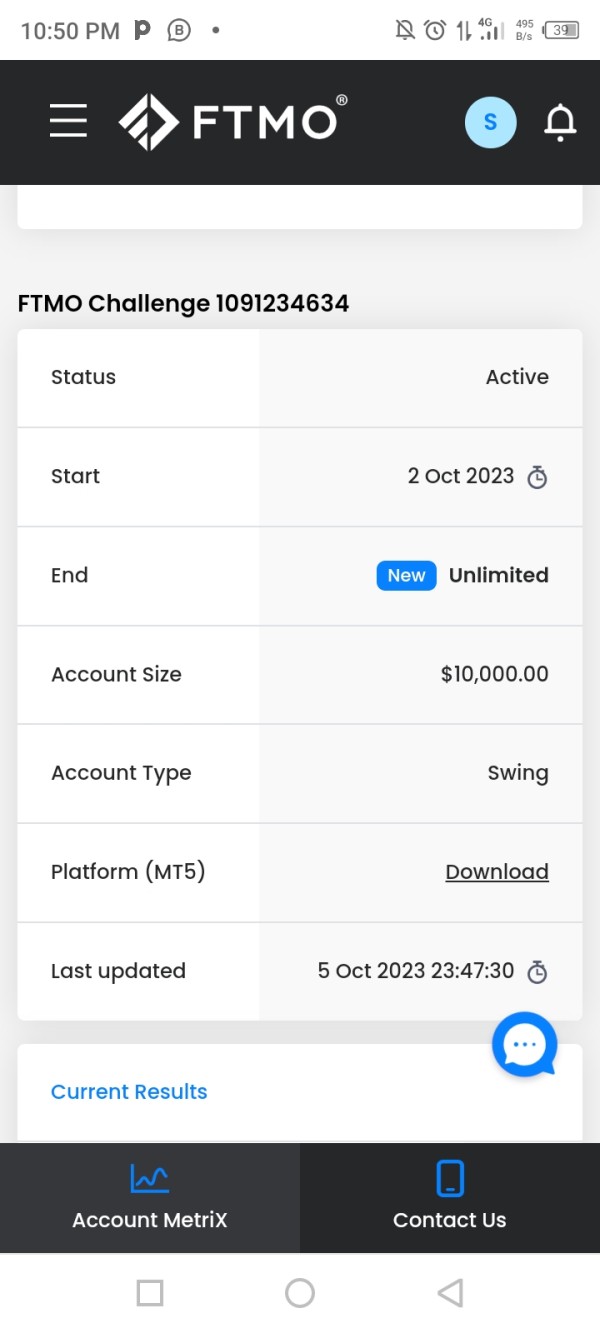

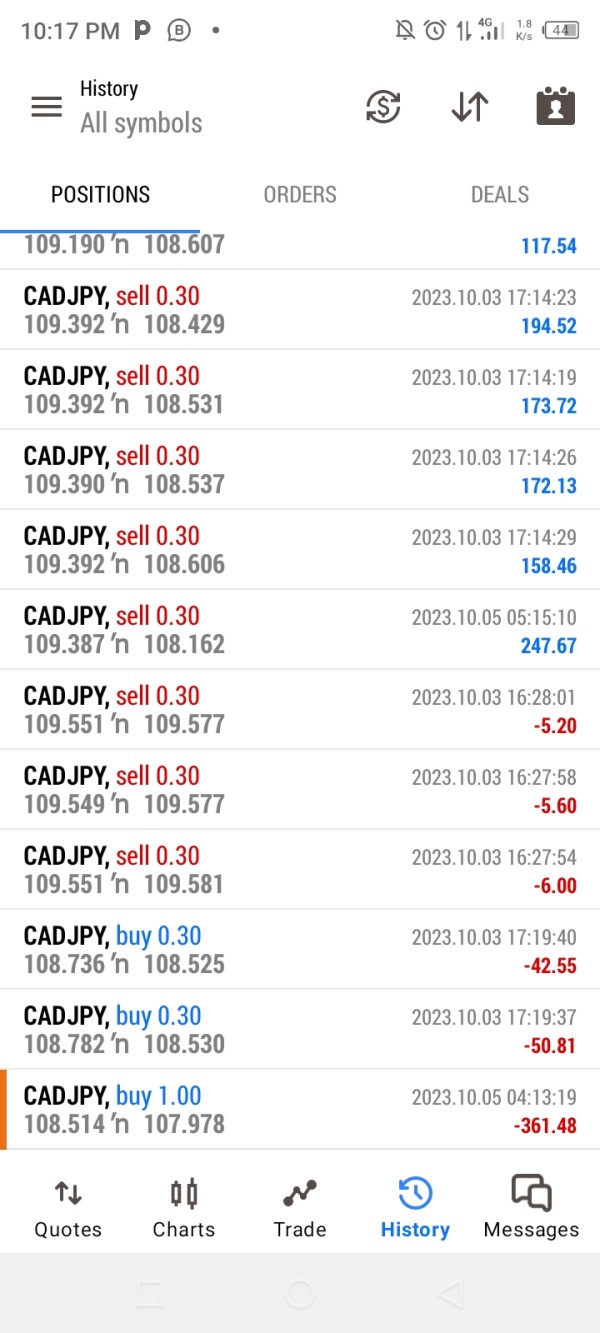

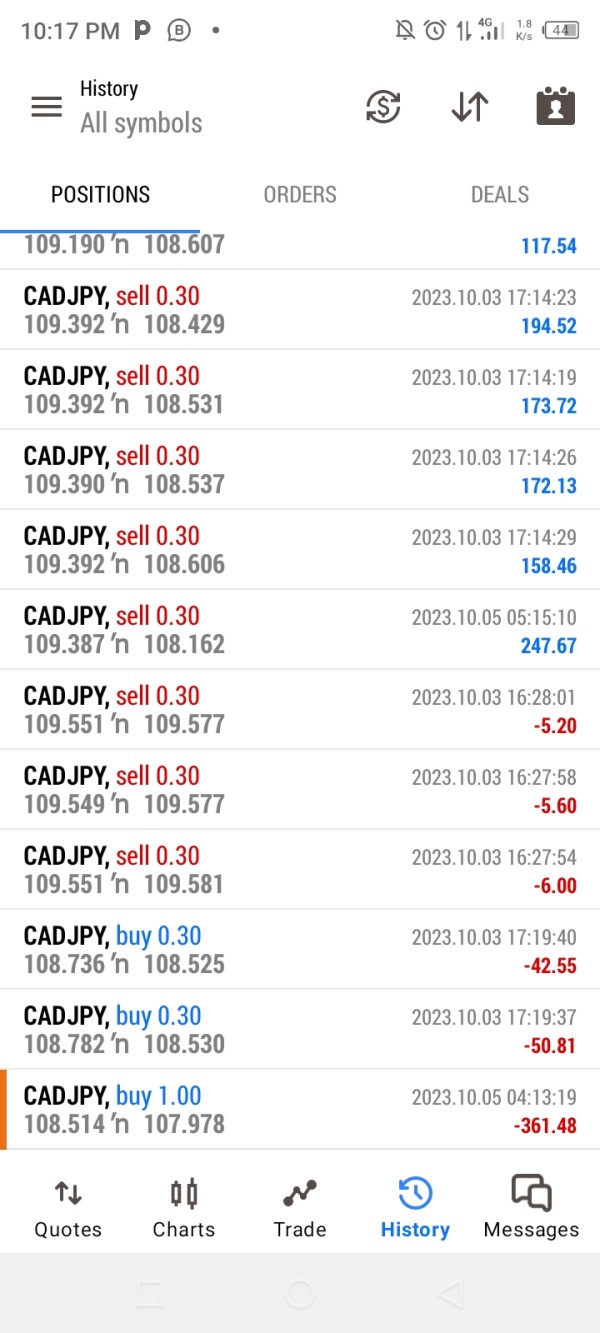

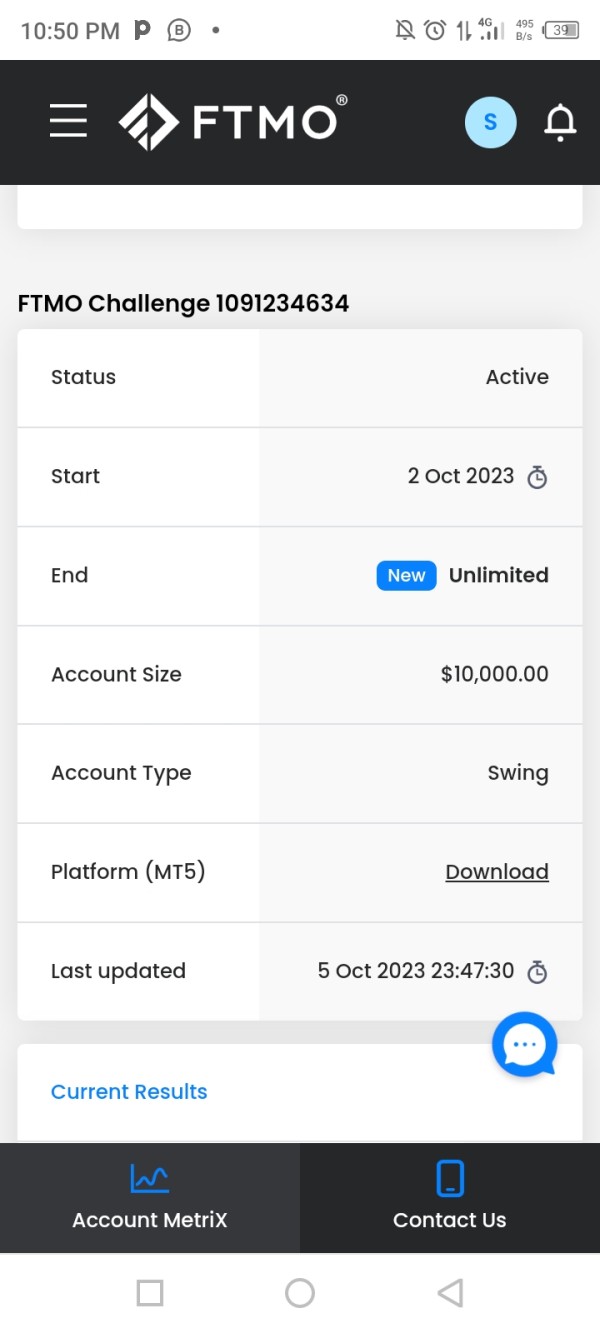

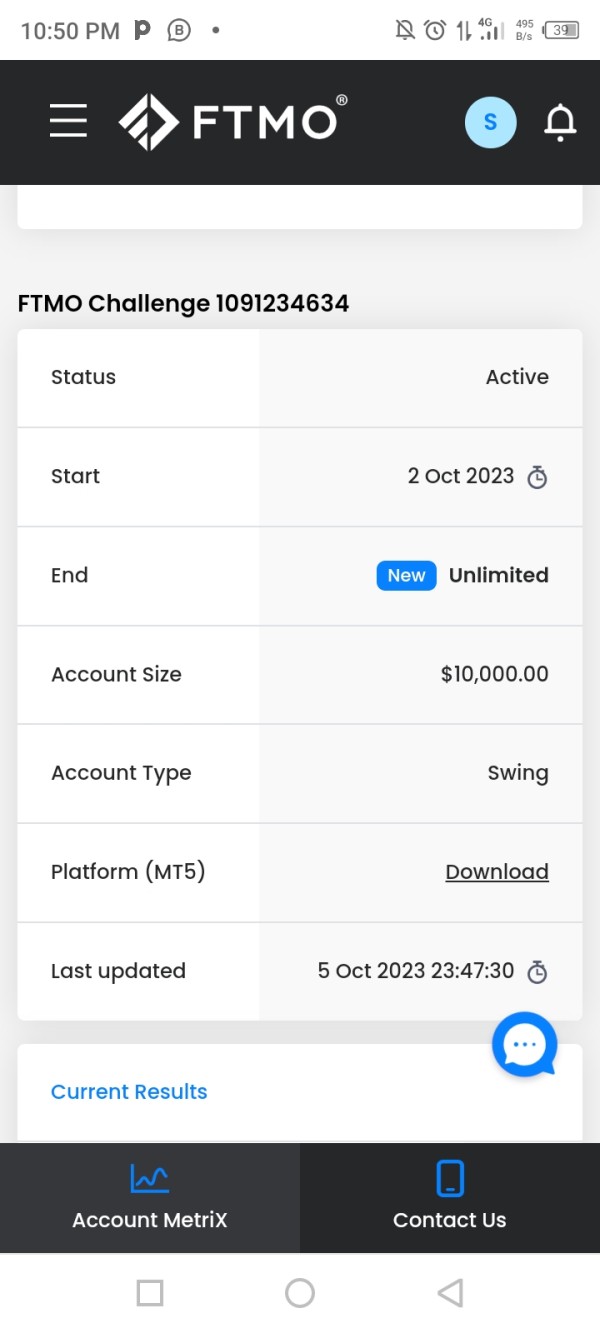

Founded in 2022, FTMO PipsPRO is positioned as a forex brokerage based in the United Kingdom. However, it has come under scrutiny for its unregulated status, with no valid licenses from recognized financial authorities. The broker claims to offer various trading platforms, but details on popular platforms like MT4 or MT5 remain unclear. FTMO PipsPRO provides access to a diverse range of asset classes, including cryptocurrencies, forex pairs, stock indices, commodities, and more.

Detailed Breakdown

Regulatory Regions

FTMO PipsPRO operates without any regulatory oversight. This lack of regulation poses significant risks to traders, as there are no safeguards in place to protect investor funds. According to sources, the broker falsely claims to be licensed in the UK, but a search in the FCA registry reveals no record of its existence (BrokersView).

Deposit/Withdrawal Methods

The broker reportedly accepts deposits only in cryptocurrencies, specifically Bitcoin and Ethereum. While this may appeal to some traders, the irreversibility of cryptocurrency transactions raises concerns about potential fraud. Many experts recommend avoiding brokers that primarily use crypto for deposits due to the difficulty of recovering funds in case of disputes (NetNewsLedger).

Minimum Deposit

FTMO PipsPRO requires a minimum deposit of £1,000 for its starter account, which is significantly higher than many reputable brokers that allow for deposits as low as £100. The high entry barrier may deter potential traders looking for more accessible options (WikiFX).

Information regarding bonuses or promotional offers is scarce, and the broker does not provide clear details about any such incentives. This lack of transparency can be a warning sign, as legitimate brokers typically outline their promotional terms clearly (PediaFX).

Tradable Asset Classes

FTMO PipsPRO claims to offer a variety of tradable assets, including cryptocurrencies, forex, stock indices, commodities, and options. However, the specifics regarding the range of instruments and their associated costs remain vague, leading to uncertainty for potential traders (BrokersView).

Costs (Spreads, Fees, Commissions)

The broker does not provide clear information about spreads, fees, or commissions, making it challenging for traders to understand the cost structure associated with trading. This lack of clarity can lead to unexpected costs that may erode trading profits (WikiFX).

Leverage

FTMO PipsPRO offers high leverage options, with maximum leverage reaching up to 5000x for specific assets. While high leverage can amplify profits, it also significantly increases the risk of substantial losses, making it a double-edged sword for traders (NetNewsLedger).

The broker does not appear to support well-known trading platforms such as MT4 or MT5. Instead, it requires users to verify their identity before gaining access to its proprietary trading platform, which raises concerns about the platform's reliability and functionality (Scam Broker Review).

Restricted Regions

FTMO PipsPRO does not provide clear information regarding restricted regions, which can be problematic for traders from jurisdictions with specific regulatory requirements. This lack of transparency can lead to potential legal issues for users (BrokersView).

Available Customer Service Languages

Customer support appears to be limited, with only an email address provided for inquiries. The absence of more immediate support options like live chat or phone support raises concerns about the broker's commitment to customer service (WikiFX).

Summary of Ratings

FTMO PipsPRO presents numerous red flags that potential traders should consider before engaging with the platform. The lack of regulation, transparency, and customer support raises serious concerns about its legitimacy and safety for traders. Consequently, it is advisable for individuals to seek alternative, regulated brokers that offer clearer terms, better support, and a more reliable trading environment.