FINSA Review 2

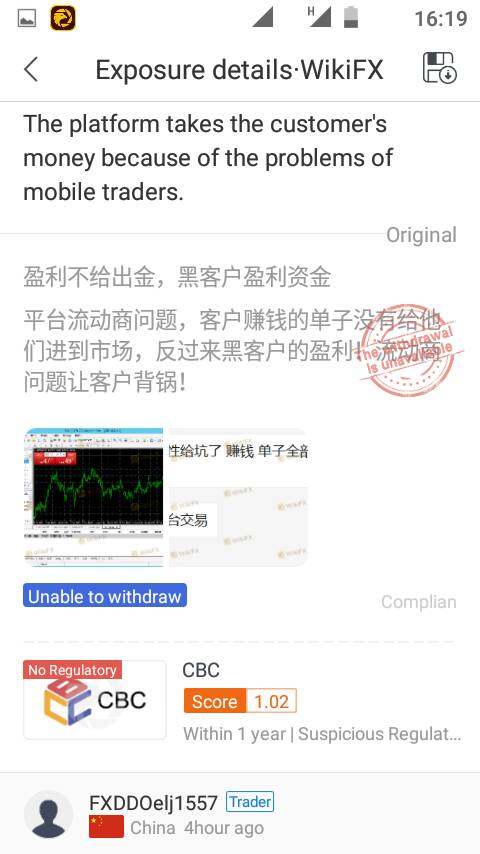

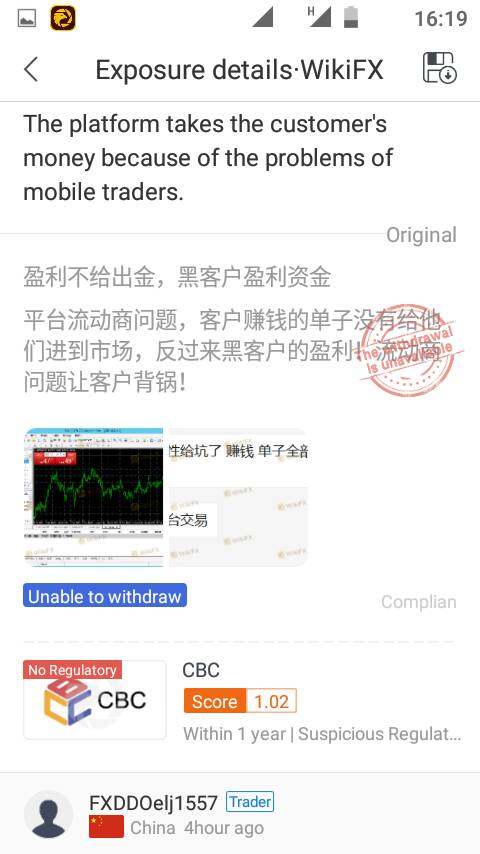

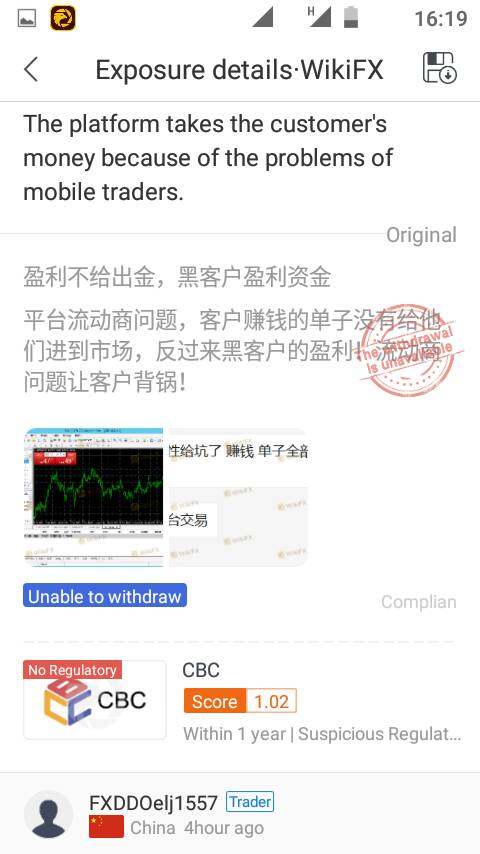

can't be trusted.suspicion of scam

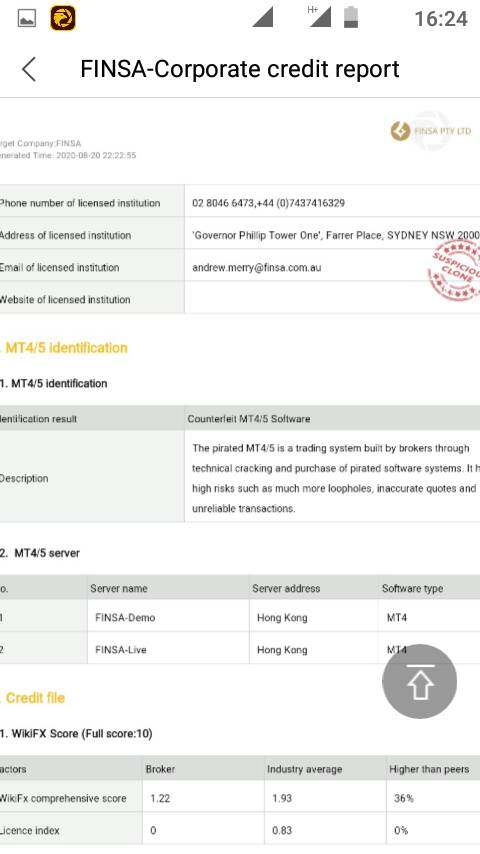

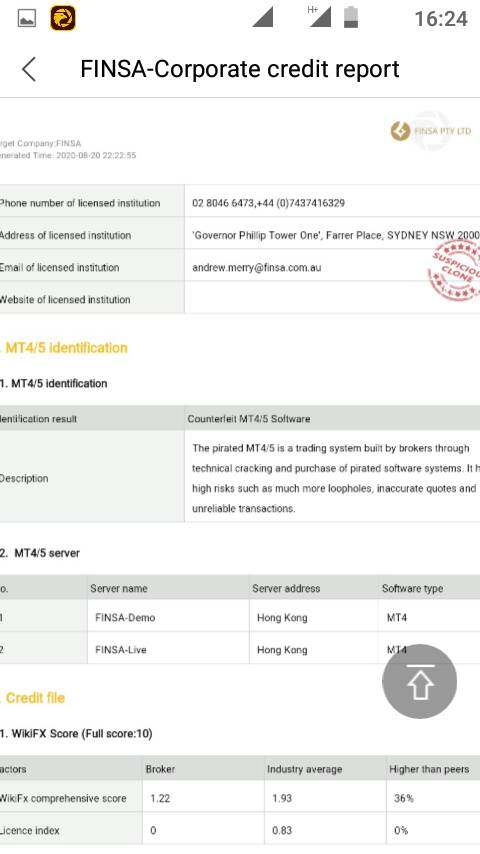

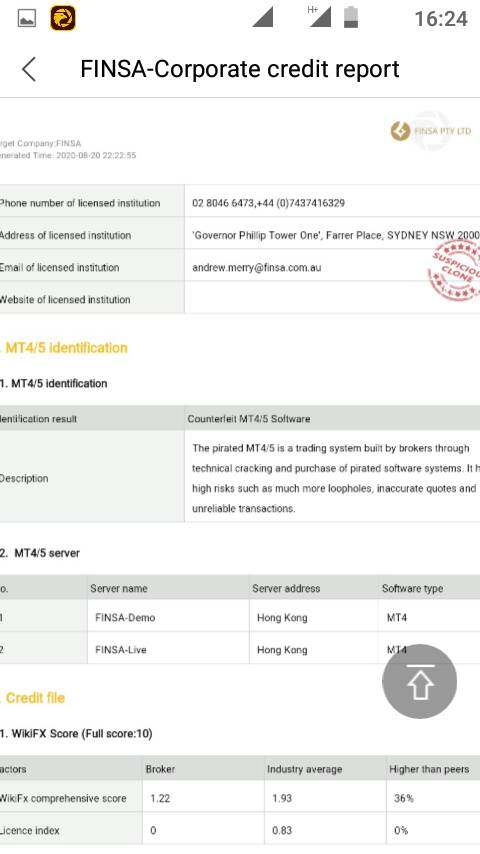

Clicking the “Help” on the upper right hand in the trading software,then clicking “About”,a website(www.finsapty.com) will be shown,which was a porn site.

FINSA Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

can't be trusted.suspicion of scam

Clicking the “Help” on the upper right hand in the trading software,then clicking “About”,a website(www.finsapty.com) will be shown,which was a porn site.

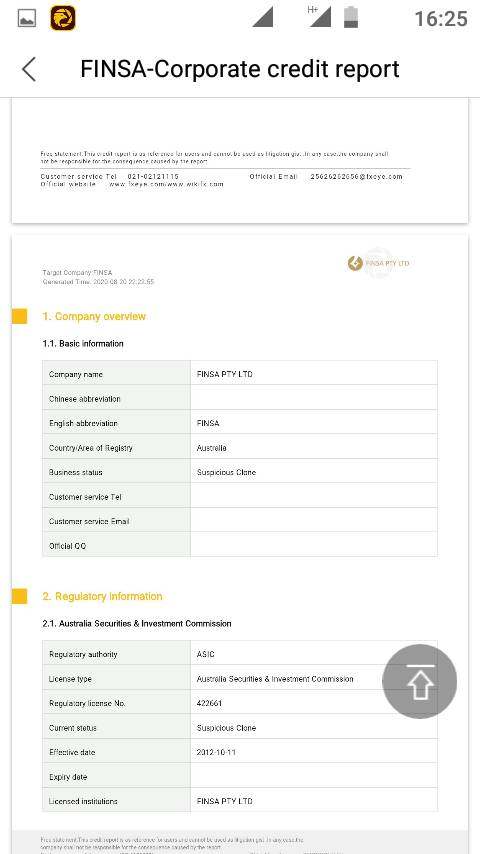

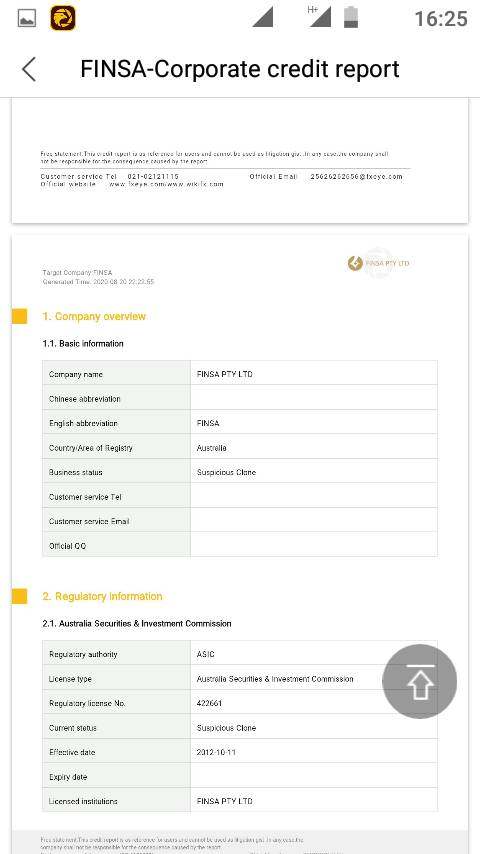

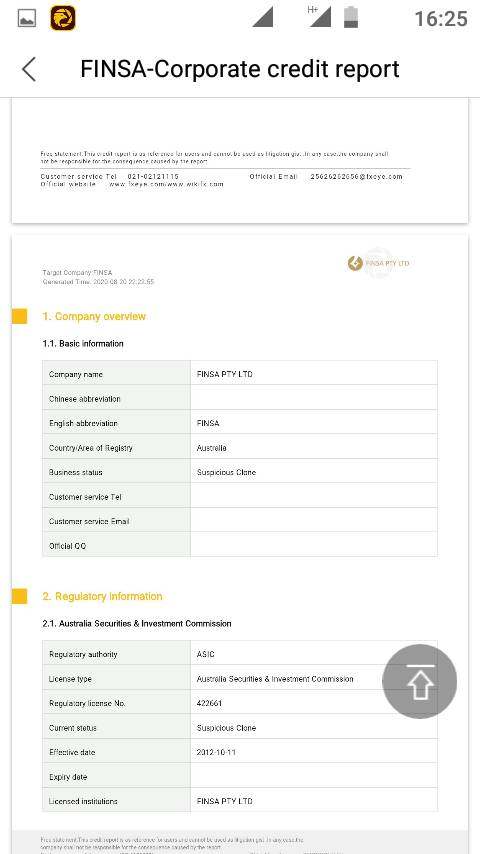

This comprehensive finsa review reveals concerning findings about Finsa Investment that potential traders must understand before making any investment decisions. Global Fraud Protection has flagged Finsa Investment as a scam operation. They strongly recommend users avoid this broker entirely. The overall assessment of this broker is decidedly negative based on available evidence.

Despite some positive internal feedback, where Glassdoor reports indicate that 67% of Finsa employees would recommend working at the company, the external trading environment presents significant red flags. Arcadia Finance notes that while some aspects of Finsa's service receive positive customer feedback, these isolated positive reviews are overshadowed by serious regulatory concerns and fraud allegations. The broker appears to target users interested in forex trading opportunities. However, the evidence suggests extreme caution is warranted.

The disconnect between internal employee satisfaction and external trading safety concerns creates a complex picture that ultimately weighs heavily toward avoiding this broker. Regulatory warnings from respected financial authorities further compound the negative assessment. This makes Finsa Investment unsuitable for serious traders seeking reliable and safe trading environments.

Regional Entity Differences: Finsa Investment operates across multiple jurisdictions with varying regulatory statuses. The situation in the United Kingdom is particularly concerning, where the Financial Conduct Authority has issued specific warnings about unauthorized activities. Traders should be aware that regulatory oversight differs significantly between regions, and what may appear legitimate in one area could be problematic in another.

Review Methodology: This evaluation is based on comprehensive analysis of publicly available information, user feedback from multiple platforms, and official regulatory communications. The assessment incorporates data from financial authority warnings, employee feedback platforms, and consumer protection organizations to provide a balanced perspective on the broker's operations and safety profile.

| Evaluation Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 0/10 | Poor |

| Tools and Resources | 0/10 | Poor |

| Customer Service and Support | 6/10 | Fair |

| Trading Experience | 0/10 | Poor |

| Trust and Safety | 1/10 | Very Poor |

| User Experience | 5/10 | Below Average |

Company Background and Business Model

Finsa Investment presents itself as a forex trading platform. However, specific details about its founding year and comprehensive company background remain unclear in available documentation. The broker's business model appears to focus on forex trading services, but the lack of transparent corporate information raises immediate concerns about the company's legitimacy and operational transparency.

The absence of clear founding information, detailed corporate structure, and comprehensive business model documentation represents a significant red flag for potential clients. Legitimate brokers typically provide extensive corporate background information, including founding details, management team profiles, and clear business operational frameworks.

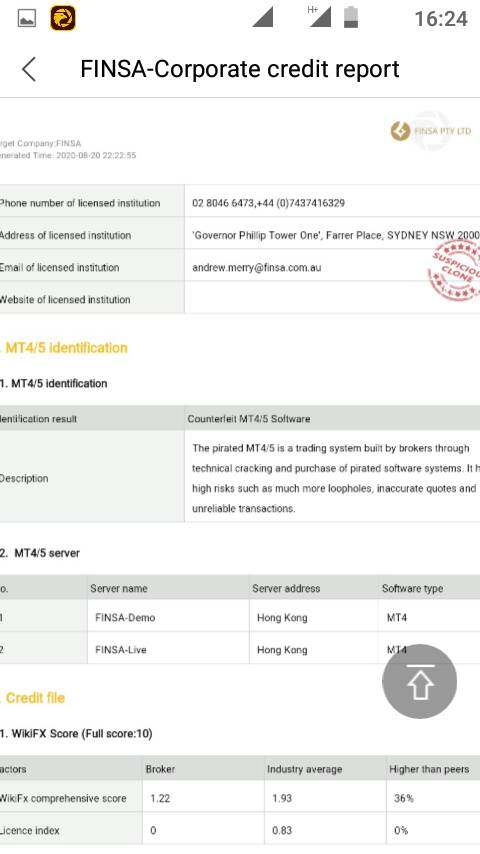

Trading Platform and Asset Coverage

Regarding trading platform specifications and asset class coverage, detailed information remains unavailable in current documentation. This lack of technical platform information, combined with unclear asset offerings, further compounds concerns about the broker's operational transparency. Legitimate forex brokers typically provide comprehensive details about their trading platforms, supported assets, and technical capabilities.

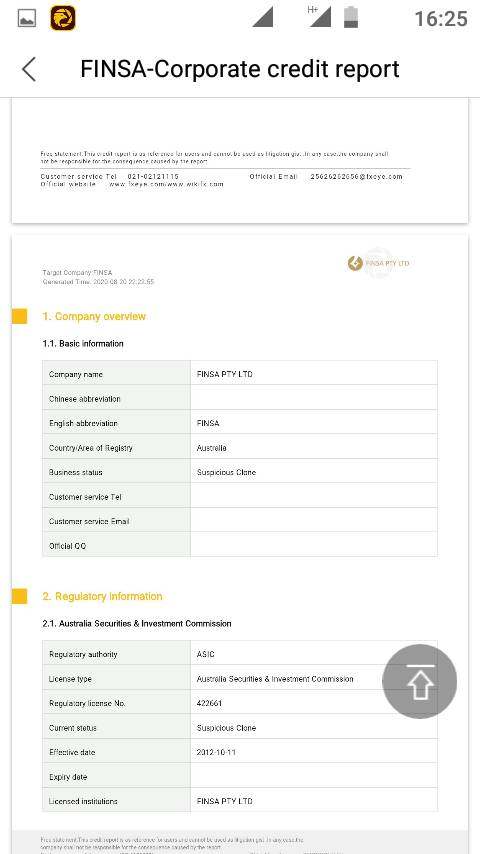

The regulatory landscape for Finsa Investment is particularly troubling, with the UK Financial Conduct Authority serving as the primary regulatory concern. The FCA's involvement indicates serious compliance issues that potential clients must carefully consider before engaging with this broker.

Regulatory Status: Finsa Investment faces significant regulatory challenges, particularly with the UK Financial Conduct Authority, which has issued warnings about unauthorized service provision. This regulatory scrutiny represents a major concern for potential clients.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. This creates uncertainty about fund management processes.

Minimum Deposit Requirements: Current documentation does not specify minimum deposit requirements. This leaves potential clients without crucial account opening information.

Bonus and Promotions: Details about promotional offers and bonus structures are not mentioned in available materials.

Tradeable Assets: Specific information about available trading instruments and asset classes remains unclear in current documentation.

Cost Structure: Comprehensive information about spreads, commissions, and fee structures is not provided in available materials. This makes cost comparison impossible.

Leverage Ratios: Specific leverage offerings are not detailed in current documentation.

Platform Options: Technical specifications and platform choices are not clearly outlined in available information.

Geographic Restrictions: Specific regional limitations are not detailed in current materials.

Customer Service Languages: Available support languages are not specified in current documentation.

This finsa review highlights the concerning lack of transparency across multiple operational aspects that legitimate brokers typically disclose comprehensively.

The evaluation of Finsa Investment's account conditions receives a score of 0/10 due to the complete absence of detailed information about account types, structures, and offerings. Legitimate forex brokers typically provide comprehensive details about various account tiers, each designed to meet different trader needs and experience levels.

The lack of information regarding minimum deposit requirements creates significant uncertainty for potential clients attempting to understand entry-level investment needs. Professional brokers usually offer multiple account types ranging from basic starter accounts to premium offerings with enhanced features and lower trading costs. Account opening procedures and verification processes remain undisclosed, which is particularly concerning given the regulatory warnings surrounding this broker.

Standard industry practice includes clear documentation of account setup requirements, verification timeframes, and compliance procedures. Special account features such as Islamic accounts for Muslim traders, demo accounts for practice, or institutional accounts for larger investors are not mentioned in available documentation. This absence of specialized account options suggests limited service sophistication and potentially narrow target market focus.

The finsa review reveals that without transparent account condition information, potential clients cannot make informed decisions about whether the broker's offerings align with their trading needs and investment capacity.

Finsa Investment receives a 0/10 rating for tools and resources due to the complete absence of information about trading tools, analytical resources, and educational materials. Professional forex brokers typically provide comprehensive suites of trading tools including technical analysis indicators, charting packages, and market research resources.

The lack of disclosed research and analysis resources represents a significant limitation for traders who rely on market insights and professional analysis to inform their trading decisions. Established brokers usually offer daily market commentary, economic calendars, and expert analysis to support client trading activities. Educational resources appear to be non-existent or undisclosed, which is particularly concerning for newer traders who require learning materials to develop their trading skills.

Quality brokers typically provide webinars, tutorials, trading guides, and educational articles to support client development. Automated trading support and algorithmic trading capabilities are not mentioned in available documentation. Modern trading environments increasingly rely on automated solutions, and the absence of such features suggests limited technological sophistication.

The absence of comprehensive tool and resource information makes it impossible to assess whether Finsa Investment provides the technological infrastructure necessary for serious trading activities.

Customer service and support receives a 6/10 rating based on the mixed signals from available feedback. While Glassdoor indicates that 67% of Finsa employees would recommend working at the company, this internal perspective contrasts sharply with external concerns about the broker's operations.

The positive employee feedback suggests that internal company culture and working conditions may be satisfactory, which could translate to some level of service quality for clients. However, employee satisfaction does not necessarily correlate with client service excellence or operational safety. Specific information about customer service channels, availability hours, and response times remains unavailable in current documentation.

Professional brokers typically offer multiple contact methods including phone, email, live chat, and sometimes social media support across extended hours. Multi-language support capabilities are not specified, which could limit accessibility for international clients. Global forex brokers usually provide support in multiple languages to serve their diverse client base effectively.

The disconnect between internal employee satisfaction and external regulatory concerns creates uncertainty about the actual quality and reliability of customer support services for trading clients.

The trading experience evaluation receives a 0/10 rating due to the complete absence of information about platform stability, execution quality, and overall trading environment. Professional forex brokers typically provide detailed specifications about their trading infrastructure, execution speeds, and platform reliability.

Platform stability and performance metrics are not disclosed, making it impossible to assess whether the broker can provide reliable trading access during volatile market conditions. Serious traders require platforms that maintain consistent performance during high-volume trading periods. Order execution quality information is not available, which is crucial for understanding how trades are processed and whether clients receive fair pricing.

Professional brokers usually provide transparency about their execution models and average execution speeds. Mobile trading capabilities and platform functionality remain undisclosed, despite mobile trading being essential for modern forex trading. Quality brokers typically offer sophisticated mobile applications with full trading functionality.

The finsa review reveals that without comprehensive trading experience information, potential clients cannot evaluate whether the broker provides the technical infrastructure necessary for successful trading activities.

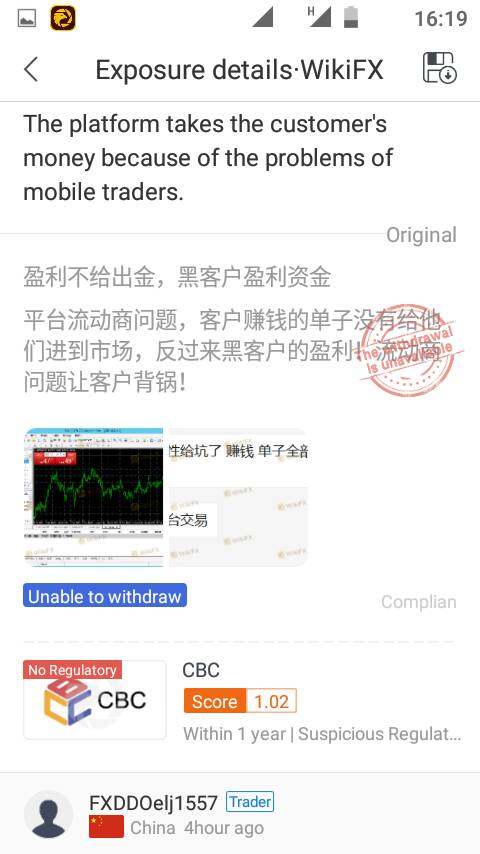

Trust and safety receives the lowest possible rating of 1/10 due to serious regulatory concerns and fraud allegations. The UK Financial Conduct Authority's warning about unauthorized service provision represents a critical safety issue that potential clients must consider carefully.

The FCA warning, issued on October 10, 2022, specifically states that Finsa Investment was providing financial services or products in the UK without proper authorization. This regulatory action indicates serious compliance failures and potential legal violations that directly impact client safety. Being flagged as a scam operation by Global Fraud Protection represents an additional layer of concern about the broker's legitimacy and operational integrity.

Such designations typically result from investigations into fraudulent practices or client complaints about unauthorized activities. Fund safety measures and client protection protocols are not disclosed in available documentation, creating uncertainty about how client investments are protected. Legitimate brokers typically provide detailed information about segregated accounts, insurance coverage, and regulatory protections.

The combination of regulatory warnings and fraud allegations creates an environment of significant risk for potential clients, making this broker unsuitable for serious trading activities.

User experience receives a 5/10 rating based on the mixed feedback available from various sources. While some users provide positive feedback according to Arcadia Finance, this is balanced against negative experiences reported on platforms like Glassdoor, where some employees describe very negative work experiences.

The positive user feedback mentioned in some reports suggests that certain aspects of the service may meet client expectations, but the limited scope and context of these reviews make comprehensive assessment difficult. Legitimate brokers typically have extensive user review databases across multiple platforms. Interface design and usability information is not available in current documentation, making it impossible to assess whether the broker provides intuitive and efficient trading interfaces.

Modern traders expect sophisticated yet user-friendly platform designs. Registration and verification processes remain undisclosed, creating uncertainty about account setup complexity and timeframes. Professional brokers usually provide clear guidance about account opening procedures and required documentation.

The presence of negative employee experiences on Glassdoor, combined with regulatory concerns, suggests potential operational issues that could impact client experience quality and service reliability.

This comprehensive finsa review concludes with a strong negative assessment of Finsa Investment as a forex trading broker. The combination of regulatory warnings from the UK Financial Conduct Authority, fraud allegations from consumer protection organizations, and the general lack of transparency across operational aspects makes this broker unsuitable for serious traders.

While some positive employee feedback suggests acceptable internal working conditions, the external trading environment presents unacceptable risks for potential clients. The absence of detailed information about account conditions, trading tools, platform specifications, and safety measures compounds the concerns raised by regulatory authorities. The broker may superficially appear to target forex trading enthusiasts, but the evidence strongly suggests that potential clients should exercise extreme caution and consider alternative, properly regulated brokers.

The regulatory warnings and fraud allegations represent fundamental safety concerns that outweigh any potential benefits the broker might offer. Serious traders seeking reliable, safe, and transparent trading environments should avoid Finsa Investment and instead focus on well-regulated brokers with established track records, comprehensive regulatory oversight, and transparent operational practices that prioritize client safety and satisfaction.

FX Broker Capital Trading Markets Review