FAITH Review 1

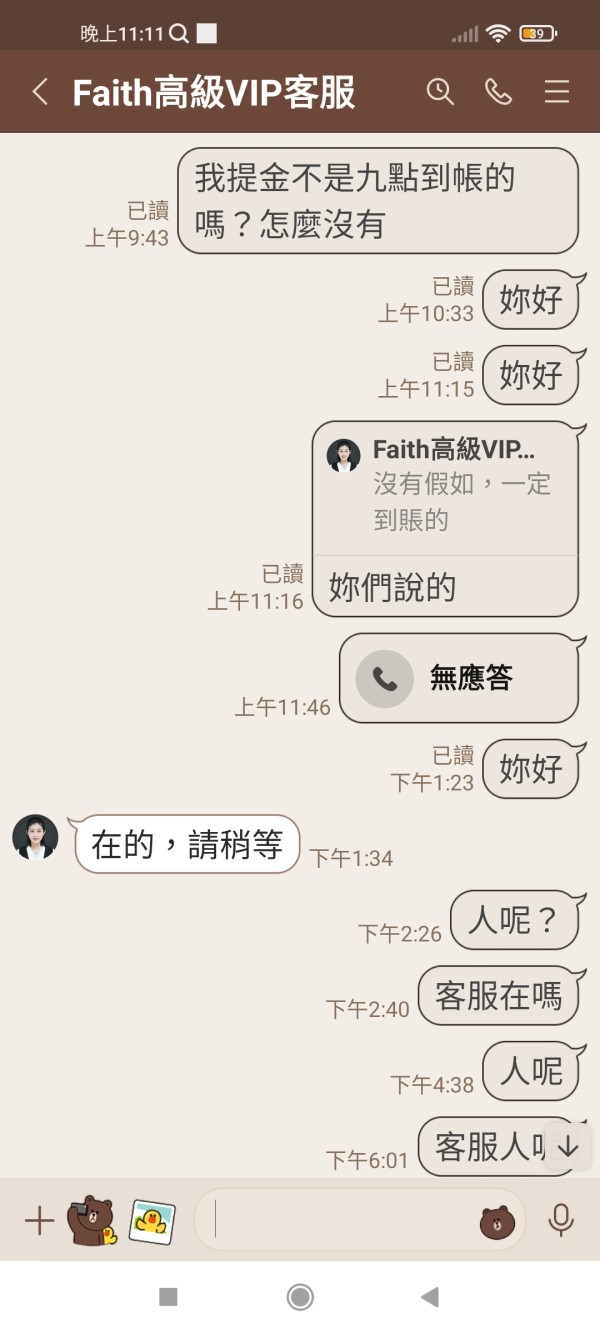

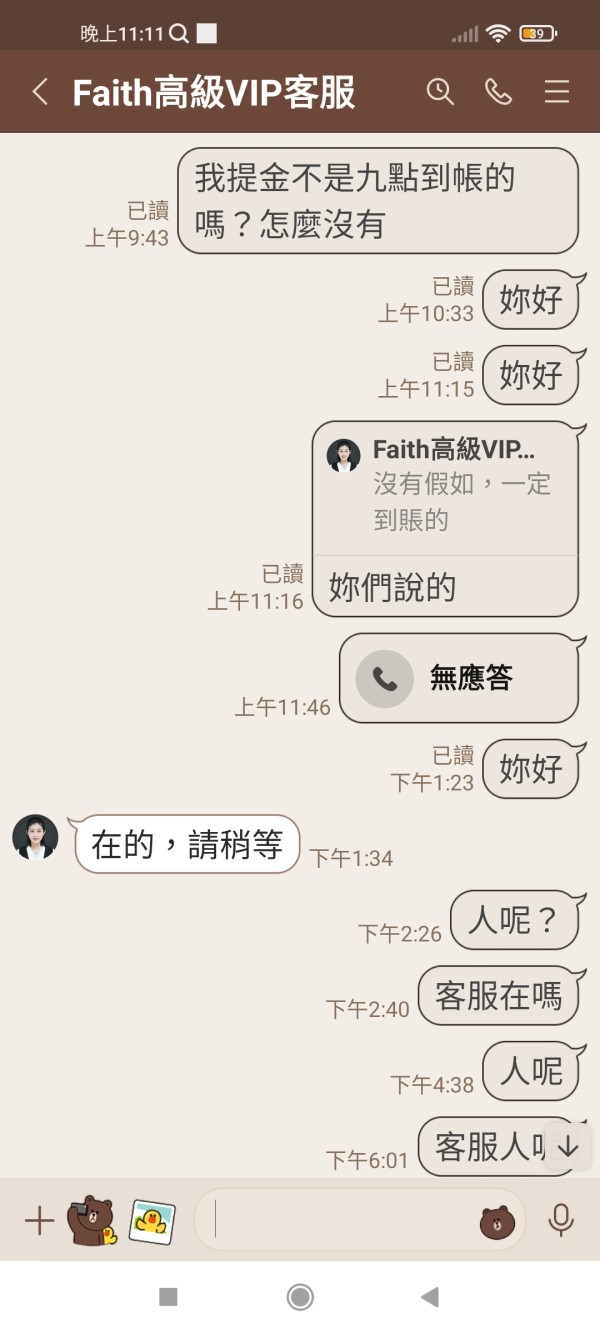

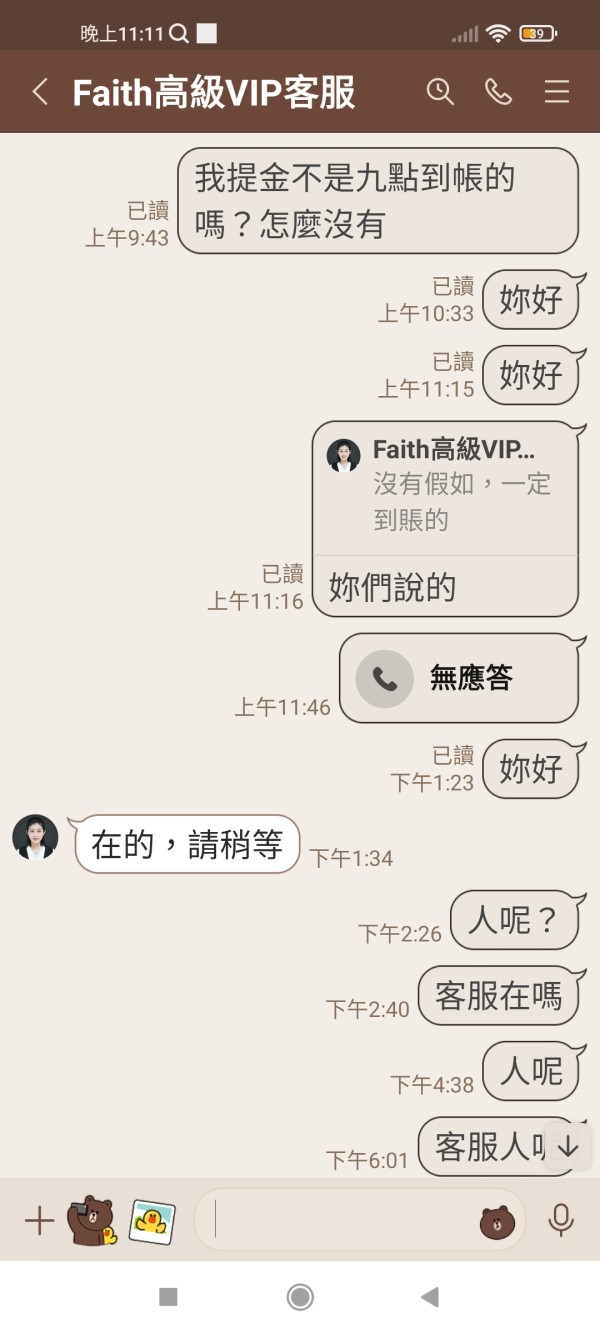

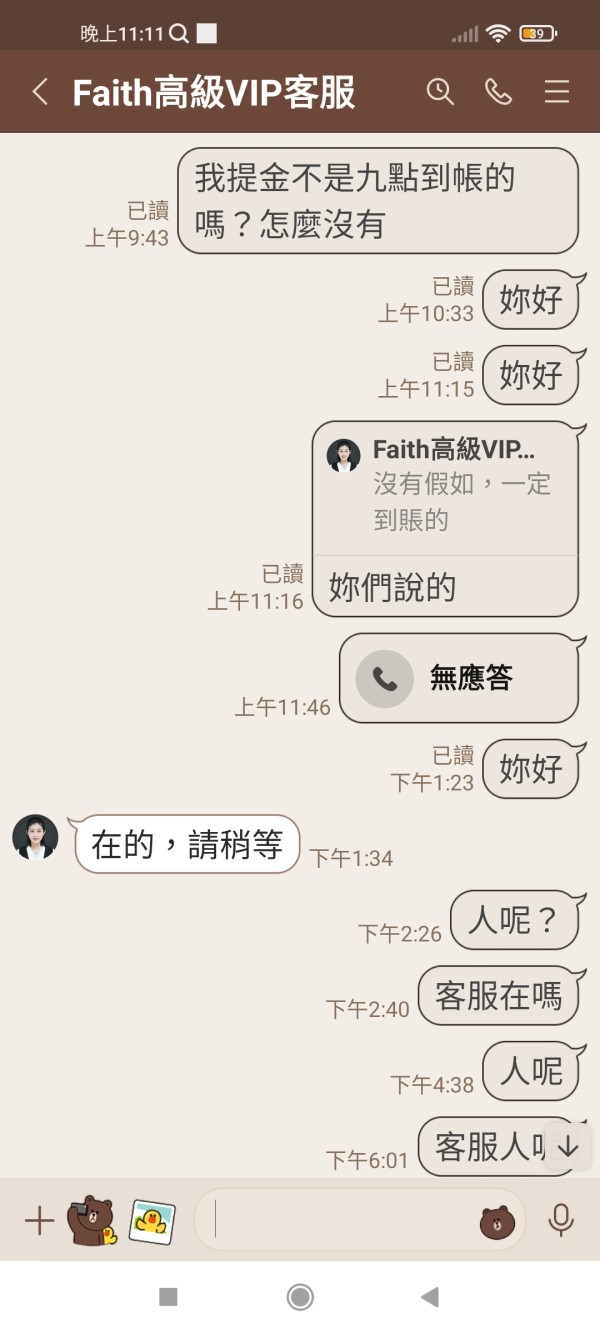

Withdrawwal requres to pay 6% tax first and no withdrawal after paying it. The customer service also does not response.

FAITH Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Withdrawwal requres to pay 6% tax first and no withdrawal after paying it. The customer service also does not response.

Faith Investment Services presents itself as a financial services provider focused on helping individuals and families achieve their retirement goals while incorporating faith-based investment principles. This faith review reveals a company that emphasizes the intersection of moral values and financial planning, particularly appealing to Christian investors seeking ethical investment options. The firm positions itself as a team of qualified financial professionals dedicated to fostering a community where faith and finance work harmoniously together. However, our comprehensive analysis reveals significant transparency concerns.

Critical information regarding regulatory oversight, trading conditions, and specific service offerings remains notably absent from available public materials. While the company's faith-centered approach may resonate with values-driven investors, the lack of detailed operational information raises questions about the firm's suitability for serious traders and investors seeking comprehensive financial services. The primary target audience appears to be faith-oriented individuals and families prioritizing long-term financial planning with moral considerations, rather than active traders seeking competitive trading conditions and robust market access.

Due to limited regulatory information available, investors should understand that different jurisdictions may have varying legal and regulatory requirements that could affect service availability and investor protections. This review is based on publicly available information and market feedback, as comprehensive trading experience data was not accessible for evaluation. Potential clients should conduct additional due diligence and verify regulatory status in their specific jurisdiction before engaging with any financial services provider.

The absence of clear regulatory information in our research suggests heightened caution is warranted.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account terms and conditions not disclosed in available materials |

| Tools and Resources | N/A | Trading tools and analytical resources not detailed in public information |

| Customer Service | N/A | Customer support structure and availability not specified |

| Trading Experience | N/A | Platform performance and trading environment details unavailable |

| Trust and Safety | N/A | Regulatory information not provided in accessible documentation |

| User Experience | N/A | User interface and overall experience metrics not available |

Faith Investment Services, LLC operates as a financial services organization comprised of qualified financial professionals who specialize in retirement planning and faith-based investment strategies. The company's core mission centers on helping individuals and families achieve their ideal retirement goals while maintaining alignment with their spiritual values and beliefs. Their approach emphasizes the integration of moral considerations into financial decision-making processes. The firm's business model appears to focus on long-term wealth building rather than short-term trading activities.

This positioning suggests they cater primarily to investors seeking comprehensive financial planning services that incorporate ethical and religious considerations into investment selection and portfolio management strategies. Unfortunately, specific details regarding the company's establishment date, trading platforms, available asset classes, and regulatory oversight remain unclear based on available information. The lack of transparency regarding these fundamental aspects of their operations presents challenges for potential clients seeking to evaluate the firm's capabilities and regulatory compliance status.

Regulatory Jurisdiction: Specific regulatory oversight information not disclosed in available materials, requiring potential clients to independently verify compliance status.

Deposit and Withdrawal Methods: Available funding options and withdrawal procedures not detailed in accessible documentation. Minimum Deposit Requirements: Entry-level investment thresholds not specified in public information.

Promotional Offers: Current bonus programs or promotional incentives not mentioned in available materials. Trading Assets: Specific investment vehicles and tradeable instruments not comprehensively outlined in accessible sources.

Cost Structure: Fee schedules, commission rates, and expense ratios not transparently disclosed in public documentation. Leverage Options: Available leverage ratios and margin requirements not specified in this faith review of accessible materials.

Platform Selection: Trading platform options and technological infrastructure not detailed in available information. Geographic Restrictions: Service availability limitations by region not clearly outlined.

Customer Service Languages: Supported communication languages not specified in available documentation.

The evaluation of Faith Investment Services' account conditions proves challenging due to insufficient publicly available information. Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spreads, and features, but Faith Investment Services has not disclosed such details in accessible materials. Without specific information about account types, minimum deposit requirements, or account opening procedures, potential clients cannot adequately assess whether the firm's offerings align with their financial capabilities and investment objectives.

This lack of transparency regarding basic account parameters represents a significant concern for prospective clients who require clear terms and conditions before committing to any financial service provider. The absence of information about specialized account features, such as Islamic-compliant options or professional trading accounts, further limits the ability to evaluate the firm's suitability for diverse client needs. In this faith review, we must note that industry standards typically require clear disclosure of account conditions, making the current information gap particularly noteworthy.

Assessment of Faith Investment Services' trading tools and analytical resources cannot be completed based on available information. Modern investment platforms typically provide comprehensive charting software, technical analysis tools, economic calendars, and market research capabilities, but no such details are accessible regarding Faith Investment Services' offerings. The absence of information about research resources, educational materials, or automated trading support limits potential clients' ability to evaluate the firm's technological capabilities and analytical support systems.

Professional traders and serious investors typically require robust analytical tools and comprehensive market research to make informed investment decisions. Educational resources represent another critical component for investment service providers, particularly for firms targeting retail investors and families planning for retirement. However, no information regarding educational programs, webinars, or learning materials is available in accessible documentation, making it impossible to assess the firm's commitment to client education and development.

Customer service evaluation for Faith Investment Services cannot be conducted comprehensively due to lack of available information regarding support channels, response times, and service quality metrics. Professional financial services firms typically offer multiple communication channels including phone support, email assistance, and live chat capabilities, but such details remain undisclosed. The absence of information about customer service hours, multilingual support options, and problem resolution procedures represents a significant transparency gap.

Clients seeking reliable financial services require confidence in their ability to receive timely assistance when needed, particularly during market volatility or technical difficulties. Without access to user feedback regarding customer service experiences or documented service level agreements, potential clients cannot assess the firm's commitment to customer support excellence. This information gap proves particularly concerning for investors who may require ongoing guidance and assistance with their investment strategies and account management.

The trading experience evaluation for Faith Investment Services remains incomplete due to insufficient information about platform performance, order execution quality, and overall trading environment. Professional trading platforms typically provide real-time market data, fast order execution, and stable connectivity, but no such specifications are available for assessment. Mobile trading capabilities represent an increasingly important aspect of modern investment services, allowing clients to monitor portfolios and execute trades from anywhere.

However, information about mobile applications or mobile-optimized platforms is not available in accessible documentation, limiting the ability to evaluate the firm's technological advancement and user convenience features. Platform stability and execution speed prove critical for investment success, particularly during volatile market conditions. Without performance data or user testimonials regarding trading experience quality, this faith review cannot provide meaningful insights into the firm's operational capabilities and reliability standards for active trading or investment management.

Trust and safety evaluation presents significant challenges due to the absence of clear regulatory information in available documentation. Regulatory oversight provides essential investor protections including segregated client funds, dispute resolution mechanisms, and operational compliance standards, but such details remain unclear for Faith Investment Services. Fund safety measures, including client money protection schemes and insurance coverage, typically represent fundamental safeguards for investment service providers.

However, specific information about asset protection protocols and financial security measures is not disclosed in accessible materials, creating uncertainty about client fund safety. Company transparency regarding ownership structure, financial statements, and regulatory compliance status typically builds investor confidence and demonstrates operational legitimacy. The current lack of such transparency raises questions about the firm's commitment to industry best practices and regulatory standards that protect client interests.

User experience assessment for Faith Investment Services cannot be completed comprehensively due to limited available feedback and interface information. Modern financial services platforms typically prioritize intuitive design, streamlined navigation, and efficient account management features, but no such details are accessible for evaluation. Registration and verification procedures represent critical first impressions for new clients, affecting overall satisfaction and onboarding success.

However, information about account opening processes, documentation requirements, and verification timelines remains unavailable in accessible sources, limiting the ability to assess user-friendliness. Overall client satisfaction metrics, including user retention rates and satisfaction surveys, typically provide valuable insights into service quality and user experience effectiveness. Without access to such data or comprehensive user testimonials, potential clients cannot gauge the firm's track record for delivering satisfactory user experiences and meeting client expectations.

This faith review reveals that Faith Investment Services lacks sufficient transparency regarding essential operational details, regulatory oversight, and service specifications. While the firm's emphasis on faith-based investment principles may appeal to values-driven investors seeking ethical financial services, the absence of critical information creates significant evaluation challenges. The company appears best suited for individuals prioritizing moral investment considerations over competitive trading conditions or comprehensive market access.

However, potential clients should exercise considerable caution and conduct thorough independent research before engaging with any financial services provider lacking clear regulatory information and transparent operational details. Major advantages include the faith-centered investment philosophy and focus on long-term retirement planning, while significant disadvantages encompass the lack of regulatory transparency and insufficient disclosure of essential service terms and conditions.

FX Broker Capital Trading Markets Review