CLSA Review 2

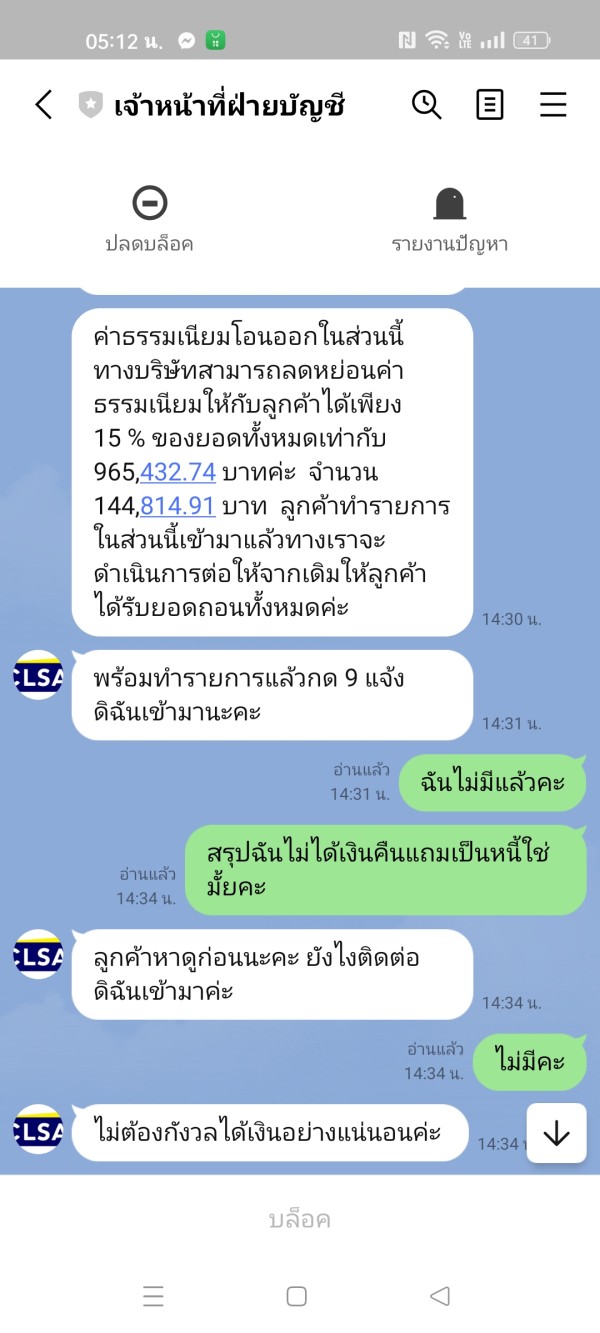

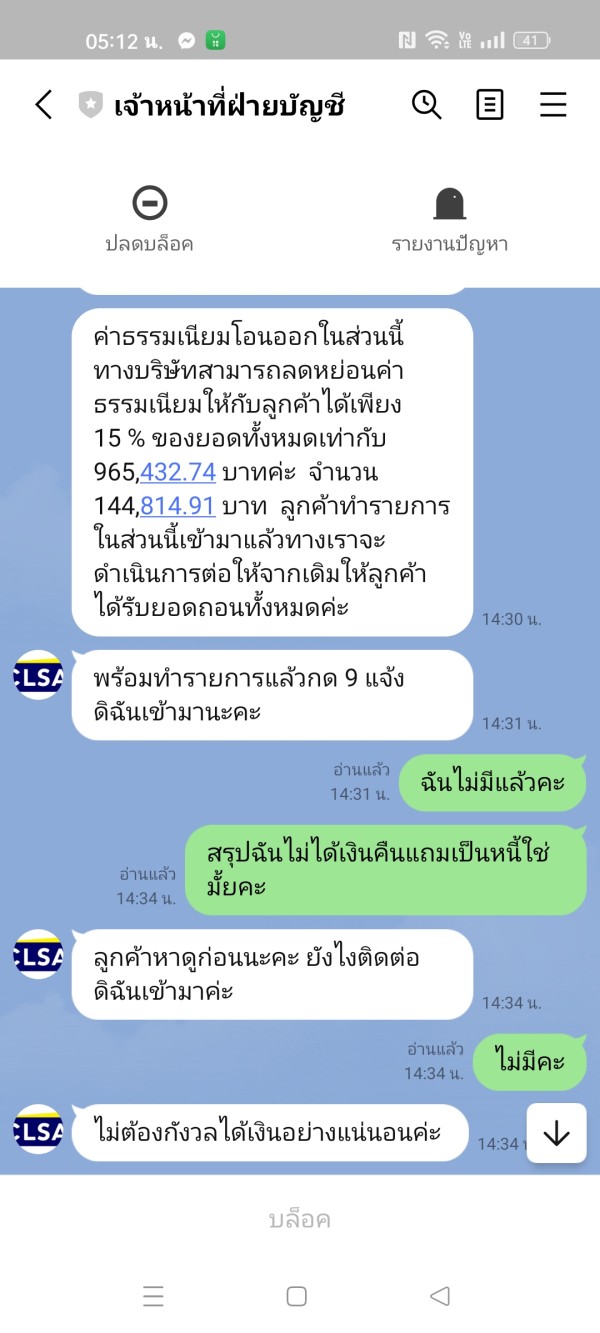

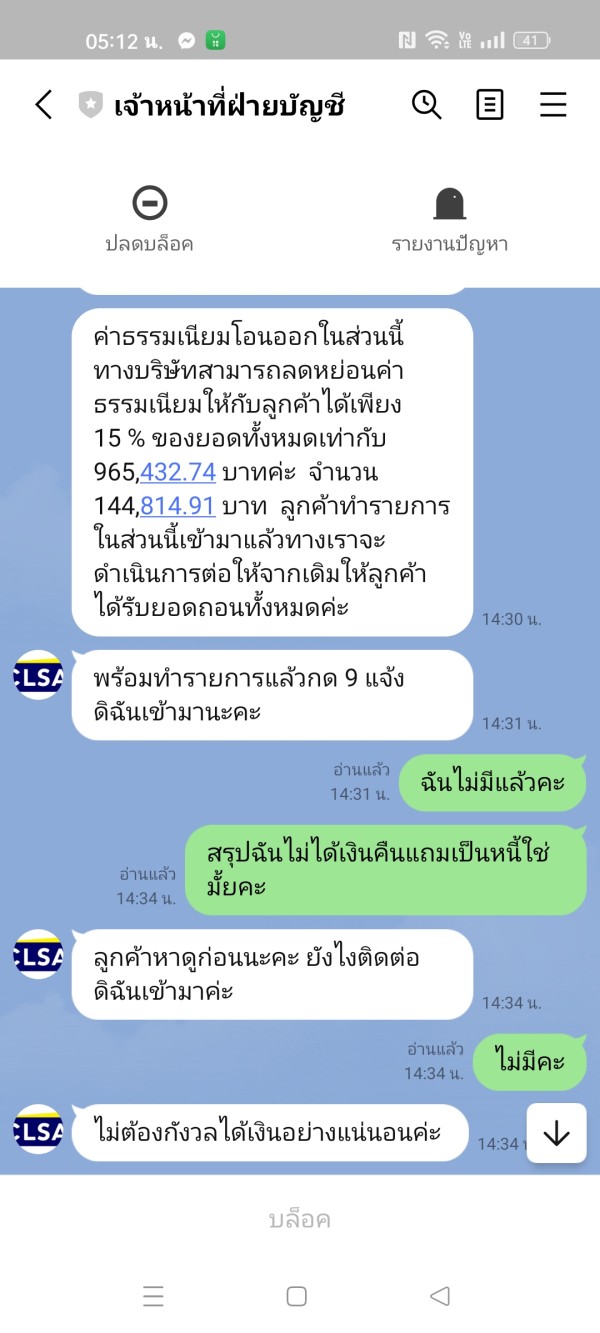

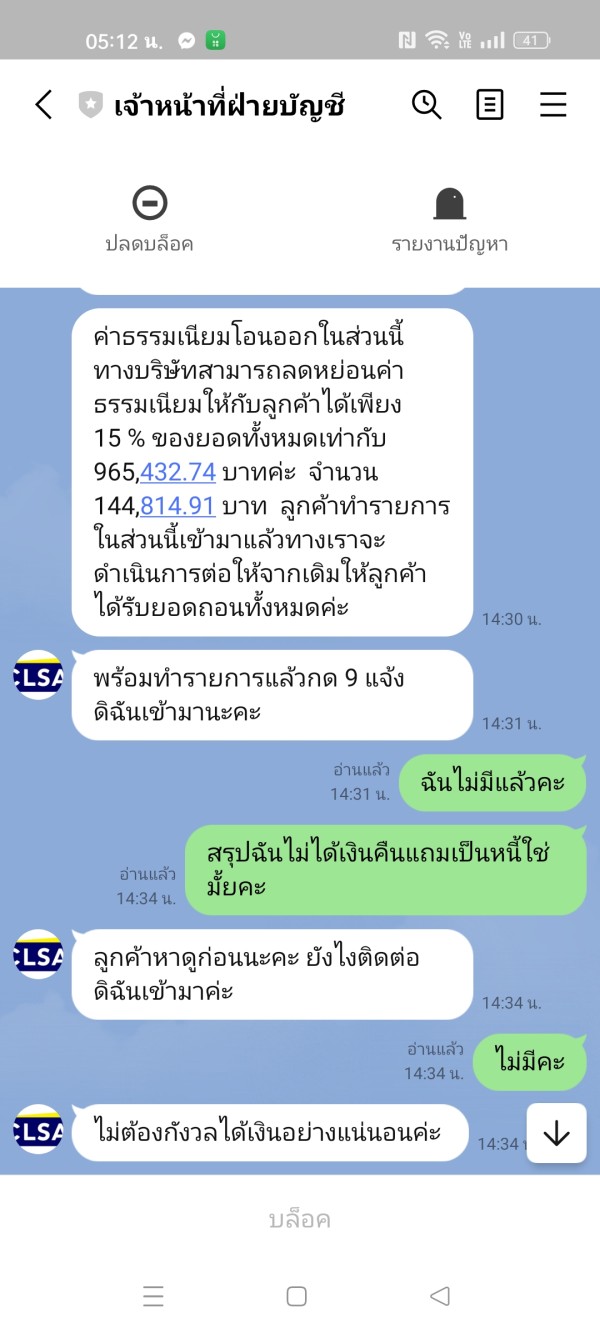

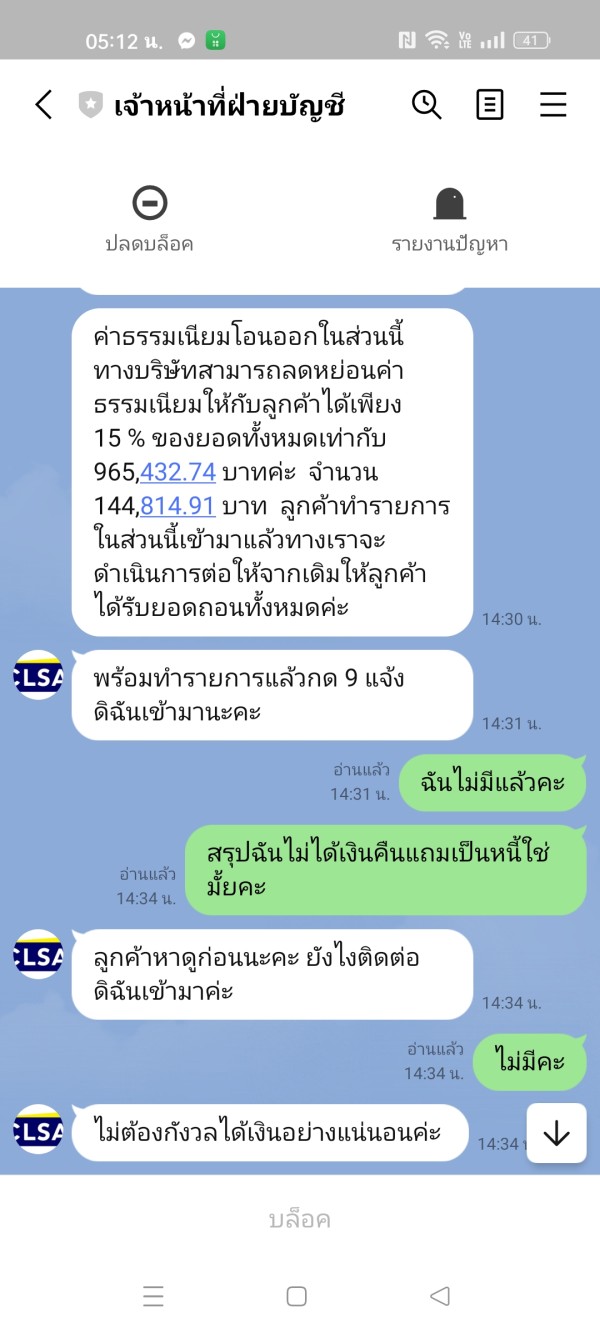

Can't withdraw money. And I have to pay a large amount of transfer fees. I would like to ask for help from the relevant agencies.

Can't withdraw money. And I have to pay for a large amount of transfer fee.

CLSA Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Can't withdraw money. And I have to pay a large amount of transfer fees. I would like to ask for help from the relevant agencies.

Can't withdraw money. And I have to pay for a large amount of transfer fee.

CLSA stands as Asia's leading and oldest independent brokerage and investment group. The company was established in 1986 with headquarters in Hong Kong. This clsa review reveals a company that has carved out a unique niche in the financial services industry, particularly focusing on Chinese capital markets for global investors. With nearly four decades of experience, CLSA operates as an independent, broker-neutral multi-asset trading platform provider. The company offers comprehensive services including alternative investments, asset management, corporate finance, capital markets, securities, and wealth management.

According to employee reviews from 90+ staff members, CLSA maintains a rating of 2.8 out of 5. This rating indicates mixed employee satisfaction levels. The company's primary strength lies in its specialized focus on Chinese capital markets and its independence from major banking institutions, which allows for more objective research and analysis. CLSA's target audience primarily consists of international investors seeking exposure to Asian markets, particularly China, through professional-grade trading and investment services.

The firm's unique positioning as an independent entity in an industry dominated by large investment banks provides both opportunities and challenges. This makes it an interesting case study for investors considering specialized Asian market exposure.

This review is based on publicly available information and user feedback compiled from multiple sources. Readers should note that financial services regulations and company offerings may vary significantly across different jurisdictions. The information presented in this clsa review reflects the current understanding of CLSA's services as of 2025, though specific details about certain operational aspects were not available in the source materials.

Potential clients should conduct their own due diligence and verify current terms, conditions, and regulatory status before making any investment decisions. The analysis presented here aims to provide an objective assessment based on available data, though some information gaps exist regarding specific trading conditions and regulatory frameworks.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific information not available in source materials |

| Tools and Resources | 6/10 | Independent multi-asset trading platform available, but limited details on specific tools |

| Customer Service | N/A | Insufficient information available for assessment |

| Trading Experience | N/A | Platform details limited in available sources |

| Trust and Reliability | 4/10 | Long-established firm since 1986 but limited regulatory transparency |

| User Experience | 5/10 | Employee rating of 2.8/5 suggests moderate satisfaction levels |

Company Background and History

CLSA has established itself as a prominent player in the Asian financial markets since its founding in 1986. As Asia's leading and oldest independent brokerage and investment group, the company has built a reputation for providing specialized services focused on Chinese capital markets. Unlike many competitors that are subsidiaries of large banking institutions, CLSA maintains its independence. This independence allows for more objective research and analysis without potential conflicts of interest.

The company's business model centers around serving global investors who seek exposure to Asian markets, particularly China. CLSA's comprehensive service portfolio includes alternative investments, asset management, corporate finance and capital markets services, securities trading, and wealth management solutions. This diversified approach enables the firm to serve various client segments, from institutional investors to high-net-worth individuals.

Trading Platform and Technology

CLSA utilizes the InfoReach Trade Management System. This system serves as an independent, broker-neutral multi-asset trading platform. The technological foundation supports the company's commitment to providing unbiased trading services across multiple asset classes. The platform's independence from specific broker interests aligns with CLSA's overall positioning as an objective service provider in the Asian markets.

While specific details about additional trading tools and platform features were not extensively detailed in available sources, the use of a professional-grade trade management system suggests a focus on institutional and sophisticated retail clients. The multi-asset capability indicates support for various investment instruments. However, the exact range of available assets requires further clarification from the company directly.

Regulatory Framework

Specific information about CLSA's regulatory oversight was not detailed in available source materials. Given the company's establishment in Hong Kong and its focus on Asian markets, potential clients should verify current regulatory status and licensing information directly with the company and relevant financial authorities.

Account Funding and Withdrawal Methods

Details regarding deposit and withdrawal methods, processing times, and associated fees were not specified in the available information. This represents a significant information gap that prospective clients should address through direct communication with CLSA representatives.

Minimum Deposit Requirements

Specific minimum deposit amounts for different account types were not disclosed in the source materials. Given CLSA's focus on institutional and sophisticated investors, minimum requirements may be substantial.

Promotional Offers and Bonuses

Information about current promotional offers, welcome bonuses, or loyalty programs was not available in the reviewed sources. This suggests either a limited promotional strategy or information that requires direct inquiry.

Available Trading Assets

While CLSA operates a multi-asset trading platform, specific details about available instruments were not comprehensively detailed in available sources. These instruments include stocks, bonds, derivatives, currencies, and alternative investments.

Cost Structure and Fees

Comprehensive information about spreads, commissions, overnight fees, and other trading costs was not available in the source materials. This represents another area requiring direct clarification from the company.

Leverage Ratios

Specific leverage offerings for different asset classes and client types were not detailed in available information.

Platform Options

The primary platform mentioned is the InfoReach Trade Management System. However, details about mobile applications, web-based platforms, or additional trading software were not specified.

Geographic Restrictions

Information about service availability in different jurisdictions was not detailed in the reviewed sources.

Customer Support Languages

Specific details about supported languages for customer service were not available. Given the company's Asian focus, multiple Asian languages are likely supported.

This clsa review highlights several information gaps that potential clients should address through direct communication with the company.

The account conditions offered by CLSA remain largely undisclosed in publicly available information. This makes it challenging to provide a comprehensive assessment of this crucial aspect. Given the company's positioning as a provider for sophisticated investors interested in Asian markets, particularly China, it's reasonable to expect that account structures are designed to accommodate institutional and high-net-worth individual clients.

The absence of detailed information about account types, minimum balance requirements, account currencies, and special features represents a significant transparency gap. In today's competitive brokerage environment, most firms readily publish their account specifications. CLSA's limited disclosure is notable. This could indicate either a focus on relationship-based business where terms are negotiated individually, or simply a preference for direct client consultation rather than public disclosure.

For potential clients, this lack of transparency necessitates direct engagement with CLSA representatives to understand available account options, associated costs, and eligibility requirements. The company's long-standing presence in the market since 1986 suggests established account structures. However, without public details, assessment remains incomplete. This clsa review emphasizes the importance of thorough due diligence through direct communication for anyone considering account opening.

CLSA's primary technological offering centers around the InfoReach Trade Management System. This system represents a professional-grade, independent, and broker-neutral multi-asset trading platform. The choice of platform suggests a commitment to providing institutional-quality tools that avoid conflicts of interest common with proprietary trading systems.

The InfoReach TMS is recognized in the industry for its comprehensive order management capabilities, real-time risk management features, and multi-asset support. However, specific details about additional research tools, analytical resources, market data provisions, and educational materials were not available in the source materials. This represents a significant information gap, particularly for retail investors who typically require comprehensive research and educational support.

The platform's independence from specific broker interests aligns well with CLSA's positioning as an objective service provider. For institutional clients and sophisticated investors, this approach offers advantages in terms of execution quality and reduced conflicts of interest. However, the apparent lack of detailed information about supplementary tools, mobile trading options, and research resources suggests either a limited offering in these areas or a preference for direct client consultation.

The scoring of 6/10 reflects the professional-grade platform foundation while acknowledging the significant information gaps regarding comprehensive tool offerings that modern traders typically expect.

Customer service quality and availability represent critical factors for any brokerage operation. However, specific information about CLSA's support infrastructure was not available in the reviewed sources. This absence of detail makes it impossible to assess response times, available communication channels, service hours, or the quality of support provided to clients.

Given CLSA's focus on institutional and sophisticated investors, the customer service model likely emphasizes relationship management rather than high-volume retail support. This approach typically involves dedicated account managers and specialized support teams familiar with complex trading requirements and Asian market nuances.

The company's Hong Kong base and Asian market focus suggest potential for multilingual support, particularly for Chinese, English, and other Asian languages. However, without specific information about support availability, language options, or service quality metrics, assessment remains speculative.

The employee rating of 2.8/5 from 90+ staff members raises questions about internal satisfaction levels, which could potentially impact customer service quality. While employee satisfaction doesn't directly correlate with customer service quality, it can be an indicator of overall organizational health and staff motivation levels.

For potential clients, the lack of publicly available customer service information necessitates direct inquiry about support availability, response times, and service standards before committing to the platform.

The trading experience offered by CLSA centers around the InfoReach Trade Management System. This system provides a foundation for professional-grade trading activities. However, specific details about execution quality, platform stability, order types, and user interface design were not available in the source materials. This makes comprehensive assessment challenging.

Professional trade management systems like InfoReach typically offer advanced order management capabilities, real-time risk monitoring, and institutional-quality execution features. These systems are designed for sophisticated users who prioritize functionality over simplified interfaces. This aligns with CLSA's apparent target market of institutional and experienced investors.

The multi-asset capability suggests support for various trading strategies and investment approaches. However, specific details about asset coverage, execution speeds, and platform reliability were not disclosed. For traders accustomed to modern retail platforms with extensive charting tools, news feeds, and analytical features, the lack of information about these supplementary features represents a concern.

The absence of detailed information about mobile trading capabilities, platform customization options, and user experience features suggests either limited offerings in these areas or a preference for direct client consultation. In today's trading environment, mobile accessibility and user-friendly interfaces have become standard expectations. This makes the information gap particularly notable.

This clsa review emphasizes that potential clients should thoroughly test platform capabilities through demos or trial periods before committing to trading activities.

CLSA's trust and reliability assessment presents a mixed picture based on available information. The company's establishment in 1986 and nearly four decades of operation in Asian markets demonstrate longevity and market survival through various economic cycles. This extended operational history suggests fundamental business stability and client retention capabilities.

The firm's positioning as an independent brokerage, separate from major banking institutions, offers both advantages and potential concerns. Independence allows for more objective research and reduced conflicts of interest. This can benefit clients seeking unbiased market analysis. However, independence also means potentially less regulatory oversight and financial backing compared to subsidiaries of major banks.

The absence of detailed regulatory information in available sources represents a significant transparency concern. In today's regulatory environment, most reputable brokerages prominently display their licensing information, regulatory compliance status, and client protection measures. CLSA's limited public disclosure in this area necessitates direct verification of regulatory status and client protection mechanisms.

The employee rating of 2.8/5 from over 90 staff members raises questions about internal satisfaction and potentially organizational management quality. While this doesn't directly impact client funds safety, it could indicate internal issues that might affect service quality or business stability.

For potential clients, the combination of long operational history and regulatory transparency gaps creates a situation requiring thorough due diligence and direct verification of licensing and client protection measures.

User experience assessment for CLSA proves challenging due to limited available feedback and information about client-facing services. The employee rating of 2.8/5 from 90+ staff members provides the primary quantitative indicator. This suggests moderate satisfaction levels within the organization. While employee satisfaction doesn't directly translate to client experience, it can indicate overall organizational health and service quality potential.

The focus on institutional and sophisticated investors suggests that CLSA's user experience model prioritizes relationship management and personalized service over mass-market retail features. This approach typically involves dedicated account managers, customized service levels, and direct communication channels. It differs from self-service platforms and automated support systems.

The use of InfoReach TMS indicates a preference for professional-grade tools that prioritize functionality and reliability over user-friendly interfaces designed for retail traders. This choice aligns with serving sophisticated clients who value execution quality and advanced features over simplified user experiences.

However, the lack of detailed information about onboarding processes, account management procedures, digital service offerings, and client feedback represents significant information gaps. Modern investors, even sophisticated ones, increasingly expect streamlined digital experiences alongside traditional relationship management.

The absence of publicly available client testimonials, case studies, or detailed service descriptions suggests either limited marketing focus or a preference for relationship-based business development. For potential clients, this necessitates direct engagement to understand service levels and user experience quality.

This comprehensive clsa review reveals a company with significant historical presence and specialized expertise in Asian markets, particularly China. However, there are notable transparency gaps that require careful consideration. CLSA's positioning as Asia's leading independent brokerage since 1986 demonstrates market longevity and specialized knowledge that could benefit investors seeking Asian market exposure.

The company appears best suited for institutional investors and sophisticated individuals who prioritize independence and specialized Asian market expertise over comprehensive retail features and transparent pricing structures. The use of professional-grade platforms like InfoReach TMS supports this positioning. However, the lack of detailed information about costs, regulatory status, and service features creates uncertainty.

Key strengths include nearly four decades of market experience, independence from major banking institutions, and specialized focus on Chinese capital markets. Primary concerns involve limited transparency regarding regulatory oversight, account conditions, and service specifics. These are combined with moderate employee satisfaction ratings that may indicate internal challenges.

Potential clients should conduct thorough due diligence, including direct verification of regulatory status, detailed discussion of account terms, and comprehensive understanding of service offerings before engaging with CLSA's services.

FX Broker Capital Trading Markets Review