Brilliant Global 2025 Review: Everything You Need to Know

Executive Summary

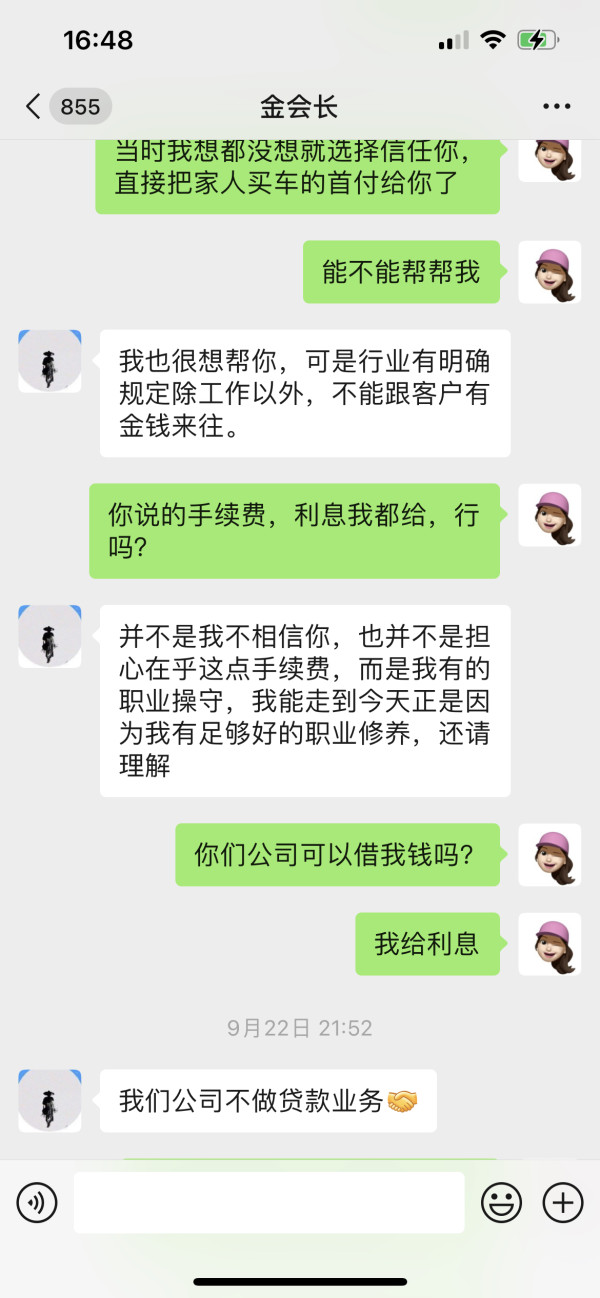

This brilliant global review shows a forex broker that has serious problems with basic services. Brilliant Global started in 2015 and is registered in China, but it has earned an extremely poor user rating of 1 out of 10, with service quality marked as "C Poor" across all areas we checked. The broker only serves 163 traders, which is very small, though it does offer VPS trading environments as one of its few good features.

The broker's performance creates major warning signs for people thinking about investing. Brilliant Global tries to help individual traders who want VPS trading solutions, but the terrible feedback about customer service and the missing regulatory information should make anyone very worried about whether they can trust this company. The tiny number of users and poor ratings mean traders should be extremely careful before choosing this platform.

Important Notice

Investors should know that this review of Brilliant Global uses limited information, and we could not find specific details about regulations. The broker does not share much information about how it operates, and important details about licenses and oversight are not clear. This brilliant global review comes from user feedback and market data we could find, without looking at individual investment experience or special cases.

Different regions may have different rules, so potential clients should check the regulatory status and whether the broker is legitimate before working with them. This review shows general market observations and should not be treated as personal investment advice.

Rating Framework

Broker Overview

Brilliant Global started trading forex in 2015 as a platform registered in China, trying to serve the growing demand for foreign exchange trading in the region. The company keeps its business model simple and focuses mainly on forex trading services, without adding other financial products or complete investment services that many competitors offer. This narrow focus was probably meant to help them become experts in forex markets, but they have not done as well as industry standards require.

The broker's approach centers on giving basic forex trading access to individual traders, with special focus on VPS trading environments. However, the platform has had trouble building a strong position in the market, keeping only 163 users since it started almost ten years ago. The slow growth suggests either very strict access rules or basic service problems that have stopped more people from using it. Information shows that Brilliant Global has not tried aggressive marketing or expansion strategies, instead keeping a low profile in the competitive forex broker world.

Important information is missing about Brilliant Global's trading platform technology, types of assets, and regulatory oversight. The lack of detailed information about trading platforms, available currency pairs, and regulatory compliance creates uncertainty about what the broker can do and whether it follows legal requirements in the forex industry.

Regulatory Oversight: Available sources do not name any regulatory authorities that watch over Brilliant Global's operations, which immediately raises concerns about compliance and investor protection standards.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees is not shared in available documents.

Minimum Deposit Requirements: The broker has not published clear information about minimum account funding requirements, making it hard for potential clients to know if they can afford it.

Promotional Offerings: No information is available about welcome bonuses, trading incentives, or promotional programs that might attract new traders to the platform.

Tradeable Assets: The range of available trading instruments, including currency pairs, commodities, or other financial products, has not been clearly specified in sources we can access.

Cost Structure: Important pricing information including spreads, commission rates, overnight financing charges, and other trading costs is not shared, preventing accurate cost analysis.

Leverage Options: Maximum leverage ratios and margin requirements have not been specified, limiting traders' ability to assess risk management parameters.

Platform Selection: Details about trading platform options, whether they made their own or use third-party solutions like MetaTrader, are not available in current sources.

Geographic Restrictions: Information about regional limitations or restricted territories is not specified in available documents.

Customer Service Languages: The range of supported languages for customer support services is not specified.

This brilliant global review shows major transparency problems that potential clients should carefully consider before trying to open accounts.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Brilliant Global show a concerning lack of transparency and detailed information. Available sources give no specific details about account types, tier structures, or the features that make different account categories different from each other. This absence of basic account information makes it impossible for potential traders to make smart decisions about which account type might work for their trading style and how much money they have.

The minimum deposit requirements are not shared, which is very unusual in an industry where being clear about entry barriers is considered normal practice. Without clear deposit information, traders cannot tell whether the broker targets retail or institutional clients, or how easy the platform might be for traders with different amounts of money. The account opening process details are also missing, leaving questions about verification requirements, what documents are needed, and how long approval takes.

Special account features that are becoming more important in modern forex trading, such as Islamic accounts that follow Sharia law, commission-free structures, or professional trader accounts with better leverage, are not mentioned in available sources. The user rating of 1 out of 10 suggests that even existing account holders are extremely unhappy with the conditions and features provided. This brilliant global review cannot find any good account advantages that would make this broker different from competitors, which represents a major weakness in their service offering.

Brilliant Global's trading tools and resources appear to be very limited based on available information. The broker has not shared details about analytical tools, charting packages, or technical indicators that are essential for making informed trading decisions. Modern forex traders expect complete analysis tools, real-time market data, and sophisticated charting capabilities, none of which are clearly described in the broker's available documents.

Research and analysis resources, which are crucial for both new and experienced traders, appear to be either missing or not prominently featured. Quality brokers typically provide market analysis, economic calendars, news feeds, and expert commentary to help traders understand market movements and make educated trading decisions. The lack of information about such resources suggests either they don't exist or the broker does a poor job marketing available features.

Educational resources represent another major gap in Brilliant Global's offering. The modern forex industry recognizes how important trader education is, with leading brokers providing webinars, tutorials, trading guides, and educational articles. No mention of educational support appears in available sources, which could explain the limited user base and poor satisfaction ratings. Automated trading support, including Expert Advisor compatibility and algorithmic trading tools, is not addressed in information we can access, limiting appeal to technologically sophisticated traders.

Customer Service and Support Analysis (Score: 2/10)

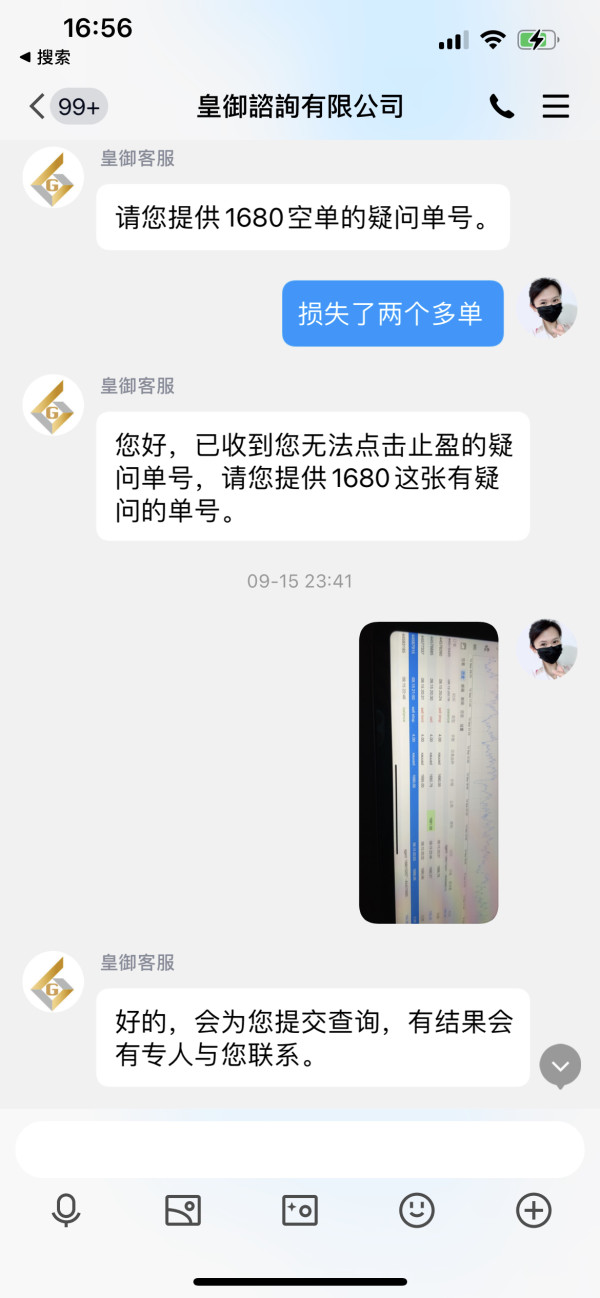

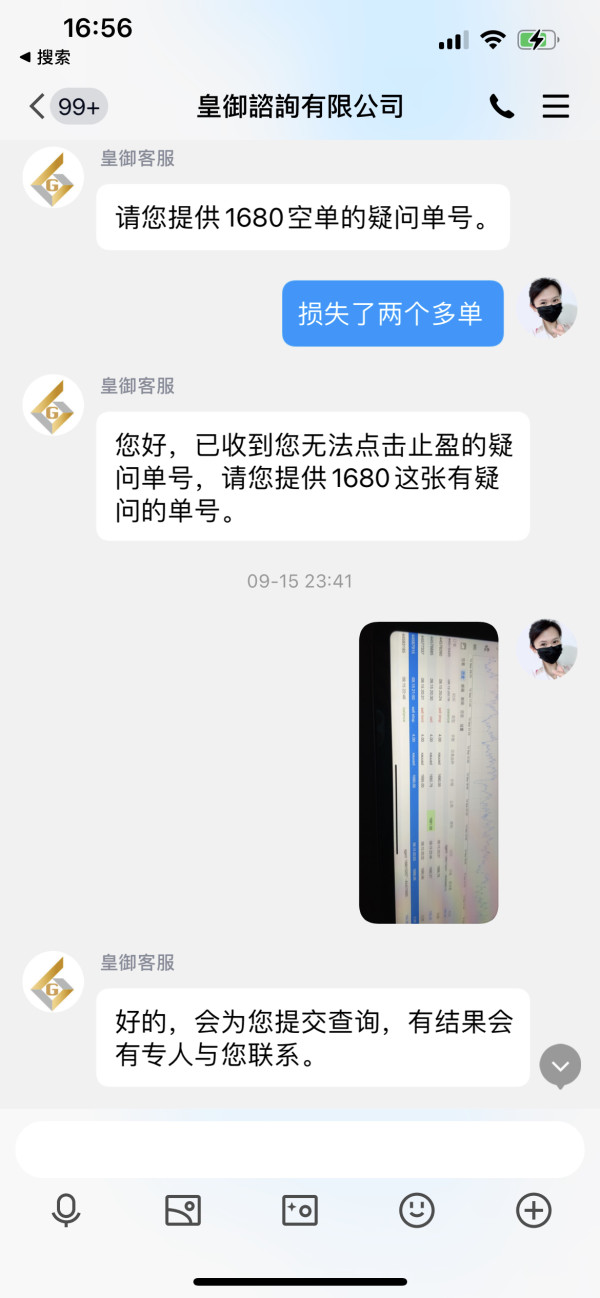

Customer service represents one of Brilliant Global's biggest weaknesses, with user feedback consistently showing poor service quality rated as "C Poor" across evaluation metrics. The specific channels available for customer support, including phone, email, live chat, or ticket systems, are not clearly documented in available sources. This lack of transparency about support access methods creates immediate concerns about how traders can get help when problems happen.

Response time performance appears to be a major problem based on user feedback, though specific service level agreements or typical response times are not published. In the competitive forex industry, traders expect quick resolution of technical issues, account problems, and trading questions. The poor service rating suggests that Brilliant Global fails to meet these basic expectations, potentially leaving traders without adequate support during critical trading situations.

The quality of service interactions, based on available feedback, falls well below industry standards. Professional forex brokers typically maintain knowledgeable support teams capable of addressing technical trading questions, platform issues, and account management concerns. The consistently poor ratings suggest either inadequately trained support staff or insufficient resources dedicated to customer service operations. Multi-language support capabilities and service hours are not specified, which could further limit accessibility for international traders requiring assistance outside standard business hours.

Trading Experience Analysis (Score: 2/10)

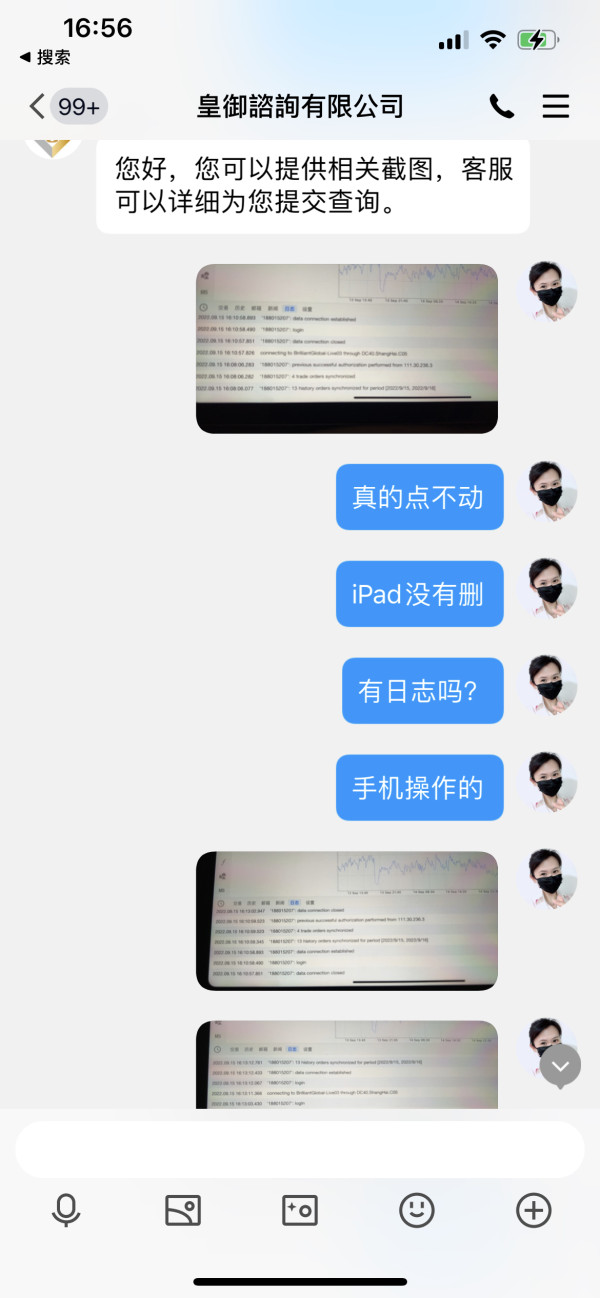

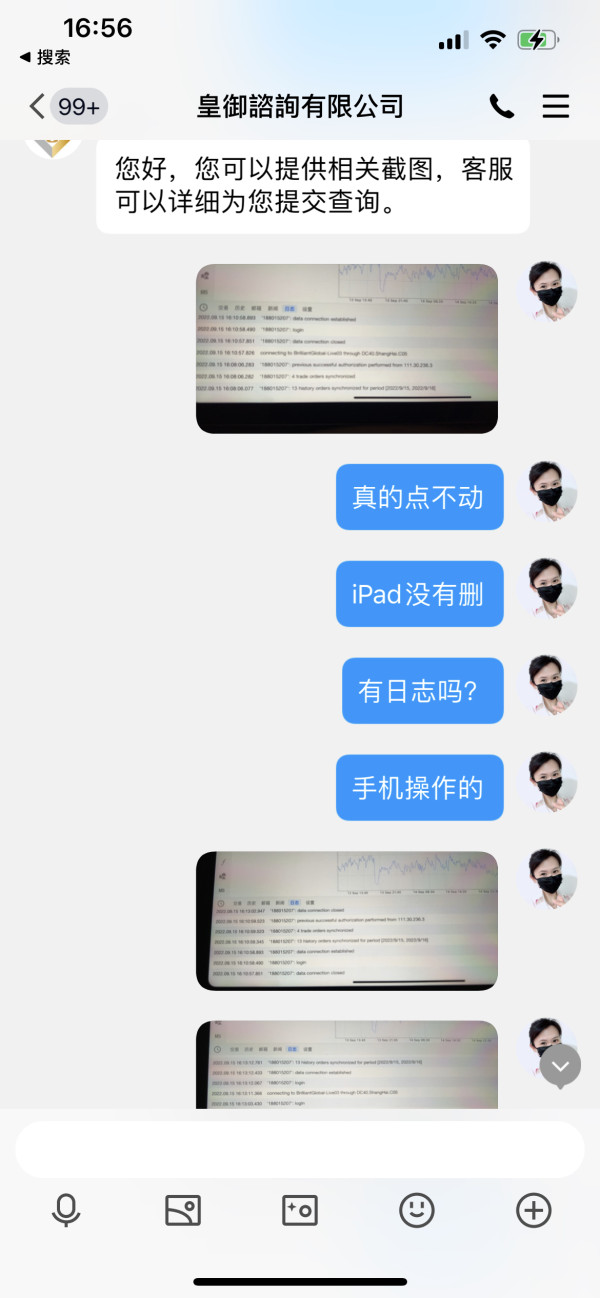

The trading experience provided by Brilliant Global appears to suffer from multiple problems that significantly impact user satisfaction. Platform stability and execution speed, which are fundamental to successful forex trading, are not adequately documented or promoted by the broker. Modern traders require reliable platform performance with minimal downtime and fast order execution to take advantage of market opportunities and manage risk effectively.

Order execution quality represents a critical concern, as available sources provide no information about execution methods, slippage rates, or order fill statistics. Professional traders need confidence that their orders will be executed at requested prices without significant delays or price changes. The absence of execution quality data suggests either poor performance or lack of transparency about trading conditions.

Platform functionality completeness cannot be assessed based on available information, as specific trading platform details are not disclosed. Essential features such as advanced order types, risk management tools, charting capabilities, and mobile trading access are not described. The limited user base of 163 traders over nearly a decade suggests that the trading experience fails to meet market expectations or attract new users through positive recommendations.

This brilliant global review cannot identify positive aspects of the trading experience based on available feedback and documentation, showing fundamental problems in platform quality and trading environment.

Trustworthiness Analysis (Score: 1/10)

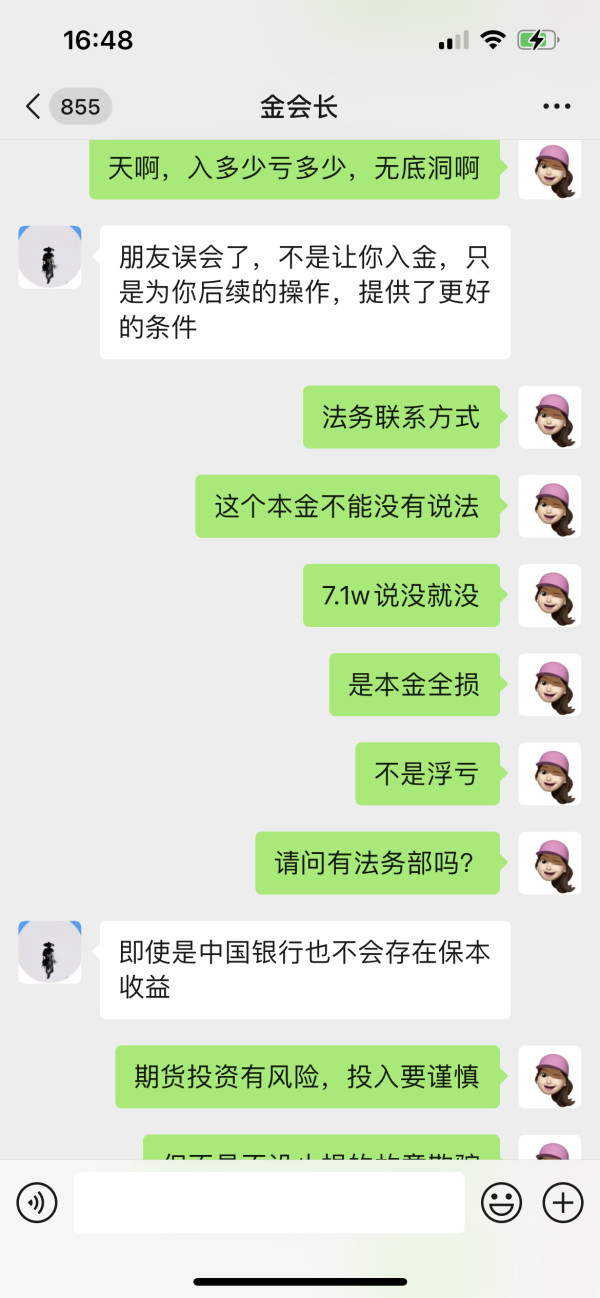

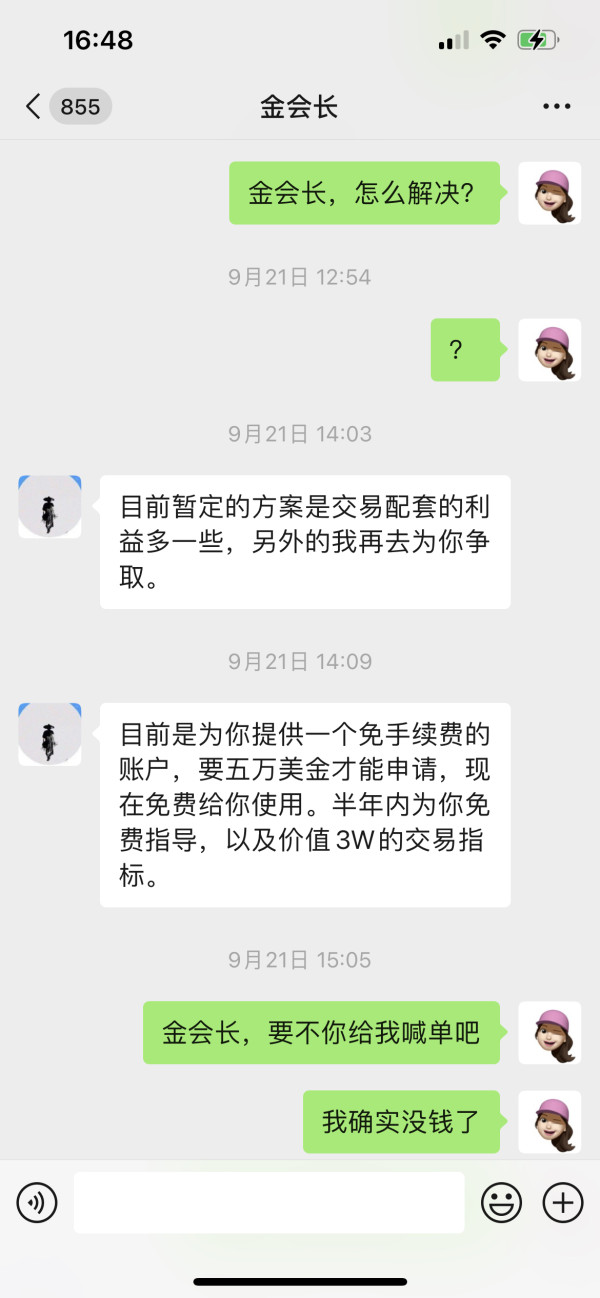

Trustworthiness represents perhaps the most critical concern regarding Brilliant Global, with multiple factors contributing to significant credibility issues. The absence of clear regulatory information in available sources creates immediate red flags about the broker's legal standing and compliance with financial services regulations. Reputable forex brokers typically prominently display their regulatory licenses and oversight authorities, as this information is crucial for trader confidence and legal protection.

Fund safety measures, including segregated client accounts, deposit insurance, and negative balance protection, are not described in documents we can access. These protections are considered essential in the modern forex industry, and their absence or lack of disclosure raises serious concerns about client fund security. Without clear information about how client deposits are protected, traders face potentially significant risks to their money.

Company transparency issues extend beyond regulatory disclosure to include basic operational information. The limited availability of detailed information about company operations, management, and business practices suggests either poor communication or potential concerns about operational legitimacy. Industry reputation appears to be severely damaged, as evidenced by the extremely low user rating of 1 out of 10, showing widespread dissatisfaction among the limited user base.

The WikiFX rating of 1 further reinforces concerns about the broker's credibility and operational standards, suggesting that independent evaluation platforms have identified significant issues with Brilliant Global's services and practices.

User Experience Analysis (Score: 2/10)

User experience with Brilliant Global appears to be consistently poor across multiple touchpoints, as evidenced by the extremely low satisfaction rating of 1 out of 10. Overall user satisfaction levels show fundamental failures in service delivery, platform usability, and customer relationship management. The small user base of 163 traders suggests that the platform either fails to attract new users or struggles to keep existing clients due to poor experience quality.

Interface design and usability information is not available in sources we can access, preventing assessment of whether the platform provides easy navigation and efficient trading workflows. Modern traders expect sophisticated yet user-friendly interfaces that enable quick trade execution and easy access to account management features. The poor user ratings suggest that interface design may be outdated or poorly implemented.

Registration and verification processes are not detailed in available sources, though user feedback suggests potential issues with account setup and onboarding procedures. Streamlined registration with clear verification requirements is essential for positive first impressions and user retention. Fund operation experience, including deposit and withdrawal processes, appears to be problematic based on overall satisfaction ratings.

Common user complaints appear to center primarily around customer service quality, though specific complaint categories are not detailed in available sources. The broker appears most suitable for traders specifically interested in VPS trading environments, though even this specialized user group should exercise significant caution given the overall service quality concerns.

Conclusion

This comprehensive brilliant global review reveals a forex broker with significant operational and service quality problems that make it difficult to recommend to traders seeking reliable trading partners. Brilliant Global's performance across all evaluation criteria falls well below industry standards, with particularly concerning issues in customer service, transparency, and overall user satisfaction. The broker's user rating of 1 out of 10 and "C Poor" service classification reflect fundamental problems that have continued throughout its operational history.

While the broker offers VPS trading environments that may appeal to specific trader segments interested in automated trading solutions, these limited advantages are overshadowed by substantial concerns about regulatory transparency, customer service quality, and overall operational reliability. The extremely small user base and poor satisfaction ratings suggest that most traders would be better served by alternative brokers with stronger track records and more comprehensive service offerings.

Potential clients should exercise extreme caution and conduct thorough research before considering Brilliant Global for their forex trading activities, particularly given the absence of clear regulatory oversight and the consistently negative user feedback regarding service quality and support responsiveness.