Be Prime Broker 2025 Review: Everything You Need to Know

Executive Summary

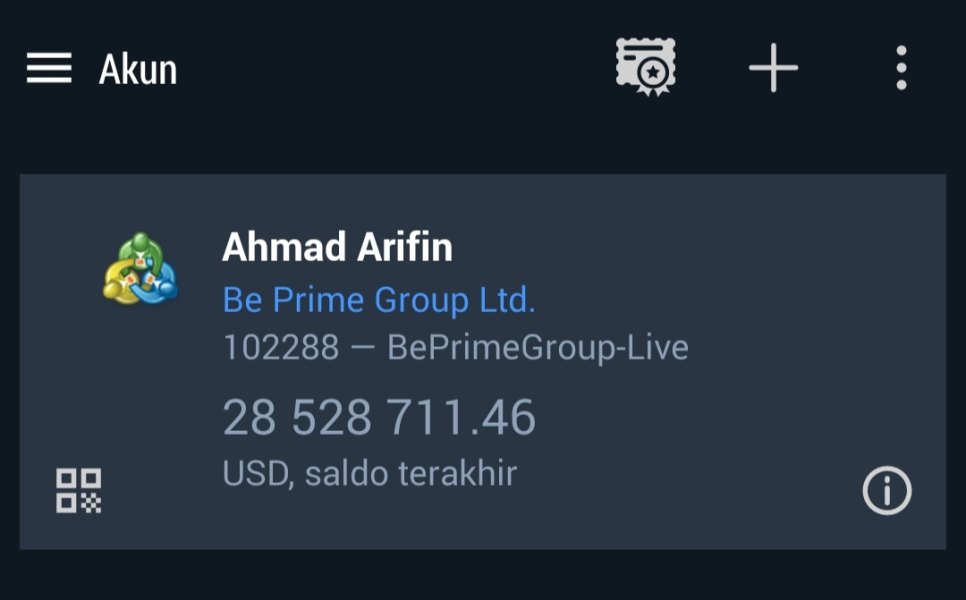

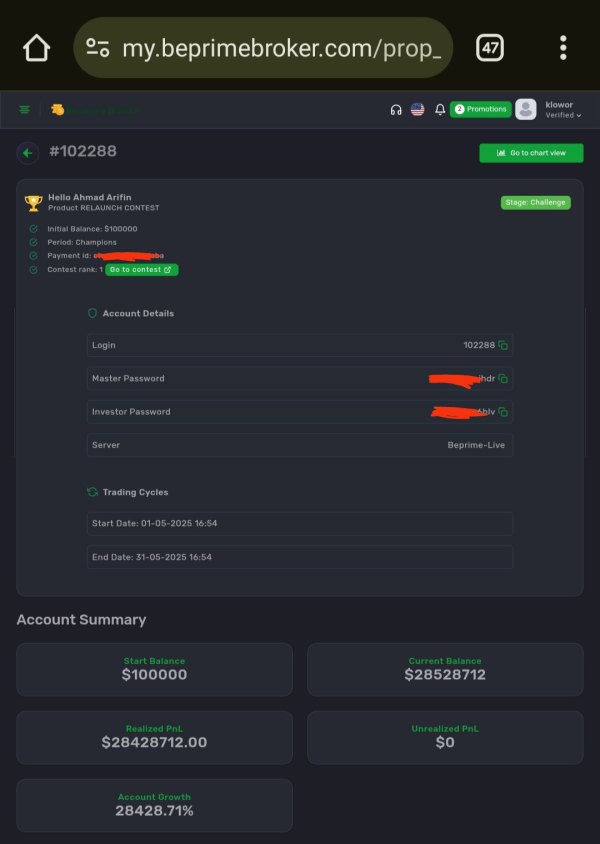

Be Prime Broker is a new player in the forex trading world. The company operates under BePrimeGroup Ltd. and offers trading in forex, derivatives, and synthetic indices to investors worldwide.

This Be Prime Broker review shows mixed results about the company's reputation. The platform has earned a 4-star rating from some users, which suggests decent satisfaction among certain traders. However, the broker's TrustScore stands at only 1 point based on 21 user reviews, which raises serious concerns about trust and reliability.

The platform targets investors who want to trade different types of assets through one account. Be Prime Broker markets itself as a complete solution for traders interested in forex markets, derivative instruments, and synthetic indices. However, the limited information about specific features and regulatory oversight means potential clients should research carefully before signing up.

Important Disclaimers

Prospective traders should be very careful when considering Be Prime Broker. The regulatory information about this broker is unclear from available sources, and comprehensive details about their operations remain limited.

Users should verify all regulatory credentials, terms of service, and operational details directly with the broker before investing any money. Different countries have different legal requirements and protections for forex trading, so traders must ensure they comply with their local regulations. This review does not provide investment advice or recommend trading with this broker.

Rating Framework

Broker Overview

Be Prime Broker operates under BePrimeGroup Ltd. as a new company in the global forex and CFD trading sector. The broker has positioned itself as a comprehensive trading platform that provides access to foreign exchange markets, derivative instruments, and synthetic indices. Specific founding details and company history information are not available in public sources, but the broker appears to target retail traders seeking diverse investment opportunities.

The company's business model focuses on offering CFD and derivative trading services to serve as a complete solution for traders. Be Prime Broker markets itself as providing access to forex pairs, commodities, and synthetic indices, which suggests a broad approach to meet different trading preferences. However, the limited publicly available information about the company's background, leadership team, and operational history shows the broker's relatively new market presence.

Despite achieving a 4-star rating in some user evaluations, the low TrustScore raises questions about operational consistency and client satisfaction. This Be Prime Broker review finds that while the broker offers multiple trading instruments, the lack of detailed information about trading platforms, regulatory oversight, and specific service features suggests potential clients should conduct thorough research before committing to the platform.

Regulatory Status: Available information does not specify the regulatory jurisdictions or licensing authorities overseeing Be Prime Broker's operations. This represents a significant concern for potential clients seeking regulatory protection.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and fees for deposits and withdrawals is not detailed in accessible sources.

Minimum Deposit Requirements: The broker's minimum deposit requirements for different account types remain unspecified in available documentation.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not available from current sources.

Trading Assets: Be Prime Broker provides access to forex currency pairs, derivative instruments, and synthetic indices. This offers traders exposure to multiple financial markets through a single platform.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available materials. This makes it difficult to assess the broker's competitiveness in pricing.

Leverage Options: Maximum leverage ratios and margin requirements across different asset classes are not specified in accessible broker information.

Platform Selection: Technical specifications about trading platforms are unclear from available sources. This includes whether the broker offers MetaTrader, proprietary platforms, or web-based solutions.

Geographic Restrictions: Information about jurisdictional limitations or restricted countries is not specified in current materials.

Customer Support Languages: Available support languages and communication channels are not detailed in accessible documentation.

This Be Prime Broker review highlights the significant information gaps that potential clients should address through direct broker contact before making trading decisions.

Account Conditions Analysis

The evaluation of Be Prime Broker's account conditions reveals substantial information limitations that affect the overall assessment. Available sources do not provide specific details about the various account types offered, their respective features, or the minimum deposit requirements for each tier. This lack of transparency about account structure makes it challenging for potential clients to understand what trading conditions they might expect.

Clear information about account opening procedures, verification requirements, or activation time is not available. The absence of details about special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the broker's appeal to diverse client segments.

The limited available information suggests that Be Prime Broker may offer standard retail trading accounts. However, specific features such as minimum trade sizes, maximum position limits, or account-specific benefits remain unclear, which is particularly concerning for traders who need to understand their trading environment fully before committing funds.

The lack of detailed information about account maintenance fees, inactivity charges, or other account-related costs makes it difficult to assess the true cost of maintaining a trading relationship with the broker. This Be Prime Broker review emphasizes that potential clients should directly contact the broker to obtain comprehensive account condition details before making any commitments.

Be Prime Broker's offering of multiple asset classes including forex, derivatives, and synthetic indices suggests a platform designed to serve diverse trading strategies. However, the evaluation reveals limited information about the specific analytical tools, research resources, and educational materials available to traders. This gap significantly impacts the assessment of the broker's value proposition for both novice and experienced traders.

The absence of detailed information about charting capabilities, technical analysis tools, or fundamental analysis resources raises questions about the platform's suitability for serious traders. Modern forex trading increasingly depends on sophisticated analytical tools, and the lack of specific information about these features represents a notable limitation.

Educational resources play a crucial role in trader development, particularly for newcomers to the forex market. However, available sources do not specify whether Be Prime Broker provides educational webinars, trading guides, market commentary, or other learning materials. These resources could help clients improve their trading skills and market understanding.

The platform's support for automated trading, expert advisors, or algorithmic trading strategies also remains unclear from available information. As many traders increasingly rely on automated solutions, this information gap could significantly impact the broker's appeal to technically sophisticated clients who require advanced trading capabilities and integration options.

Customer Service and Support Analysis

The assessment of Be Prime Broker's customer service capabilities faces significant limitations due to the absence of specific information about support channels, availability, and service quality. Available sources do not detail whether the broker provides phone support, live chat, email assistance, or other communication methods for client inquiries and issue resolution.

Response time expectations remain unspecified, which are crucial for traders who may need immediate assistance during market hours. The lack of information about customer service availability across different time zones particularly affects international traders who may require support outside standard business hours in the broker's primary operating jurisdiction.

Service quality indicators, such as staff expertise levels, problem resolution procedures, or escalation processes for complex issues, are not documented in accessible sources. This absence of service quality information makes it difficult for potential clients to assess whether they would receive adequate support for their trading activities and account management needs.

Multi-language support capabilities, essential for serving international clients effectively, are also not specified. Given the global nature of forex trading, the availability of native-language support can significantly impact the client experience, particularly for complex technical issues or account-related inquiries that require precise communication.

The low TrustScore of 1 based on user reviews may reflect customer service challenges. However, specific feedback about support experiences is not detailed in available sources.

Trading Experience Analysis

The trading experience evaluation for Be Prime Broker encounters substantial limitations due to insufficient technical information about platform performance, execution quality, and user interface design. Available sources do not provide specific details about platform stability, order execution speeds, or the technical infrastructure supporting trading operations.

Order execution quality represents a fundamental aspect of forex trading. However, information about execution models, slippage rates, or fill quality during different market conditions remains unavailable, and traders require reliable execution, particularly during volatile market periods.

Platform functionality details, including available order types, risk management tools, and trading interface features, are not specified in accessible documentation. Modern traders expect sophisticated platform capabilities, and the lack of specific information about these features limits the ability to evaluate the broker's technological offerings.

Mobile trading experience, increasingly important as traders seek flexibility and accessibility, is not detailed in available sources. The quality of mobile applications, cross-platform synchronization, and mobile-specific features could significantly impact trader satisfaction but remain unspecified.

The trading environment's overall user-friendliness, including navigation ease, customization options, and learning curve considerations, cannot be adequately assessed without more detailed platform information. This Be Prime Broker review emphasizes that potential clients should request platform demonstrations or trial access to evaluate the trading experience firsthand.

Trust and Reliability Analysis

The trust and reliability assessment of Be Prime Broker reveals significant concerns that potential clients must carefully consider. The broker's TrustScore of 1 based on 21 user reviews represents one of the most critical red flags in this evaluation. This indicates substantial user dissatisfaction or trust issues that warrant serious attention.

Regulatory oversight information, fundamental to broker credibility, remains unclear from available sources. The absence of specific regulatory licenses, oversight authorities, or compliance certifications creates uncertainty about the legal framework governing the broker's operations and client fund protection measures.

Fund security measures, including client money segregation, deposit insurance, or compensation schemes, are not detailed in accessible documentation. These protections are essential for trader confidence, and their absence or unclear status significantly impacts the broker's reliability profile.

Company transparency regarding ownership structure, financial reporting, or operational disclosures appears limited based on available information. Transparent operations and clear corporate governance contribute significantly to broker credibility, and the apparent lack of such information raises additional concerns.

The broker's industry reputation, including any awards, recognitions, or industry partnerships, is not documented in available sources. Established brokers typically build industry recognition over time, and the absence of such credentials may reflect the broker's relatively new market presence or limited industry standing.

User Experience Analysis

The user experience evaluation for Be Prime Broker presents a complex picture with mixed signals from available feedback sources. While the broker has achieved a 4-star rating in some user evaluations, the contrasting TrustScore of 1 creates uncertainty about overall client satisfaction levels. This suggests significant variability in user experiences.

Interface design and platform usability information remains limited, making it difficult to assess how easily traders can navigate the platform, execute trades, or access account information. User-friendly design significantly impacts trader efficiency and satisfaction, particularly for newcomers to forex trading who may require intuitive interfaces.

Registration and account verification processes are not detailed in available sources, though these procedures significantly impact the initial user experience. Streamlined onboarding processes contribute to positive first impressions, while complex or lengthy procedures may discourage potential clients.

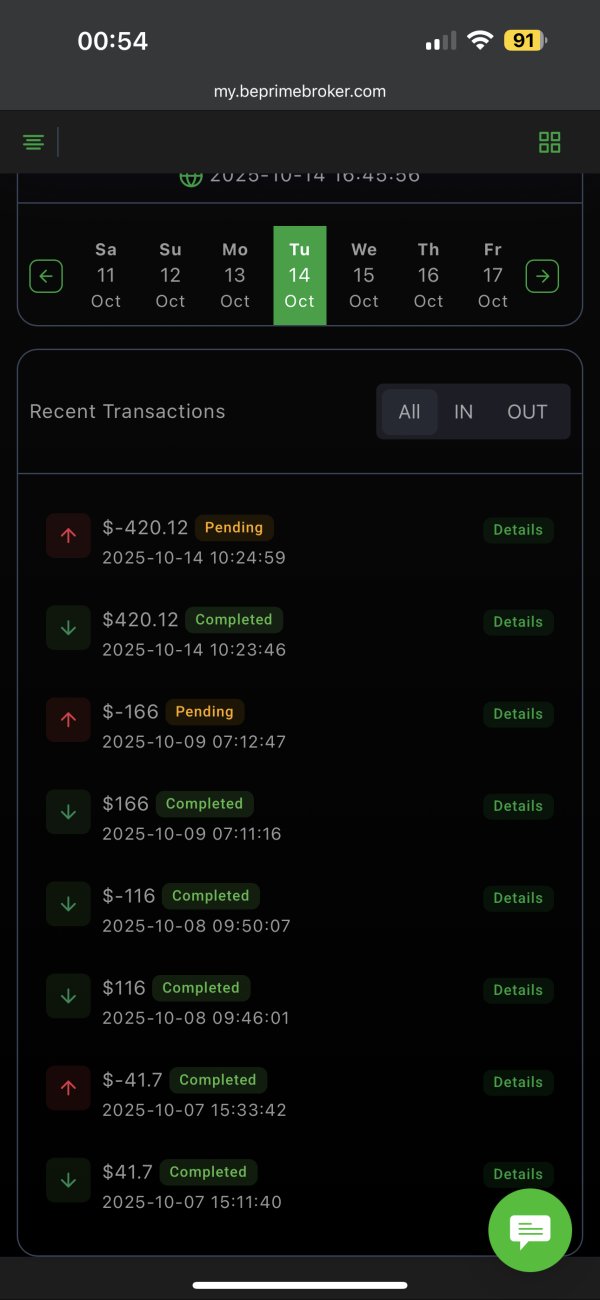

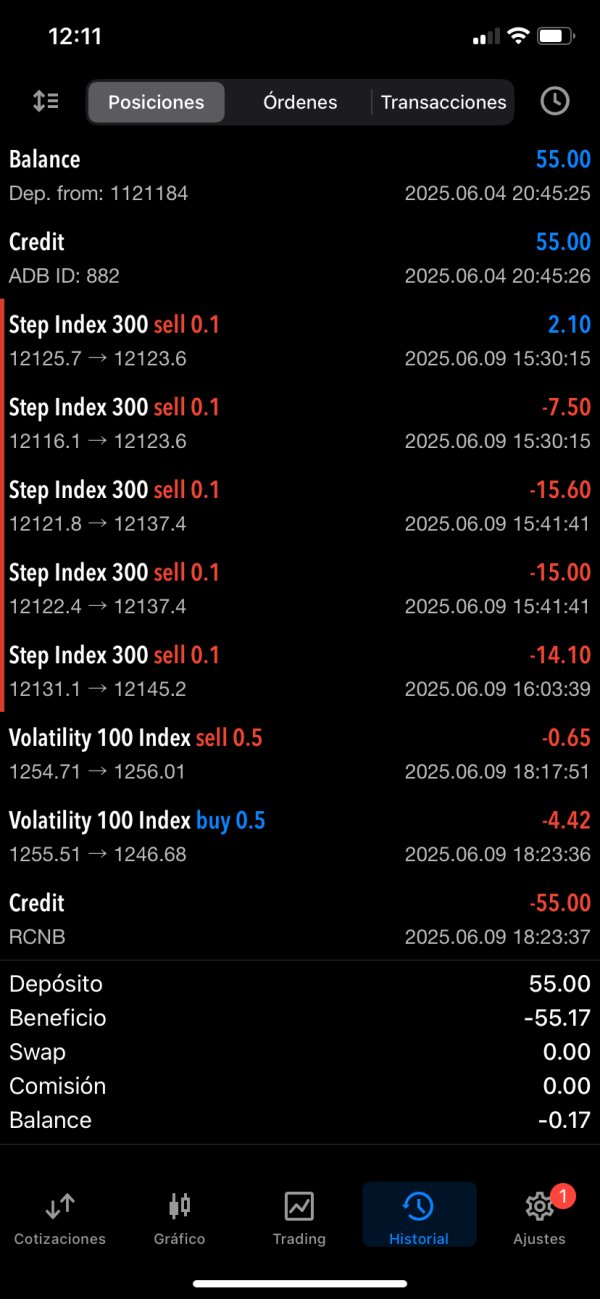

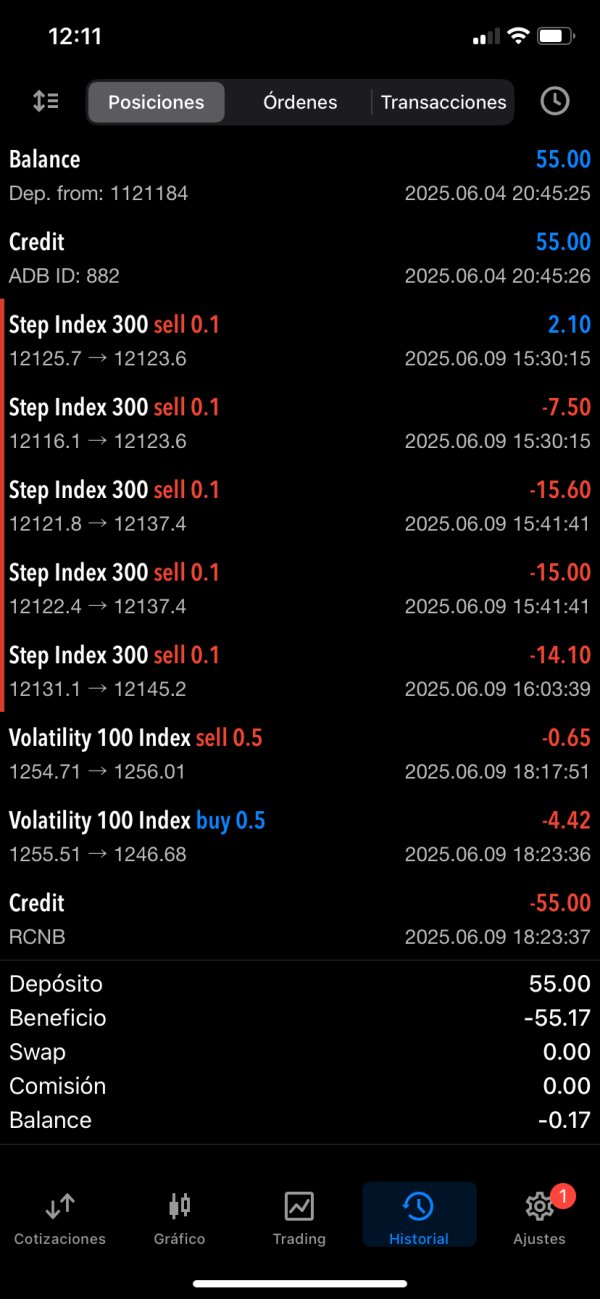

Fund management experience, including the ease of deposits, withdrawal processing efficiency, and transparency of financial transactions, cannot be adequately assessed due to limited available information. These operational aspects significantly impact user satisfaction and trust in the broker's services.

Common user complaints or recurring issues that might affect the trading experience are not specifically documented in accessible sources. Understanding typical user concerns helps potential clients anticipate possible challenges and make informed decisions about broker selection.

The apparent disconnect between the 4-star rating and the low TrustScore suggests that user experiences may vary significantly. This possibly depends on account types, trading volumes, or specific service interactions.

Conclusion

This comprehensive Be Prime Broker review reveals a brokerage operation that presents significant challenges for potential clients seeking reliable and transparent forex trading services. While the broker offers access to multiple asset classes including forex, derivatives, and synthetic indices, the substantial information gaps and concerning trust metrics suggest the need for extreme caution.

The most significant concern emerges from the broker's TrustScore of 1 based on user reviews, which directly contradicts the 4-star rating mentioned in some sources. This discrepancy, combined with the lack of clear regulatory information, creates substantial uncertainty about the broker's reliability and operational standards.

Be Prime Broker may suit traders specifically seeking access to synthetic indices and derivative instruments, provided they conduct thorough due diligence and can accept the associated risks. However, the limited transparency regarding trading conditions, costs, and regulatory oversight makes this broker unsuitable for risk-averse traders or those requiring comprehensive regulatory protection. Potential clients should prioritize direct communication with the broker to address information gaps and consider alternative, more established brokers with clearer regulatory standing and better trust metrics.