Atirox 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

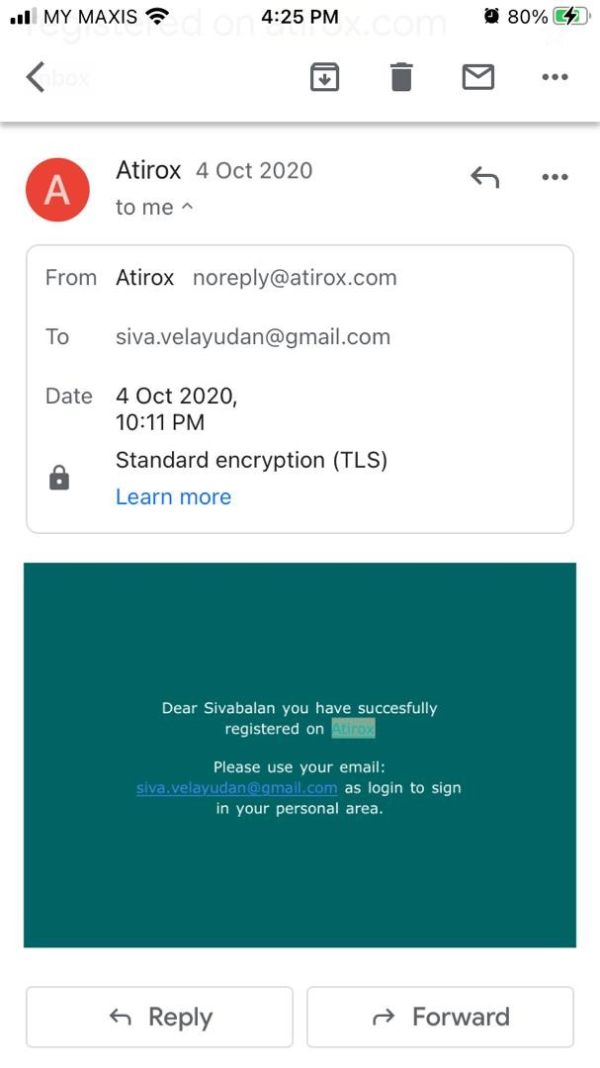

Atirox, established in 2015, operates as an unregulated forex broker out of Saint Vincent and the Grenadines. While it entices experienced traders with striking offers such as high leverage up to 1:1000 and impressively low minimum deposits starting at just $1, it also remains deeply contested due to significant concerns regarding its trustworthiness. Many users report troubling experiences, especially highlighting serious issues with fund withdrawals. Customer feedback has flagged delayed payments and outright denials that fuel apprehension about the brokers reliability. Although Atirox may initially appeal to traders willing to navigate unregulated environments, one must carefully weigh the potential high rewards against the considerable risks involved.

⚠️ Important Risk Advisory & Verification Steps

Trading with an unregulated broker like Atirox carries substantial risks:

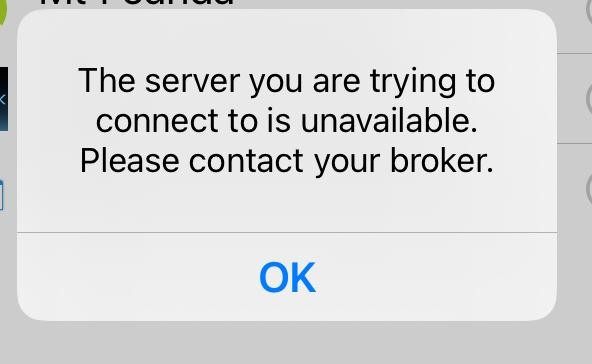

- High Likelihood of Withdrawal Issues: Numerous users have reported being unable to access their funds, raising serious red flags about the broker's operations.

- Lack of Regulatory Oversight: Being unregulated, there is no authority monitoring the broker's activities, which protects clients in case of disputes or insolvencies.

- High Trading Costs: While there are attractive leverage options, the actual trading spreads often exceed industry norms, making trades considerably more expensive.

Self-Verification Steps:

- Check Broker's Registration: Search for the broker's registration details on official financial authorities' websites to confirm legitimacy.

- Research User Experiences: Read comprehensive reviews and feedback from existing traders before investing funds.

- Examine Withdrawal Policies: Familiarize yourself with the broker's withdrawal practices and experiences shared by other users.

Broker Ratings

Broker Overview

Company Background and Positioning

Atirox, formally known as Atixox Inc., operates from Saint Vincent and the Grenadines. Although it was founded in 2015, there are significant concerns regarding its compliance with regulatory standards. Notably, while the broker claims to have a registration number with a financial authority, actual searchable proof remains elusive as no verification appears in the listings of credible regulatory bodies. This lack of transparency and accountability raises severe questions about the broker's trustworthiness and market positioning.

Core Business Overview

Atirox offers a suite of trading in forex and CFDs, where clients can access a range of financial instruments, including numerous forex pairs, indices, commodities, and up to 9 crypto trading options. The MT4 platform is the main trading interface for clients, granting access to various tools and automated trading options. However, the claims of being a true ECN broker are undercut by user reports of high spreads and fees that are not competitive with other industry offerings.

Quick-Look Details

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Beginning with trustworthiness, potential clients need to carefully dissect the contradictory regulatory claims associated with Atirox. The company asserts its registration but lacks verifiable documentation— a hallmark of unregulated brokers. Users are advised to consider methods for self-verification, such as referencing official financial websites to ascertain whether atirox complies with recognized licensing protocols.

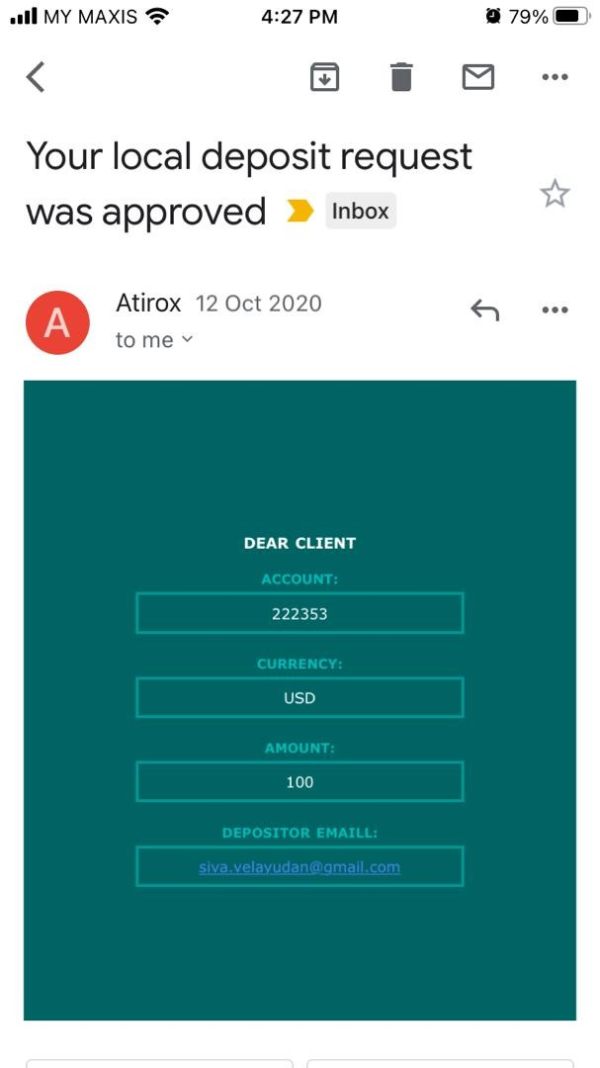

Users looking for insights into fund safety should take note of extensive negative feedback regarding withdrawal practices. Many traders have reported extended delays and outright denials of access to their accounts, highlighting the need for extreme caution when dealing with this broker.

Trading Costs Analysis

Trading with Atirox presents a double-edged sword. While the low starting commission structure can be enticing, it is crucial to consider the substantial hidden costs. For instance, user testimonials indicate spreads reaching up to 5 pips on major currency pairs, significantly higher than many regulated competitors where offers start at 1 pip, as seen in brokers like EasyMarkets.

For traders, this distinction could mean the difference between profit and loss, and thus it is paramount to assess both the advantages of high leverage combined with the "traps" of non-trading fees.

Atirox employs the MT4 platform, highly regarded in the trading community for its user-friendly interface and robust functionality. However, it falls short of offering significant differentiation as many brokers provide similar platforms. The absence of advanced tools unique to the broker is a downside, coupled with mixed reviews regarding overall user experience, emphasizing usability concerns.

User Experience Analysis

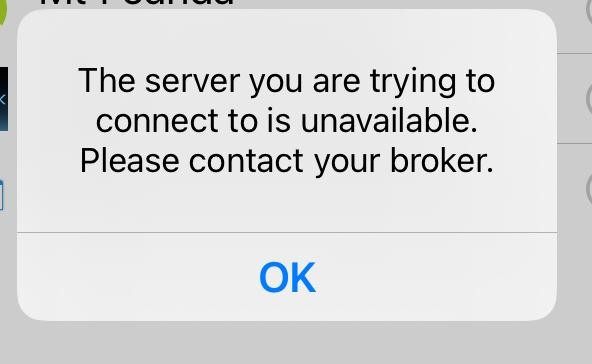

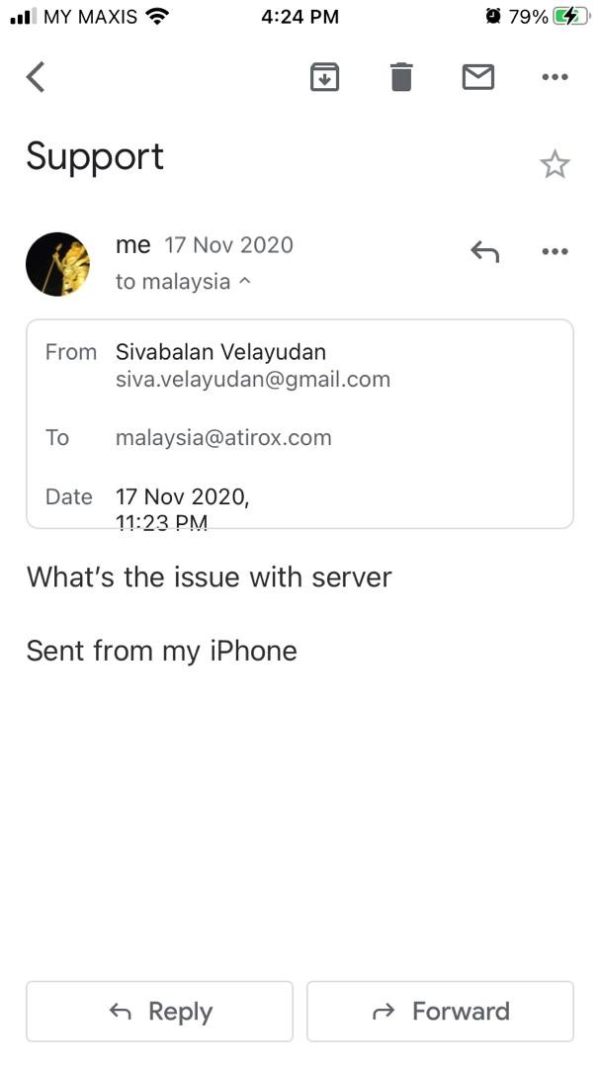

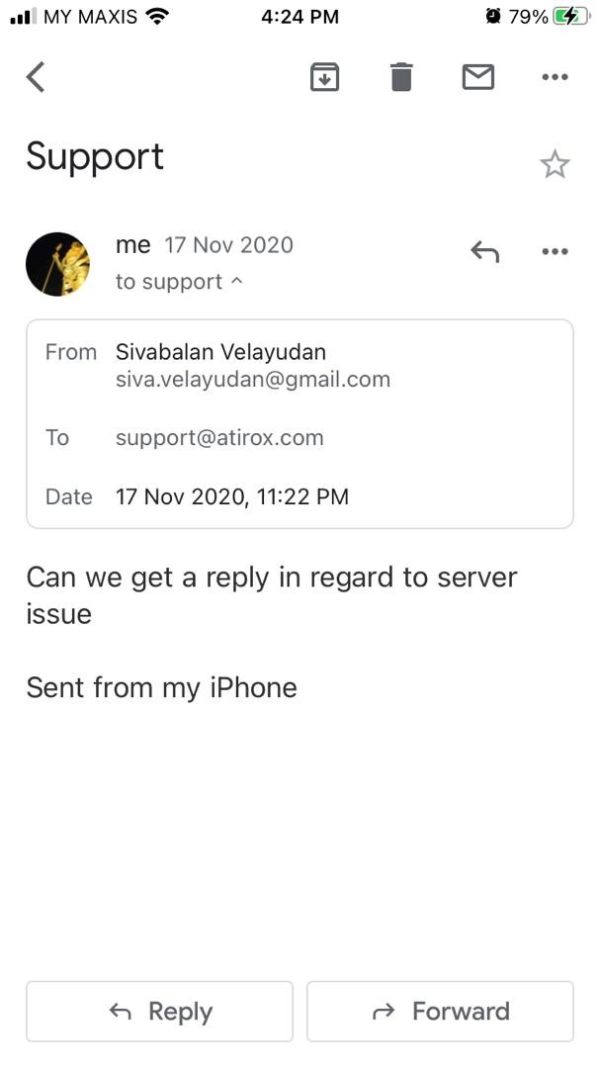

The user experience appears to be a mixed bag. While some clients appreciate the diversification of account types and trading instruments, others express dissatisfaction with the platforms usability and navigational issues. Reports of unresponsive customer service add to the dissatisfaction surrounding user interactions with the broker.

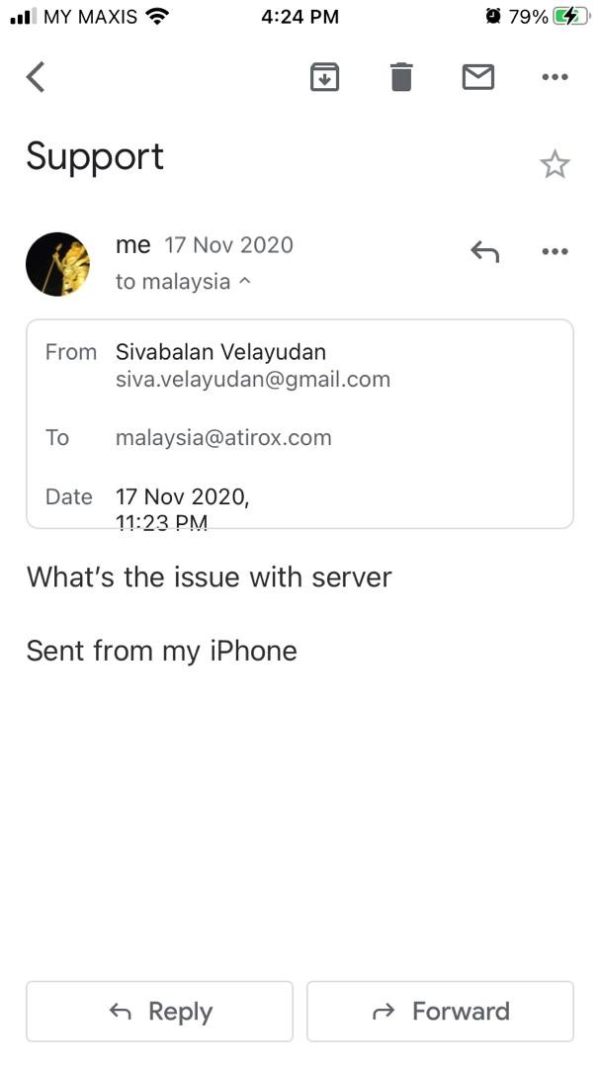

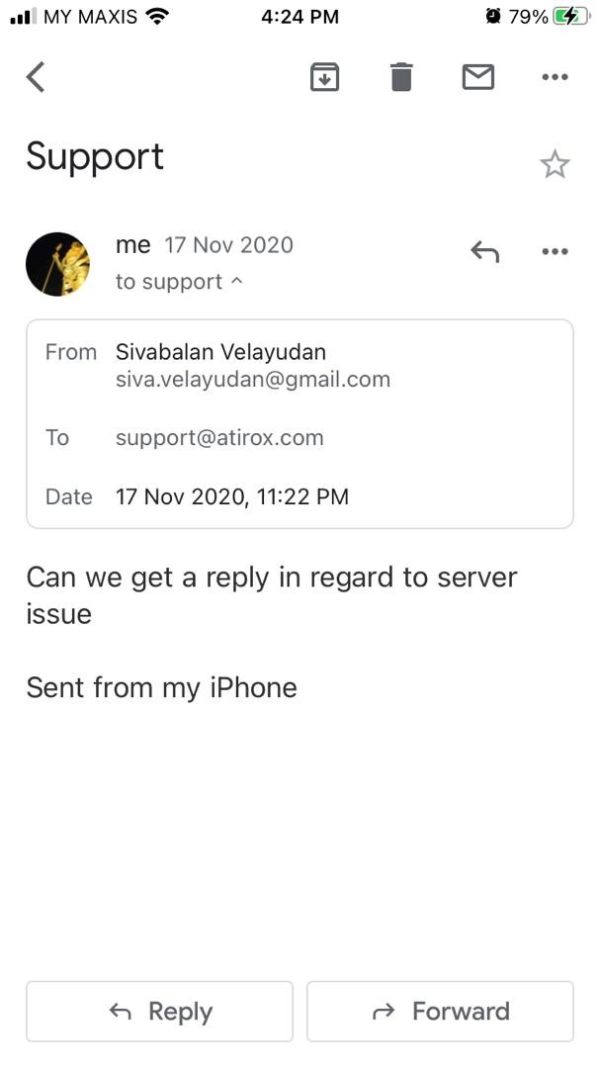

Customer Support Analysis

When it comes to customer support, Atirox faces significant challenges. With numerous reports indicating lack of response and difficulty in account management, traders might find themselves in a precarious position when seeking assistance. These issues underscore the necessity of thorough analysis and preparation before engaging with the broker.

Account Conditions Analysis

With an initial deposit starting at just $1, Atirox may initially seem appealing to novices. However, the high-risk environment with substantial leverage could lead to significant losses if not carefully navigated. Additionally, the diverse account options—ranging from Micro to Pro accounts—offer various trading conditions, but each presents substantial risks, especially in the context of high leverage.

Conclusion

Atirox poses as an intriguing option for experienced traders who can tolerate the high-risk environment associated with an unregulated broker. However, potential users should approach with extreme caution. The combination of withdrawal issues, high trading costs, and absence of reliable customer support raises significant concerns. It is essential for anyone considering trading with this broker to weigh their options and perhaps seek alternatives that promise more robust regulatory protections and customer satisfaction.

For traders interested in exploring safer options, consider platforms offering guaranteed regulatory oversight, better spread conditions, and improved customer service.