ASX Review 1

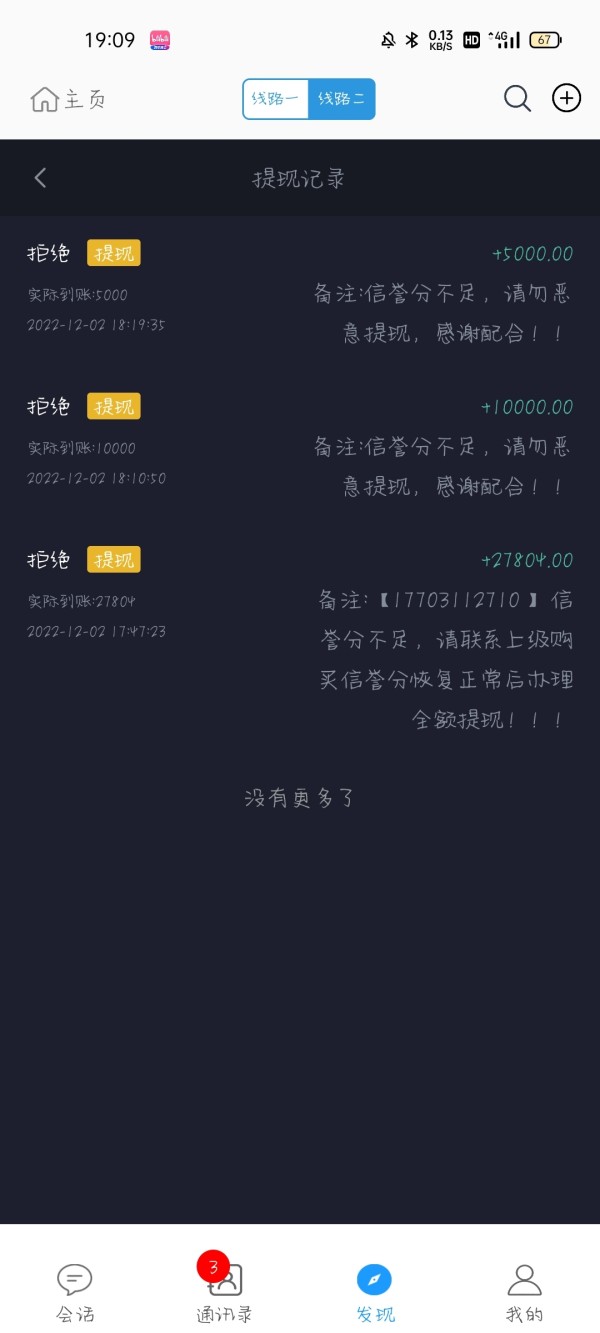

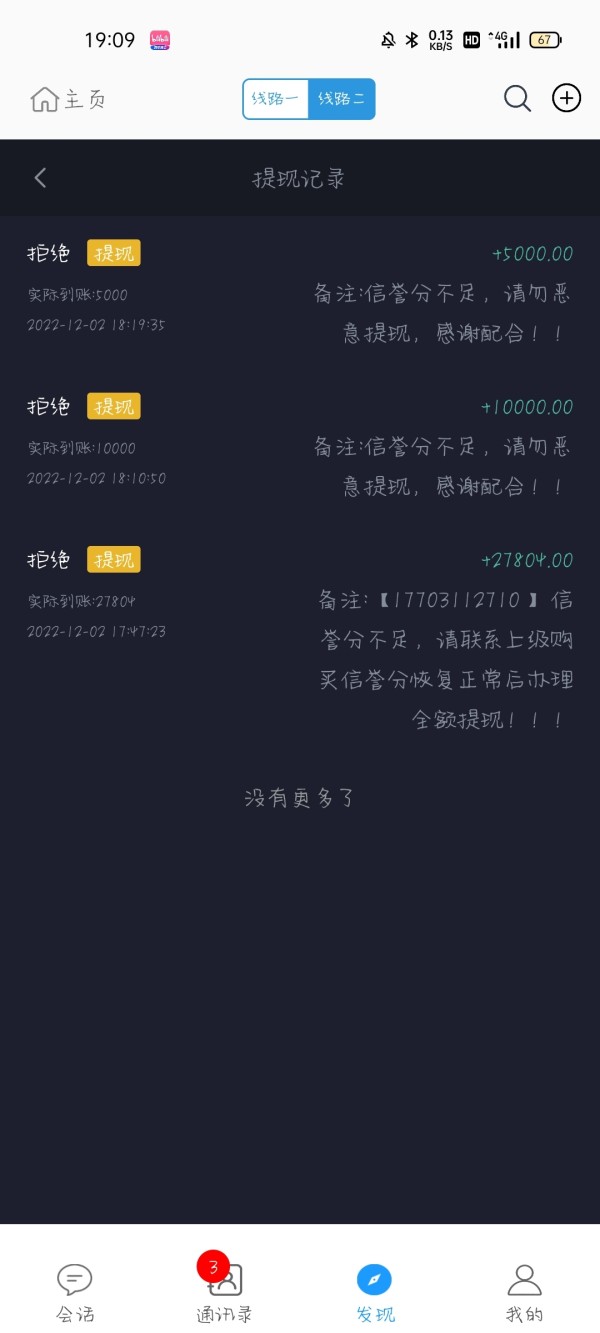

I was scammed. The platform says that my credit score is too low so I need to buy it. 2 points require 10000

ASX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I was scammed. The platform says that my credit score is too low so I need to buy it. 2 points require 10000

This comprehensive asx review examines the Australian Securities Exchange as a trading platform for 2025. ASX stands as Australia's primary stock exchange, offering diversified trading products with a reasonable commission structure that appeals to various investor types. The platform provides access to over 2,000 listed companies across multiple industries. This makes it an attractive destination for both individual and institutional investors.

Key highlights include competitive trading costs with commissions as low as $2 per trade and relatively accessible minimum deposit requirements of $50 for Australian clients. The exchange supports a wide range of asset classes including stocks, ETFs, cryptocurrencies, forex, CFDs, indices, commodities, and metals. This positions it as a comprehensive trading destination.

The platform primarily targets investors seeking diversified investment opportunities across equity markets, cryptocurrency assets, and international trading instruments. With its established market presence and global ranking among the top 15 exchanges by market capitalization, ASX continues to attract both domestic and international traders looking for reliable market access and competitive trading conditions.

Potential users should note significant variations in minimum deposit requirements based on country of residence. Amounts range from $50 for Australian clients to as much as $10,000 for other jurisdictions. This geographical disparity in account conditions requires careful consideration before account opening.

This review is based on publicly available market information and user feedback compiled from various sources. Due to limited access to certain regulatory details and internal operational data, some aspects of this evaluation may not reflect the complete picture of ASX's services and capabilities.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 8/10 | Competitive $2 commission and accessible $50 minimum deposit for Australian clients |

| Tools and Resources | 7/10 | Diverse asset classes and comprehensive trading platforms with market coverage |

| Customer Service | N/A | Insufficient information available in source materials |

| Trading Experience | N/A | Specific platform performance data not provided in available sources |

| Trust and Security | N/A | Detailed regulatory information not specified in source materials |

| User Experience | N/A | Comprehensive user feedback data not available in source materials |

ASX operates as Australia's principal stock exchange. It hosts more than 2,000 listed companies spanning diverse industries from mining and resources to technology and financial services. According to available market data, the exchange maintains its position among the world's top 15 exchanges by market capitalization. This reflects its significant role in global financial markets. The platform has evolved beyond traditional equity trading to encompass a broader range of financial instruments, adapting to modern investor demands for diversified portfolio options.

The exchange facilitates transactions through various broker partnerships. Platforms like eToro provide access to ASX-listed securities. This broker integration model allows ASX to offer both direct share ownership and CFD trading options, giving investors flexibility in their trading strategies. Unlike many CFD-focused brokers, the ASX ecosystem through partners like eToro provides underlying ASX-listed shares for direct ownership alongside leveraged trading opportunities. This caters to different risk appetites and investment approaches.

The business model centers on connecting investors to market opportunities through licensed participants and broker partnerships. This asx review reveals that the exchange supports trading across stocks, ETFs, cryptocurrencies, forex, CFDs, indices, commodities, and metals, positioning itself as a comprehensive trading destination for both domestic and international investors seeking exposure to Australian and global markets.

Regulatory Jurisdiction: Specific regulatory oversight details were not comprehensively detailed in available source materials. ASX operates under Australian financial market regulations.

Deposit and Withdrawal Methods: Available source materials did not provide detailed information about specific funding methods and withdrawal processes.

Minimum Deposit Requirements: Australian clients can open accounts with a minimum deposit of $50. International clients may face requirements ranging up to $10,000 depending on their country of residence.

Bonuses and Promotions: Current promotional offerings and bonus structures were not specified in the available source materials.

Tradeable Assets: The platform supports an extensive range of assets including stocks, ETFs, cryptocurrencies, forex, CFDs, indices, commodities, and metals. This provides comprehensive market access for diverse investment strategies.

Cost Structure: Trading costs include a $2 commission per trade for ASX stock trading through partner platforms like eToro. Additional spread information and detailed fee structures were not fully specified in available materials.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in the available source materials.

Platform Options: Trading access is facilitated through platforms such as eToro. These provide both web-based and mobile trading capabilities for ASX-listed securities.

Geographic Restrictions: Minimum deposit requirements vary significantly based on country of residence. This indicates different service levels for various jurisdictions.

Customer Support Languages: Specific language support options were not detailed in available source materials.

This asx review highlights the exchange's focus on accessibility and diverse asset coverage. Some operational details require direct inquiry with broker partners for complete information.

ASX's account structure through broker partners demonstrates strong accessibility for Australian investors. The $50 minimum deposit requirement represents one of the more reasonable entry points in the market. This low barrier to entry makes ASX trading accessible to retail investors and those beginning their investment journey. However, the significant variation in minimum deposits for international clients, potentially reaching $10,000, creates a tiered access system that may limit international participation.

The commission structure of $2 per trade for ASX stocks represents competitive pricing within the Australian market context. This flat-rate approach provides cost predictability for traders regardless of trade size, benefiting both small and large position traders. The absence of detailed information about account types suggests a streamlined approach. This asx review notes that specific account features and premium services may require direct consultation with broker partners.

Account opening processes and verification procedures were not detailed in available materials. This indicates potential variations depending on the chosen broker partner. The lack of information about Islamic accounts or other specialized account types suggests these features may not be prominently offered or may be broker-dependent.

Overall, the account conditions favor Australian residents with straightforward, cost-effective access. International clients face higher barriers that may impact the platform's global accessibility and competitiveness.

ASX provides access to a comprehensive range of trading instruments spanning traditional equities, modern cryptocurrency markets, and international assets through forex and CFD trading. The platform's strength lies in its diversity, offering stocks, ETFs, cryptocurrencies, forex, CFDs, indices, commodities, and metals under one umbrella. This breadth allows investors to implement sophisticated portfolio diversification strategies without requiring multiple broker relationships.

The integration with platforms like eToro suggests access to modern trading tools and real-time market data. Specific details about research capabilities, charting tools, and analytical resources were not comprehensively detailed in available sources. The platform reportedly provides real-time market news and analysis covering both local Australian markets and global market dynamics, supporting informed trading decisions.

Educational resources and automated trading support details were not specified in available materials. This represents potential areas for improvement or features that require direct inquiry. The absence of detailed information about advanced trading tools, algorithmic trading support, or comprehensive research platforms suggests these may be areas where ASX's broker partners differentiate their offerings.

The platform's tool set appears designed to serve both beginning and experienced traders. The depth of advanced features remains unclear from available information. This balanced approach supports the exchange's broad user base while potentially leaving room for enhancement in specialized trading tool provision.

Customer service information was notably absent from available source materials. This prevents a comprehensive evaluation of ASX's support capabilities through its broker partners. This information gap represents a significant limitation in assessing the overall user experience, as customer support quality often determines trader satisfaction and problem resolution effectiveness.

The absence of details about customer service channels, response times, and support quality suggests this area may require direct investigation by potential users. Multi-language support availability, particularly important given ASX's international client base, was not specified in available materials.

Service hours, technical support capabilities, and escalation procedures remain unclear. This makes it difficult for potential users to assess whether support services meet their trading needs. The lack of user feedback examples or customer service case studies in available materials further limits the ability to evaluate support effectiveness.

This gap in customer service information represents a notable weakness in the available data about ASX's trading ecosystem. Potential users should prioritize direct inquiry about support services when evaluating broker partners for ASX trading access.

Specific trading experience details including platform stability, execution speed, and order processing quality were not detailed in available source materials. This information gap prevents comprehensive evaluation of the actual trading environment users can expect when accessing ASX markets through broker partners.

Platform functionality details, mobile trading capabilities, and user interface quality remain unspecified. This limits the ability to assess whether the trading environment meets modern trader expectations. The absence of technical performance data, such as execution times, slippage statistics, or platform uptime metrics, makes it difficult to evaluate trading experience quality.

Mobile trading experience, increasingly important for active traders, was not detailed in available sources. This asx review notes that while platforms like eToro typically offer mobile access, specific features and performance characteristics for ASX trading were not specified.

The lack of user feedback about trading experience, platform reliability, or execution quality in available materials represents a significant information gap. Technical performance comparisons with other platforms or exchanges were also not available, limiting the ability to position ASX's trading experience within the broader market context.

ASX maintains its position among the world's top 15 exchanges by market capitalization. Specific regulatory details and security measures were not comprehensively outlined in available source materials. This ranking suggests institutional credibility and market confidence, but detailed regulatory compliance information requires further investigation.

Fund security measures, client money protection protocols, and insurance coverage details were not specified in available materials. The absence of information about segregated client accounts, regulatory compensation schemes, or third-party security audits limits the ability to fully assess investor protection levels.

Company transparency regarding financial statements, regulatory filings, and operational disclosures was not detailed in available sources. Industry reputation indicators beyond market capitalization ranking were not provided, making it difficult to assess peer recognition or regulatory standing comprehensively.

The handling of negative events, regulatory changes, or market disruptions was not addressed in available materials. Third-party ratings, regulatory assessments, or independent security evaluations were not referenced, representing gaps in trust verification data.

Despite ASX's established market position and global ranking, the limited availability of detailed regulatory and security information in source materials prevents a complete trust assessment. Potential users should seek additional verification through direct regulatory and broker inquiries.

Comprehensive user experience data including satisfaction ratings, interface design feedback, and usability assessments were not available in source materials. This information gap prevents evaluation of how well ASX's trading ecosystem meets user expectations and needs across different trader types and experience levels.

Registration and verification process details were not specified. This makes it difficult to assess account opening efficiency and user onboarding quality. Fund operation experiences, including deposit and withdrawal processes, timeline expectations, and user satisfaction levels, remain unclear from available sources.

Common user complaints, feature requests, or satisfaction trends were not detailed in available materials. The absence of user demographic analysis or trader behavior patterns limits understanding of how different user types experience the platform.

Interface design quality, navigation efficiency, and feature accessibility were not addressed in available sources. User feedback compilation, improvement tracking, or platform evolution based on user input was not documented in available materials.

This comprehensive lack of user experience data represents a significant limitation in evaluating ASX's practical usability and trader satisfaction levels. Potential users should seek current user reviews and conduct platform trials when possible.

This asx review reveals ASX as a significant trading destination offering competitive commission rates and diverse asset access. It is particularly attractive to Australian investors with its $50 minimum deposit requirement. The exchange's position among global top 15 exchanges by market capitalization demonstrates institutional credibility and market significance.

The platform best serves investors seeking diversified portfolio exposure across traditional equities, modern cryptocurrency markets, and international trading instruments. Both individual retail investors and institutional participants can benefit from the comprehensive asset coverage and competitive fee structure. This is particularly true for those focused on Australian market exposure with global diversification options.

Key strengths include low-cost trading at $2 per transaction and extensive asset variety spanning stocks, ETFs, cryptocurrencies, forex, CFDs, indices, commodities, and metals. However, significant limitations exist in available information about regulatory details, customer service quality, and user experience metrics. International investors face substantially higher minimum deposits, potentially limiting global accessibility compared to Australian client advantages.

FX Broker Capital Trading Markets Review