Is Assexmarkets safe?

Pros

Cons

Is Assexmarkets Safe or Scam?

Introduction

Assexmarkets is a forex broker that has garnered attention in the trading community. Operating from an offshore jurisdiction, it positions itself as a platform for traders looking to engage in various financial instruments, including currency pairs, commodities, and cryptocurrencies. However, the lack of regulatory oversight raises significant concerns about its reliability and safety. In the volatile world of forex trading, where scams are prevalent, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to investigate the safety and legitimacy of Assexmarkets through a structured analysis, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory environment is essential for any trader evaluating a broker. Regulation serves as a safeguard, ensuring that brokers adhere to certain standards and protect their clients' interests. Assexmarkets claims to operate under the jurisdiction of Saint Vincent and the Grenadines, an offshore region notorious for its lax regulatory framework. The absence of stringent oversight raises red flags regarding the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The lack of a valid regulatory license means that Assexmarkets is not subject to the same level of scrutiny as brokers regulated by reputable authorities such as the FCA in the UK or ASIC in Australia. This absence of oversight increases the risk of potential fraud or mismanagement of client funds. Furthermore, offshore brokers often operate with minimal accountability, making it challenging for traders to seek recourse in case of disputes or financial losses. Therefore, it is imperative for traders to approach Assexmarkets with caution, as its unregulated status significantly impacts its safety profile.

Company Background Investigation

A thorough investigation of a broker's background can reveal much about its credibility. Assexmarkets was established in 2021, which means it has a relatively short history in the forex market. The company claims to offer a wide range of trading instruments, but details about its ownership structure and management team are scarce. This lack of transparency raises concerns about the broker's operational integrity.

The management team's experience and qualifications play a crucial role in determining a broker's reliability. Unfortunately, there is limited information available regarding the backgrounds of the individuals running Assexmarkets. Without a proven track record or a transparent ownership structure, traders may find it difficult to trust the broker fully. Moreover, the absence of detailed disclosures about the company's operations and financial health further exacerbates the uncertainty surrounding Assexmarkets.

In summary, the company's limited history, combined with a lack of transparency about its management and ownership, raises significant concerns about its legitimacy and operational practices. Traders must exercise caution when considering engaging with Assexmarkets, as these factors contribute to its overall risk profile.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is critical. Assexmarkets promotes itself with enticing features, such as no minimum deposit requirements and high leverage ratios of up to 1:400. However, these attractive conditions often come with hidden risks and costs that traders should be aware of.

Assexmarkets employs a structure where spreads and commissions can vary significantly. Below is a comparison of the core trading costs:

| Fee Type | Assexmarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Assexmarkets are higher than the industry average, which can eat into traders' profits. Additionally, the lack of clarity regarding commission structures may lead to unexpected costs, especially for those who engage in frequent trading. Furthermore, the broker's high leverage ratios, while appealing, can expose traders to significant risks, particularly if they are inexperienced. High leverage can amplify losses, leading to negative account balances, especially given the broker's lack of a negative balance protection policy.

Traders should be cautious of the trading conditions presented by Assexmarkets. The combination of higher spreads, unclear commission structures, and high leverage presents a potentially dangerous environment for traders, especially those who are new to the forex market.

Client Fund Security

The safety of client funds is paramount when selecting a broker. Assexmarkets operates without any regulatory oversight, which raises serious questions about the security of traders' funds. A reliable broker typically maintains segregated accounts to protect client funds, ensuring that they are not used for the broker's operational expenses.

Unfortunately, Assexmarkets does not provide adequate information regarding its fund security measures. There is no mention of whether client funds are held in segregated accounts or if the broker offers any form of investor protection. This lack of transparency significantly increases the risk for traders, as they may have little recourse in the event of financial mismanagement or insolvency.

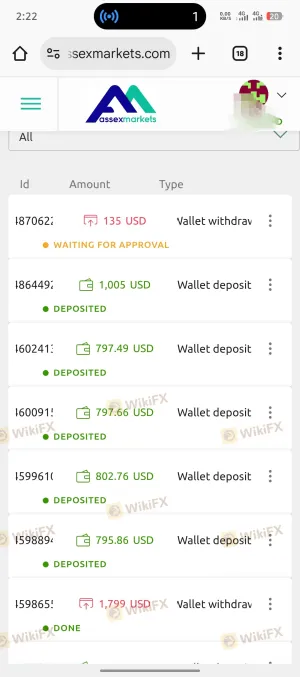

Moreover, the absence of a negative balance protection policy means that traders could potentially lose more than their initial investment. This is particularly concerning for those who may not fully understand the risks associated with trading on margin. Historical complaints from clients regarding withdrawal issues further exacerbate concerns about fund safety and overall trust in Assexmarkets.

In conclusion, the lack of clear information about fund security measures and the absence of regulatory oversight make Assexmarkets a risky choice for traders concerned about the safety of their investments.

Customer Experience and Complaints

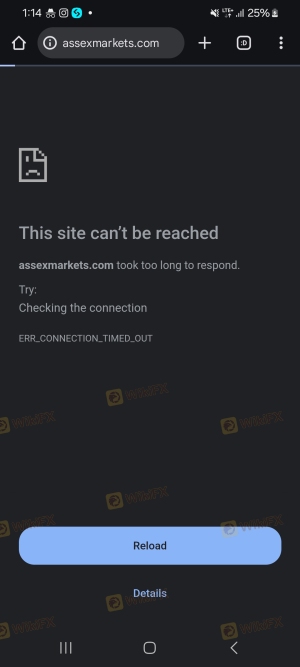

Customer feedback is a valuable indicator of a broker's reliability and service quality. While Assexmarkets presents itself as a user-friendly platform, numerous complaints from clients suggest otherwise. Traders have reported difficulties in withdrawing funds, which is a significant red flag for any broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | No clear answers |

| Poor Customer Support | High | Inconsistent |

Common complaints include slow withdrawal processes and a lack of responsiveness from customer support. In some cases, clients have reported being unable to access their funds, which raises serious concerns about the broker's operational integrity. For instance, one user reported being unable to withdraw their funds after multiple attempts, leading to frustration and distrust in the broker's practices.

Overall, the feedback from clients indicates a troubling trend regarding Assexmarkets' customer service and withdrawal processes. These issues not only undermine the broker's credibility but also pose significant risks for traders who may find themselves unable to access their funds when needed.

Platform and Trade Execution

A broker's trading platform is critical in determining the overall trading experience. Assexmarkets offers the widely used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, the performance and execution quality of the platform are equally important.

Traders have reported mixed experiences with order execution on Assexmarkets. While the MT4 platform itself is generally reliable, users have expressed concerns about slippage and order rejections during volatile market conditions. These issues can significantly impact trading outcomes, especially for those employing scalping or high-frequency trading strategies.

Furthermore, the absence of clear information regarding the broker's policies on slippage and rejected orders raises concerns about potential manipulation. Traders must be vigilant and ensure they understand the execution quality they can expect when using Assexmarkets.

In summary, while Assexmarkets provides access to a popular trading platform, the execution quality and potential issues with slippage and order rejections warrant careful consideration from traders.

Risk Assessment

Engaging with Assexmarkets entails a range of risks that traders should be aware of before opening an account. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Fund Safety | High | Lack of transparency regarding fund security. |

| Customer Service | Medium | Reports of poor response times and withdrawal issues. |

| Trading Conditions | High | High spreads and leverage present significant risks. |

Given the high-risk profile associated with Assexmarkets, traders should exercise extreme caution. It is advisable to implement robust risk management strategies, such as using smaller position sizes and avoiding high leverage, to mitigate potential losses.

Conclusion and Recommendations

In light of the comprehensive analysis conducted, it is evident that Assexmarkets presents several red flags that warrant serious consideration. The lack of regulatory oversight, combined with a troubling history of client complaints, raises significant concerns about the broker's legitimacy and safety.

While Assexmarkets may seem appealing due to its trading conditions and platform, the associated risks outweigh the potential benefits. As such, traders are advised to approach this broker with caution and consider alternatives that are regulated by reputable authorities.

For those seeking reliable trading options, it is recommended to explore brokers such as Admiral Markets, IC Markets, or OANDA, which offer robust regulatory frameworks, transparent trading conditions, and a commitment to client safety. Always prioritize safety and due diligence when choosing a forex broker to ensure a secure trading experience.

In conclusion, Is Assexmarkets safe? The evidence suggests that it is not a safe choice for traders, and caution is strongly advised when considering this broker.

Is Assexmarkets a scam, or is it legit?

The latest exposure and evaluation content of Assexmarkets brokers.

Assexmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Assexmarkets latest industry rating score is 1.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.