Is Yuheng Capital safe?

Business

License

Is Yuheng Capital Safe or Scam?

Introduction

Yuheng Capital is a financial brokerage firm that has gained attention in the forex market since its inception in 2017. Headquartered in China, it claims to offer a variety of investment opportunities across different asset classes, including stocks, bonds, futures, and options. However, as the forex market continues to attract traders globally, it becomes increasingly vital for potential clients to assess the credibility and reliability of brokers like Yuheng Capital. The absence of proper regulation and the prevalence of scams in the trading sector necessitate a cautious approach when selecting a trading partner. This article aims to provide a comprehensive analysis of Yuheng Capital, focusing on its regulatory status, company background, trading conditions, client experiences, and overall safety. The evaluation methodology includes a review of multiple sources, including user reviews, regulatory databases, and financial reports.

Regulation and Legitimacy

One of the primary indicators of a brokerage's trustworthiness is its regulatory status. Yuheng Capital operates without oversight from any recognized financial regulatory authorities, which raises significant concerns about its legitimacy. The absence of regulation means that there is no independent body to monitor its business practices, potentially exposing traders to various risks. Below is a summary of the regulatory information for Yuheng Capital:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight is a critical issue for potential clients. Regulated brokers are typically required to adhere to strict guidelines that ensure the safety of client funds and fair trading practices. In contrast, unregulated brokers like Yuheng Capital can operate with limited transparency, making it difficult for clients to resolve disputes or recover lost funds. Furthermore, the absence of a valid license suggests a higher risk of fraudulent activities, which is a significant red flag for traders. Therefore, assessing whether Yuheng Capital is safe is paramount, and the current regulatory landscape does not provide a favorable outlook.

Company Background Investigation

Founded in 2017, Yuheng Capital has positioned itself as a player in the forex trading arena. However, its short history raises questions about its stability and longevity. The company claims to offer various account types, including individual, joint, corporate, and institutional accounts, catering to a wide range of investors. Despite these offerings, the lack of transparency surrounding its ownership structure and management team is concerning.

The management team behind Yuheng Capital is not well-documented, which is a crucial component for assessing a company's credibility. A robust management team with a proven track record in finance and trading can significantly enhance a broker's reputation. Unfortunately, the limited information available about the team raises doubts about their expertise and commitment to ethical practices. Furthermore, the company's opacity regarding its operational practices and financial health makes it challenging to ascertain whether Yuheng Capital is safe for traders. The absence of detailed disclosures about financial performance and business strategies further exacerbates these concerns.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are of utmost importance. Yuheng Capital presents a range of trading instruments, but the overall fee structure and potential hidden costs require careful examination. The following table summarizes the core trading costs associated with Yuheng Capital:

| Fee Type | Yuheng Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1 pip | 1-2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Not Specified | 1-3% |

The spreads offered by Yuheng Capital appear competitive at first glance; however, the lack of clarity regarding commissions and overnight fees is concerning. Traders should be wary of brokers that do not disclose their fee structures clearly, as this can lead to unexpected costs that diminish profitability. Additionally, the absence of a specified overnight interest rate raises questions about how Yuheng Capital manages its positions and whether it imposes additional charges on traders. These factors contribute to the overall assessment of whether Yuheng Capital is safe, as unclear cost structures can indicate potential exploitation of clients.

Client Funds Security

The security of client funds is a crucial aspect of any brokerage's credibility. Yuheng Capital's lack of regulation raises significant concerns regarding the safety measures it has in place. The absence of clear information about fund segregation, investor protection, and negative balance protection policies is alarming. In regulated environments, brokers are typically required to maintain client funds in separate accounts, ensuring that traders' money is not misused for operational expenses. However, without regulatory oversight, it is unclear whether Yuheng Capital adheres to such practices.

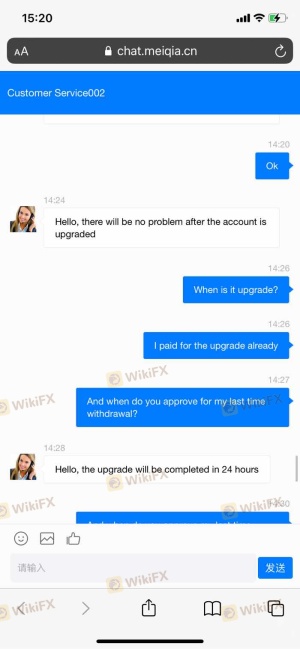

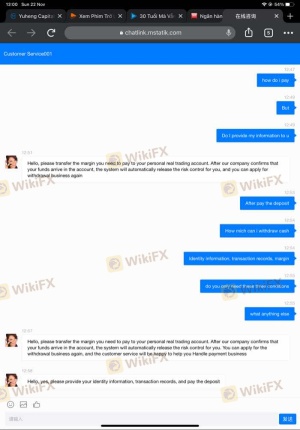

Moreover, the historical context reveals that many unregulated brokers have faced allegations of mishandling client funds, leading to significant financial losses for traders. Reports of clients being unable to withdraw funds from Yuheng Capital further exacerbate concerns about its operational integrity. These issues highlight the importance of assessing whether Yuheng Capital is safe, as the security of client funds directly impacts traders' financial well-being.

Client Experience and Complaints

Client feedback is a valuable resource for evaluating a broker's reliability and operational practices. A review of user experiences with Yuheng Capital reveals a pattern of complaints primarily centered around withdrawal issues and customer support responsiveness. The following table summarizes the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

| Transparency Concerns | High | Poor |

Many users have reported difficulties in accessing their funds, with some claiming that they were unable to withdraw their money after depositing significant amounts. Such complaints indicate a potential risk of being scammed, as clients often face various obstacles when attempting to retrieve their funds. Additionally, the quality of customer support has been criticized, with users citing long response times and inadequate assistance. These issues raise serious questions about whether Yuheng Capital is safe for traders, as a lack of responsive support can exacerbate the frustration experienced by clients dealing with withdrawal problems.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. Yuheng Capital provides a web-based trading platform, but user reviews suggest that it may not meet the expectations of traders seeking a seamless experience. Issues such as order execution quality, slippage, and order rejections have been reported, indicating potential manipulation or inefficiencies in the trading environment.

Traders have expressed concerns about the platform's stability, with reports of crashes during high-volatility periods. Such incidents can significantly impact traders' ability to execute trades and manage their positions effectively. The lack of transparency regarding the platform's technology and operational reliability raises further doubts about whether Yuheng Capital is safe for traders. A broker's platform should facilitate smooth trading experiences, and any signs of instability or manipulation can deter potential clients.

Risk Assessment

Engaging with an unregulated broker like Yuheng Capital inherently carries risks that must be carefully considered. The following risk assessment summarizes the key risk areas associated with trading through Yuheng Capital:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Fund Security Risk | High | Lack of transparency on fund protection |

| Operational Risk | Medium | Reports of platform instability |

| Customer Service Risk | Medium | Poor responsiveness to client issues |

Given the high regulatory and fund security risks, potential clients should exercise extreme caution when considering Yuheng Capital as a trading partner. It is advisable to seek alternative options that offer better regulatory protection and transparency. Traders should also consider implementing risk mitigation strategies, such as using smaller account sizes and diversifying their trading portfolios.

Conclusion and Recommendations

In conclusion, the investigation into Yuheng Capital raises significant concerns about its safety and reliability as a forex broker. The absence of regulation, coupled with numerous client complaints regarding withdrawal issues and poor customer support, suggests that traders should approach this broker with caution. The lack of transparency regarding trading conditions and fund security further exacerbates these concerns.

For traders seeking a safe and reliable trading environment, it is recommended to consider brokers that are regulated by recognized financial authorities and have a proven track record of client satisfaction. Options such as brokers regulated by the FCA or ASIC may provide a more secure trading experience. In light of the evidence presented, it is clear that Yuheng Capital may not be the best choice for traders prioritizing safety and transparency in their trading activities.

Is Yuheng Capital a scam, or is it legit?

The latest exposure and evaluation content of Yuheng Capital brokers.

Yuheng Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Yuheng Capital latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.