Is YONGAN FUTURES safe?

Business

License

Is Yongan Futures Safe or Scam?

Introduction

Yongan Futures Co., Ltd. is a futures brokerage firm based in Hangzhou, China, primarily engaged in commodity and financial futures brokerage, asset management, and investment consulting services. Founded in 1992, Yongan Futures has positioned itself as a significant player in the Chinese financial markets. However, as with any trading platform, it is crucial for traders to exercise caution when evaluating the credibility and safety of a broker. The foreign exchange market, known for its volatility, can pose substantial risks, particularly with unregulated or poorly regulated brokers. In this article, we will investigate whether Yongan Futures is safe or potentially a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and risk factors.

Regulation and Legitimacy

The regulatory environment for forex brokers is critical in determining their legitimacy and safety. A well-regulated broker is typically more reliable, as regulatory bodies impose stringent rules to protect traders. Upon investigating Yongan Futures, it is notable that the broker operates without any significant regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation raises red flags regarding the broker's operational integrity. Regulatory bodies such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) provide a safety net for traders by ensuring that brokers adhere to high standards of conduct. Without such oversight, clients of Yongan Futures may face heightened risks, including potential fraud or mismanagement of funds. Additionally, the lack of a verified regulatory status suggests that traders should be cautious when considering this broker, leading to the question: Is Yongan Futures safe?

Company Background Investigation

Understanding a broker's history and ownership structure is essential for assessing its reliability. Yongan Futures has a long history, having been established in 1992, and has undergone various transformations over the years. The company is publicly traded and has a significant employee base, indicating a level of operational scale.

The management team at Yongan Futures consists of experienced professionals with backgrounds in finance and investment. However, the transparency regarding their qualifications and the company's overall governance practices remains limited. The level of information disclosed about the company's operations and financials is critical; without thorough disclosures, it is challenging for traders to evaluate the broker's trustworthiness.

Moreover, the ownership structure reveals that the company is primarily held by provincial financial holdings, which may influence its operational decisions. This concentration of ownership could lead to conflicts of interest, further complicating the assessment of whether Yongan Futures is safe for traders.

Trading Conditions Analysis

Yongan Futures offers various trading conditions, including spreads, commissions, and overnight interest rates. However, it is essential to analyze whether these conditions align with industry standards.

| Fee Type | Yongan Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 2 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by Yongan Futures are higher than the industry average, which could significantly impact trading profitability. Furthermore, the absence of a clear commission structure may lead to hidden fees that could surprise traders. Such discrepancies in trading conditions raise concerns about the broker's transparency and fairness, leading to further inquiries about whether Yongan Futures is safe for retail traders.

Client Fund Safety

When considering a broker, the safety of client funds is paramount. Yongan Futures claims to implement measures to protect client funds, but the lack of regulatory oversight complicates this claim. It is crucial to assess whether the broker employs fund segregation practices, investor protection schemes, and negative balance protection policies.

While Yongan Futures appears to have some security measures in place, the absence of regulatory backing means that traders may have limited recourse in the event of a dispute or financial mishap. Historical issues regarding fund safety or disputes involving the broker would also be relevant, but such information is scarce. This lack of transparency raises the question again: Is Yongan Futures safe?

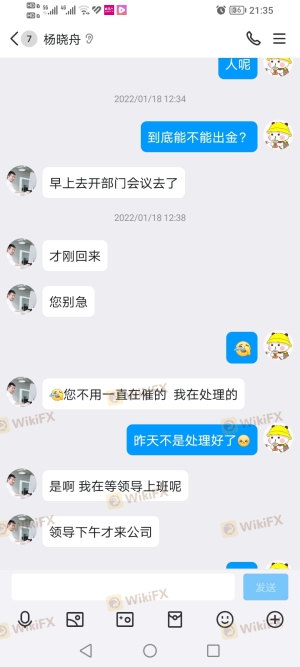

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews and testimonials from existing clients can provide insights into the broker's service quality and responsiveness. However, Yongan Futures has received mixed reviews, with some users reporting satisfactory experiences while others have raised complaints regarding withdrawal delays and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Service | Medium | Average |

Common complaints include difficulties in withdrawing funds and inadequate customer support. These issues can significantly affect a trader's experience and raise concerns about the broker's operational integrity. The prevalence of these complaints leads to the conclusion that Yongan Futures may not be entirely safe for traders who require reliable support and quick access to their funds.

Platform and Execution

The trading platform's performance is critical for a seamless trading experience. Yongan Futures provides access to trading platforms that are generally user-friendly, but the execution quality and reliability of these platforms must also be scrutinized. Traders have reported instances of slippage and order rejections, which can be detrimental in fast-moving markets.

Moreover, any signs of platform manipulation, such as sudden price spikes or discrepancies during trading hours, should be closely examined. If traders experience consistent issues with execution, it could indicate deeper operational problems within the broker, further questioning whether Yongan Futures is safe for trading activities.

Risk Assessment

Evaluating the overall risk associated with trading with Yongan Futures is essential for potential clients. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No significant regulatory oversight. |

| Operational Risk | Medium | Mixed customer feedback and complaints. |

| Financial Risk | Medium | Higher spreads and potential hidden fees. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Yongan Futures. Seeking alternative brokers with better regulatory oversight and customer service may be prudent for those who prioritize safety.

Conclusion and Recommendations

In conclusion, after a thorough investigation of Yongan Futures, it becomes apparent that the broker presents several risks that potential clients should consider. The lack of regulatory oversight, mixed customer feedback, and higher-than-average trading costs indicate that Yongan Futures may not be entirely safe for traders.

For those considering entering the forex market, it is advisable to explore alternative brokers with robust regulatory frameworks, transparent fee structures, and positive customer reviews. Brokers such as IG, OANDA, or Forex.com are examples of more established firms that may offer a safer trading environment. Ultimately, traders should prioritize their safety and security when choosing a broker, ensuring they fully understand the risks involved before proceeding.

Is YONGAN FUTURES a scam, or is it legit?

The latest exposure and evaluation content of YONGAN FUTURES brokers.

YONGAN FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YONGAN FUTURES latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.