Regarding the legitimacy of VEGLFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is VEGLFX safe?

Business

License

Is VEGLFX markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

ULTIMA MARKETS UK LIMITED

Effective Date: Change Record

2007-10-16Email Address of Licensed Institution:

yilu.wang@ultima-markets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ultima-markets.co.uk/Expiration Time:

--Address of Licensed Institution:

Regus New London House 6 London Street London City Of London EC3R 7AD UNITED KINGDOMPhone Number of Licensed Institution:

+4407920145175Licensed Institution Certified Documents:

Is Veglfx Safe or a Scam?

Introduction

Veglfx is a forex broker that has garnered attention in the trading community for its offerings in the foreign exchange market. Established with the intent to provide trading services to both novice and experienced traders, Veglfx positions itself as a viable option for those looking to engage in forex trading. However, the forex market is notorious for its lack of regulation and the prevalence of scams, making it essential for traders to carefully evaluate the credibility of brokers before committing their funds. In this article, we will investigate the safety and legitimacy of Veglfx by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our assessment is based on data gathered from multiple reputable sources, including regulatory databases and trader reviews.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. A broker that is regulated by a reputable authority is generally seen as more trustworthy, as these regulators enforce strict standards to protect investors. Unfortunately, Veglfx does not appear to be regulated by any top-tier financial authority. This raises significant concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation indicates that Veglfx is not subject to oversight by any recognized financial body, which could leave traders vulnerable to potential fraud or malpractice. A lack of regulatory compliance often correlates with higher risks, as unregulated brokers can operate without stringent requirements for transparency, fund segregation, and client protection. Therefore, it is advisable for traders to exercise caution when considering Veglfx as a trading partner.

Company Background Investigation

Veglfx, operated by VE Group Limited, has a relatively obscure presence in the forex trading landscape. The company claims to have been in operation for several years, but detailed information about its history, ownership structure, and management team is scarce. This lack of transparency can be a red flag for potential investors.

The management team‘s background is particularly important, as experienced and reputable leadership can significantly enhance a broker's credibility. Unfortunately, Veglfx does not provide sufficient details regarding its executives or their professional qualifications. Without this information, it is challenging to assess the company’s reliability. A transparent company typically discloses its management teams credentials, allowing potential clients to gauge their expertise and track record in the financial industry.

Trading Conditions Analysis

When evaluating whether Veglfx is safe, understanding its trading conditions is crucial. The broker claims to offer competitive spreads and trading fees, but without concrete data, it is difficult to ascertain the accuracy of these claims.

| Fee Type | Veglfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The lack of clarity regarding specific fees and costs can be concerning. Traders should be wary of hidden fees that may not be immediately apparent. A broker with a convoluted fee structure can lead to unexpected costs that diminish trading profits. Therefore, it is essential for traders to reach out to Veglfx directly for comprehensive information regarding their fee structure before opening an account.

Customer Funds Security

The safety of client funds is paramount when assessing the reliability of a forex broker. Veglfx's policies regarding fund security, such as fund segregation and investor protection measures, are not clearly stated.

Traders should inquire whether Veglfx keeps client funds in segregated accounts, which is a common practice among reputable brokers. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security. Additionally, the presence of negative balance protection can safeguard traders from losing more than their initial investment, a critical feature in volatile markets.

Historically, any incidents involving fund mismanagement or security breaches would also be relevant to consider. Unfortunately, there is little information available regarding Veglfx's past performance in this area, further complicating the assessment of its safety.

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability. Reviews for Veglfx are mixed, with some users reporting satisfactory experiences, while others have raised concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Misleading Information | High | Unresolved |

Common complaints often revolve around difficulties in withdrawing funds, which is a significant red flag. A broker that complicates or delays withdrawals may be engaging in unethical practices, potentially indicating that it is not safe to trade with them.

For example, one trader reported that despite multiple requests for a withdrawal, their funds remained inaccessible for an extended period, leading to frustration and loss of trust in the broker. Such experiences highlight the importance of assessing a broker's withdrawal process before committing funds.

Platform and Trade Execution

The performance of the trading platform is another critical factor in determining whether Veglfx is safe. A reliable platform should offer stability, fast execution, and minimal slippage. However, there are concerns regarding the execution quality at Veglfx.

Users have reported instances of significant slippage and order rejections during volatile market conditions, which can adversely affect trading outcomes. Furthermore, any signs of platform manipulation—such as frequent re-quotes or discrepancies between market prices and executed trades—should be closely monitored.

A broker that fails to provide a smooth and transparent trading experience may not be trustworthy, as these issues can severely hinder a trader's ability to execute their strategies effectively.

Risk Assessment

Engaging with Veglfx comes with inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Fund Security Risk | High | Lack of information on fund protection measures. |

| Customer Support Risk | Medium | Reports of poor responsiveness to client inquiries. |

To mitigate these risks, traders should consider conducting thorough due diligence before opening an account. It is advisable to start with a small investment, if any, and to test the platform's functionality and customer service before committing larger amounts of capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that Veglfx raises several red flags that warrant caution. The absence of regulatory oversight, lack of transparency regarding its management and fee structure, and reports of customer complaints indicate that Veglfx may not be a safe trading environment.

Traders should be particularly wary of engaging with Veglfx, as the risks associated with unregulated brokers can lead to significant financial losses. For those seeking reliable alternatives, it is recommended to consider brokers that are regulated by top-tier authorities and have established a solid reputation in the industry.

In summary, is Veglfx safe? Based on the analysis, it would be prudent for traders to exercise caution and consider other regulated options to ensure their trading experience is secure and trustworthy.

Is VEGLFX a scam, or is it legit?

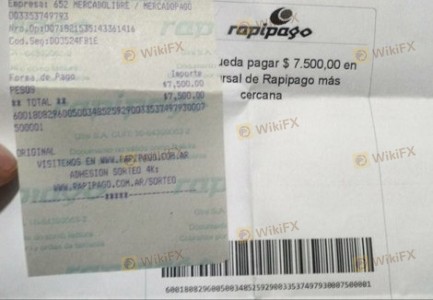

The latest exposure and evaluation content of VEGLFX brokers.

VEGLFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VEGLFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.