Is VanomFX safe?

Business

License

Is VanomFX Safe or Scam?

Introduction

VanomFX positions itself as a forex broker operating in the vast and competitive foreign exchange market. With claims of offering a wide array of trading instruments, including forex, commodities, and indices, it aims to attract both novice and seasoned traders. However, the importance of scrutinizing a forex broker's legitimacy cannot be overstated. Traders need to ensure that their chosen broker adheres to regulatory standards, provides secure trading environments, and maintains transparent operational practices. This article aims to assess the safety and reliability of VanomFX through a comprehensive investigation that includes regulatory scrutiny, company background, trading conditions, customer experiences, and risk evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety. VanomFX claims to be registered in the United Kingdom; however, it does not provide any valid regulatory information. This lack of regulation raises significant concerns regarding the broker's legitimacy. Below is a summary of the regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | United Kingdom | Not Verified |

The absence of a valid license from recognized regulatory bodies such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) suggests that VanomFX operates in a high-risk environment. The lack of oversight means that traders have limited recourse in the event of disputes or financial mismanagement. Moreover, several reviews highlight a history of complaints related to withdrawal issues, further questioning the broker's operational integrity. Given these factors, it is clear that is VanomFX safe is a pressing concern for potential traders.

Company Background Investigation

VanomFX's history and ownership structure are essential to understanding its operational legitimacy. Established in 2021, the broker claims to provide a range of trading services; however, details about its ownership and management team are scarce. The website provides minimal information, which raises questions about transparency. A thorough investigation reveals that the company lacks a well-documented history or a robust corporate structure. This lack of transparency can be alarming for traders who typically prefer brokers with a well-established reputation and clear operational protocols.

Moreover, the absence of a credible management team with relevant industry experience further complicates the assessment of VanomFX's reliability. High levels of transparency and accountability are essential in the financial services industry, and the lack thereof can be a significant red flag. Therefore, the question of is VanomFX safe remains unanswered as potential clients are left in the dark regarding the broker's operational integrity.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value proposition. VanomFX claims to provide competitive trading fees, but the lack of transparency regarding its fee structure raises concerns. Below is a comparison of the core trading costs:

| Fee Type | VanomFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies (typically $5 per lot) |

| Overnight Interest Range | N/A | Varies (typically 2-4%) |

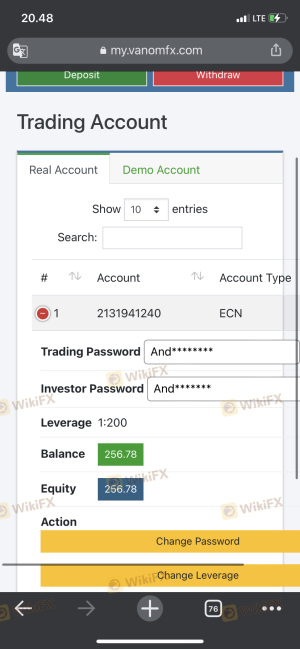

The absence of clear information regarding spreads, commissions, and overnight fees makes it difficult for traders to evaluate the cost-effectiveness of trading with VanomFX. Moreover, the high leverage of up to 1:1000 may attract traders, but it also significantly increases the risk associated with trading. The lack of clarity in fees and the potential for hidden costs contribute to the skepticism surrounding the broker's safety. Thus, traders must carefully consider whether is VanomFX safe before committing their funds.

Client Fund Security

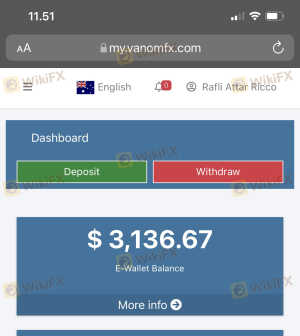

The security of client funds is a paramount concern for any trader. VanomFX claims to implement various safety measures; however, the lack of regulatory oversight raises significant doubts about the effectiveness of these measures. A thorough analysis reveals that the broker does not provide adequate information on fund segregation, investor protection, or negative balance protection policies.

The absence of these critical safeguards can expose traders to high risks, especially in volatile market conditions. Furthermore, numerous complaints from users regarding withdrawal issues and the inability to access funds highlight potential vulnerabilities in VanomFX's operational framework. These historical disputes indicate a pattern of behavior that could jeopardize client funds, reinforcing the need for traders to question is VanomFX safe for their investments.

Customer Experience and Complaints

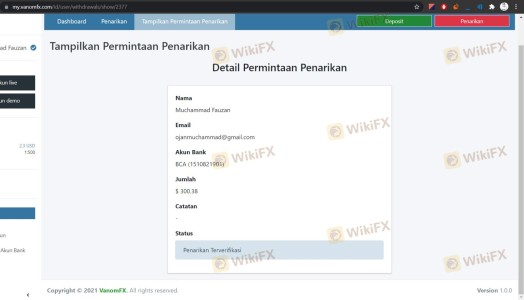

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Numerous reviews of VanomFX reveal a concerning trend of complaints, primarily focused on withdrawal issues and poor customer service. Below is a summary of the major complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Deactivation | High | Poor |

| Lack of Communication | Medium | Poor |

For instance, many users have reported being unable to withdraw their funds, with some claiming that their accounts were deactivated without prior notice. The company's response to these complaints has been largely inadequate, leaving clients frustrated and without resolution. Such patterns of behavior strongly suggest that potential users should critically evaluate is VanomFX safe before engaging with the platform.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. VanomFX offers a web-based trading platform, which is reportedly less reliable than industry-standard platforms like MetaTrader 4 or 5. Concerns regarding order execution quality, slippage, and the potential for order rejections have been raised in various reviews.

Traders have reported instances of significant slippage during volatile market conditions, raising questions about the platform's reliability. Given the importance of efficient trade execution in forex trading, the lack of a robust platform can severely hinder trading performance. Therefore, the question of is VanomFX safe is further complicated by the potential for execution issues that could lead to financial losses.

Risk Assessment

The overall risk associated with trading with VanomFX is considerable. A detailed risk assessment reveals the following:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about oversight. |

| Financial Risk | High | Withdrawal issues and client complaints indicate potential financial mismanagement. |

| Platform Risk | Medium | Inconsistent execution and potential slippage could lead to losses. |

Given these risks, traders should approach VanomFX with extreme caution. It is advisable to conduct thorough due diligence and consider alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence gathered throughout this investigation raises significant concerns regarding the safety and legitimacy of VanomFX. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that potential traders should be wary. The question of is VanomFX safe remains largely unanswered, with numerous red flags indicating potential risks.

For traders seeking reliable and secure trading environments, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some reputable alternatives include brokers that are regulated by the FCA or ASIC, which offer greater transparency and security for client funds. Ultimately, traders should prioritize their safety and due diligence when selecting a forex broker.

Is VanomFX a scam, or is it legit?

The latest exposure and evaluation content of VanomFX brokers.

VanomFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VanomFX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.