Is USTrade safe?

Business

License

Is USTrade Safe or Scam?

Introduction

USTrade positions itself as a player in the forex and cryptocurrency trading markets, attracting traders with promises of competitive trading conditions and diverse investment opportunities. However, the burgeoning online trading landscape is fraught with risks, making it crucial for traders to thoroughly evaluate their brokers before committing funds. The lack of regulation and oversight in many trading platforms can lead to significant financial losses. This article aims to investigate whether USTrade is a safe trading option or a potential scam. Our assessment is based on a comprehensive analysis of user reviews, regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

When assessing a broker's trustworthiness, regulation is a key factor. Regulatory bodies enforce rules that protect traders and ensure fair trading practices. Unfortunately, USTrade is not regulated by any recognized financial authority, which raises significant red flags. Below is a summary of USTrade's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation means that USTrade operates without the oversight that can safeguard traders from fraudulent practices. Unregulated brokers can manipulate trading conditions and impose unfair fees without repercussions. Additionally, user reports indicate that many traders have faced difficulties in withdrawing funds, a common issue with unregulated platforms. This lack of oversight and the associated risks highlight that USTrade is not a safe option for traders.

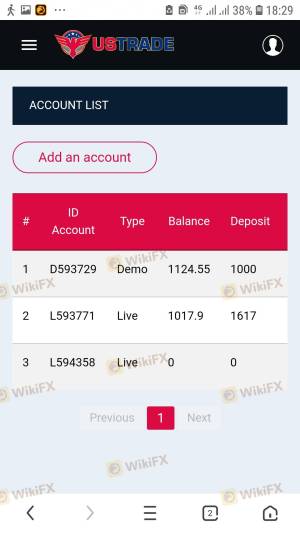

Company Background Investigation

USTrade's history and ownership structure are crucial in determining its credibility. The company's website provides minimal information regarding its establishment, ownership, and management team. This opacity is concerning, as reputable brokers typically offer detailed insights into their background and leadership. The lack of transparency can indicate potential issues, as it makes it challenging for traders to assess the company's reliability.

Furthermore, the absence of a clear management team with relevant experience raises questions about the operational integrity of USTrade. Without a solid foundation and experienced leadership, the platform may lack the necessary expertise to manage trading effectively and ethically. Given these factors, it is reasonable to conclude that USTrade lacks the transparency and oversight necessary for a safe trading environment.

Trading Conditions Analysis

USTrade advertises attractive trading conditions, including low spreads and high leverage. However, it is essential to scrutinize these claims against industry standards. Here is a comparison of USTrade's trading costs with the industry average:

| Cost Type | USTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.2 pips | < 2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs at USTrade is significantly higher than the industry average, which can erode trading profitability. Additionally, the lack of clarity regarding commissions and overnight interest rates raises concerns about hidden fees. Traders should be wary of platforms that do not disclose their fee structures transparently, as this can lead to unexpected costs. Therefore, it is evident that USTrade's trading conditions may not be as favorable as advertised, further questioning its safety.

Client Fund Security

The safety of client funds is paramount when selecting a broker. USTrade does not provide sufficient information regarding its security measures for client funds. Key aspects to consider include fund segregation, investor protection, and negative balance protection.

A reputable broker typically segregates client funds from operational funds to protect traders in the event of bankruptcy. However, since USTrade lacks regulatory oversight, there are no guarantees regarding fund safety. Additionally, the absence of information about investor protection mechanisms raises concerns about potential losses. Historical reports indicate that many users have experienced significant difficulties accessing their funds, which is a major warning sign. Consequently, it is clear that USTrade does not prioritize client fund security, making it a risky choice for traders.

Client Experience and Complaints

Customer feedback is a vital component in evaluating a broker's reliability. User reviews of USTrade reveal a pattern of complaints, particularly regarding withdrawal issues and poor customer service. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inadequate |

| Misleading Information | High | Unresponsive |

Many users report being unable to withdraw their funds, a critical issue that can indicate potential fraud. Additionally, the quality of customer service has been criticized, with many traders stating that their concerns were not adequately addressed. For instance, one user reported being unable to access their account funds for months, with no response from the support team. Such complaints highlight that USTrade may not be a reliable platform for traders, as it fails to address critical issues effectively.

Platform and Execution

The trading platform's performance and execution quality are crucial for a successful trading experience. USTrade's platform has received mixed reviews, with some users reporting stability issues and delays in order execution. Slippage and order rejections are common complaints among traders, which can significantly impact trading outcomes.

Moreover, the platform's lack of transparency regarding its execution policies raises concerns about potential manipulation. Traders should be cautious if they notice patterns of slippage that consistently disadvantage them. In light of these factors, it is evident that USTrade's platform may not provide the reliability and execution quality that traders require.

Risk Assessment

Overall, the risks associated with trading through USTrade are substantial. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research and consider using only regulated brokers with a solid track record. Additionally, starting with a small deposit can help minimize potential losses while assessing the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that USTrade is not a safe trading option. The lack of regulation, poor customer feedback, and insufficient transparency raise significant concerns about its legitimacy. Traders should exercise extreme caution when considering this platform, as it may pose considerable risks to their investments.

For those seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities, offer transparent fee structures, and provide robust customer support. Some recommended options include established brokers with a strong regulatory framework, such as IG Group or Forex.com, which are known for their commitment to client safety and fair trading practices. Ultimately, the choice of broker can significantly impact trading success, making it essential to prioritize safety and reliability.

Is USTrade a scam, or is it legit?

The latest exposure and evaluation content of USTrade brokers.

USTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USTrade latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.