Is UOSHENG safe?

Business

License

Is Uosheng Safe or a Scam?

Introduction

Uosheng is a forex broker that has recently come under scrutiny in the trading community. Positioned as a platform for retail traders, it claims to offer competitive trading conditions and a wide range of financial instruments. However, the forex market is notorious for its volatility and the presence of unscrupulous brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article investigates the legitimacy of Uosheng by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The information is derived from multiple credible sources, including user reviews and expert analyses.

Regulation and Legitimacy

The regulatory environment is a critical factor in evaluating whether a broker is safe or a scam. Uosheng claims to be regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the U.S. National Futures Association (NFA). However, upon closer inspection, it appears that Uosheng does not meet the necessary criteria to be considered a regulated entity by these organizations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINTRAC | M20153968 | Canada | Not a forex regulator |

| NFA | 0531209 | USA | Not an approved member |

The absence of oversight from recognized regulatory authorities raises significant concerns about the safety of funds deposited with Uosheng. FINTRAC does not issue licenses for forex trading, and Uosheng is not recognized as an approved member of the NFA. Therefore, it is safe to conclude that Uosheng is not regulated, making it potentially unsafe for traders.

Company Background Investigation

Uosheng World Limited, the parent company of Uosheng, was established relatively recently, and its operational history is limited. The company's ownership structure is not transparent, which is often a red flag in the forex industry. The management team lacks publicly available information regarding their professional backgrounds, which further complicates the assessment of the company's legitimacy. Transparency is crucial in the financial services sector, and the lack of information about Uosheng's leadership raises concerns about its accountability and operational integrity.

Trading Conditions Analysis

The trading conditions offered by Uosheng are another area of concern. The broker advertises competitive spreads and various account types; however, the actual costs associated with trading may not be as favorable as they appear.

| Fee Type | Uosheng | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.2 pips |

| Commission Model | $10 per lot | $5 per lot |

| Overnight Interest Range | High | Moderate |

The comparison indicates that Uoshengs fees may be higher than average, particularly concerning overnight interest rates. Traders should be cautious of any fees that appear to be unusually high, as they can significantly impact overall profitability.

Client Fund Security

A critical aspect of evaluating whether Uosheng is safe involves analyzing its client fund security measures. Uosheng claims to implement fund segregation and investor protection policies; however, there is little evidence to support these claims. Without proper regulatory oversight, the effectiveness of these measures is questionable.

Historical complaints about withdrawal issues and fund accessibility have been reported, indicating that traders may face difficulties in retrieving their investments. Such issues are a significant concern when considering the safety of a broker.

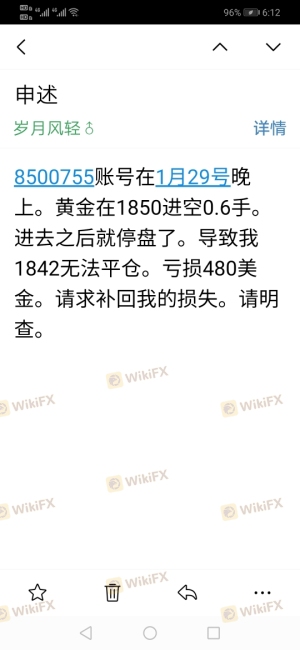

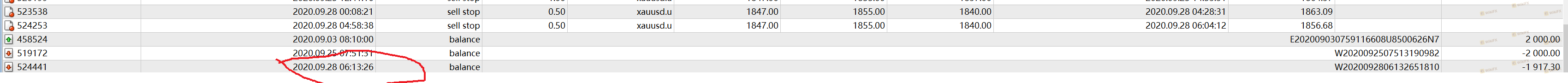

Customer Experience and Complaints

User feedback provides valuable insights into the operational integrity of Uosheng. Many users have reported negative experiences, particularly concerning withdrawal issues and lack of responsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delay | Medium | Average |

Common complaints include difficulties in withdrawing funds, delayed responses from customer service, and a lack of transparency regarding fees. One user reported being unable to withdraw funds for over a month, which raises serious concerns about the operational practices of Uosheng.

Platform and Trade Execution

The trading platform provided by Uosheng is another critical factor in assessing its reliability. While the broker claims to offer a robust trading environment, reviews indicate that users have experienced issues with platform stability, order execution quality, and instances of slippage.

Traders have reported delays in order execution, which can lead to unfavorable trading outcomes. Such issues are particularly concerning in a market where timing is crucial. The potential for platform manipulation or unfair practices adds another layer of risk for traders using Uosheng.

Risk Assessment

Given the various factors discussed, the overall risk associated with trading through Uosheng is considerable.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No legitimate regulatory oversight |

| Financial Risk | High | High fees and withdrawal issues |

| Operational Risk | Medium | Platform stability concerns |

To mitigate these risks, traders are advised to exercise extreme caution. It is recommended to start with a small investment or consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Uosheng is not a safe trading option. The lack of regulatory oversight, coupled with numerous complaints regarding fund security and customer service, paints a concerning picture. Traders should be wary of the potential risks involved and consider alternative, well-regulated brokers for their trading activities.

If you are looking for reliable alternatives, consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or NFA. These brokers typically offer better protection for your funds and more transparent trading conditions. Always remember to conduct thorough research and assess the safety of any broker before investing your hard-earned money.

Is UOSHENG a scam, or is it legit?

The latest exposure and evaluation content of UOSHENG brokers.

UOSHENG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UOSHENG latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.