Regarding the legitimacy of Tradesto forex brokers, it provides VFSC and WikiBit, .

Is Tradesto safe?

Business

License

Is Tradesto markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

TRADESTO CORPORATION

Effective Date:

2018-04-27Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Tradesto Safe or Scam?

Introduction

Tradesto is an online forex broker that has been operational since 2012, primarily registered in Saint Vincent and the Grenadines. It positions itself as a platform for both novice and experienced traders, offering a range of trading instruments including forex, precious metals, and crude oil. Given the proliferation of online trading platforms, it is crucial for traders to conduct thorough due diligence before engaging with any broker. The financial landscape is fraught with risks, and the potential for scams is ever-present. This article aims to provide an objective analysis of Tradesto's legitimacy and safety by examining its regulatory status, company background, trading conditions, client fund security, and customer experiences.

To ensure a comprehensive evaluation, this investigation utilizes various sources, including user reviews, regulatory disclosures, and expert analyses. The assessment framework focuses on key areas such as regulatory compliance, operational history, financial security, and customer feedback, forming a holistic view of whether Tradesto is safe for traders.

Regulation and Legitimacy

The regulatory landscape is a vital aspect of any brokerage's credibility. A broker's license from a reputable authority signifies adherence to specific financial standards, ensuring a level of protection for clients. Unfortunately, Tradesto's regulatory status raises significant concerns. Although it claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC), both licenses have been revoked or exceeded, leading to questions about the broker's operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 14736 | Vanuatu | Revoked |

| ASIC | 616 567 698 | Australia | Exceeded |

The revocation of the VFSC license indicates that Tradesto no longer meets the necessary regulatory requirements, while the ASIC license being marked as "exceeded" suggests that the broker may not be compliant with Australian financial regulations. This lack of valid regulation could expose traders to significant risks, making it crucial to question whether Tradesto is safe to trade with.

Company Background Investigation

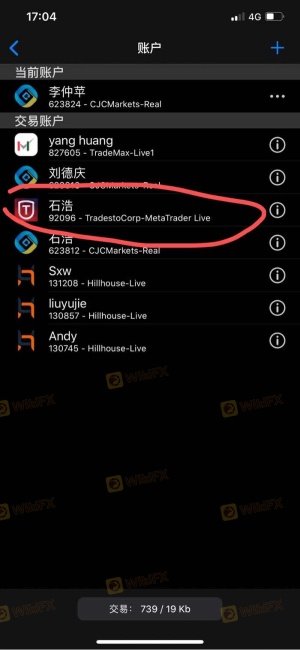

Tradesto's history and ownership structure provide additional context to its operational integrity. Founded in 2012, the broker claims to operate under multiple entities, including Tradesto Corporation in Saint Vincent and the Grenadines and Tradesto UK Limited in the United Kingdom. However, the registration in Saint Vincent and the Grenadines is particularly concerning, as the local financial authority does not issue licenses for forex trading, which raises red flags about the broker's legitimacy.

The management team behind Tradesto has not been extensively documented, which adds to the opacity surrounding the company. A lack of transparency regarding the leadership and their professional backgrounds can deter potential investors, as it raises questions about accountability and operational standards. Furthermore, the absence of comprehensive information disclosure about the company's financial health and operational practices further complicates the assessment of whether Tradesto is safe.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are critical for understanding their operational model. Tradesto claims to provide competitive spreads and a low minimum deposit requirement of $100. However, the overall fee structure appears to be convoluted, with some reports indicating hidden fees that could catch traders off guard.

| Fee Type | Tradesto | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | $10 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Tradesto are above average compared to industry standards, and the commission structure can lead to higher trading costs than anticipated. Such discrepancies in trading conditions may be indicative of a broker that does not prioritize transparency, prompting further concerns about whether Tradesto is safe for traders.

Client Fund Security

The safety of client funds is paramount when assessing a broker's reliability. Tradesto's website provides limited information regarding its fund security measures. There are no clear indications of client fund segregation or investor protection schemes, which are standard practices among reputable brokers.

The absence of negative balance protection policies also poses a significant risk to traders, as they could potentially lose more than their initial investment. Historical complaints regarding fund withdrawals further underscore the potential dangers associated with trading on this platform. Reports of clients being unable to withdraw their funds raise serious alarms about the safety of investments with Tradesto, leading to the conclusion that Tradesto is not safe for trading.

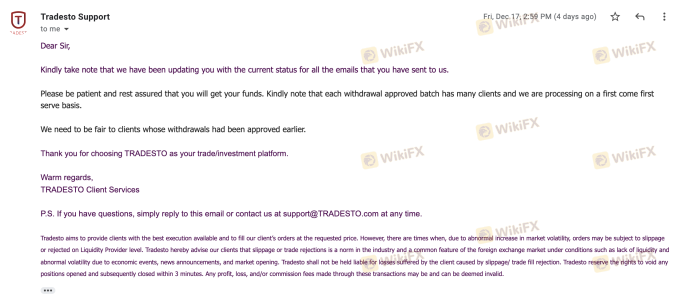

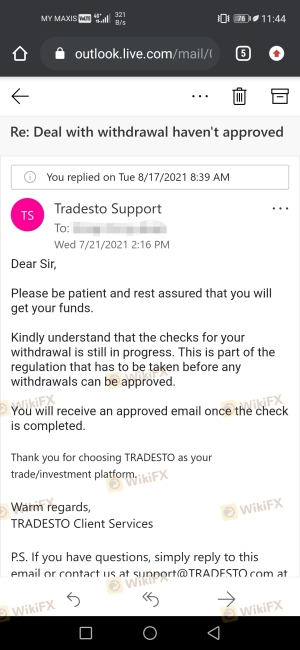

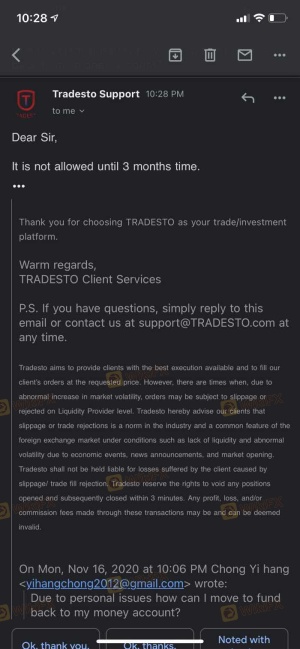

Customer Experience and Complaints

User feedback plays a crucial role in evaluating a broker's trustworthiness. A review of customer experiences with Tradesto reveals a pattern of dissatisfaction, particularly concerning withdrawal issues and the quality of customer support. Many users have reported difficulties in accessing their funds, with some claiming that their accounts were disabled without clear explanations.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Account Disabling | High | Inconsistent |

| Customer Support Quality | Medium | Lacks effectiveness |

Two notable cases highlight these issues: one trader reported waiting over six months for a withdrawal, while another encountered unhelpful responses from customer support when seeking assistance. Such complaints suggest a troubling trend, raising serious questions about whether Tradesto is safe for potential investors.

Platform and Execution

The trading platform offered by Tradesto, MetaTrader 4 (MT4), is widely recognized for its user-friendly interface and robust trading tools. However, the performance and execution quality on this platform have come under scrutiny. Users have reported instances of slippage and order rejections, which can severely impact trading outcomes.

Moreover, there are no indications of any manipulative practices, but the overall execution quality remains a concern. Traders must be cautious of platforms that compromise on execution, as this can lead to significant financial losses. Hence, the question remains: is Tradesto safe for executing trades?

Risk Assessment

Trading with Tradesto presents several risks that potential investors should carefully consider. The lack of regulation, questionable trading conditions, and historical complaints all contribute to an elevated risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | Withdrawal issues |

| Operational Risk | Medium | Platform reliability |

To mitigate these risks, traders should conduct thorough research, consider using risk management strategies, and possibly seek alternatives that offer better regulatory oversight and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tradesto is not safe for traders. The broker's lack of valid regulation, combined with numerous customer complaints and questionable trading conditions, paints a concerning picture. It is advisable for potential investors to exercise extreme caution when considering this platform.

For traders seeking reliable alternatives, brokers regulated by reputable authorities such as the FCA or ASIC should be prioritized. These brokers typically provide better transparency, customer support, and safety for client funds. In light of the findings, it is prudent to avoid Tradesto and explore more trustworthy options in the forex market.

Is Tradesto a scam, or is it legit?

The latest exposure and evaluation content of Tradesto brokers.

Tradesto Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradesto latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.