Is Tradesafefxbtc safe?

Business

License

Is tradesafefxbtc Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, tradesafefxbtc has emerged as a broker that claims to offer various trading services. Positioned as a platform for both novice and experienced traders, it promises access to a wide range of trading instruments and tools. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the reliability of brokers before committing their funds. This article aims to investigate whether tradesafefxbtc is a legitimate trading platform or a potential scam. Our analysis is grounded in a thorough examination of the broker's regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. tradesafefxbtc operates without any recognized regulatory oversight, which raises significant concerns about its trustworthiness. The absence of regulation implies that there is no governing body to hold the broker accountable for its practices, potentially exposing traders to substantial risks. Below is a summary of the regulatory information for tradesafefxbtc:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a valid regulatory framework means that tradesafefxbtc does not adhere to the strict operational guidelines that protect traders' interests. In many jurisdictions, regulated brokers are required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This is a crucial safeguard against potential misuse of funds. Without such oversight, the risk of losing investments due to mismanagement or fraudulent activities increases significantly.

Furthermore, the history of compliance for tradesafefxbtc is concerning. Reports indicate that the broker has been associated with various complaints from users who have faced issues with fund withdrawals and transparency. The absence of a regulatory body to oversee these matters further exacerbates the situation, making it imperative for potential clients to exercise caution when considering this broker.

Company Background Investigation

Understanding the background of tradesafefxbtc is essential in assessing its credibility. The broker claims to have been operational for several years, but detailed information about its ownership structure and management team is scarce. This lack of transparency raises red flags, as reputable brokers typically provide clear information about their corporate structure and key personnel.

The management teams expertise is a significant factor in a broker's reliability. In the case of tradesafefxbtc, there is little to no information available regarding the qualifications or professional backgrounds of its leaders. This opacity can be indicative of a broader issue within the organization, as it suggests a potential lack of accountability and oversight. Without a well-defined leadership team with proven experience in the financial industry, traders may find themselves at risk when dealing with this broker.

Moreover, the overall transparency of tradesafefxbtc is lacking. The broker does not provide sufficient information about its operational practices, which is a standard expectation in the forex industry. Traders should be able to access comprehensive details about the broker's services, fees, and terms of service. The absence of such information can be a warning sign, suggesting that tradesafefxbtc may not have the best interests of its clients at heart.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions offered are of utmost importance. tradesafefxbtc claims to provide competitive spreads and various account types, but the lack of transparency regarding its fee structure raises concerns. Traders should be aware of all costs associated with trading to avoid unexpected charges that could erode their profits. Below is a comparison of the core trading costs associated with tradesafefxbtc:

| Fee Type | tradesafefxbtc | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The spreads offered by tradesafefxbtc are reported to be variable, which can lead to higher costs during volatile market conditions. Additionally, the lack of a clear commission structure can leave traders uncertain about how much they will be charged for their trades. This ambiguity is particularly concerning, as it can lead to hidden costs that traders may not anticipate.

Moreover, the broker's policies regarding overnight interest, or swap rates, are not clearly defined. This lack of clarity can significantly impact traders who hold positions overnight, as they may face unexpected charges that could affect their overall trading strategy. Overall, the trading conditions presented by tradesafefxbtc warrant skepticism, particularly in light of the broader concerns regarding its regulatory status and transparency.

Client Fund Safety

The safety of client funds is a paramount concern when selecting a forex broker. tradesafefxbtc does not provide adequate information regarding its measures for safeguarding client funds. The absence of regulatory oversight raises significant questions about the security of deposits made with the broker.

In regulated environments, brokers are typically required to maintain segregated accounts, ensuring that client funds are protected from the broker's operational risks. However, tradesafefxbtc has not demonstrated adherence to such practices. The lack of investor protection mechanisms, such as negative balance protection, further exacerbates the risk for traders. If the broker were to face financial difficulties or insolvency, clients could potentially lose their entire investment without any recourse.

Furthermore, historical reports from clients indicate issues with fund withdrawals and overall transparency regarding the handling of funds. Numerous complaints have surfaced, highlighting difficulties in retrieving funds after trading profits were supposedly earned. These issues paint a troubling picture of tradesafefxbtc as a broker that may not prioritize the safety and security of its clients' investments.

Customer Experience and Complaints

The experiences of clients can provide valuable insights into the reliability of a broker. In the case of tradesafefxbtc, customer feedback has been largely negative, with numerous complaints regarding fund withdrawals and communication issues. Many users have reported being unable to access their funds after making deposits, raising serious concerns about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Limited |

| Customer Support Issues | High | Ineffective |

A common complaint among users is the difficulty in withdrawing funds. Several reports indicate that clients were asked to make additional deposits or pay fees before being allowed to withdraw their profits, a tactic often associated with fraudulent schemes. This practice is alarming and raises significant red flags regarding the legitimacy of tradesafefxbtc.

For example, one user reported being pressured to deposit additional funds to access their earnings, while another highlighted the lack of communication from the broker when attempting to resolve withdrawal issues. These cases illustrate a troubling pattern of behavior that suggests tradesafefxbtc may not be acting in the best interests of its clients.

Platform and Execution

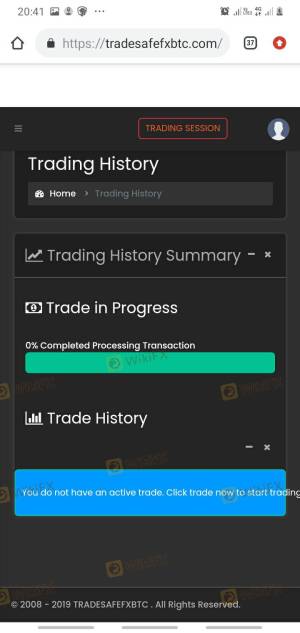

The trading platform and execution quality are critical components of a trader's experience. tradesafefxbtc claims to offer a user-friendly trading platform, but feedback from clients suggests otherwise. Many users have reported issues with platform stability, order execution delays, and instances of slippage.

The execution quality is particularly concerning, as traders rely on timely and accurate order fills to effectively manage their positions. Reports of high slippage and rejected orders indicate that tradesafefxbtc may not provide the level of service expected from a reputable broker. Such issues can significantly impact trading performance, particularly in fast-moving markets.

Additionally, there have been allegations of platform manipulation, where traders believe that the broker may have interfered with order execution to benefit its own interests. These concerns further undermine the credibility of tradesafefxbtc as a legitimate trading platform.

Risk Assessment

Engaging with tradesafefxbtc presents several risks that potential clients should be aware of. The absence of regulation, coupled with numerous complaints and a lack of transparency, paints a concerning picture of the broker's operational integrity. Below is a summary of the key risk areas associated with trading with tradesafefxbtc:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Fund Safety Risk | High | Lack of segregated accounts and protections |

| Execution Risk | Medium | Reports of slippage and order rejections |

| Withdrawal Risk | High | Frequent complaints about withdrawal issues |

To mitigate these risks, potential traders should conduct thorough due diligence before engaging with tradesafefxbtc. It is advisable to seek out regulated brokers with a proven track record of transparency and client protection. Additionally, traders should consider starting with a small investment and testing the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that tradesafefxbtc operates with significant risks that could jeopardize traders' investments. The lack of regulatory oversight, numerous client complaints, and transparency issues raise serious concerns about the broker's legitimacy. While some traders may be drawn to the platform due to its promises of returns and trading opportunities, the potential for scams and fraudulent practices cannot be overlooked.

For traders considering their options, it is highly recommended to avoid tradesafefxbtc and seek out reputable, regulated brokers that prioritize client safety and transparency. Brokers with established regulatory frameworks, positive client feedback, and clear operational practices are far more likely to provide a secure trading environment. Always remember to conduct thorough research and due diligence before making any financial commitments in the forex market.

Is Tradesafefxbtc a scam, or is it legit?

The latest exposure and evaluation content of Tradesafefxbtc brokers.

Tradesafefxbtc Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradesafefxbtc latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.