Regarding the legitimacy of Tickmill forex brokers, it provides ASIC, FSA and WikiBit, (also has a graphic survey regarding security).

Is Tickmill safe?

Business

License

Is Tickmill markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Trade Nation Australia Pty Ltd

Effective Date: Change Record

2012-10-11Email Address of Licensed Institution:

andrew.merry@finsa.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 17 123 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

00447437416329Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Tickmill Ltd

Effective Date:

--Email Address of Licensed Institution:

info@tickmill.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.tickmill.comExpiration Time:

--Address of Licensed Institution:

Office 3, F28-F29, Eden Plaza, Eden Island, SeychellesPhone Number of Licensed Institution:

(+248) 4347072Licensed Institution Certified Documents:

Is Tickmill Safe or Scam?

Introduction

Tickmill is an international forex and CFD broker that has established itself as a competitive player in the trading market since its inception in 2014. With a focus on low-cost trading and fast execution, Tickmill aims to cater to both retail and institutional traders. However, with the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and safety of brokers before committing their funds. This article investigates whether Tickmill is a safe broker or if it raises any red flags that could suggest it is a scam. Our analysis is based on a thorough examination of regulatory status, company background, trading conditions, customer safety measures, and user experiences.

Regulation and Legitimacy

Regulation is a key factor in assessing the safety of any forex broker. Tickmill operates under several regulatory frameworks, which enhances its credibility. The broker is regulated by the following authorities:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (UK) | 717270 | United Kingdom | Verified |

| CySEC (Cyprus) | 278/15 | Cyprus | Verified |

| FSA (Seychelles) | SD008 | Seychelles | Verified |

| FSCA (South Africa) | 49464 | South Africa | Verified |

| DFSA (Dubai) | F007663 | Dubai | Verified |

Tickmill's regulation by tier-1 authorities like the FCA and CySEC indicates a high level of oversight and adherence to strict financial standards. The FCA, in particular, offers investor protection of up to £85,000, which adds an additional layer of security for traders. Tickmill has maintained a clean regulatory record, with no significant compliance issues reported, which further supports the assertion that Tickmill is safe for trading.

Company Background Investigation

Tickmill was founded in 2014 and is headquartered in London, UK, with additional offices in several jurisdictions. The company is owned by Tickmill Group, which operates through various subsidiaries across different regions. The management team comprises experienced professionals with extensive backgrounds in finance and trading, ensuring that the broker is well-equipped to meet the needs of its clients.

Transparency is a critical aspect of any financial institution, and Tickmill scores well in this regard. The broker provides comprehensive information about its services, fees, and trading conditions on its website. Furthermore, it regularly updates its clients about market conditions and trading opportunities through its educational resources, webinars, and market analysis. This level of transparency contributes to the overall assessment that Tickmill is safe for traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and commissions, is essential. Tickmill offers competitive trading conditions characterized by low spreads and no hidden fees. The overall fee structure is as follows:

| Fee Type | Tickmill | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 0.0 - 1.6 pips | 0.5 - 1.2 pips |

| Commission Model | $3 per lot (Raw Account) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Tickmills spreads start as low as 0.0 pips for its Raw Account, making it attractive for high-frequency traders. However, it is essential to note that while the broker does not charge deposit or withdrawal fees, the overnight interest rates can vary, which might affect long-term positions. Overall, the trading conditions indicate that Tickmill is safe for both novice and experienced traders.

Customer Funds Security

The safety of customer funds is paramount in the forex trading industry. Tickmill employs several measures to protect client funds, including segregated accounts, which ensure that clients' funds are kept separate from the broker's operating funds. This means that in the unlikely event of the broker's insolvency, client funds remain protected.

Furthermore, Tickmill offers negative balance protection, which guarantees that clients will not lose more than their deposited funds, providing an additional safety net. The broker also participates in investor compensation schemes, which further enhances the security of client funds. Historically, Tickmill has not faced significant issues regarding fund safety, reinforcing the conclusion that Tickmill is safe to trade with.

Customer Experience and Complaints

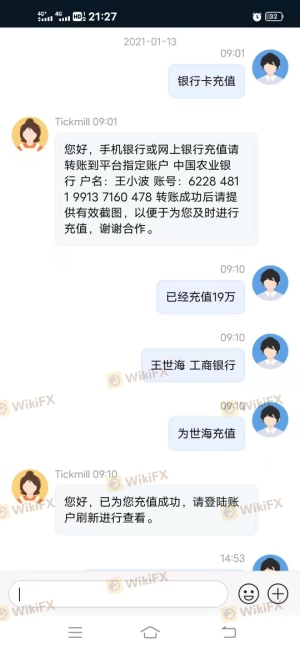

Customer feedback plays a crucial role in assessing a broker's reliability. Tickmill generally receives positive reviews regarding its trading conditions and customer support. However, like any broker, it has faced some complaints. Common issues reported by users include delays in withdrawals and concerns about customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed promptly |

| Customer Service Issues | High | Improvements ongoing |

For instance, some users have reported waiting longer than expected for withdrawal processing, particularly during peak times. Nevertheless, the company has made efforts to improve its response times and has addressed these complaints effectively. Overall, while there are some complaints, they do not significantly undermine the broker's credibility, suggesting that Tickmill is safe for trading.

Platform and Execution

Tickmill provides access to popular trading platforms, including MetaTrader 4 and MetaTrader 5, which are known for their stability and user-friendly interfaces. The broker boasts an impressive average execution time of 0.15 seconds, ensuring that trades are executed quickly and efficiently.

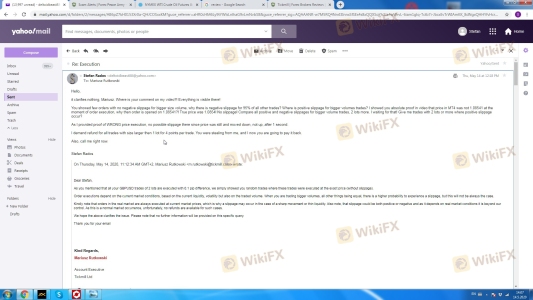

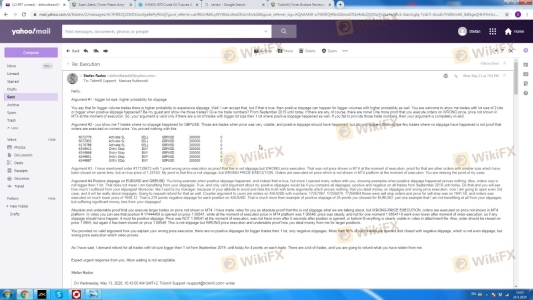

Concerns about slippage and re-quotes are minimal, as Tickmill operates on a no dealing desk (NDD) model, which further enhances the trading experience. There have been no significant reports of platform manipulation or issues that would indicate a lack of integrity. Consequently, traders can feel confident in the execution quality provided by Tickmill, reinforcing that Tickmill is safe for trading.

Risk Assessment

While Tickmill offers a robust trading environment, it is essential to consider the inherent risks associated with forex trading. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Operational Risk | Medium | Potential for technical issues |

| Market Risk | High | Volatility in financial markets |

To mitigate these risks, traders should consider implementing sound risk management strategies, such as setting stop-loss orders and diversifying their trading portfolio. Overall, while there are risks involved, they are manageable, indicating that Tickmill is safe for traders willing to engage responsibly.

Conclusion and Recommendations

In conclusion, after a thorough investigation into Tickmill's regulatory status, company background, trading conditions, customer safety measures, and user experiences, it is clear that Tickmill is safe for trading. The broker is well-regulated, has a transparent operational structure, and offers competitive trading conditions, making it a reliable choice for both novice and experienced traders.

However, potential clients should remain vigilant and conduct their due diligence before trading. For those seeking alternatives, brokers such as IG and OANDA also offer robust trading environments with strong regulatory backing. Ultimately, trading should be approached with caution, and selecting a reputable broker like Tickmill can significantly enhance the trading experience.

Is Tickmill a scam, or is it legit?

The latest exposure and evaluation content of Tickmill brokers.

Tickmill Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tickmill latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.