Is SWIFT EARNERS safe?

Business

License

Is Swift Earners Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, traders are presented with numerous options for brokers, one of which is Swift Earners. This platform claims to offer various financial services, including forex trading and investment opportunities. However, with the proliferation of scams in the financial sector, it is crucial for traders to exercise caution and conduct thorough evaluations of any broker before committing their funds. This article aims to provide an objective analysis of Swift Earners, assessing its safety and legitimacy. To accomplish this, we will examine regulatory compliance, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the forex industry, as it ensures that brokers adhere to specific standards of conduct. The regulatory landscape for Swift Earners is somewhat murky. According to available information, the platform does not appear to be registered with any major regulatory authority. The absence of a regulatory license raises significant concerns regarding the safety of funds and the legitimacy of the services offered.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of regulatory oversight is a significant red flag, as it suggests that Swift Earners may not be subject to the rigorous checks and balances that reputable brokers undergo. Without proper regulation, traders are left vulnerable to potential fraud and mismanagement of their funds. The importance of regulatory compliance cannot be overstated; it serves as a safety net for traders, ensuring that their investments are protected and that they have recourse in case of disputes.

Company Background Investigation

Understanding the background of a broker is essential for assessing its reliability. Swift Earners has a relatively short history, having been established only recently. The ownership structure of the company is also unclear, as it appears that the identities of the owners are concealed behind privacy protection services. This lack of transparency raises concerns about accountability and trustworthiness.

Management experience is another critical factor. While the website may tout a team of experienced professionals, there is little verifiable information available regarding their qualifications and backgrounds. A lack of credible information can lead to skepticism about the broker's ability to manage trading effectively and protect client interests.

Trading Conditions Analysis

The trading conditions offered by Swift Earners are a vital aspect to consider. The platform claims to provide competitive spreads and various account types, but specific details are often vague. Understanding the fee structure is crucial, as hidden fees can significantly impact overall profitability.

| Fee Type | Swift Earners | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding fees and spreads raises concerns about the broker's transparency. Traders should be wary of platforms that do not provide detailed and accessible information about their trading conditions, as this could be indicative of potential issues down the line.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. Swift Earners client fund security measures are not well-documented, which is troubling. Effective fund protection strategies typically include segregated accounts, investor compensation schemes, and negative balance protection. However, without clear policies in place, traders may be putting their investments at risk.

Additionally, there have been no reported incidents of fund mismanagement or security breaches, but the lack of information leaves room for concern. Traders should always seek brokers that prioritize fund security and have a proven track record in this regard.

Customer Experience and Complaints

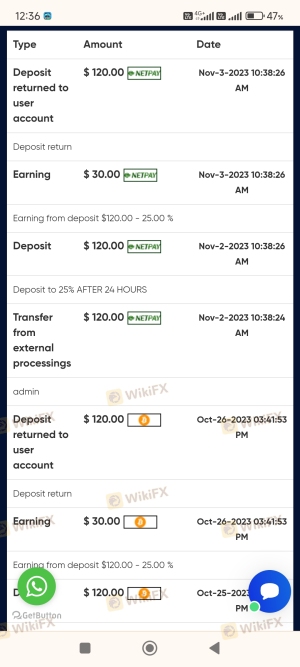

Customer feedback is invaluable in assessing the reliability of a broker. For Swift Earners, reviews are mixed, with some users reporting positive experiences while others express dissatisfaction. Common complaints include issues with withdrawal processes and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

One notable case involved a trader who reported significant delays in processing a withdrawal request, leading to frustration and a loss of trust in the platform. The company's response to such complaints has been criticized as inadequate, which further exacerbates concerns about its reliability.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Swift Earners claims to offer a user-friendly interface and efficient execution, but user experiences vary. Some traders have reported issues with slippage, where the execution price differs from the expected price, which can negatively impact trading outcomes.

Moreover, there are no clear indications of platform manipulation, but the lack of transparency regarding execution policies raises questions. Traders should be cautious and consider platforms with a proven track record of reliable execution and robust performance.

Risk Assessment

Using Swift Earners involves several risks that traders should be aware of. The lack of regulation, unclear fee structures, and mixed customer feedback all contribute to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | Medium | Unclear fee structures may impact profitability. |

| Operational Risk | Medium | Mixed reviews on platform performance. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with transparent practices. Diversifying investments and maintaining a cautious approach can also help manage potential losses.

Conclusion and Recommendations

In conclusion, while Swift Earners presents itself as a viable option for forex trading, numerous red flags suggest that traders should proceed with caution. The lack of regulatory oversight, unclear fee structures, and mixed customer feedback raise significant concerns about the platform's safety and legitimacy.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated, have transparent fee structures, and maintain a positive reputation among users. Overall, while Swift Earners may not be an outright scam, the potential risks associated with trading on this platform warrant careful consideration and further investigation.

Is SWIFT EARNERS a scam, or is it legit?

The latest exposure and evaluation content of SWIFT EARNERS brokers.

SWIFT EARNERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SWIFT EARNERS latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.