Is STV Global Limited safe?

Business

License

Is STV Global Limited Safe or a Scam?

Introduction

STV Global Limited is a forex brokerage that positions itself as a provider of trading solutions for various market instruments, including forex, commodities, stocks, indices, and cryptocurrencies. As the forex market continues to grow in popularity, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers like STV Global Limited. With numerous reports of scams and fraudulent activities in the industry, traders must exercise caution before committing their funds to any platform. This article aims to provide a thorough analysis of STV Global Limited, assessing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we have relied on a variety of sources, including regulatory databases, user reviews, and industry reports. The evaluation framework includes an examination of regulatory compliance, company history, trading costs, customer fund security, and user feedback. By synthesizing this information, we aim to answer the pressing question: Is STV Global Limited safe for trading?

Regulatory and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its safety and legitimacy. STV Global Limited claims to be regulated by the American National Futures Association (NFA) with a regulatory ID of 0557476. However, further investigation reveals that this claim is misleading, as the NFA has categorized STV Global Limited as an unauthorized entity. This lack of valid regulation raises significant concerns regarding the safety of traders' funds and the broker's operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0557476 | United States | Unauthorized |

The absence of a credible regulatory framework means that STV Global Limited does not adhere to the stringent compliance measures typically enforced by recognized authorities. This lack of oversight can expose traders to higher risks, including potential fraud and mismanagement of funds. Historically, brokers without proper regulation have been associated with unethical practices, such as refusal to process withdrawals and manipulation of trading conditions.

Company Background Investigation

STV Global Limited was established relatively recently, with its incorporation date registered in May 2023. The company operates out of the United States, but its rapid establishment raises questions about its stability and long-term viability. The ownership structure of STV Global Limited remains opaque, with limited information available regarding its founders and management team. This lack of transparency can be a red flag for potential investors.

The management team's background is crucial in assessing the broker's reliability. While STV Global Limited claims to have an experienced team, specific details about their qualifications and prior industry experience are scarce. This absence of information can lead to skepticism regarding the broker's operational integrity and commitment to providing a secure trading environment.

In terms of transparency, STV Global Limited's website offers minimal disclosure about its business practices, fees, and risk warnings. A brokerage that prioritizes transparency is more likely to foster trust among its clients. Therefore, the lack of clear information about STV Global Limited's operational practices raises concerns about its commitment to ethical trading.

Trading Conditions Analysis

When evaluating a brokerage, understanding the trading conditions it offers is paramount. STV Global Limited claims to provide competitive trading conditions, including spreads starting from 0.0 pips and leverage up to 1:500. However, the absence of a demo account or comprehensive fee structure on its website leaves potential clients in the dark regarding the actual costs associated with trading.

| Fee Type | STV Global Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 0.1 - 1.0 pips |

| Commission Model | No commissions | Varies (0-10 USD) |

| Overnight Interest Range | Not specified | 1.5% - 3% |

While the low spreads may seem attractive, the lack of clarity regarding other fees and commissions could indicate hidden costs that may affect profitability. Traders should be cautious of brokers that do not provide a transparent fee structure, as this may lead to unexpected charges that could significantly impact trading outcomes.

Customer Fund Security

The security of customer funds is a primary concern for any trader. STV Global Limited claims to implement measures such as segregated accounts to protect client funds. This means that clients' funds are kept separate from the broker's operating capital, reducing the risk of misappropriation. However, the effectiveness of these measures is questionable, given the broker's lack of regulatory oversight.

Additionally, STV Global Limited does not appear to offer robust investor protection mechanisms, such as negative balance protection, which can safeguard traders from losing more than their initial investment. The absence of these protective measures further exacerbates the risks associated with trading with this broker.

Historically, unregulated brokers have faced numerous issues related to fund security, including withdrawal problems and allegations of fraud. Therefore, potential clients must carefully consider the risks associated with trading with STV Global Limited, particularly regarding the safety of their investments.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of STV Global Limited indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and inadequate customer support. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal issues | High | Delayed responses |

| Poor customer support | Medium | Limited channels |

| Lack of transparency | High | No clear answers |

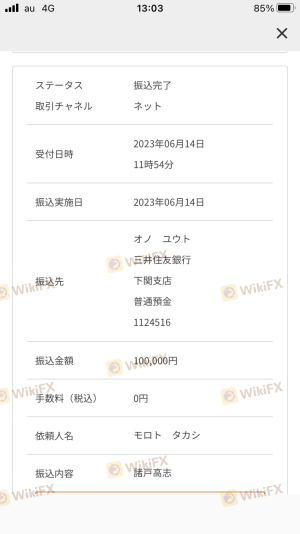

One notable case involved a trader who reported being unable to withdraw their funds for several weeks, leading to frustration and financial loss. Such experiences highlight the importance of evaluating a broker's customer service and responsiveness, especially in times of need.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors for traders. STV Global Limited offers the ST5 trading platform, which is designed to provide a user-friendly experience. However, reviews indicate that the platform may suffer from stability issues, leading to delayed executions and occasional slippage.

Additionally, the quality of order execution is vital for traders, particularly in a fast-paced market. Reports of high slippage and rejected orders raise concerns about the broker's operational integrity. Traders must be vigilant and assess whether STV Global Limited can provide the execution quality necessary for their trading strategies.

Risk Assessment

Trading with STV Global Limited carries inherent risks, primarily due to its lack of regulation and transparency. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Security Risk | High | Lack of investor protections |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should consider using risk management strategies, such as setting stop-loss orders and diversifying their investments. Additionally, conducting thorough research and seeking alternative brokers with better regulatory oversight may enhance safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that STV Global Limited is not a safe brokerage for trading. The lack of valid regulation, combined with reports of withdrawal issues and inadequate customer support, raises significant red flags. Traders should exercise extreme caution and consider the potential risks associated with investing in this broker.

For those seeking a more secure trading environment, it is advisable to explore alternative brokers that are regulated by reputable authorities. Options such as OANDA, Pepperstone, or IronFX offer more transparency and better protection for traders' investments. Ultimately, ensuring the safety of your funds should be the top priority when selecting a forex broker.

Is STV Global Limited a scam, or is it legit?

The latest exposure and evaluation content of STV Global Limited brokers.

STV Global Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STV Global Limited latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.