Is ProEquityMarkets safe?

Business

License

Is ProEquityMarkets Safe or Scam?

Introduction

ProEquityMarkets is a forex broker that positions itself as a platform for trading various financial instruments, including currencies, cryptocurrencies, commodities, and CFDs. As the forex market continues to attract traders globally, it is essential for potential investors to assess the trustworthiness and reliability of brokers like ProEquityMarkets before committing their funds. With the rise of online trading, numerous scams have emerged, making it crucial for traders to conduct thorough evaluations of any broker they consider. This article employs a comprehensive investigative approach, utilizing multiple sources to analyze ProEquityMarkets' regulatory status, company background, trading conditions, and customer experiences to determine whether ProEquityMarkets is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. ProEquityMarkets claims to operate under the jurisdiction of the United Kingdom, but it lacks proper regulatory oversight from recognized authorities. The absence of regulation raises significant concerns regarding the safety of traders' funds and the broker's adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | United Kingdom | Not Registered |

The lack of a license from the FCA or any other reputable regulatory body indicates that ProEquityMarkets is unregulated. This situation is alarming, as regulated brokers are required to adhere to strict financial guidelines, including maintaining segregated accounts for client funds and providing investor protection measures. Without such oversight, traders are at a higher risk of losing their investments without any recourse. The absence of regulatory compliance is a significant red flag, leading to the conclusion that ProEquityMarkets is not safe for trading.

Company Background Investigation

ProEquityMarkets was established in 2023, making it a relatively new entrant in the forex market. The company's ownership structure and management team are not clearly disclosed, which is a common characteristic among potentially fraudulent brokers. Transparency is vital for trust, and the lack of available information regarding the company's leadership raises concerns about its accountability and operational integrity.

The management team's background is crucial in assessing the broker's reliability. However, the absence of publicly available information regarding their experience and qualifications further complicates the evaluation. A reputable broker typically provides detailed information about its management team, including their professional backgrounds and expertise in the financial sector. The lack of such transparency suggests that ProEquityMarkets may not be a safe option for traders seeking a trustworthy platform.

Trading Conditions Analysis

Understanding the trading conditions offered by ProEquityMarkets is essential for potential clients. The broker claims to provide competitive trading fees and various account types, but the absence of clear information on its fee structure can be misleading. Traders should be cautious of brokers with vague or complex fee policies, as they may hide significant costs.

| Fee Type | ProEquityMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.3 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by ProEquityMarkets appear to be higher than the industry average, which could eat into traders' profits. Additionally, the lack of clarity regarding commissions and overnight interest rates raises concerns about hidden fees that may not be immediately apparent to traders. Such practices can lead to significant financial losses, indicating that ProEquityMarkets may not be safe for trading.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. ProEquityMarkets does not provide clear information regarding its fund security measures. The absence of details about segregated accounts, investor protection schemes, or negative balance protection policies raises serious concerns about the safety of traders' investments.

Unregulated brokers like ProEquityMarkets are not required to adhere to the same standards as regulated firms, which often have strict measures in place to protect client funds. The lack of such assurances means that traders could potentially lose their entire investment without any means of recovery. Historical issues related to fund safety, such as withdrawal problems or fund mismanagement, are also prevalent among unregulated brokers, further emphasizing the risks involved. Therefore, it is reasonable to conclude that ProEquityMarkets is not safe for traders who prioritize the security of their funds.

Customer Experience and Complaints

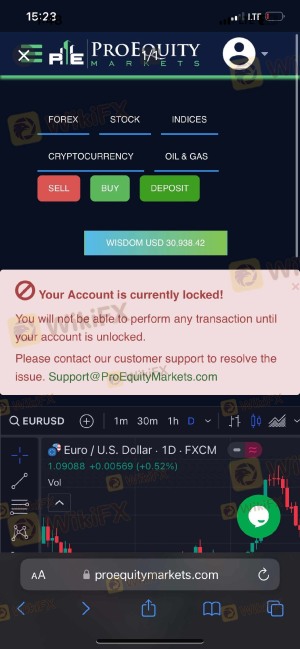

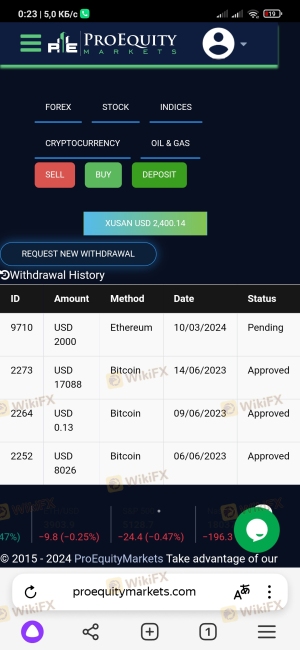

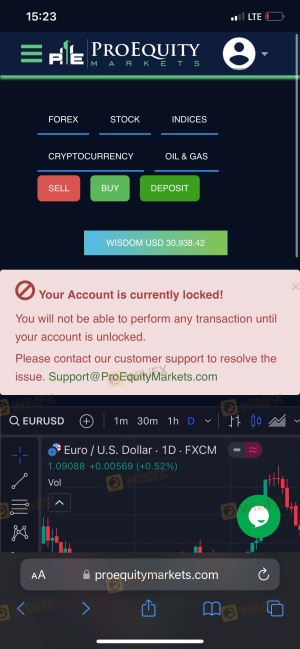

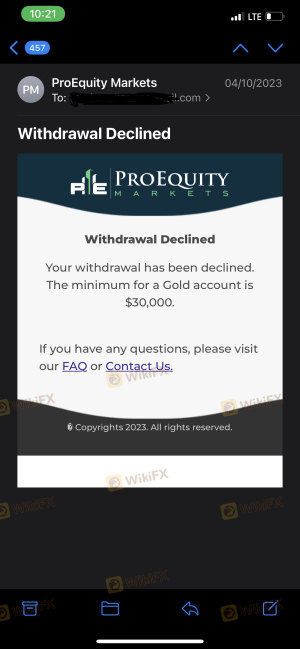

Analyzing customer feedback provides valuable insights into the reliability of ProEquityMarkets. Numerous reviews and complaints highlight a pattern of negative experiences among users. Common complaints include difficulty in withdrawing funds, poor customer service, and aggressive sales tactics urging clients to deposit more money.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Misleading Promotions | High | None |

Several users have reported being blocked from withdrawing their funds after profitable trades, often being told they need to upgrade their accounts to access their money. Such practices are indicative of potential scam operations, as they exploit traders' trust and financial commitments. The overall negative sentiment surrounding customer experiences suggests that ProEquityMarkets may not be a safe choice for prospective traders.

Platform and Execution

The trading platform's performance is another crucial aspect to consider. ProEquityMarkets utilizes the MetaTrader 4 (MT4) platform, which is widely recognized for its user-friendly interface and advanced trading features. However, user reviews indicate issues with order execution quality, including slippage and high rejection rates.

Traders have expressed concerns about the platform's reliability, with reports of delayed order executions and technical glitches during critical trading periods. Such issues can significantly impact trading outcomes, leading to financial losses. The presence of these negative indicators raises further doubts about the broker's integrity and operational standards, reinforcing the notion that ProEquityMarkets is not a safe option for trading.

Risk Assessment

Engaging with ProEquityMarkets presents several risks that traders should be aware of. The absence of regulation, combined with the company's questionable practices and negative customer feedback, contributes to a high-risk environment for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker poses significant risks. |

| Financial Risk | High | High spreads and hidden fees can lead to losses. |

| Operational Risk | Medium | Platform issues may affect trading performance. |

To mitigate these risks, traders should conduct thorough research, avoid making hasty decisions, and consider using regulated brokers with a proven track record of reliability. Seeking advice from financial experts can also help traders navigate this complex landscape and make informed decisions.

Conclusion and Recommendations

In conclusion, the investigation into ProEquityMarkets reveals numerous red flags that suggest it may not be a safe broker for trading. The lack of regulatory oversight, combined with negative customer experiences and questionable trading practices, raises serious concerns about the broker's legitimacy. Potential traders should exercise extreme caution and consider alternative options that offer better transparency, regulatory compliance, and customer support.

For those seeking reliable trading platforms, it is advisable to explore well-regulated brokers with positive reputations and proven track records. By prioritizing safety and transparency, traders can protect their investments and enhance their overall trading experience. Ultimately, ProEquityMarkets is not safe, and potential clients should be wary of engaging with this broker.

Is ProEquityMarkets a scam, or is it legit?

The latest exposure and evaluation content of ProEquityMarkets brokers.

ProEquityMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ProEquityMarkets latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.